Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

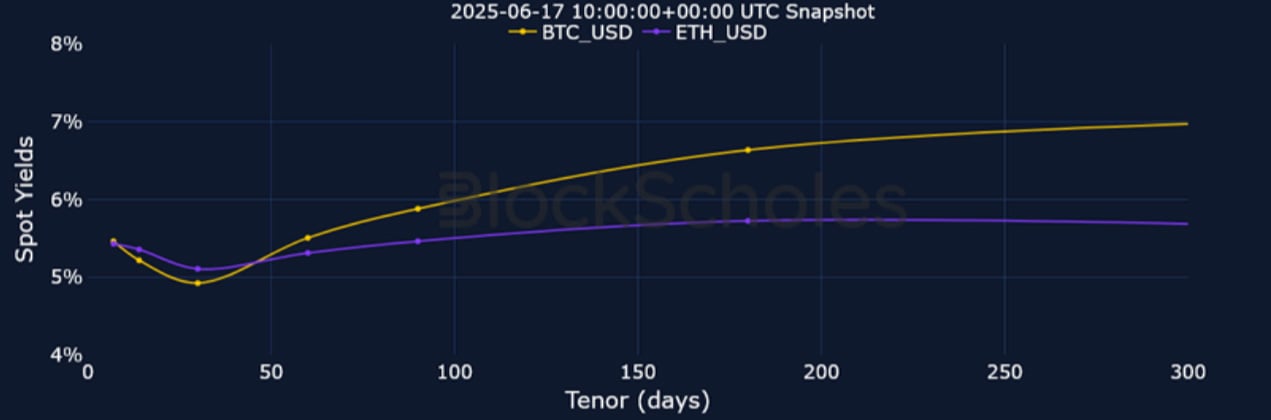

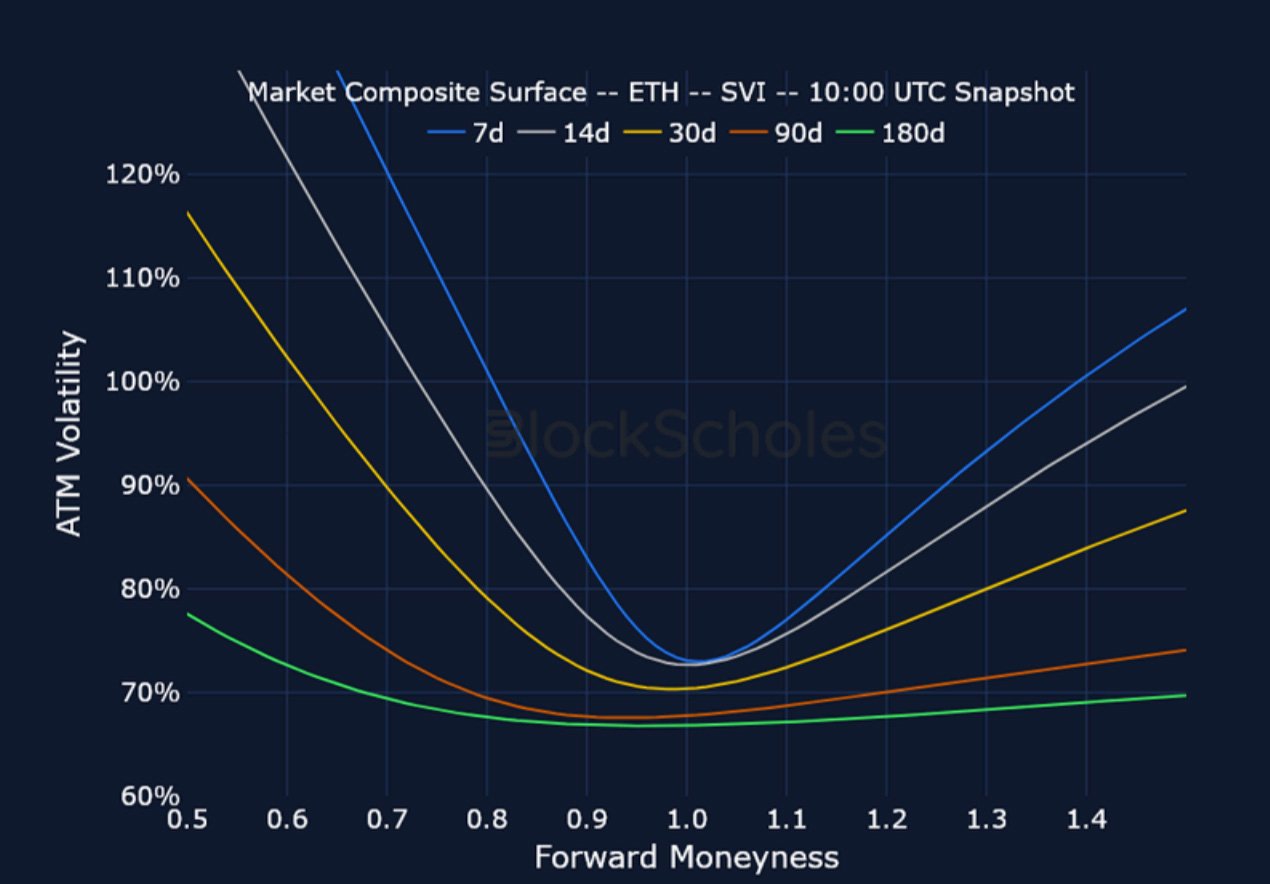

Over the past week crypto markets were given the reminder that President Trump’s tariff war is not the only significant driver of spot and derivative markets. This time last week, BTC was trading above $110K bolstered by news of a “fruitful” negotiation between the US and China, according to Commerce Secretary Howard Lutnick. Only a few days later BTC dropped to as low as $103K as tensions in the Middle East between Israel and Iran escalated. ETH’s term structure of volatility remains inverted, while short-tenor volatility smiles assign a more than 2% premium to OTM puts. That contrasts funding rates for ETH however, which currently has longs paying the funding to short traders. Additionally, over the weekend, we have noticed a convergence between BTC and ETH 30-day futures yields at 5%.

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

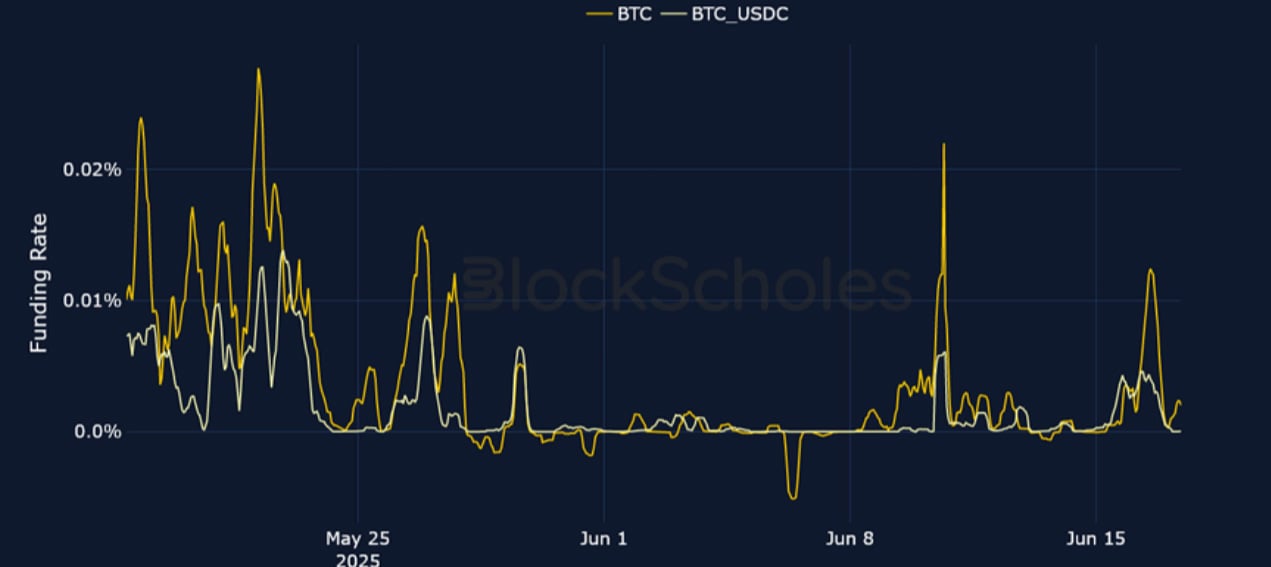

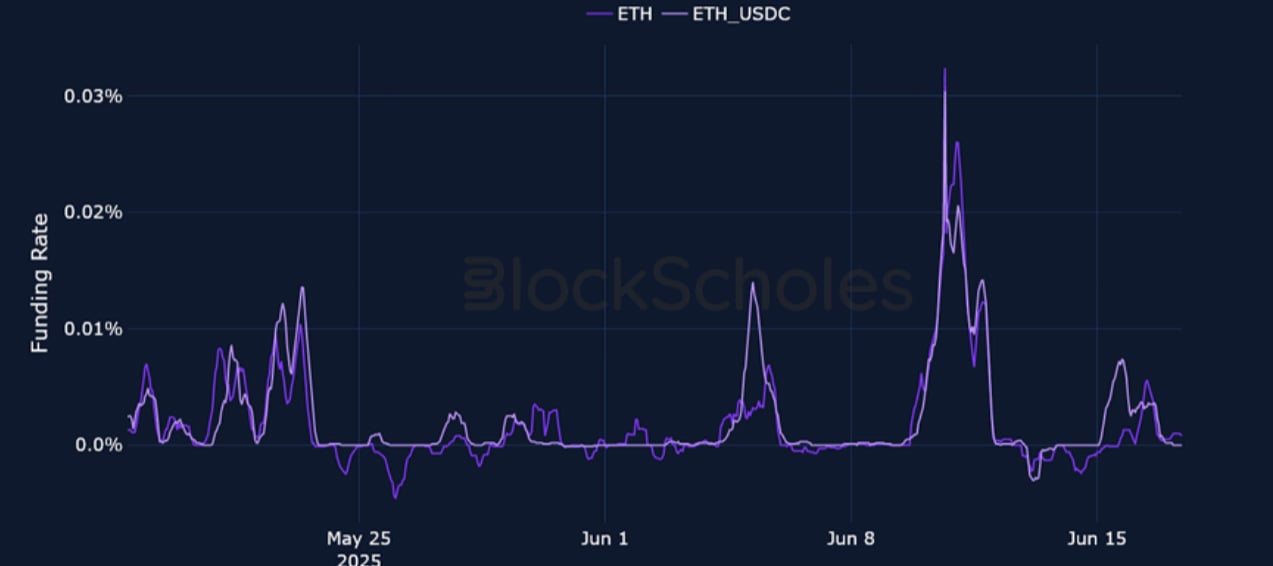

Perpetual Swap Funding Rate

BTC FUNDING RATE – The most recent spike in BTC funding rates coincided with news reports that Iran was willing to deescalate tensions with Israel.

ETH FUNDING RATE – After being negative for most of the past week, ETH funding rates now bare a slight positive rate, contrasting short-tenor skew.

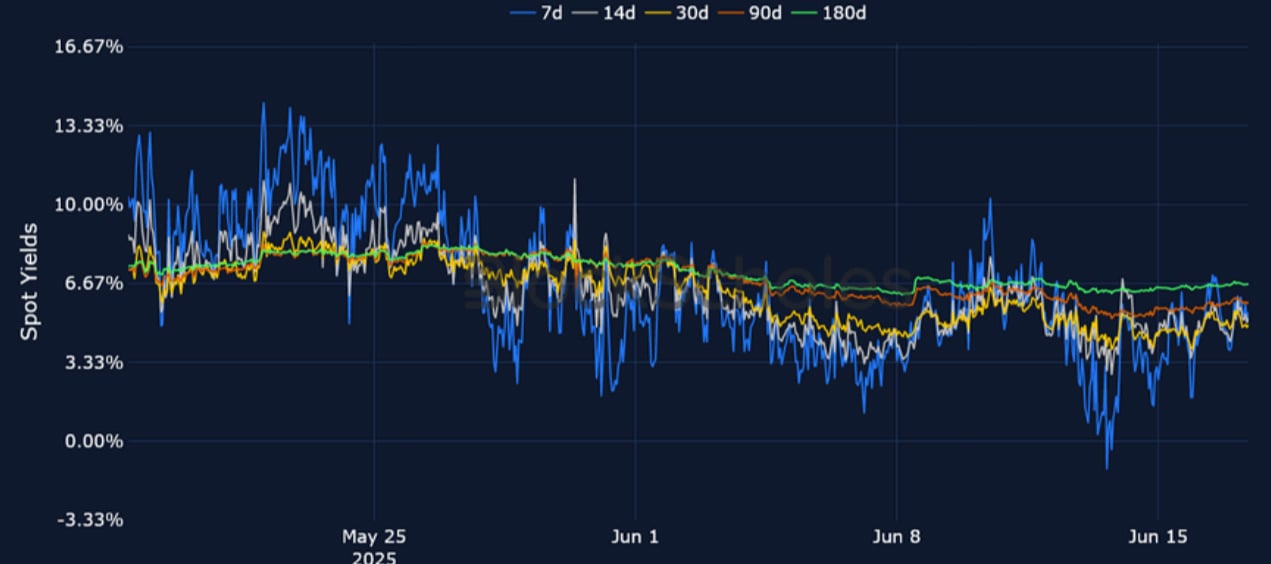

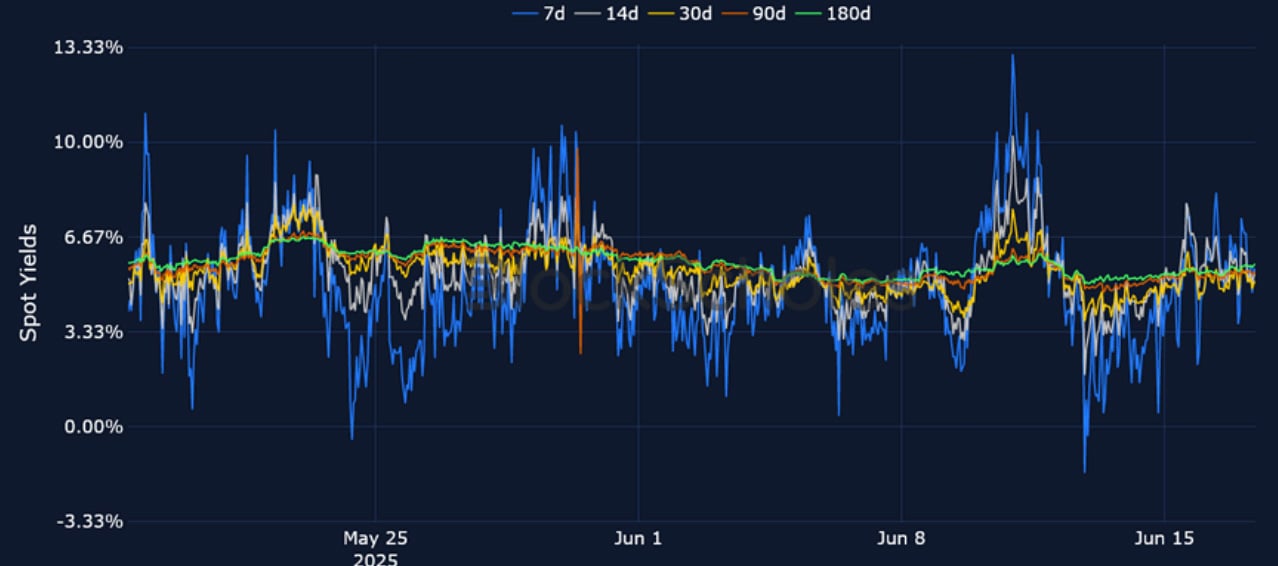

Futures Implied Yields

BTC Futures Implied Yields – Futures yields have converged at tenors below 30-days, though remain higher in BTC beyond those maturities.

ETH Futures Implied Yields – ETH futures-implied yields are compressed around 5% at all tenors currently.

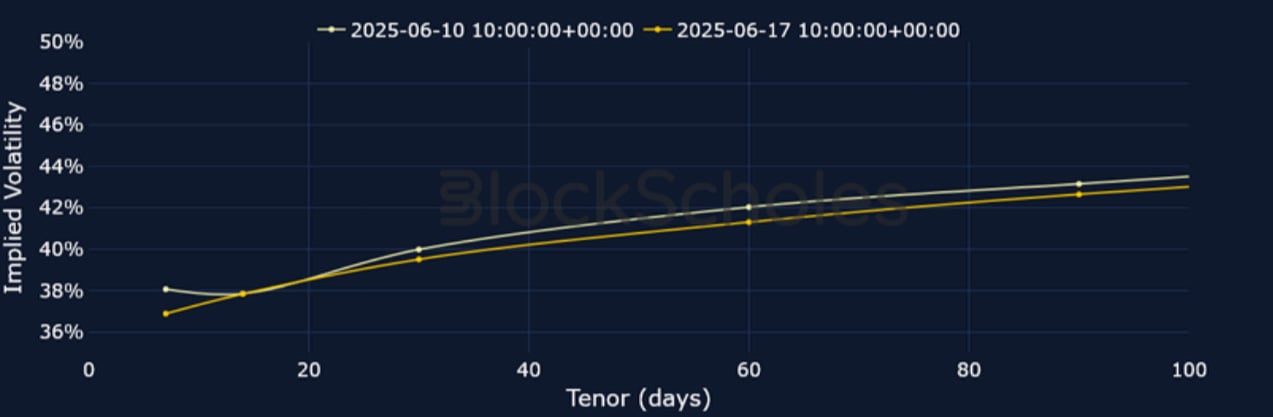

BTC Options

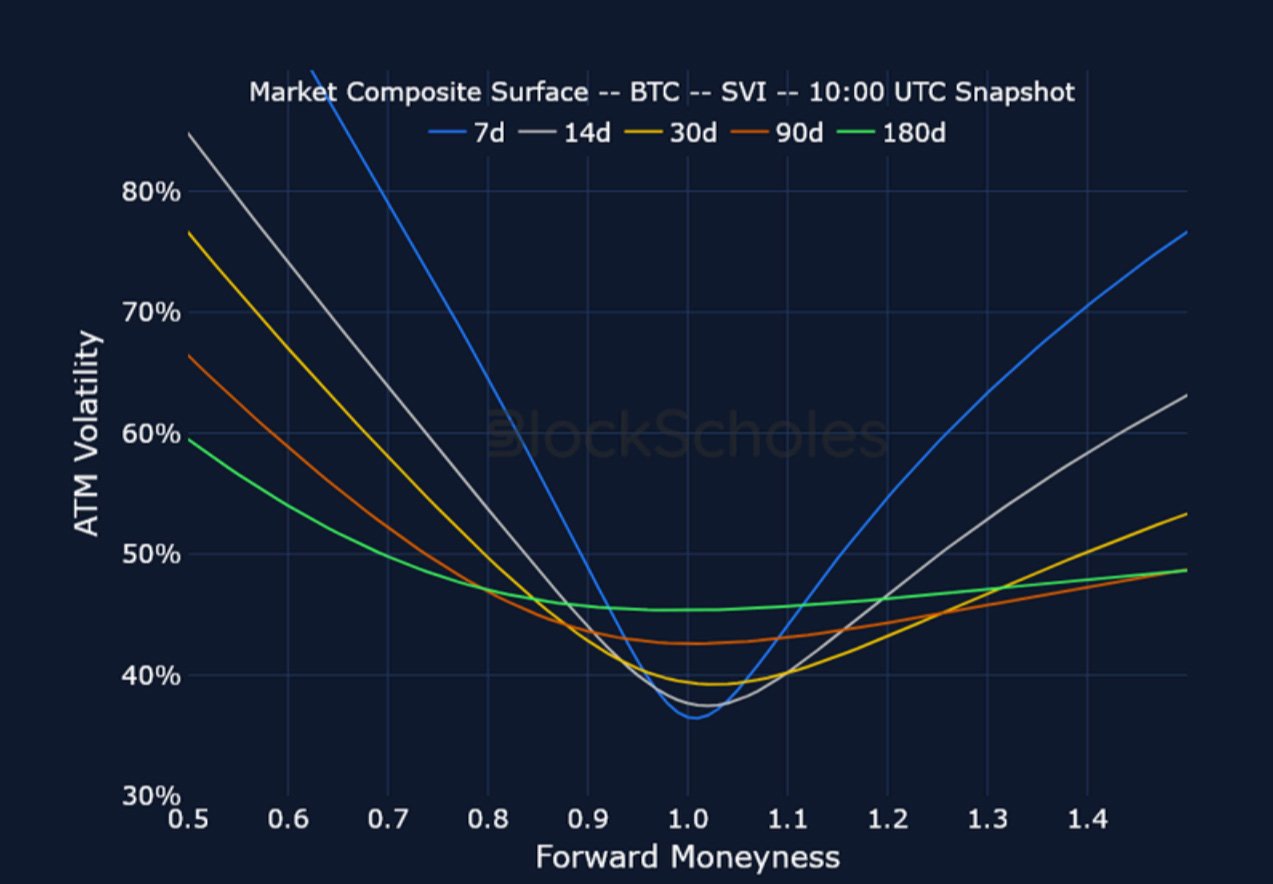

BTC SVI ATM IMPLIED VOLATILITY – Short-term implied volatility is hovering at 37%, while 7-day realized volatility remains flat at 30%.

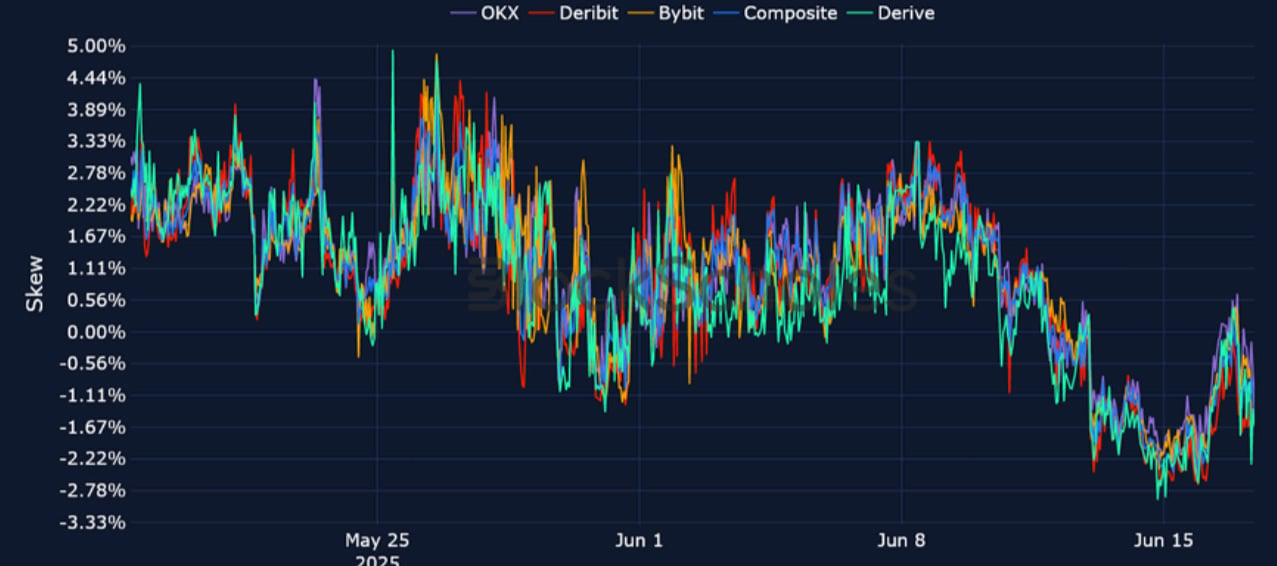

BTC 25-Delta Risk Reversal – The 7-day risk reversal risk-reversal has abated much of its bearish tilt, though remains skewed towards OTM puts by 1.3%.

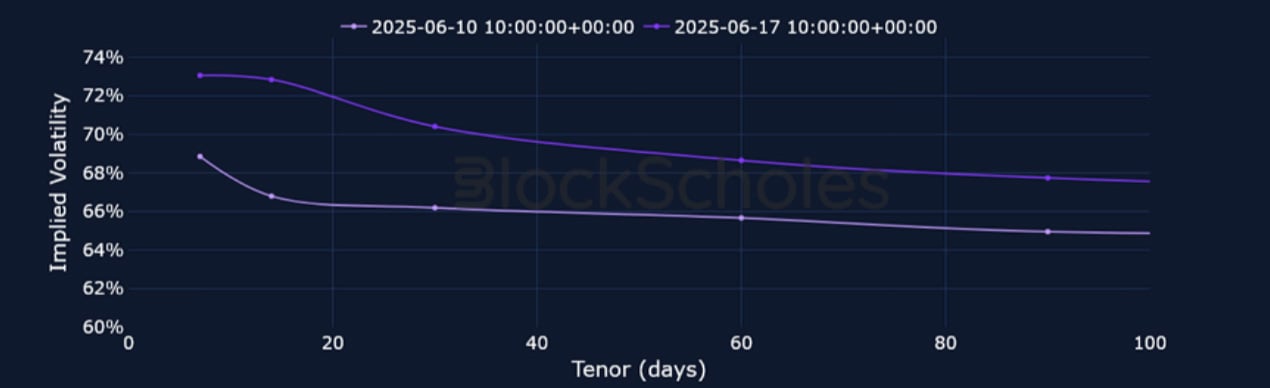

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – ETH’s volatility term structure maintains the inversion of last week, though is now at higher outright levels.

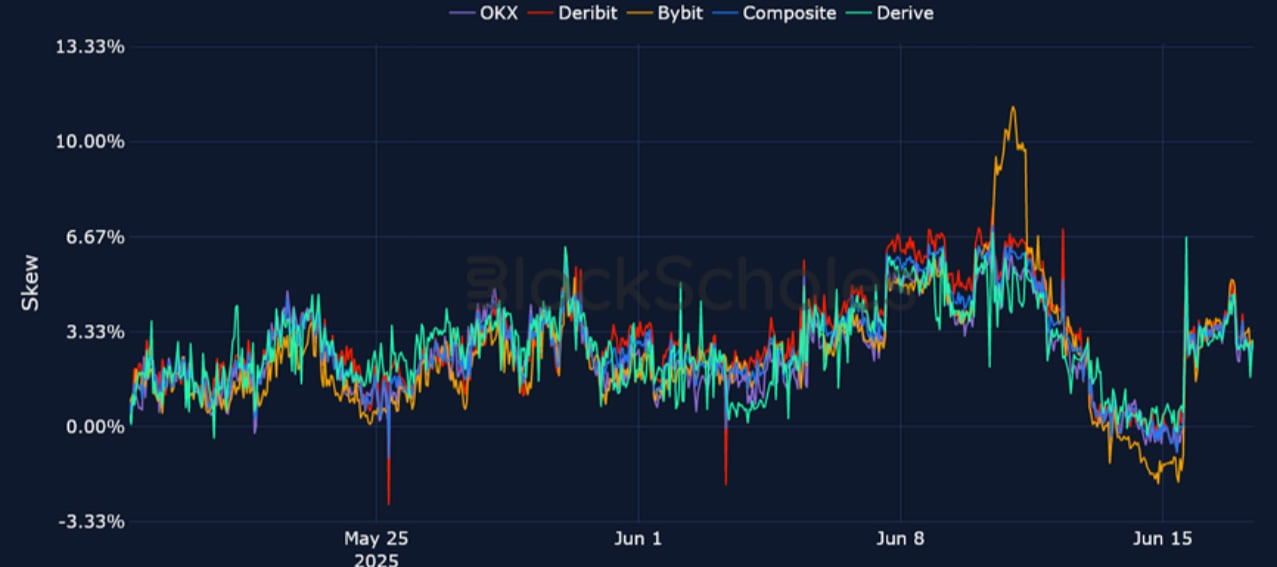

ETH 25-Delta Risk Reversal – Short-tenor ETH smiles contrast the positive funding rates seen in perp markets, with traders assigning a 2% premium towards OTM puts as ETH spot price is down more than 8% over the past week.

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

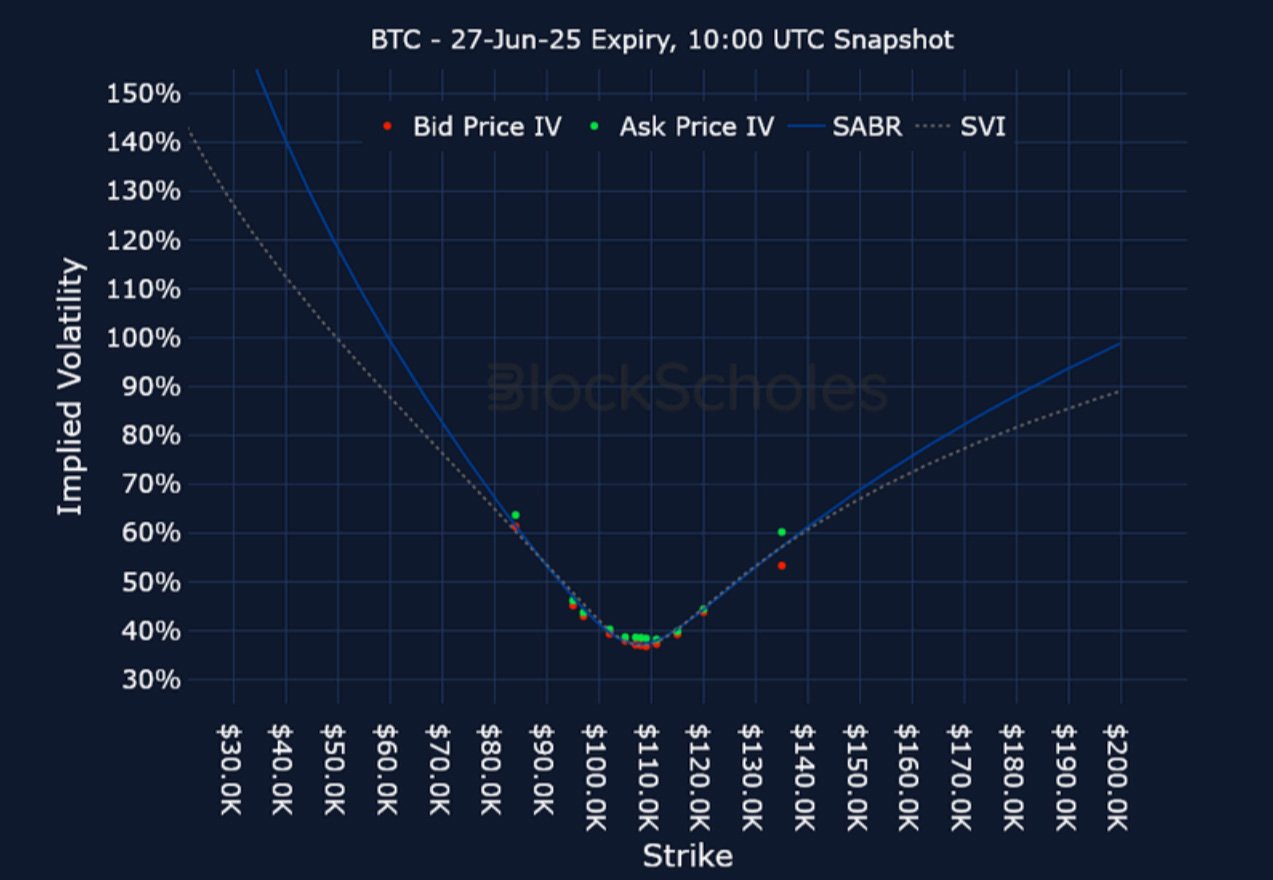

Listed Expiry Volatility Smiles

BTC 27-JUN EXPIRY – 9:00 UTC Snapshot.

ETH 27-JUN EXPIRY – 9:00 UTC Snapshot.

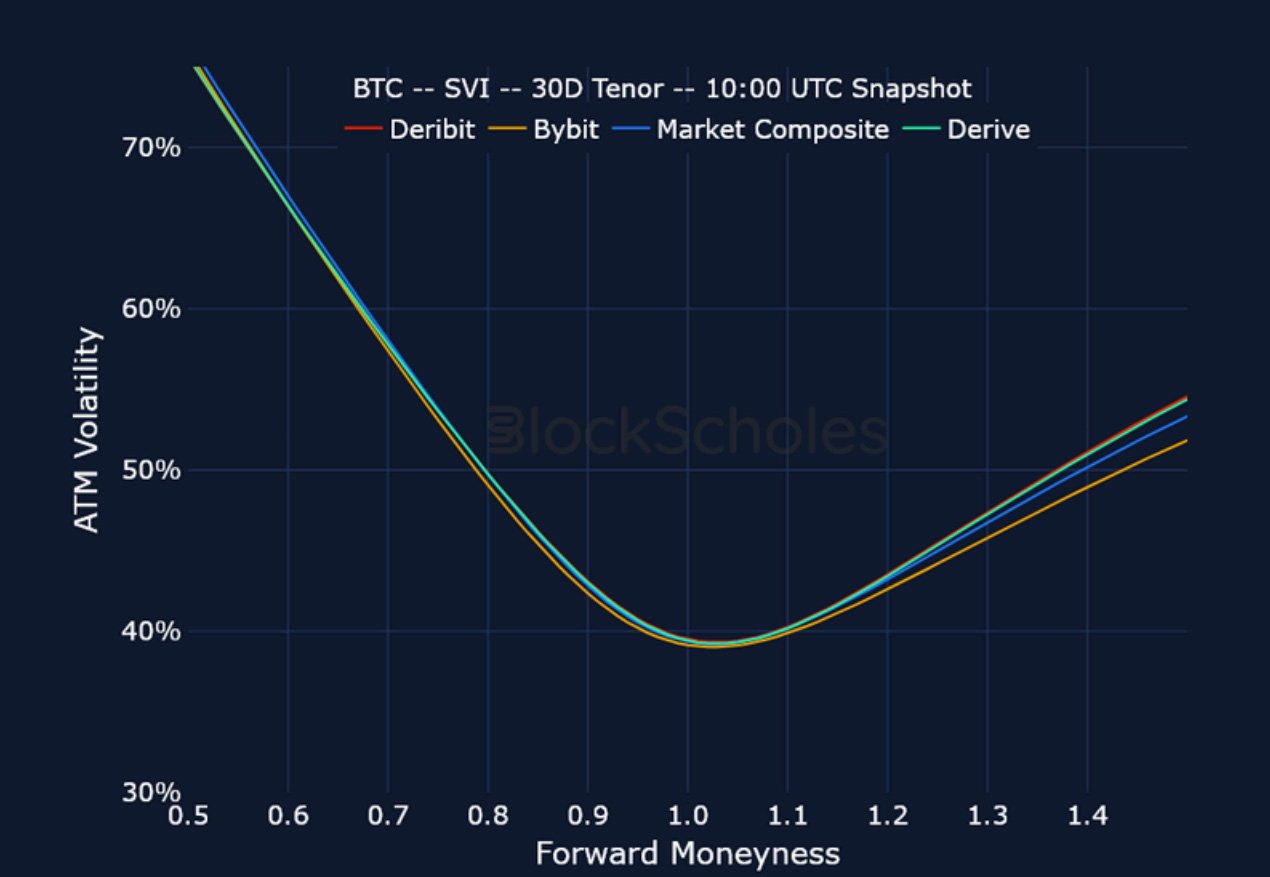

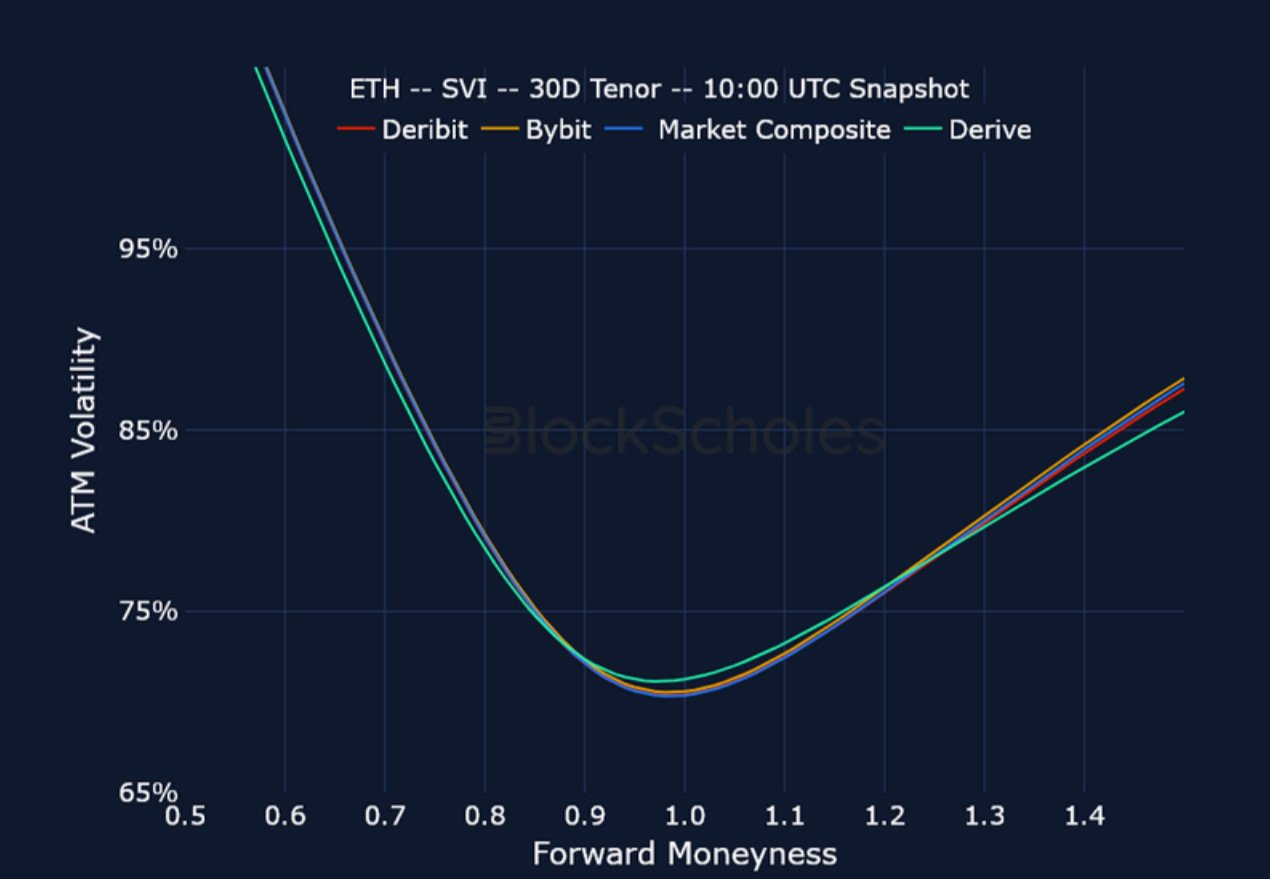

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

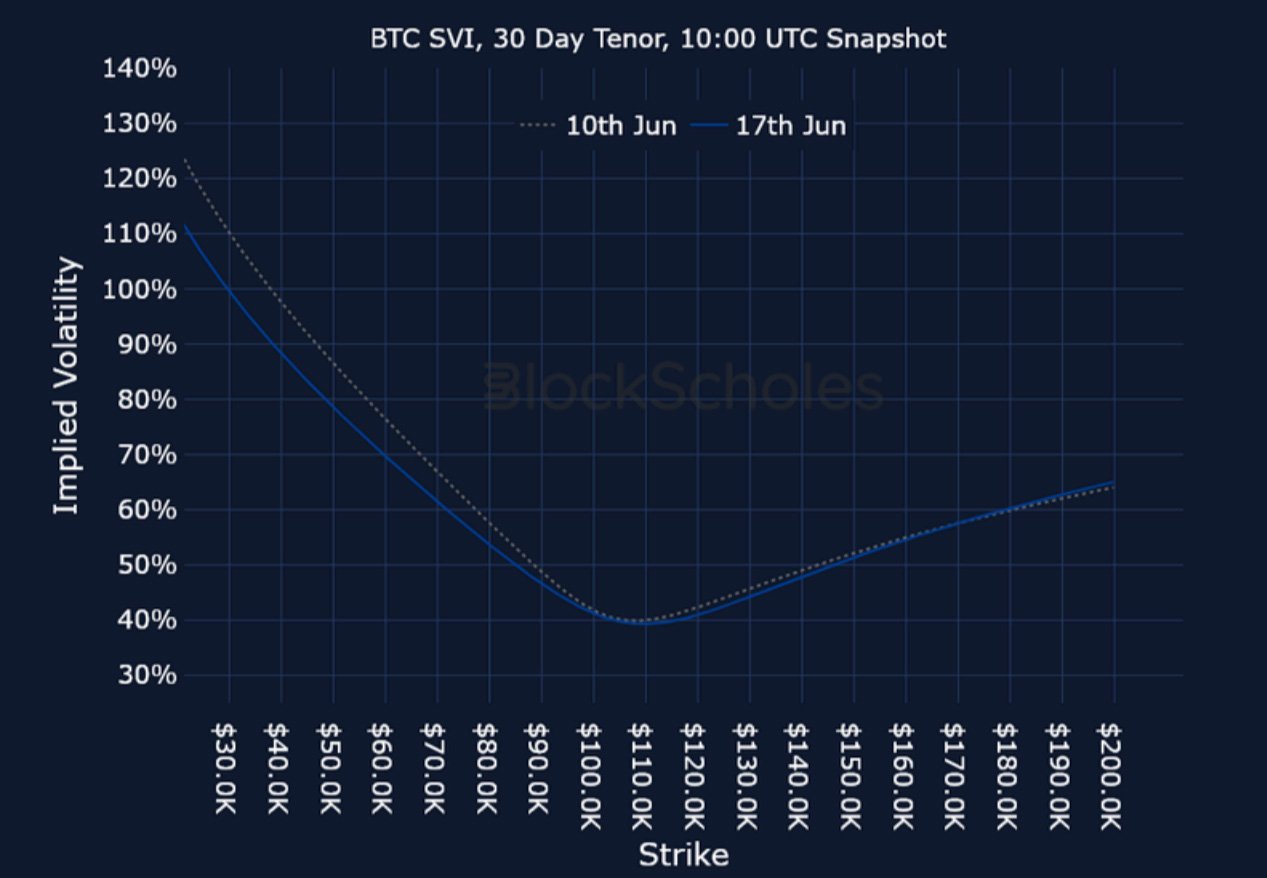

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)