Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Crypto asset prices this week have largely traded with the ebbs and flows of macro developments in the US. Last Thursday, BTC surged to a new all-time high of $124K, bolstered by a CPI report which markets ultimately digested as not being hot enough to derail the Fed from cutting rates in their next September meeting (despite the highest core MoM reading all year). Signs of profit taking meant that level did not hold for long – prices then fell following a stronger-than-expected PPI inflation report, which showed inflation at the wholesale level rising at its fastest pace since June 2022. Since Monday, BTC has traded rangebound between $114K and $117K, in line with sideways price action in US equities, as risk-on markets eagerly await clues about the future path of monetary policy from Chair Powell during his Jackson Hole speech on Friday.

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

Perpetual Swap Funding Rate

BTC FUNDING RATE – Funding rates jumped to their highest levels so far in the month of August, coinciding with a new record high of $124K on Aug 14, 2025.

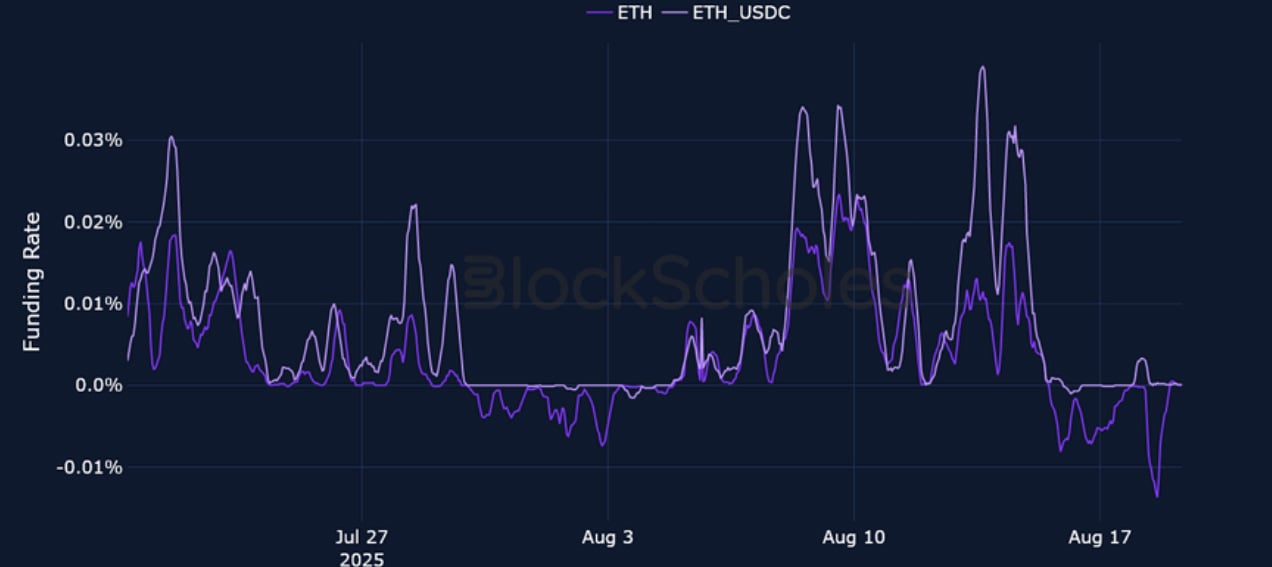

ETH FUNDING RATE – Trader’s anticipated a potential break past the Nov 2021 ATH for ETH earlier this week, as 8-hourly funding rates rallied past 0.03%. However, as ETH came up $100 short before pulling back, funding rates subsequently dipped below zero.

Futures Implied Yields

BTC Futures Implied Yields – The futures term structure disinverted as a higher than expected PPI inflation report ignited a sell-off in risk-on assets.

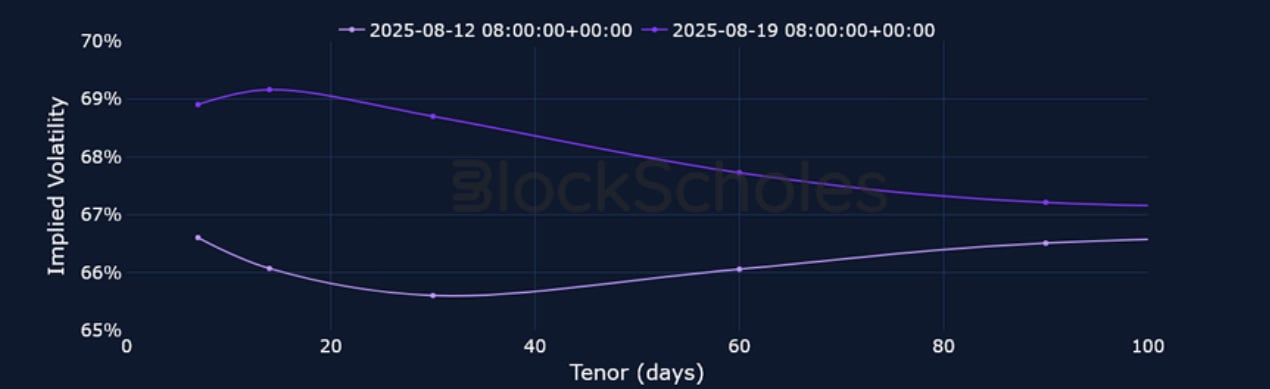

ETH Futures Implied Yields – Futures markets still express a slight willingness to pay a premium above ETH’s spot price for long exposure, though that has fallen from its highs of 13% earlier in the week.

BTC Options

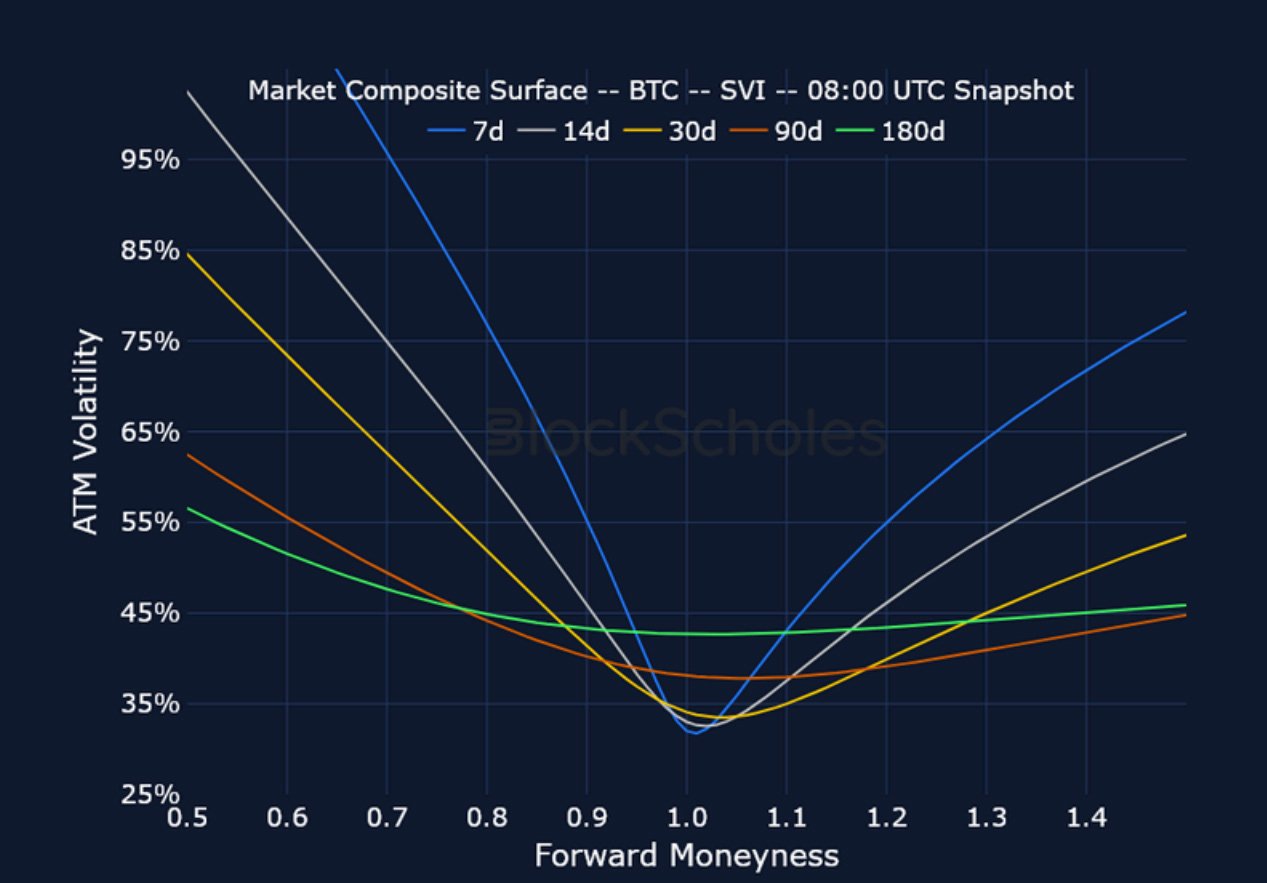

BTC SVI ATM IMPLIED VOLATILITY – As with previous rallies to ATHs, short- tenor vol failed to jump high enough to invert the term structure of volatility.

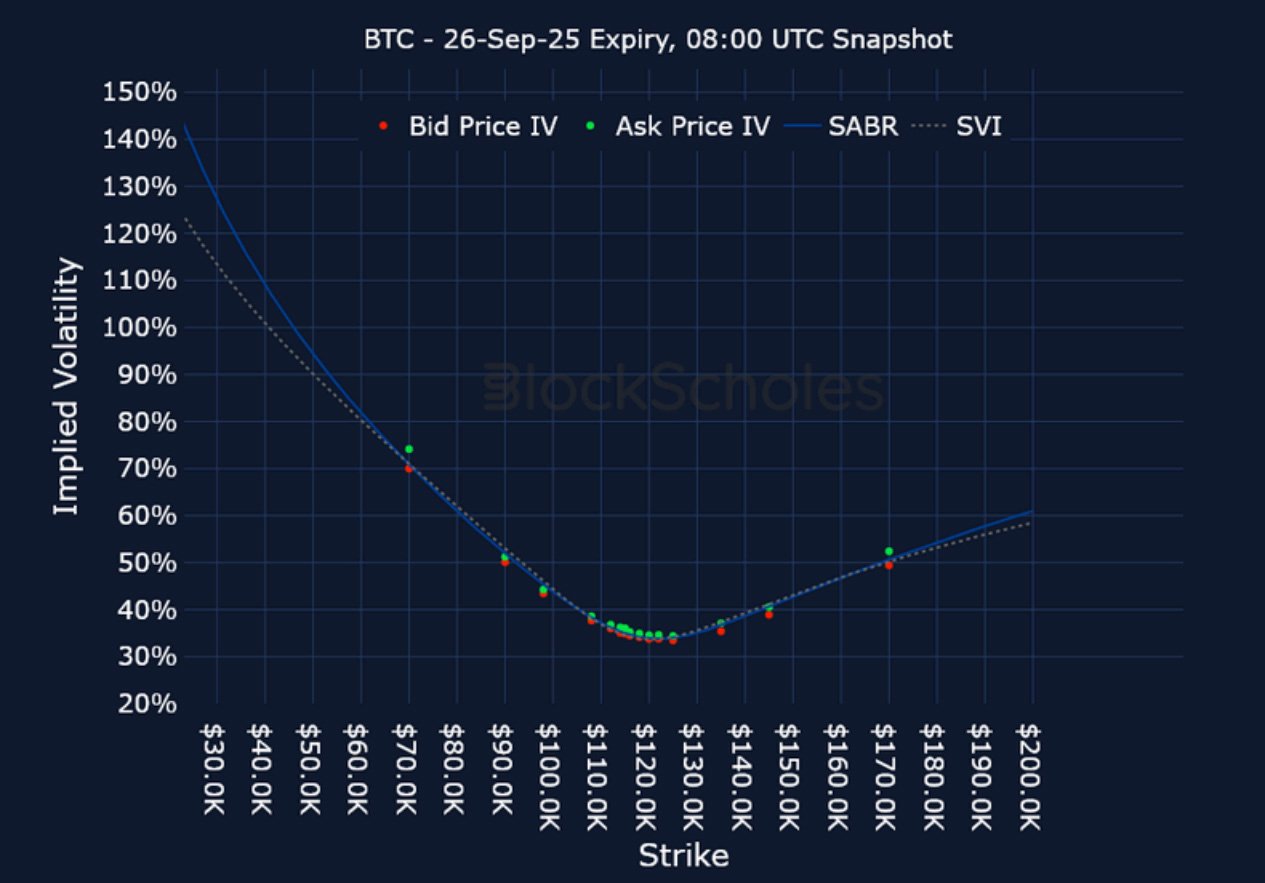

BTC 25-Delta Risk Reversal – As BTC now trades 7% below the $124K level, options markets continue to price in further downside action, with short-tenor volatility smiles skewed as much as 4% towards OTM puts.

ETH Options

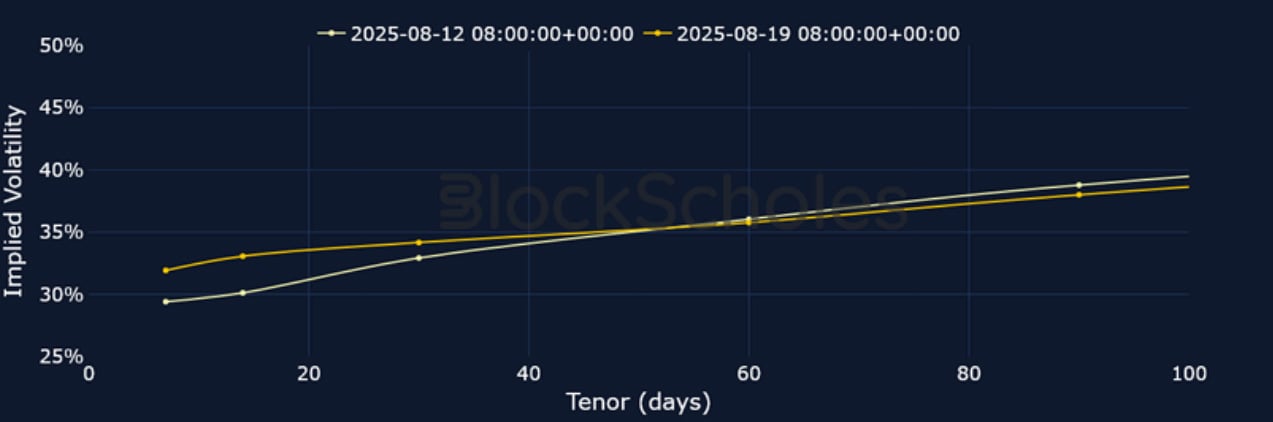

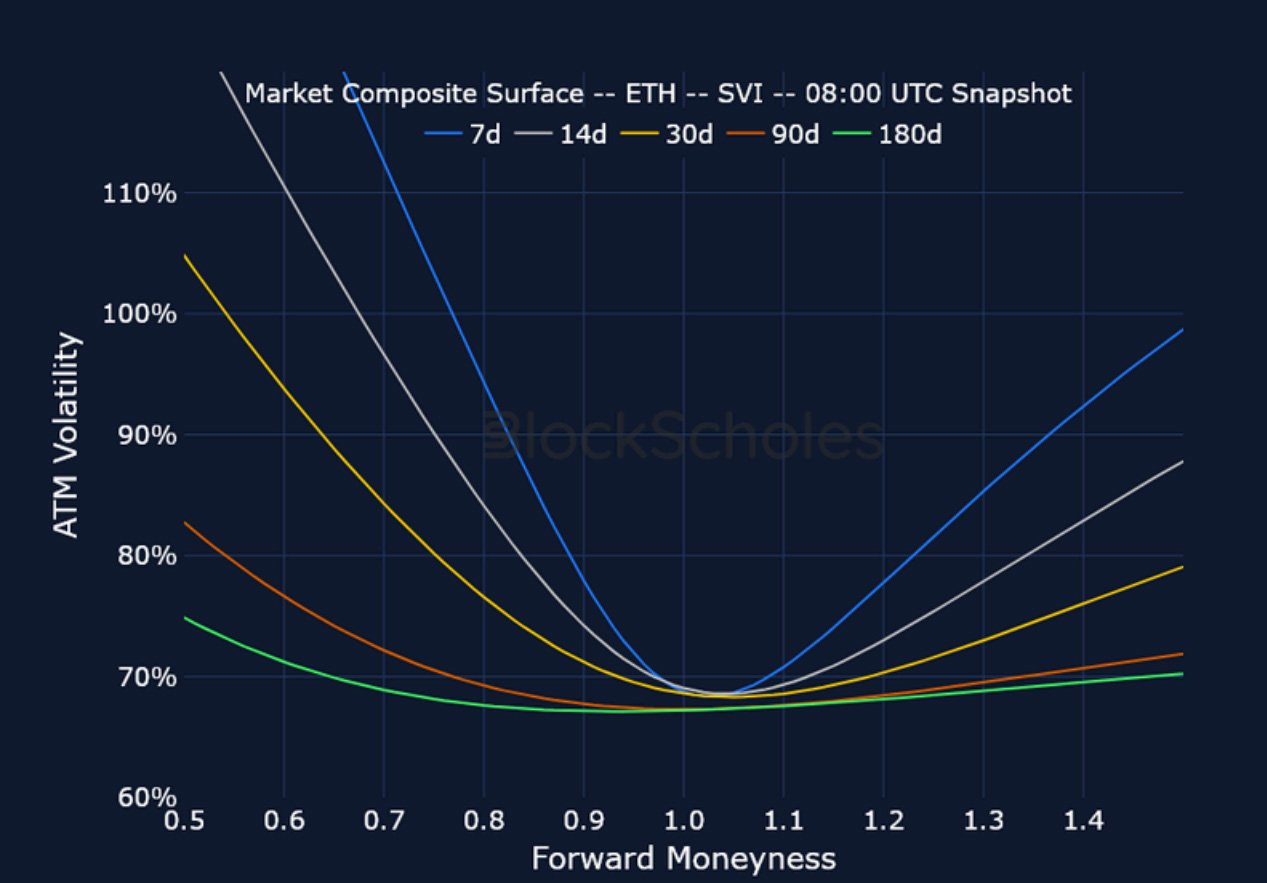

ETH SVI ATM IMPLIED VOLATILITY – As we have often seen in the past, ETH’s term structure has quickly compressed following a small, brief inversion.

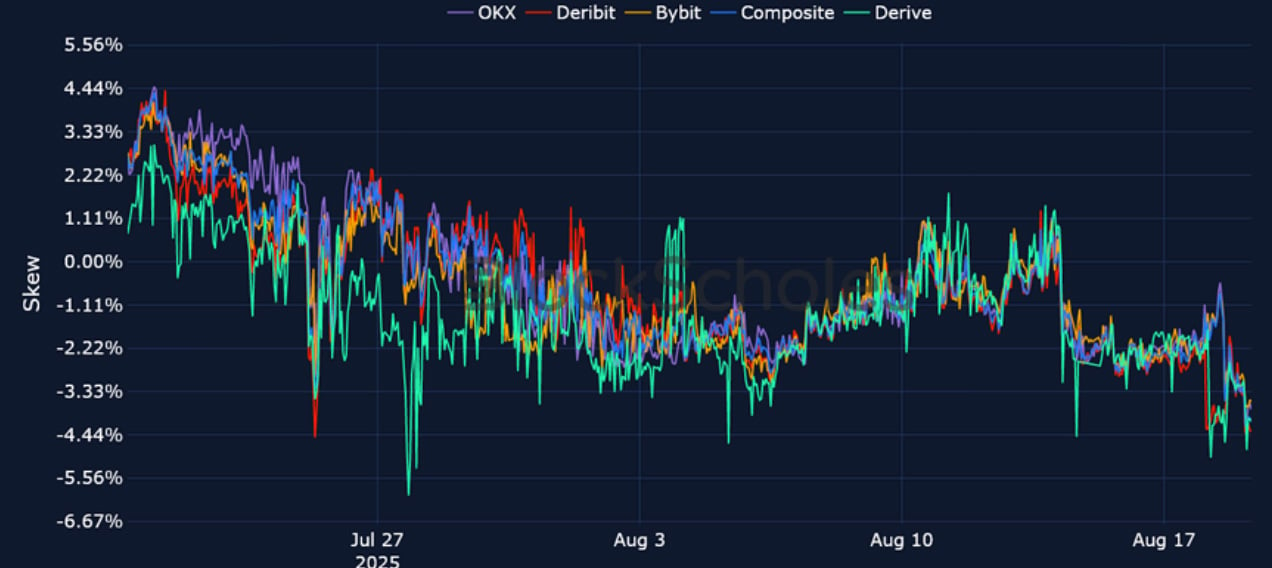

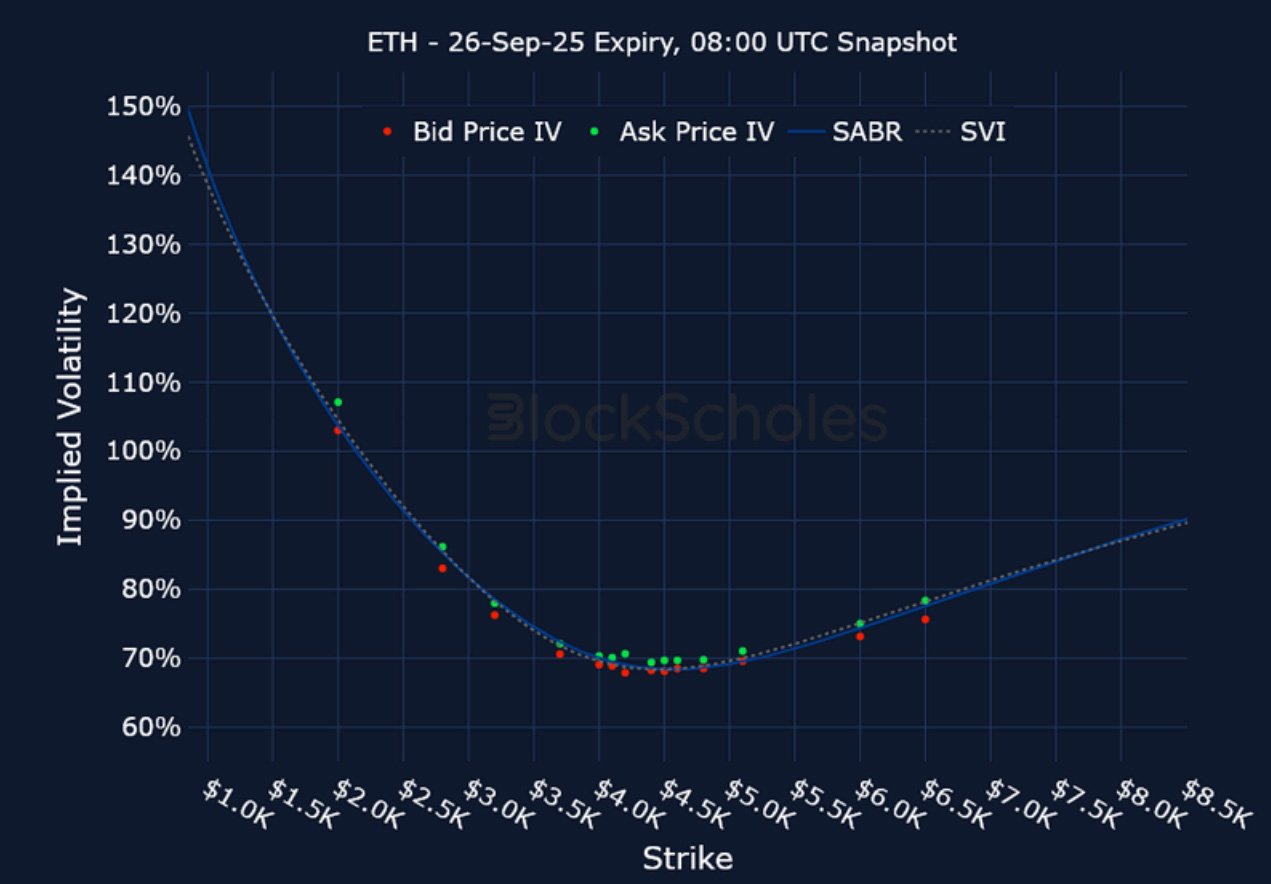

ETH 25-Delta Risk Reversal – Since July, we have seen voracious demand for Ether, pushing the token past $4,700. However, recent outflows in Spot ETFs and a declining spot price coincides with a demand for downside protection in options markets.

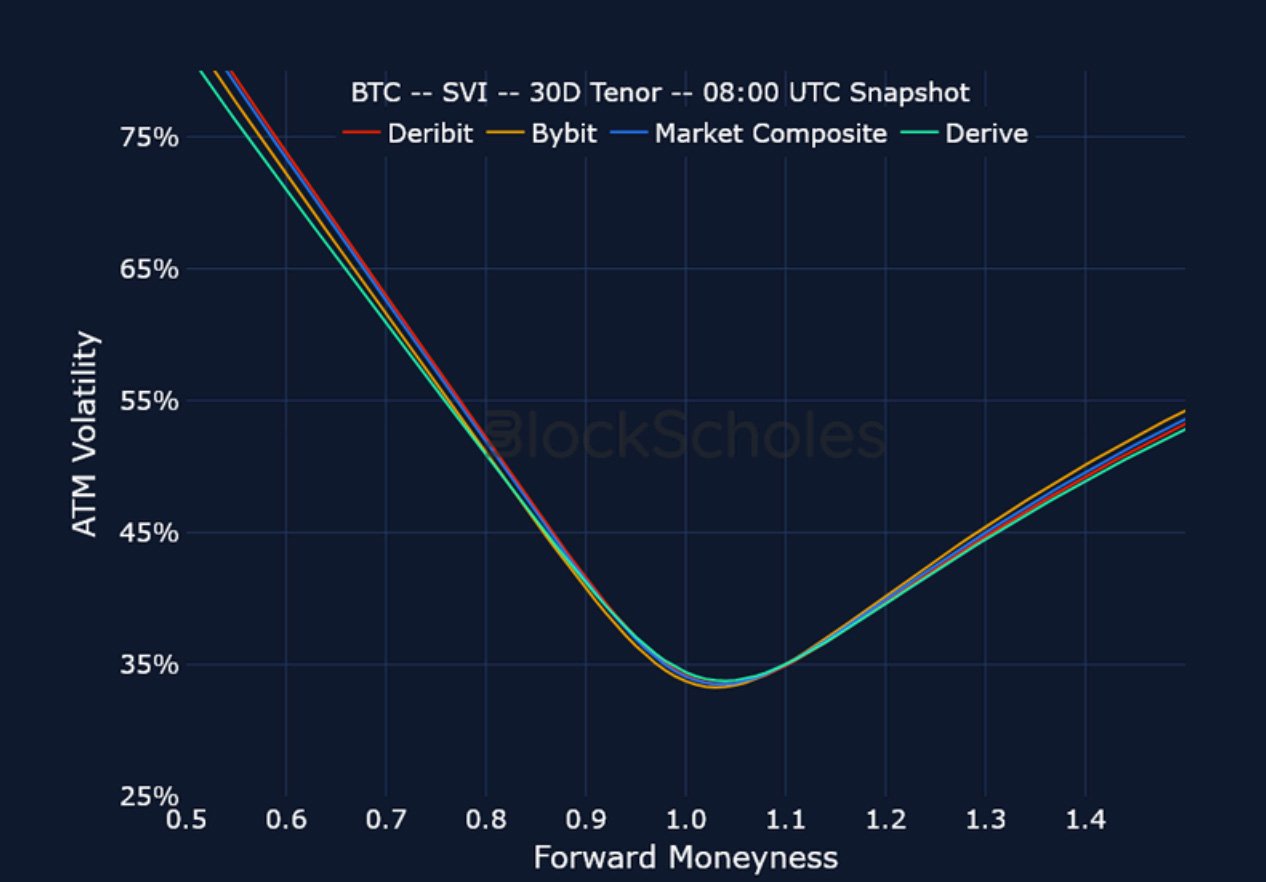

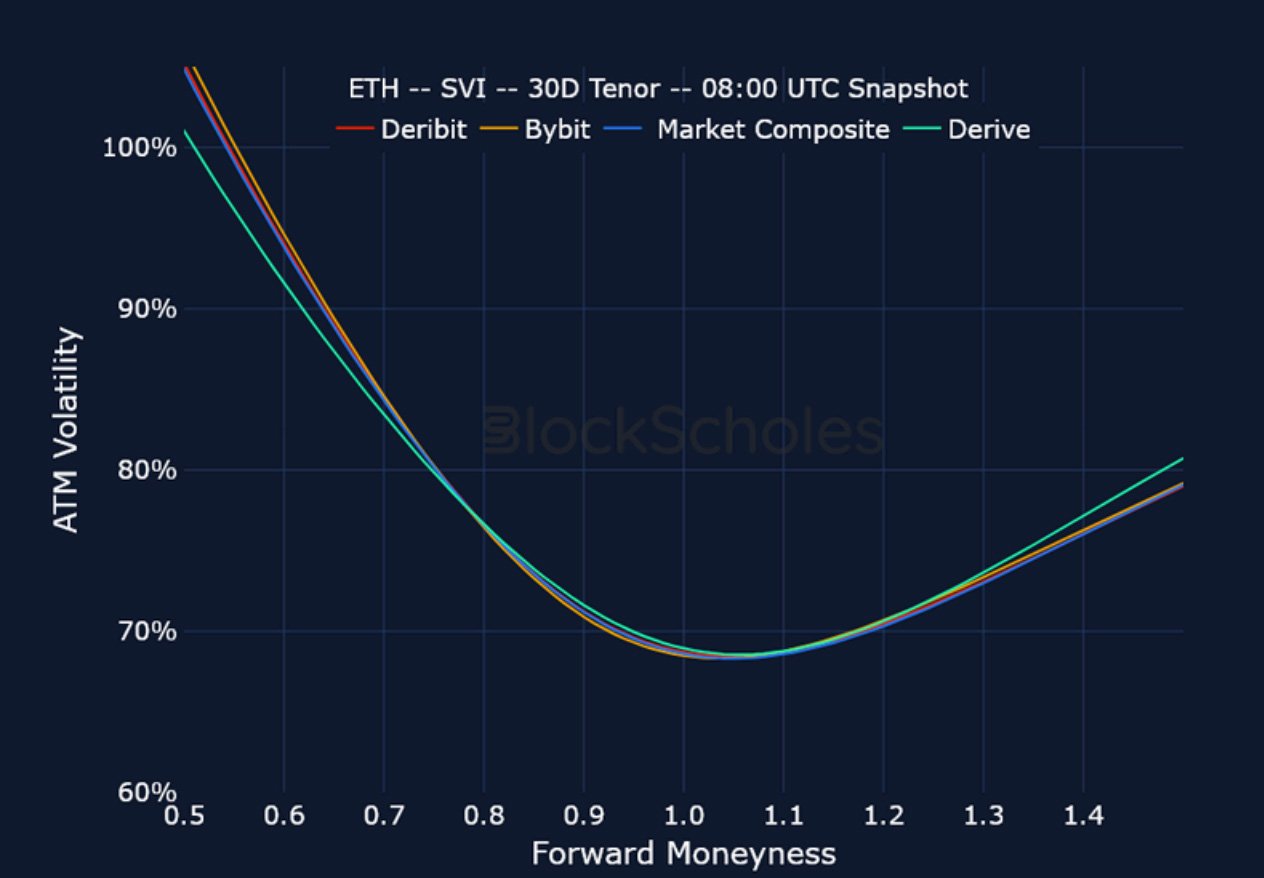

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

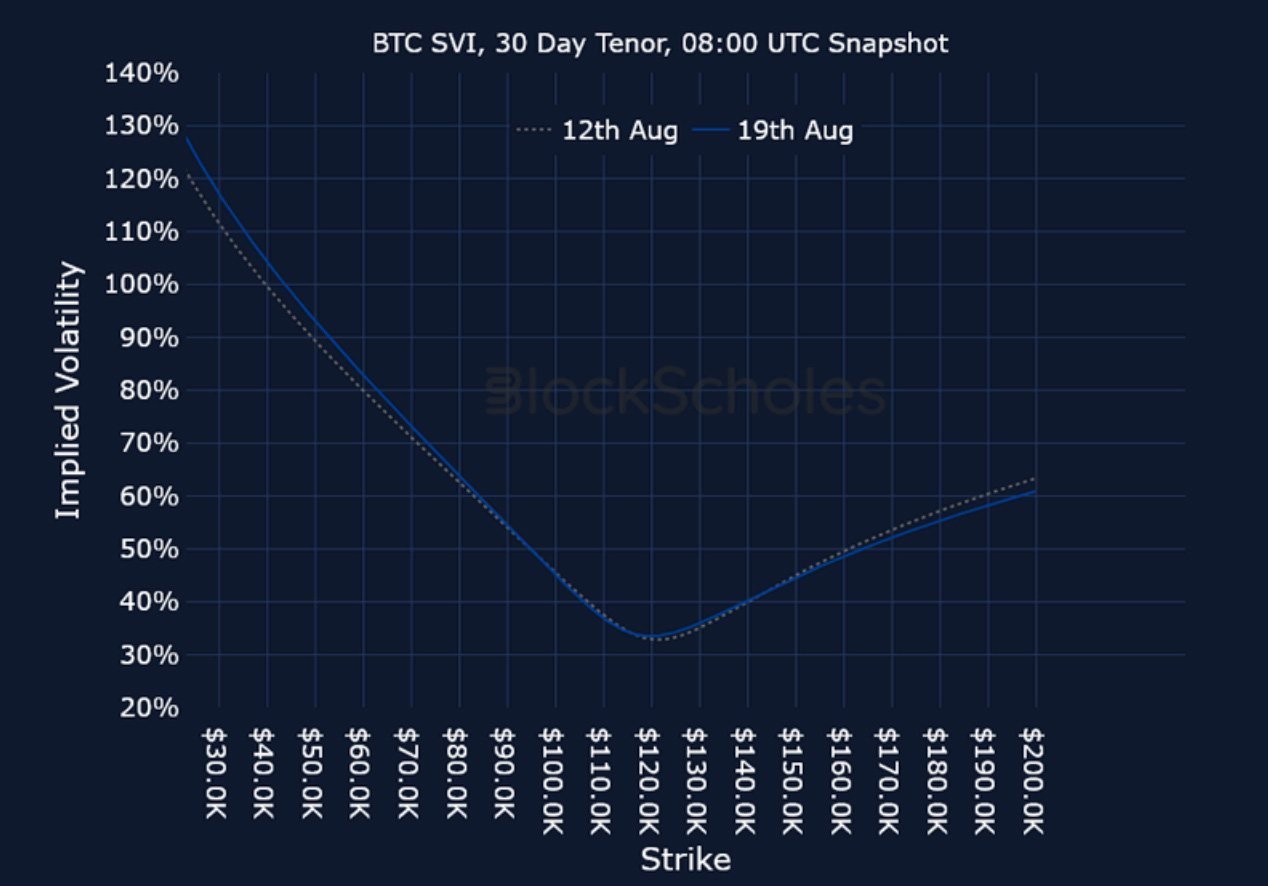

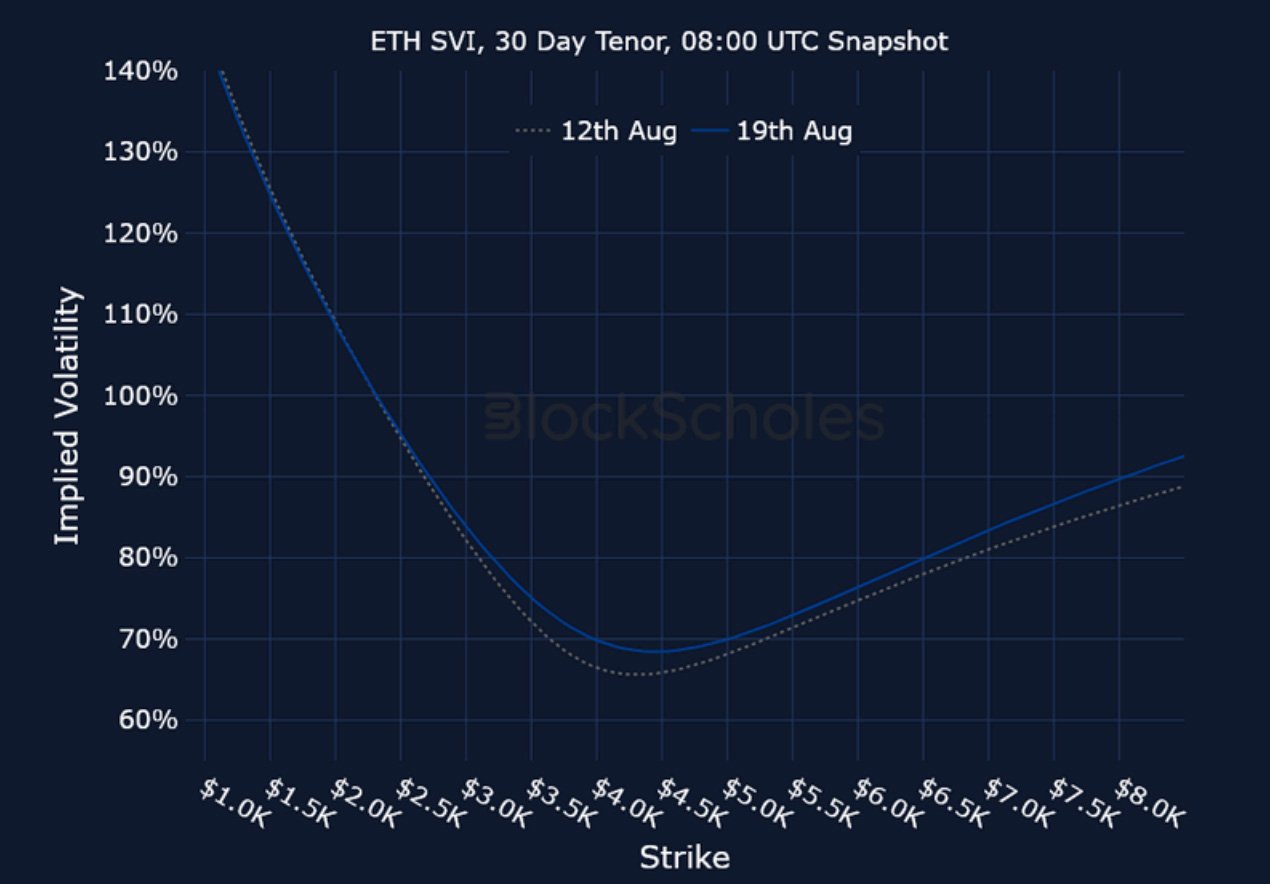

Listed Expiry Volatility Smiles

BTC 26-SEP EXPIRY – 9:00 UTC Snapshot.

ETH 26-SEP EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)