Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

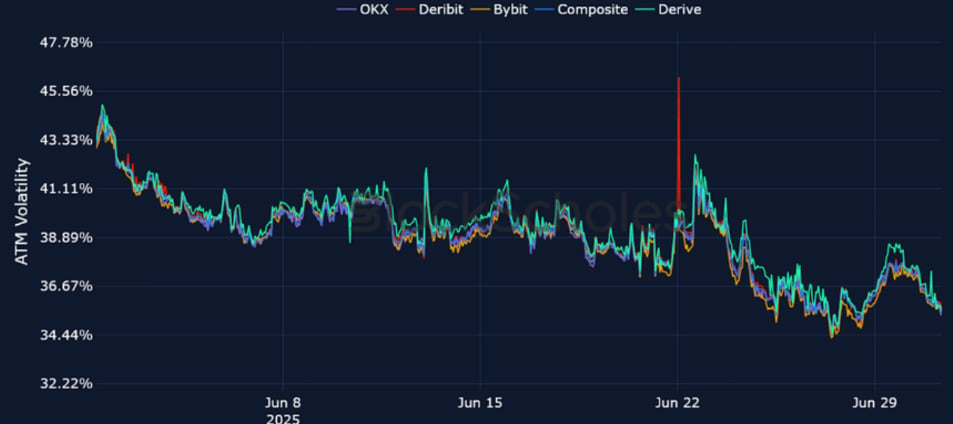

Over the past week, BTC and ETH spot prices have consolidated within a range of $105-108K and $2.4- 2.5K, respectively. The sideways slog follows an earlier rally, when President Trump brokered a ceasefire in the Middle East. BTC perpetual contracts saw a return to positive funding rates, while ETH funding rates continue to remain close to neutral. The lack of big moves in spot price has also left its mark on options markets. BTC 7-day at-the-money implied volatility fell as low as 27%, breaking below a long- held 30-35% floor for implied volatility – that was the lowest levels of volatility priced by the market for BTC options since October 2023. Equally, ETH’s inverted term structure of volatility has abated, though short-tenor volatility continues to maintain nearly double the premium of similar-dated BTC options.

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

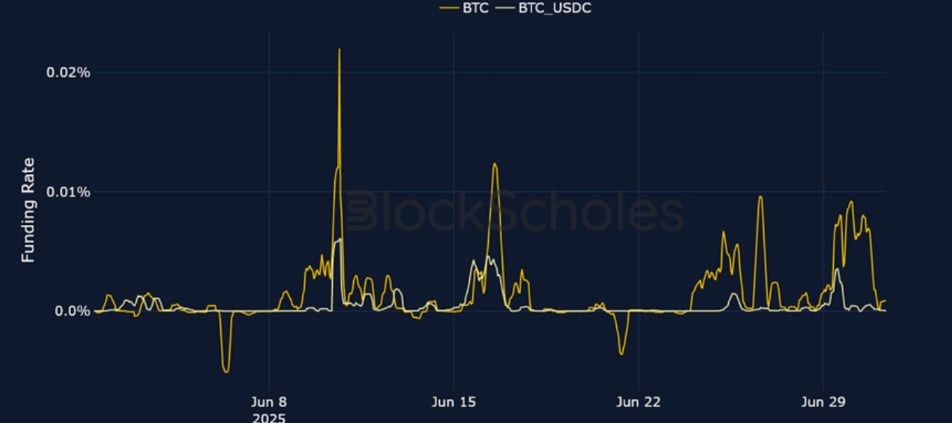

Perpetual Swap Funding Rate

BTC FUNDING RATE – The ceasefire in the Middle East brought a return to positive funding rates for BTC as spot price jumped to $108K.

ETH FUNDING RATE – Moves for peace brokered by President Trump did not, however, have any meaningful impact on ETH perpetual funding rates.

Futures Implied Yields

BTC Futures Implied Yields – 7-day spot yields have traded between as low as 0.75% and as high as 7.86%, now closer to the lower-end of the week’s range.

ETH Futures Implied Yields – Both the term structure of ETH implied volatility, and ETH futures term structure are now positively sloped.

BTC Options

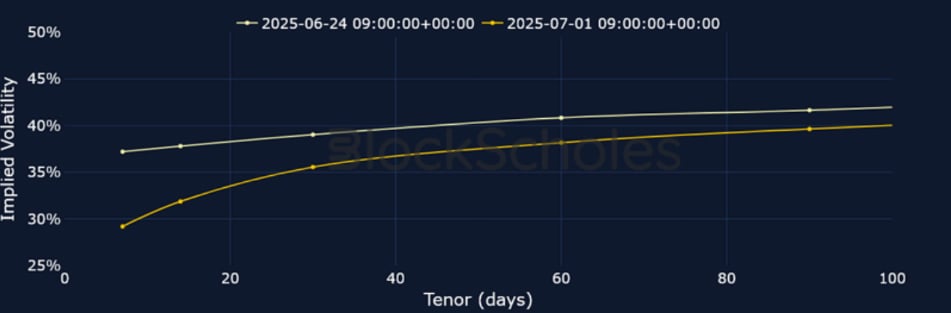

BTC SVI ATM IMPLIED VOLATILITY – The past week saw 7-day implied volatility fall to 27.6% – a level last seen in October 2023.

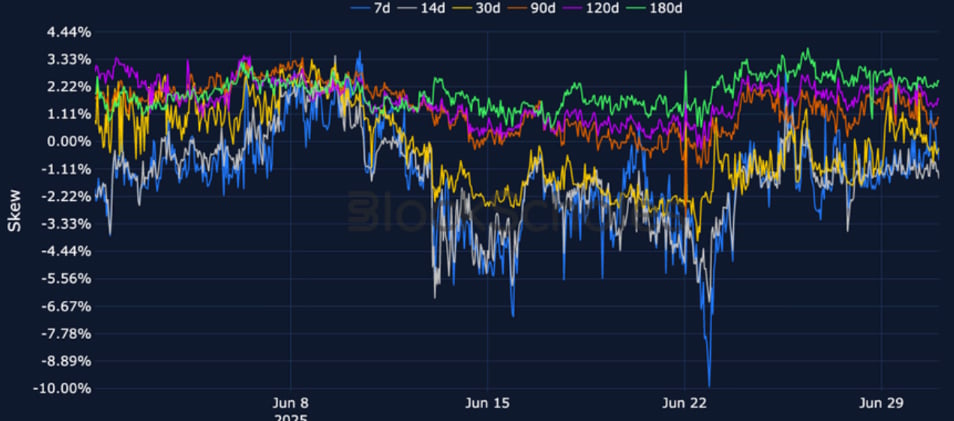

BTC 25-Delta Risk Reversal – The past week has seen a recovery for BTC smiles to a modestly-bullish skew, from a previous tilt towards OTM puts.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – ETH’s term structure is no longer contrasting BTC’s – both are upward sloping, as front-end vol has collapsed.

ETH 25-Delta Risk Reversal – ETH short-tenor smile skews have failed to meaningfully break out in either direction this week; perhaps a reflection of spot price which has also been range-bound close to $2.5K.

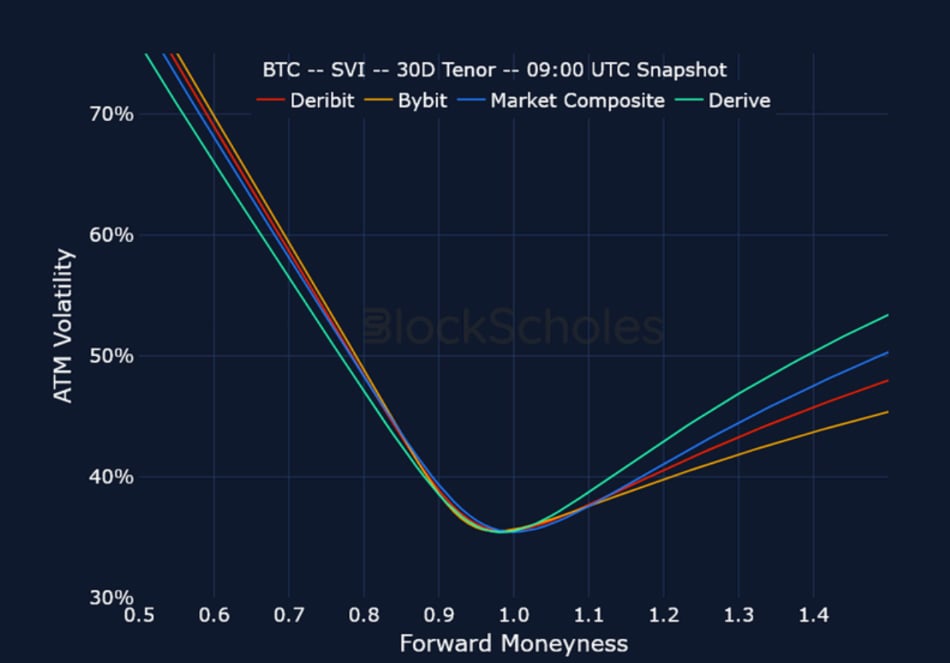

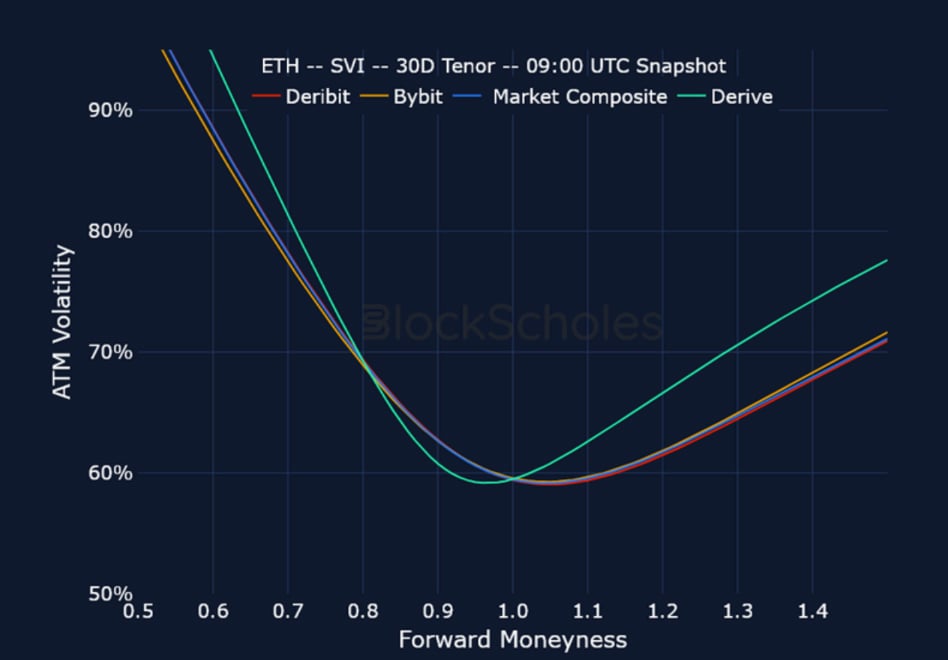

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

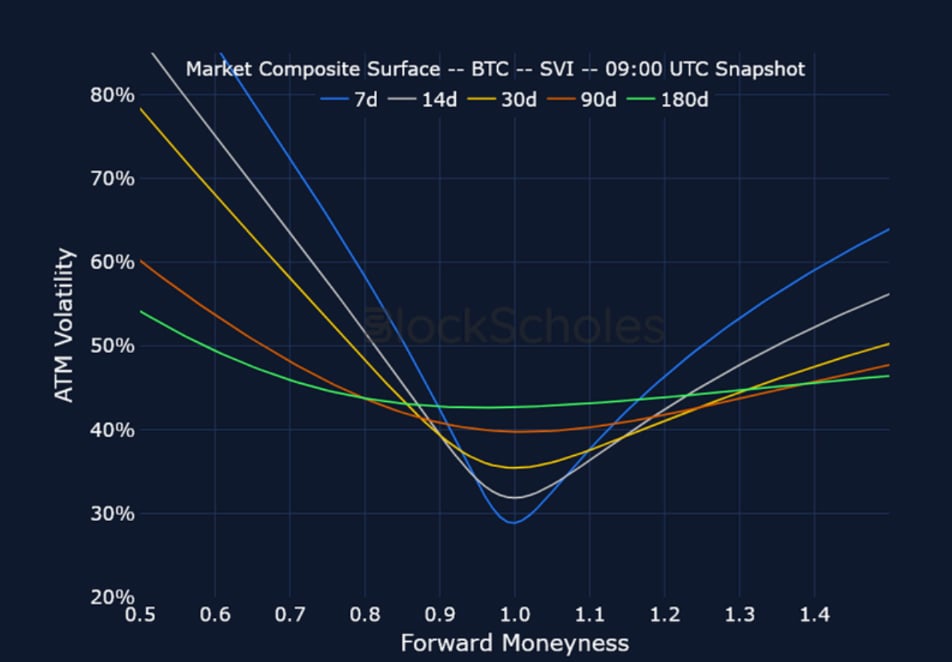

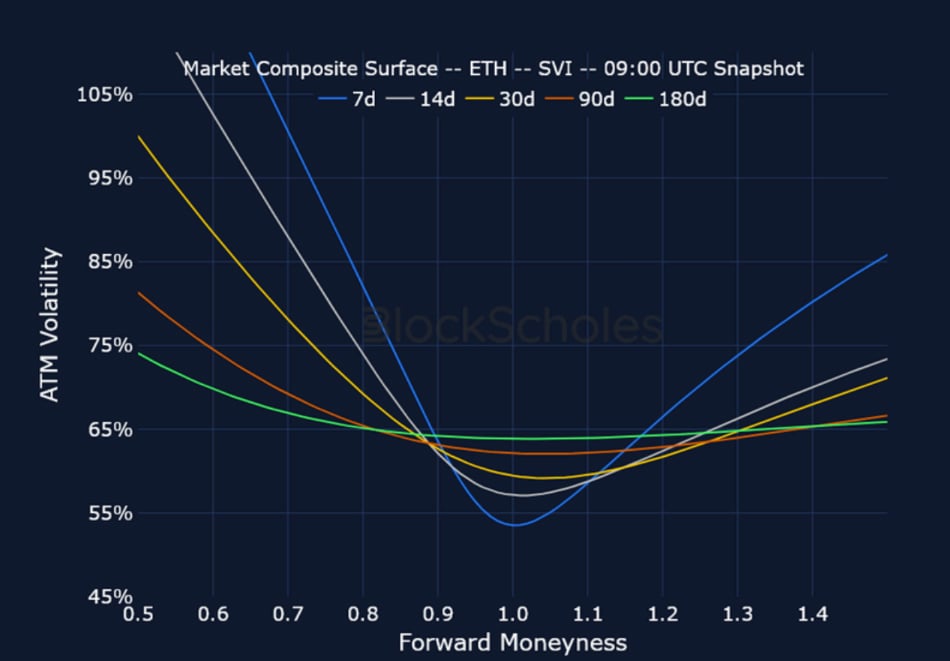

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

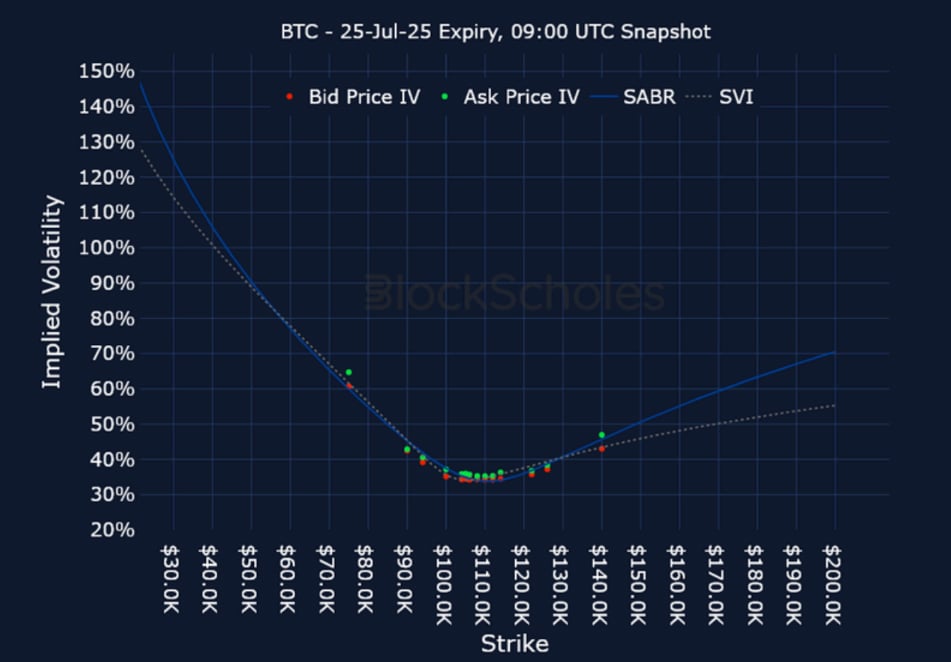

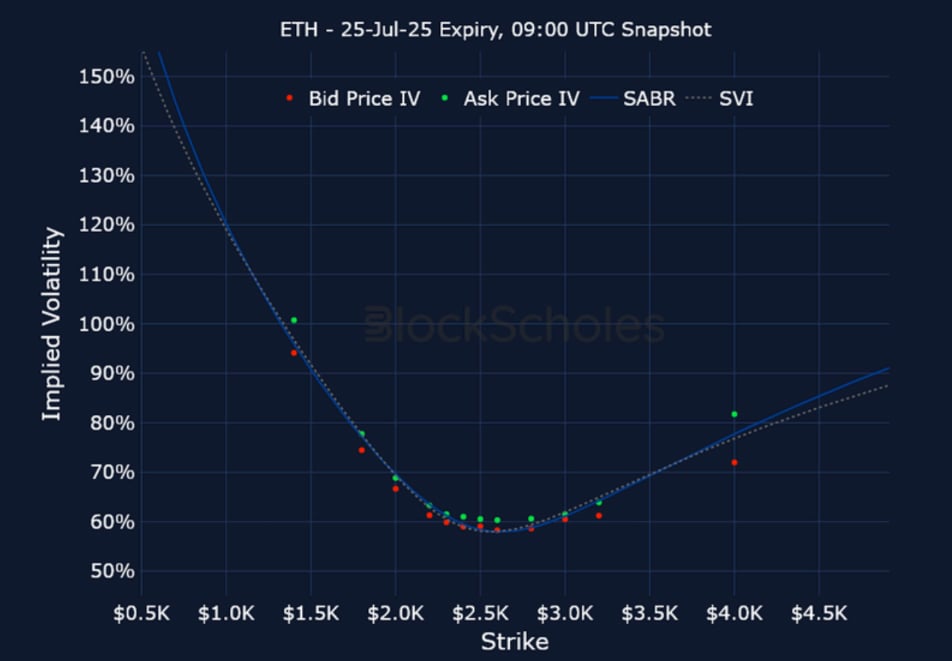

Listed Expiry Volatility Smiles

BTC 25-JUL EXPIRY – 9:00 UTC Snapshot.

ETH 25-JUL EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

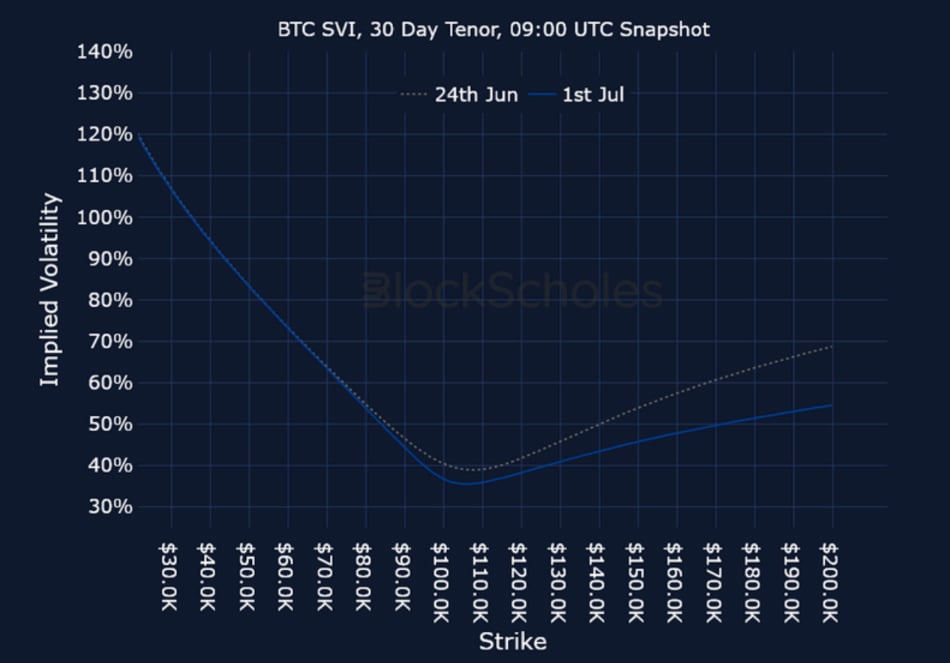

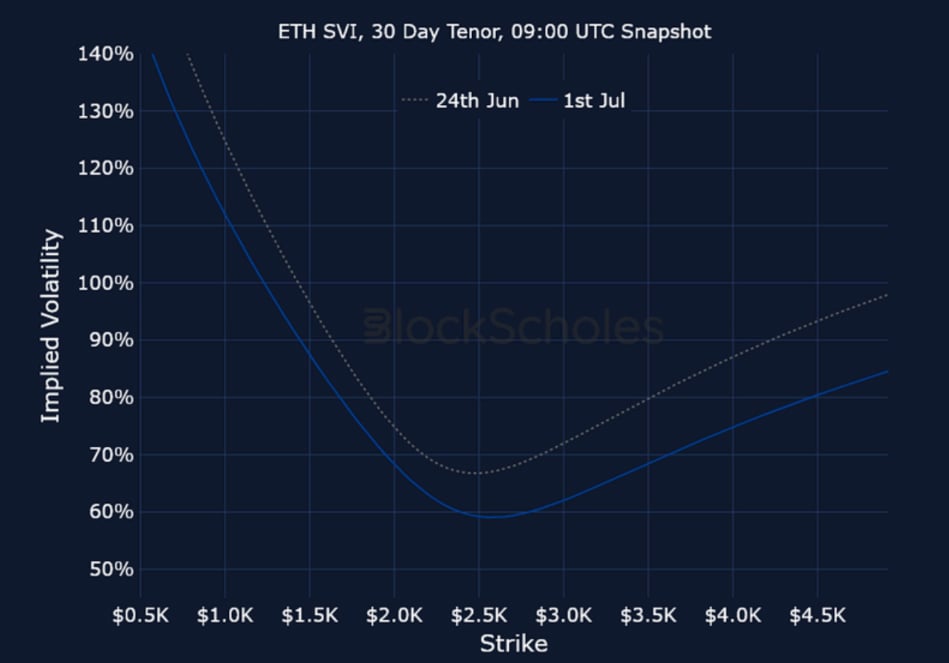

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)