“Thanks for The Memories” – Fall Out Boy

Much has been made about bitcoin’s four-year boom and bust cycle. This pattern of an exponential rise, a collapse, and a new rise higher has held true through most of bitcoin history. That being said, there’s a good argument to be made that this has come to an end.

First, let’s ask, why the four-year cycle occurred in the first place. There are three contributing factors:

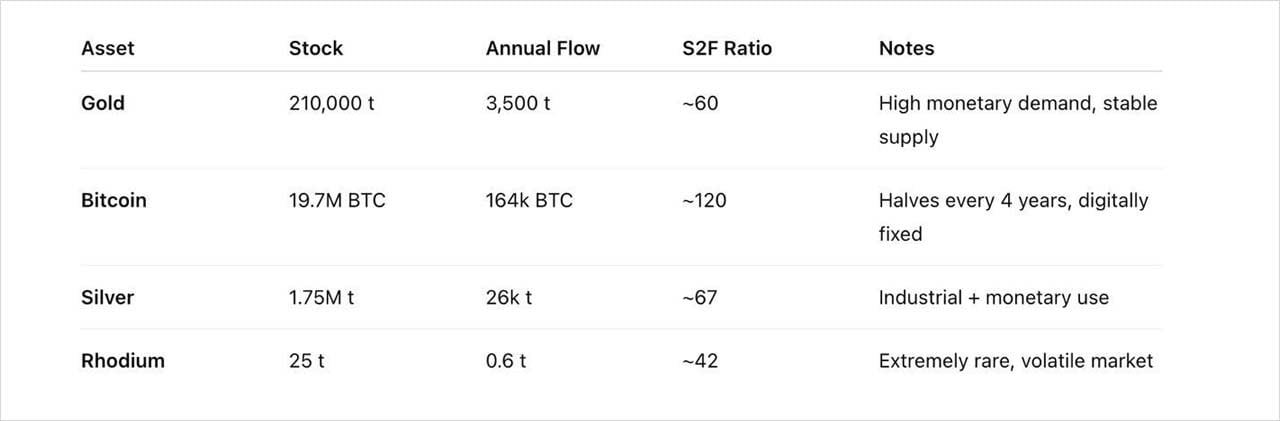

1. The Halving – Every 210,000 blocks (approximately four years), bitcoin mining rewards cut in half overnight. This creates a supply shock that spurs a rally over the successive few years. The scarcity of supply of an asset is often measured by stock-to-flow. The ratio of existing supply to new supply entering the market annually. Gold, a scarce asset, has an S2F ratio of 60. It varies slightly as more gold is discovered at unknown times. Currently, Bitcoin S2F is about 120, meaning about ½ as much new supply enters the market annually as compared to gold. This will only increase after each successive halving.

2. Global Liquidity Cycles – Much has been made by us and others about bitcoin’s correlation to M2 global liquidity. Coincidentally, liquidity, many believe, follows a four-year cycle as well. It’s not quite as exact as the metronomic timing of a bitcoin halving, but it does align. If this is the case, then it makes sense that bitcoin has followed in line.

3. Psychology – With each successive bull run, a new wave of adoption occurs. People follow Gandhi’s Ignore You, Laugh at You, Fight You, You Win, pattern. As such, every four or so years, people adjust more closely to acknowledging bitcoin’s relevance, and it gains more legitimacy. People get overexcited, and then a collapse occurs, and the process starts over again.

Now, let’s ask, are these things still dictating the price of bitcoin?

1. The Halving – With each halving, the change in the amount of new bitcoin as a percentage of total supply becomes less and less significant. When the new annual supply represented 25% of the total supply, a decrease to 12.5% really meant something. Now, as it goes from ~.8% to .4%, the impact is not that meaningful. @DocFleury and I wrote about this in 2020, link.

2. Global Liquidity Cycles – Global liquidity does remain a relevant aspect of BTC price, though it is changing. The transition from a retail-led to institutional-led asset has changed the trading behavior of bitcoin. Institutions are accumulating long-term. They won’t be shaken out by short to medium-term dips in price. As such, though global liquidity will still have a bearing on BTC price, the sensitivity to M2 liquidity will continue to wane. Further, the OTC institutional buying of BTC produces less volatility as well. That being said, this is the real bet for bitcoin. Runaway spending is going to be absorbed by BTC and continue the march to Valhalla.

3. Psychology – The more broadly BTC gains adoption, the more stable it will become in people’s minds. Retail capitulation will matter less. In addition, the transition to institution-led buying will also make the retail impact on price less significant.

In summary, it appears that bitcoin, while still possessing much greater upside than almost any other asset in the world, is transitioning from cyclical growth to more linear growth (on a logarithmic scale). Global liquidity is now in the driver’s seat. Unlike most assets, which come top-down, from institutions to retail, bitcoin has come from grassroots support into institutional spheres. As a result, we are seeing stabilizing behavior as the market matures, growing more orderly in real-time. (image credit @DeathCabToQE)

View original post on X here.

AUTHOR(S)