Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Crypto markets were temporarily plagued by a wave of risk-off sentiment in the past week when President Trump and Elon Musk engaged in a public feud on social media. BTC approached the $100K mark, while ETH fell more than 7% during the peak of the drama on June 6, resulting in short-tenor volatility smile skews for both assets to tilt towards OTM puts. That has since reversed on the back of advancements in the GENIUS act for crypto stablecoins and a potential easing of trade tensions between the US and China. Today, BTC is trading just shy of $110K, while ETH has outperformed all 10 of the top crypto tokens by market-cap. With that move in spot, ETH options markets are now at their most bullish levels so far this month, with volatility smiles across the term structure skewed towards OTM calls.

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

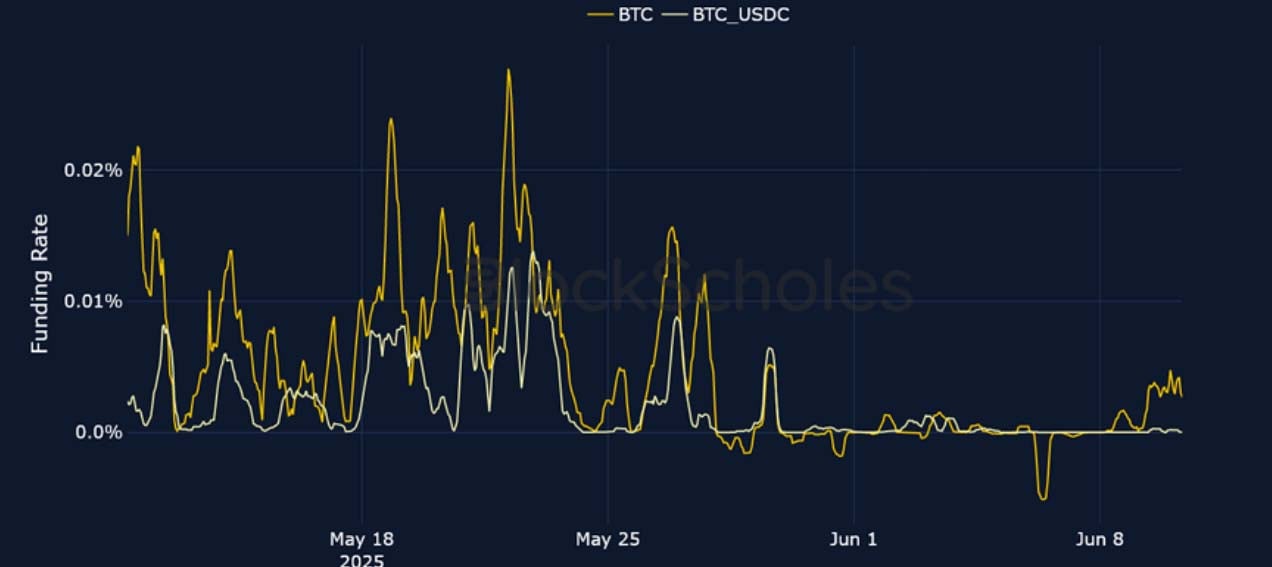

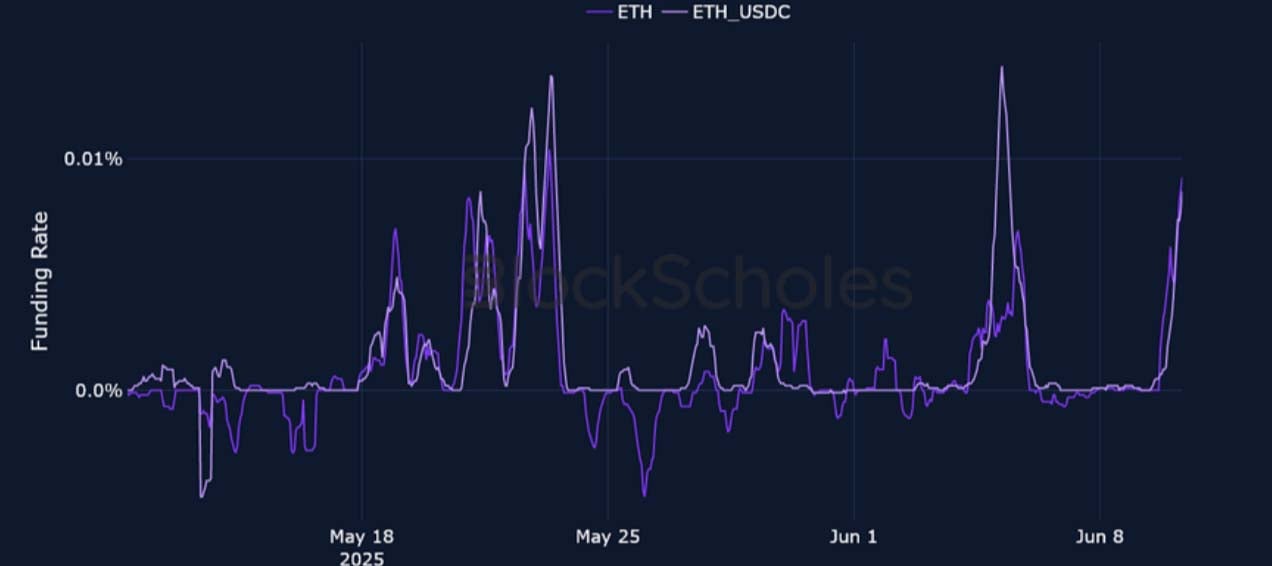

Perpetual Swap Funding Rate

BTC FUNDING RATE – A public feud between President Trump and Elon Musk coincided with BTC falling towards $100K and funding rates turning negative.

ETH FUNDING RATE – ETH funding rates were less affected, and have since jumped up as ETH spot price outperforms today (+7% over the past 24 hours).

Futures Implied Yields

BTC Futures Implied Yields – After a temporary return to an upward sloping curve last week, BTC’s futures term structure has now inverted once more.

ETH Futures Implied Yields – 7-day ETH futures-implied yields are 2% percentage points higher than their 180-day counterparts.

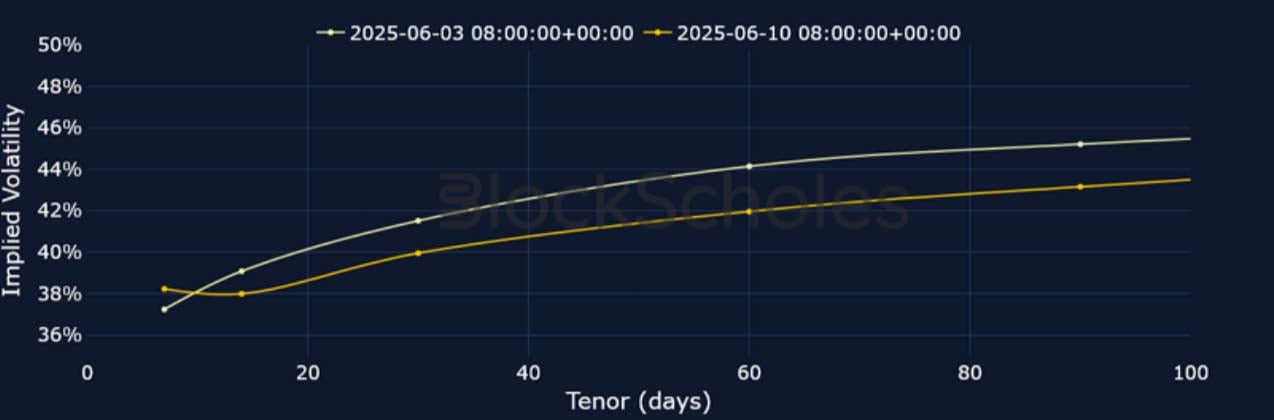

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – Short-term volatility has bounced from its early June lows of 32%, though not enough to flatten the term structure.

BTC 25-Delta Risk Reversal – Similar to the quieter response in BTC funding rates relative to ETH, BTC call-skew is more than half that of ETH at all tenors.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – ETH’s volatility term structure has re- inverted once more, from its previously compressed shape.

ETH 25-Delta Risk Reversal – Short-tenor ETH smiles now hold their largest skew towards OTM calls so far in June. 7-day skew has exceeded 6% as ETH spot price outperforms all other top 10 crypto tokens by market-cap today.

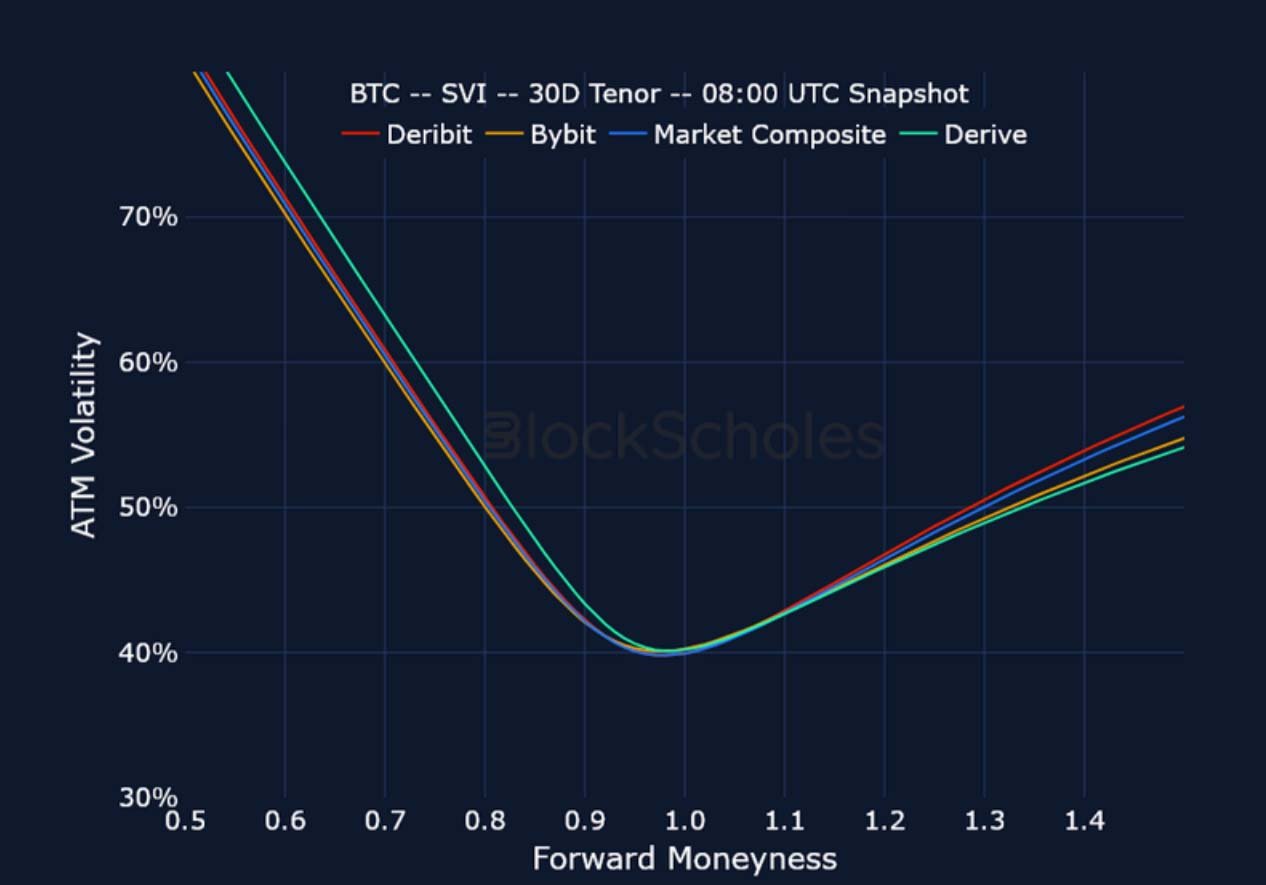

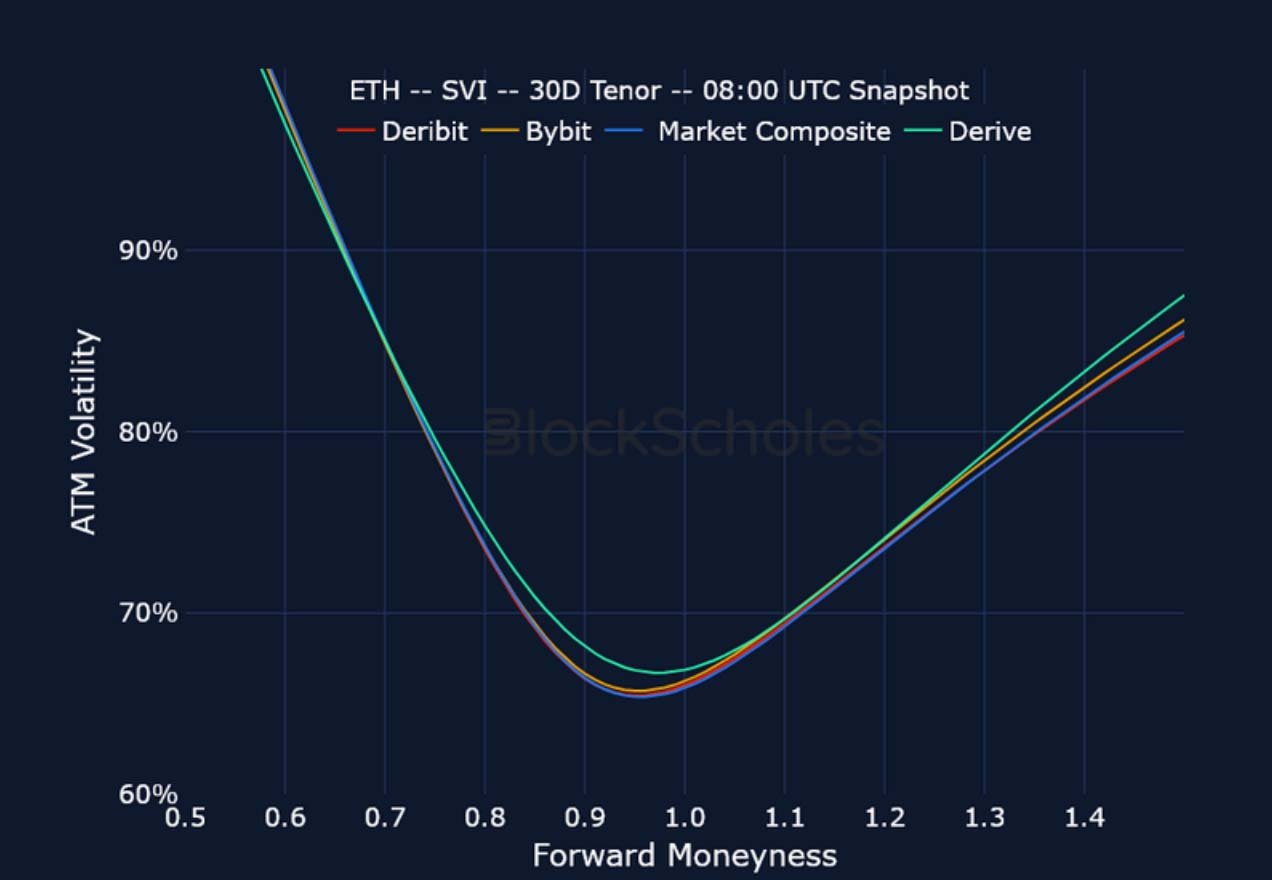

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

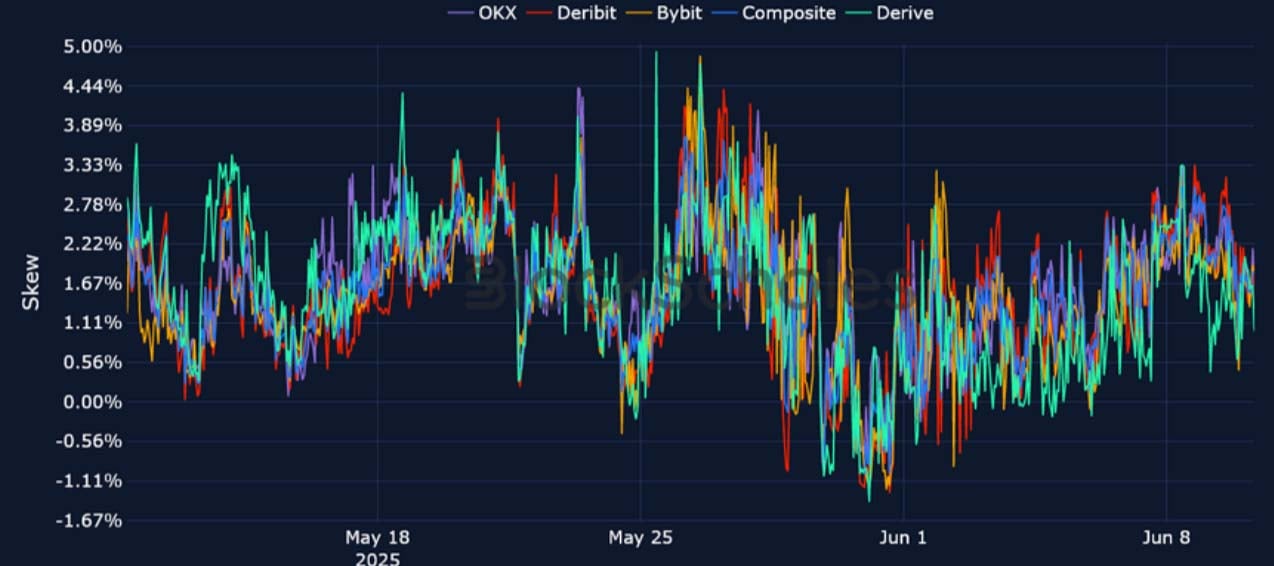

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

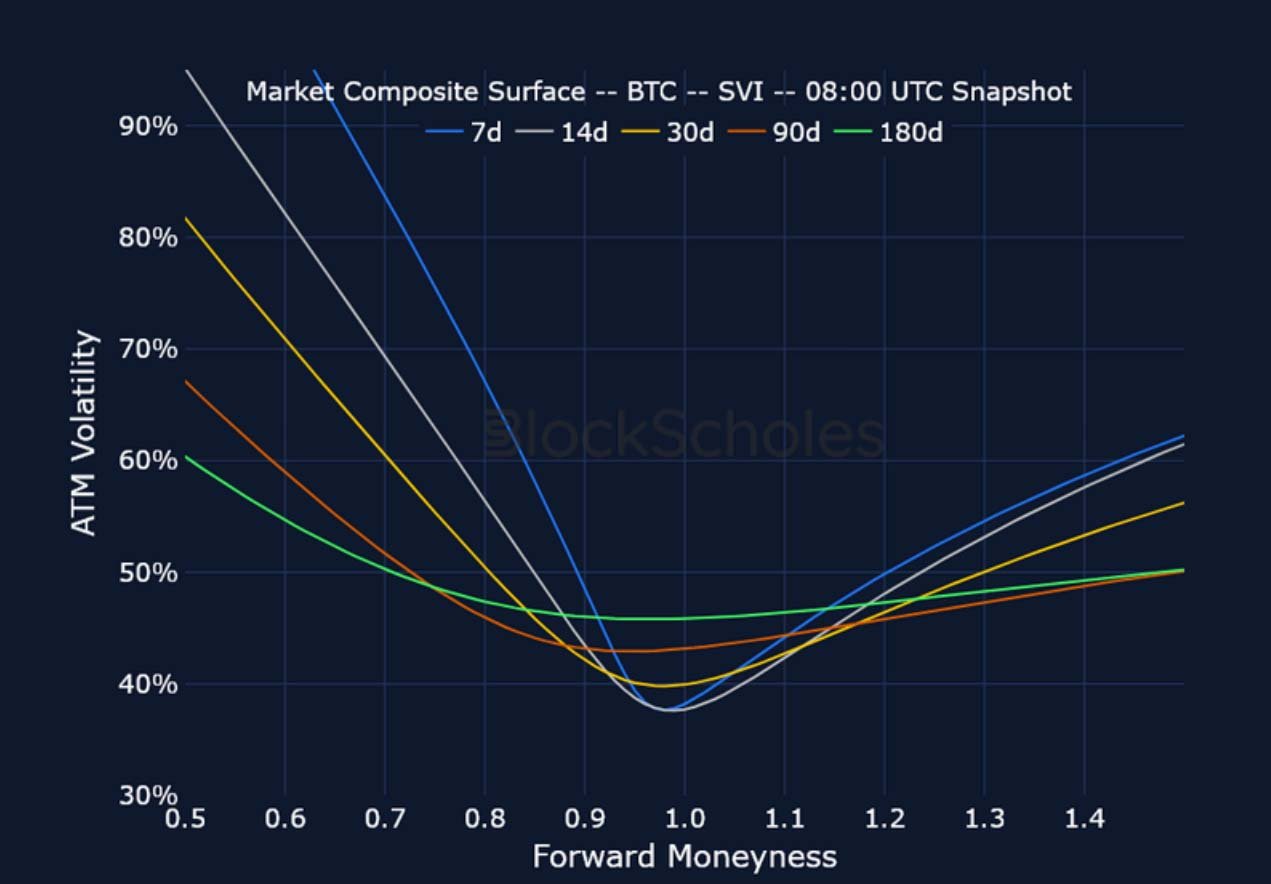

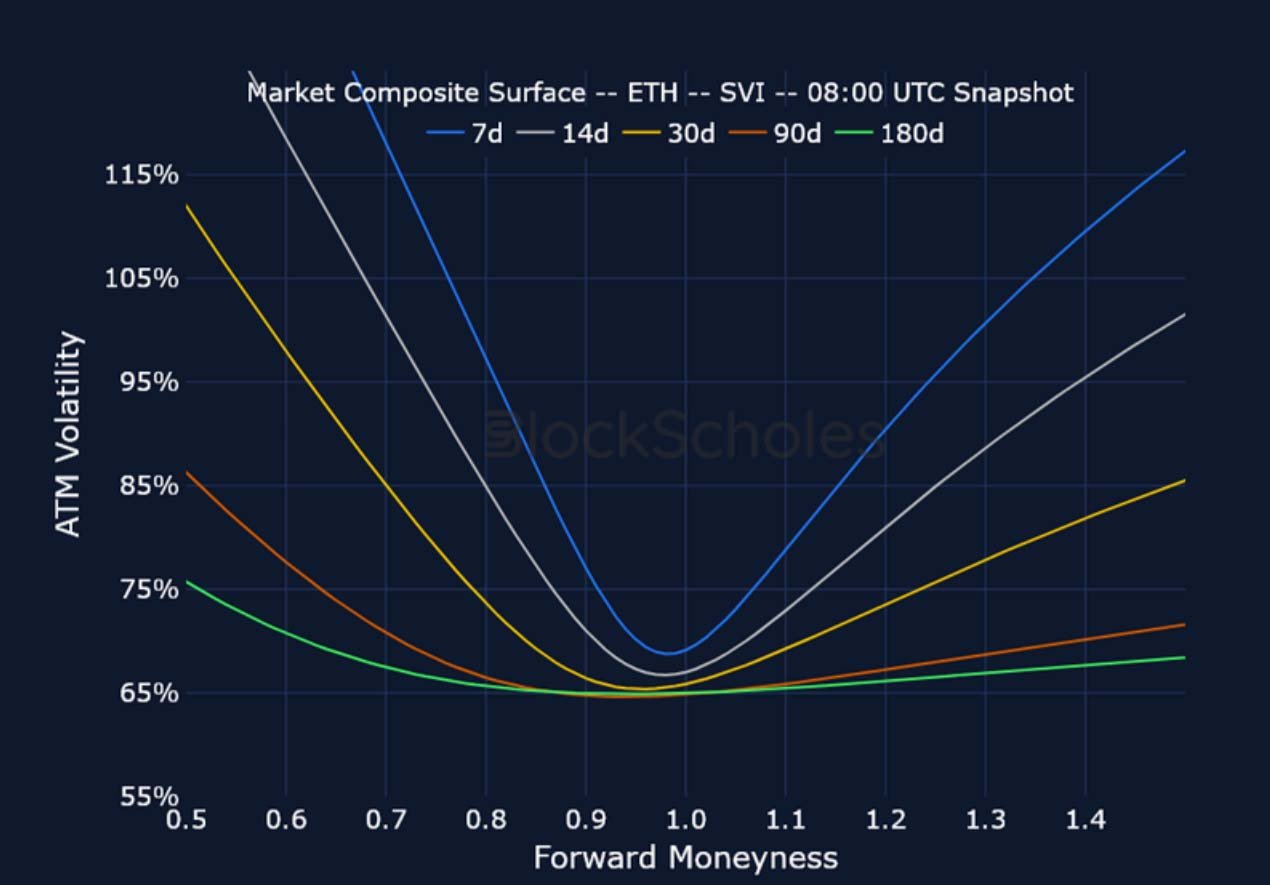

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

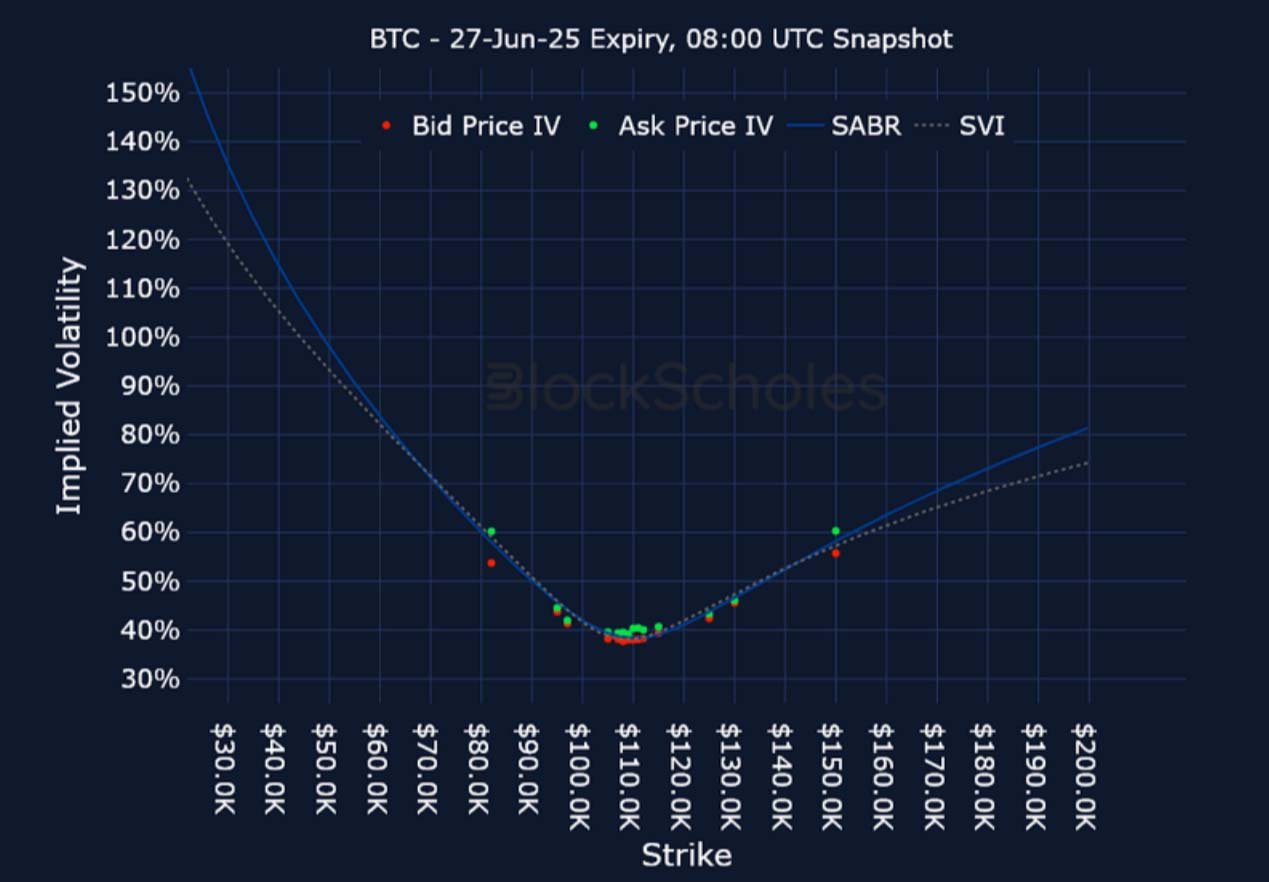

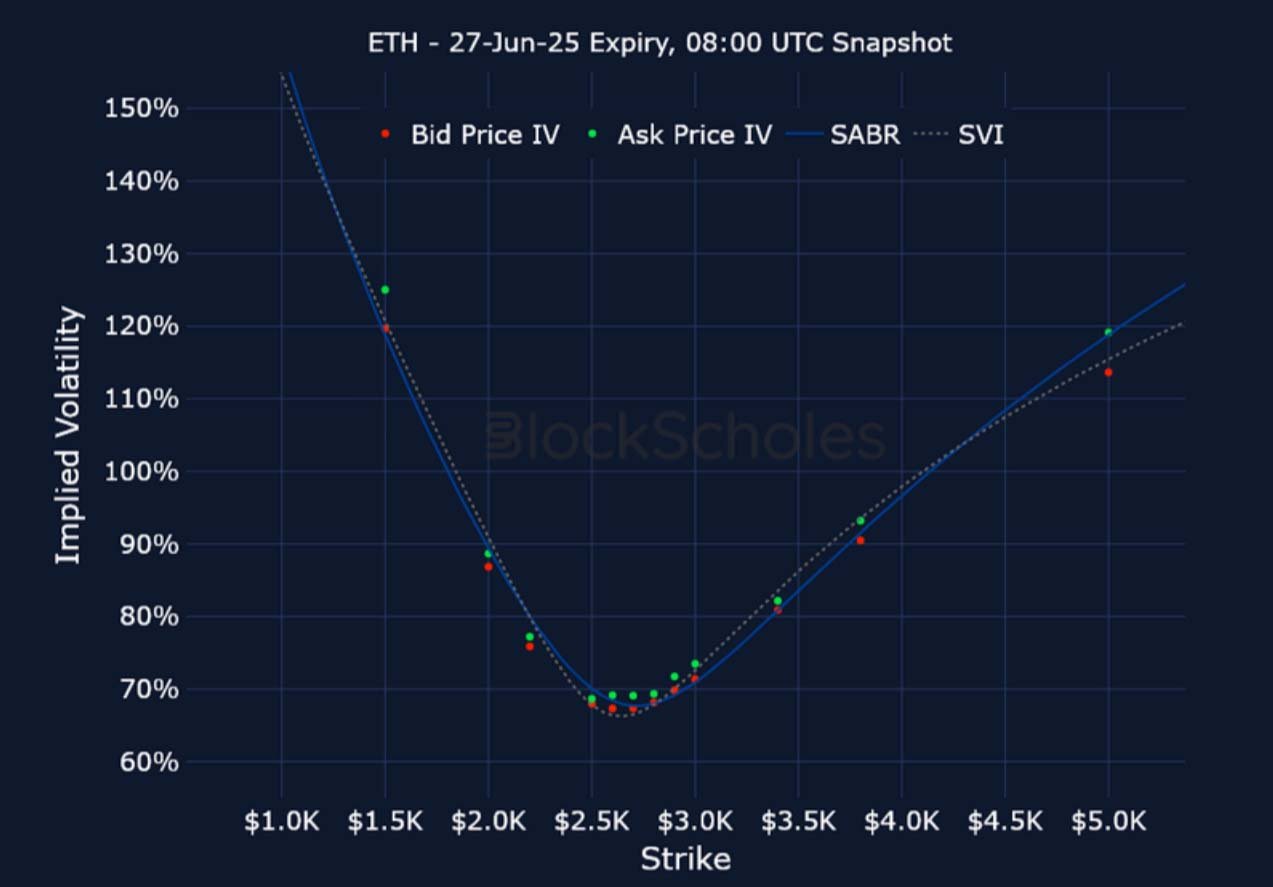

Listed Expiry Volatility Smiles

BTC 27-JUN EXPIRY – 9:00 UTC Snapshot.

ETH 27-JUN EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

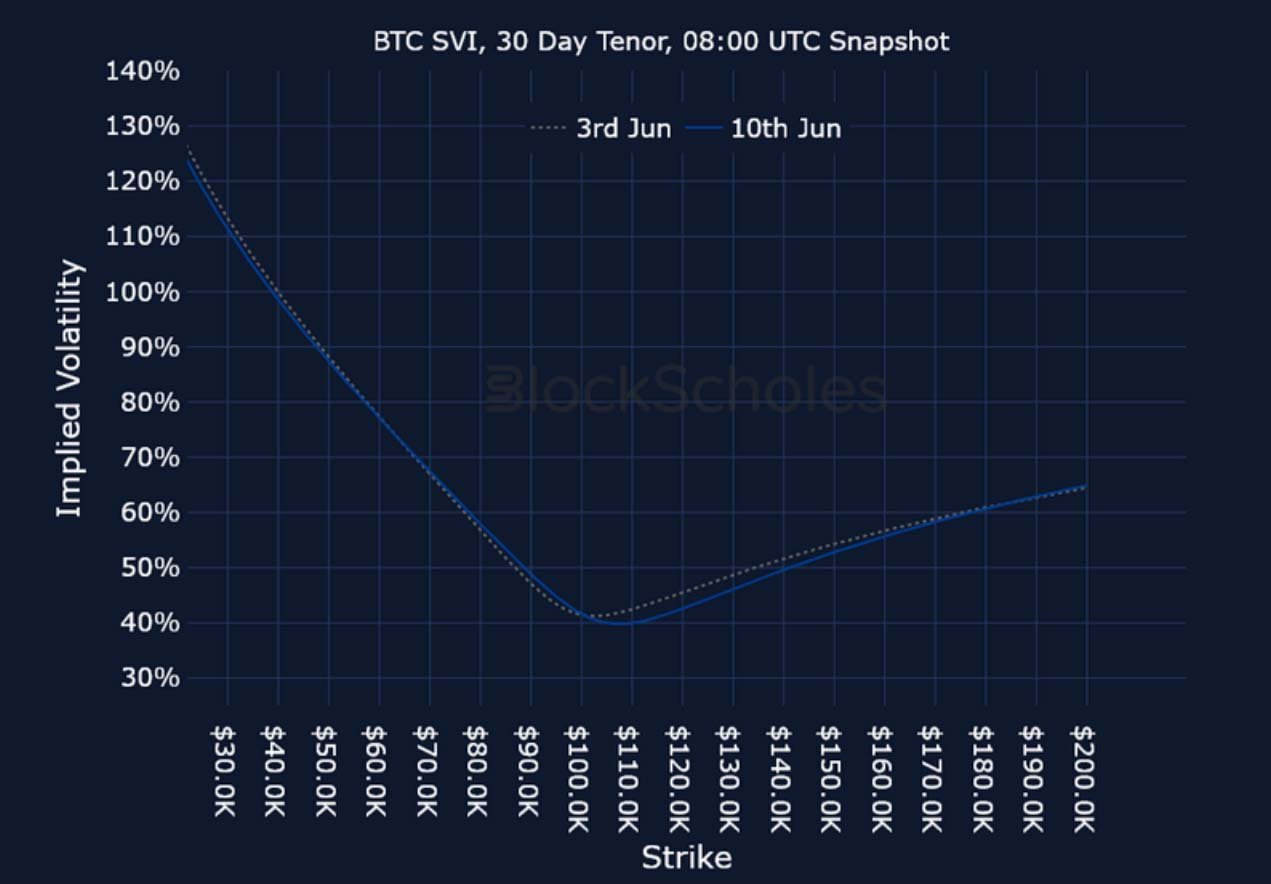

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)