Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

The main event of the past week was Chair Powell’s highly anticipated Jackson Hole speech. There he caught markets off-guard by portraying a slightly more dovish-than-expected outlook on the September FOMC meeting, which ignited a widespread rally across crypto and risk-on markets. Implied-odds of a September rate cut shot past 90%, ETH rallied 15% on the day to a new ATH, and BTC rose to $117K. A drop in IV levels for BTC and ETH following Powell’s speech suggests traders had at least partly priced in some volatility around the event. A divergence took place however in the immediate aftermath, as ETH volatility bounced back quickly to 70%, while BTC drifted closer to its historical lows. Since then, a major weekend selloff for BTC which saw it drop to a 7-week low has ignited a big jump in short-tenor IV to 40% – a level 7-day options IV last traded at in mid-July 2025. That move has been accompanied by a significant skew towards OTM put options. ETH’s spot price on the other hand has showed far stronger resilience, holding above its pre-Jackson Hole level, unlike BTC. Options markets also price in a far less bearish picture for ETH relative to BTC.

Futures Implied Yields

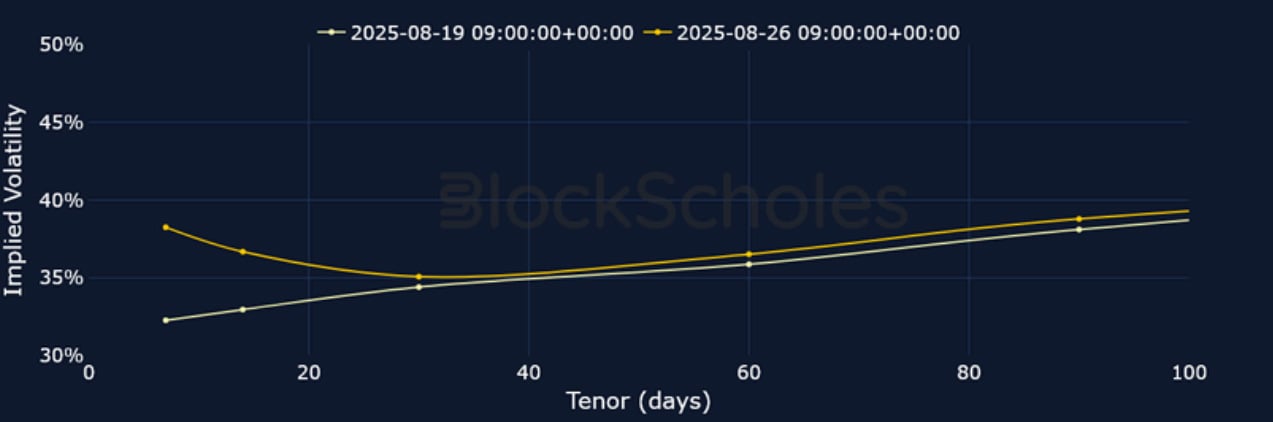

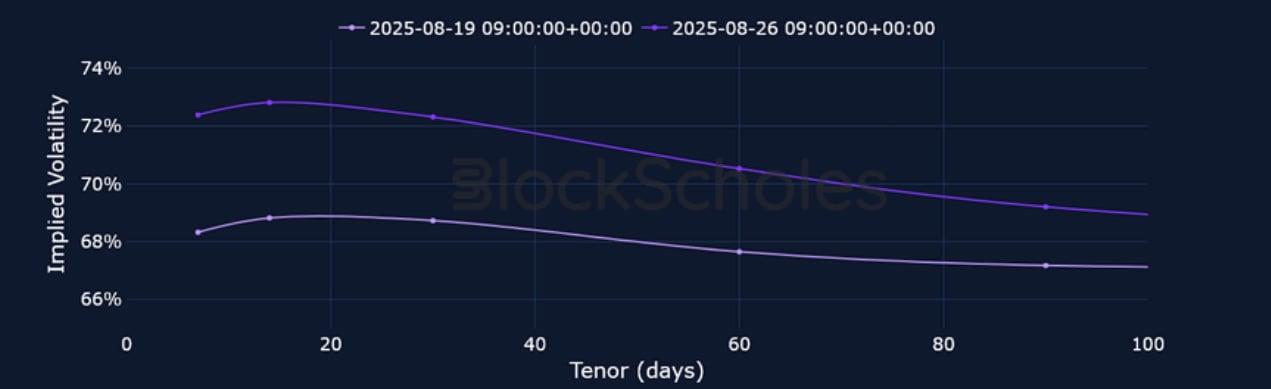

1-Month Tenor ATM Implied Volatility

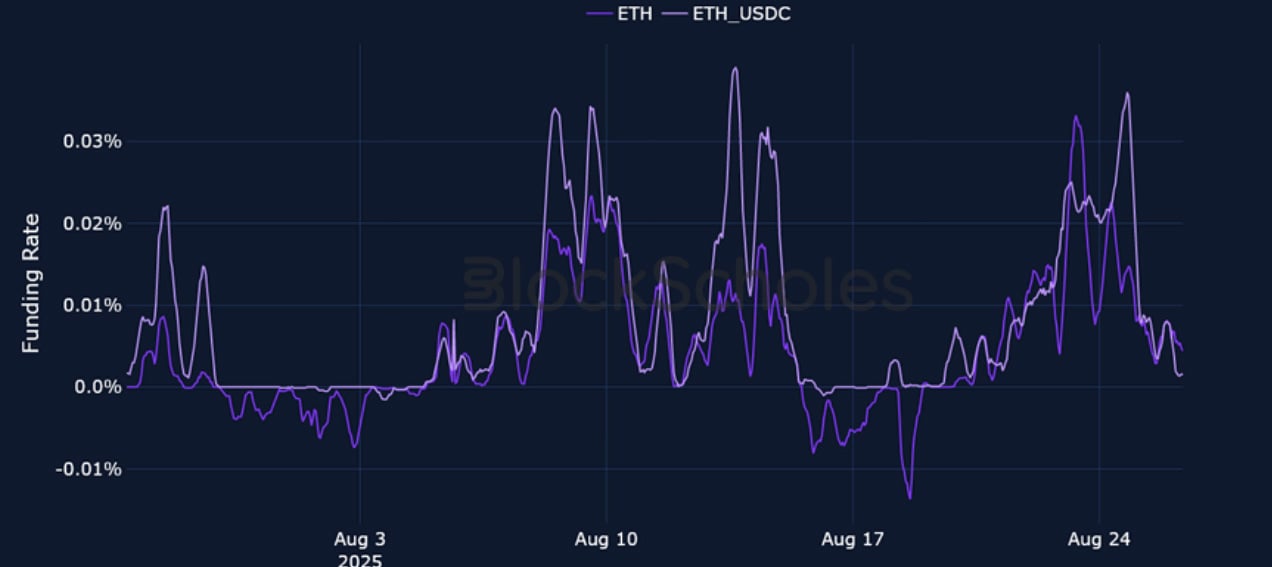

Perpetual Swap Funding Rate

BTC FUNDING RATE – BTC funding rates rose to their highest levels all month over the weekend, before falling 0% amidst the spot price sell-off.

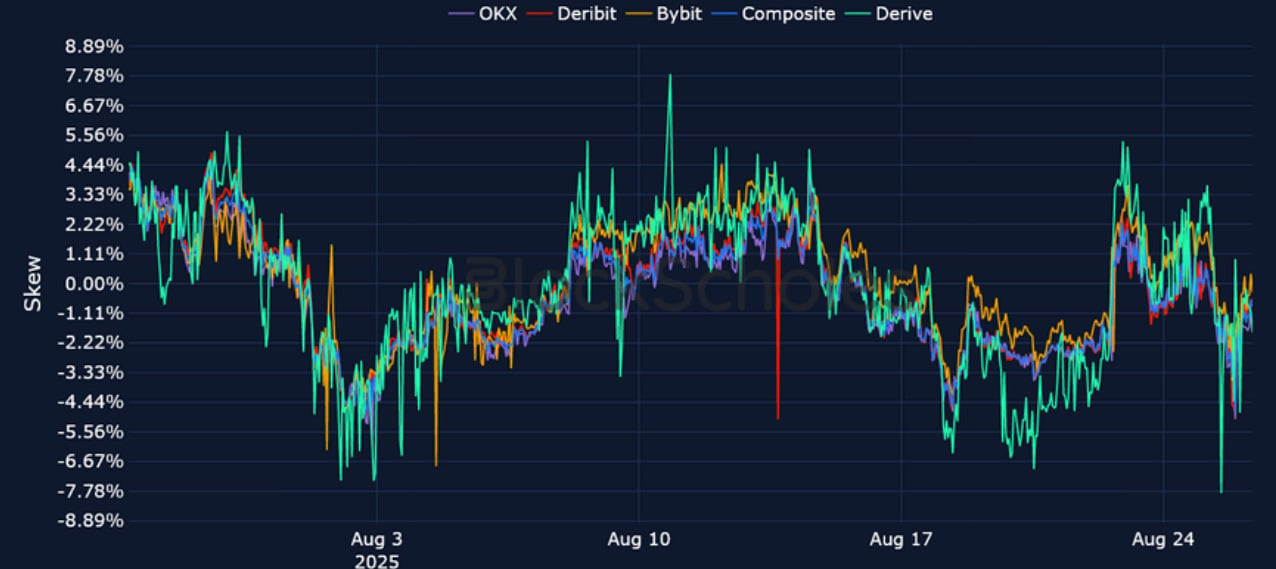

ETH FUNDING RATE – After hitting two new all-time highs first on Friday 22 Jul after Chair Powell’s speech and then again on Sunday evening, ETH funding rates jumped as high as 0.036%, before now trading close to neutral. That mirrors a similar move in options market skew which surged to 7.1% for short- tenor options, and is now close to 0%.

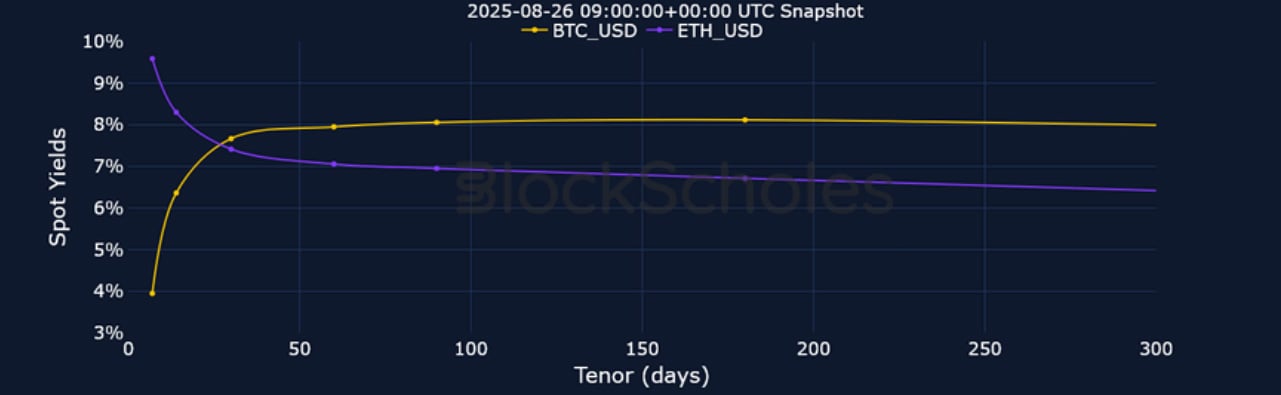

Futures Implied Yields

BTC Futures Implied Yields – After inverting on the weekend, short-tenor futures yields have now dropped from 15% to 4%, as BTC trades at $109K.

ETH Futures Implied Yields – In contrast to the upward sloping futures term structure for BTC, ETH’s term structure has inverted. The initial inversion coincided with its first ATH since Nov 2021.

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – After trading at historically low levels, BTC IV jumped 14 percentage points to 40% – a level not seen since Jul 15.

BTC 25-Delta Risk Reversal – A significantly bearish premium is currently assigned to put contracts for BTC relative to calls. That’s also across the term structure, as traders anticipate downside moves in the short- and long-term.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – As ETH reached a new ATH of $4,946, its term structure of volatility inverted, with short-tenor IV surging to 75%.

ETH 25-Delta Risk Reversal – While BTC 25-delta skew is tilted as much as 8% towards OTM puts, ETH skew suggests traders are far less bearish on Ether. That is perhaps a reflection of spot price moves between the two assets. ETH recovered to its pre-Jackson Hole levels, while BTC has failed to do the same.

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

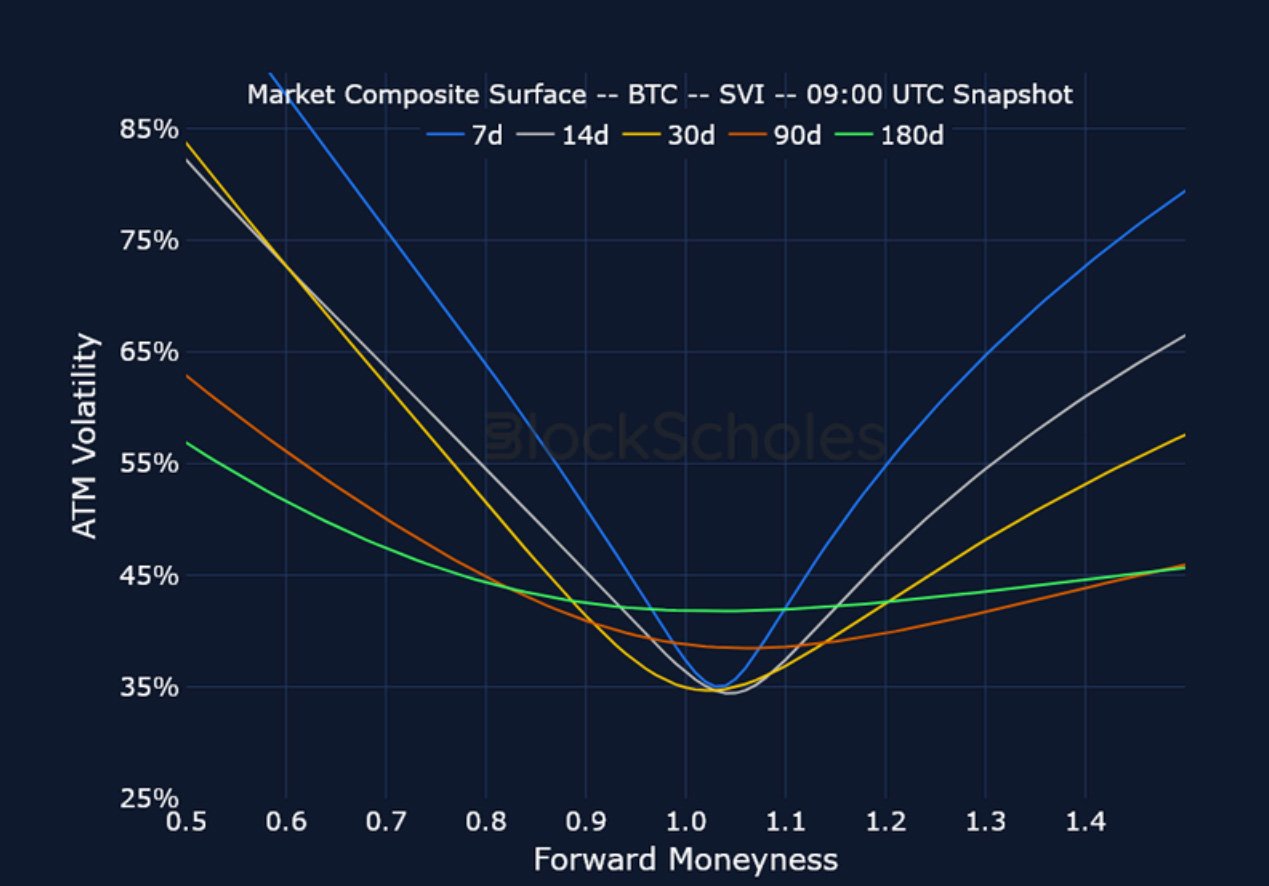

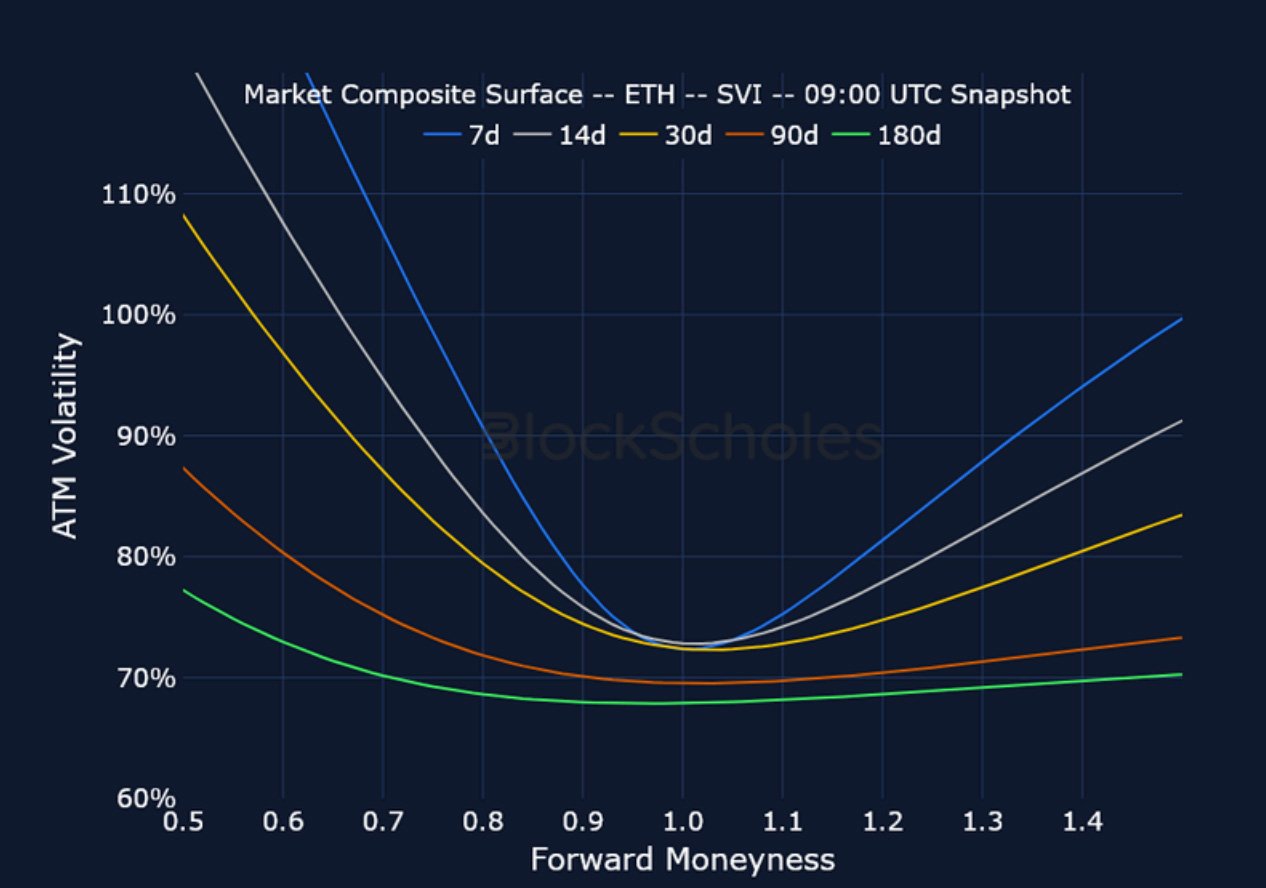

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

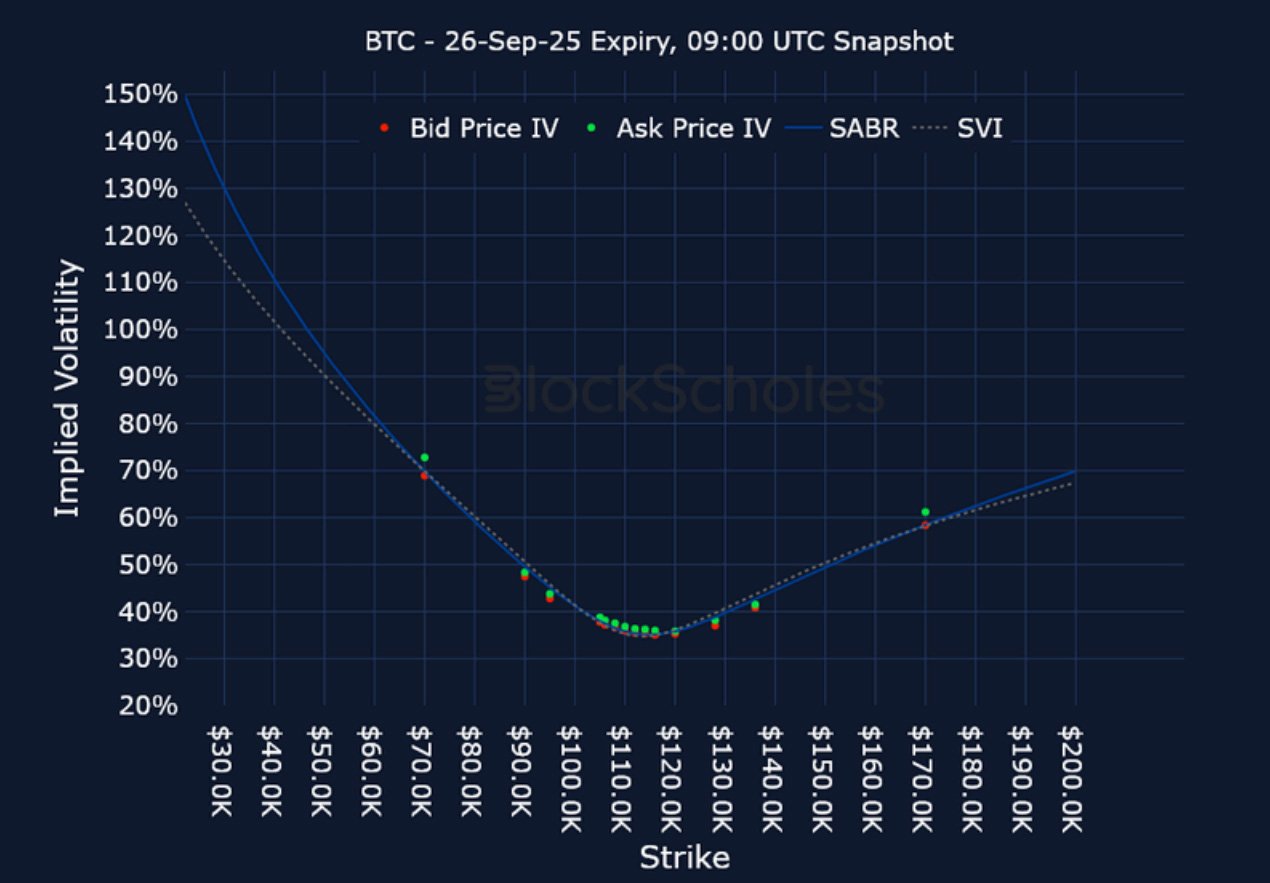

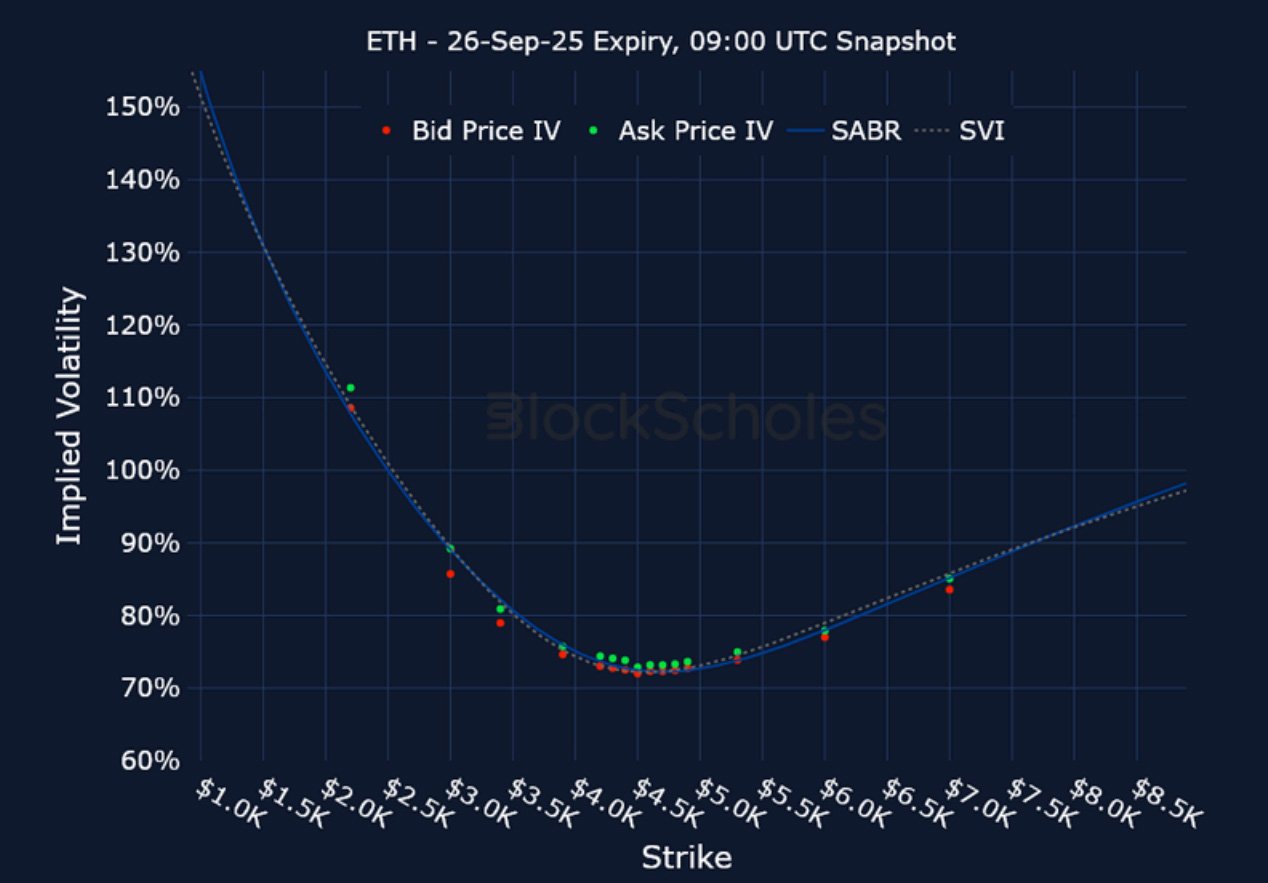

Listed Expiry Volatility Smiles

BTC 26-SEP EXPIRY – 9:00 UTC Snapshot.

ETH 26-SEP EXPIRY – 9:00 UTC Snapshot.

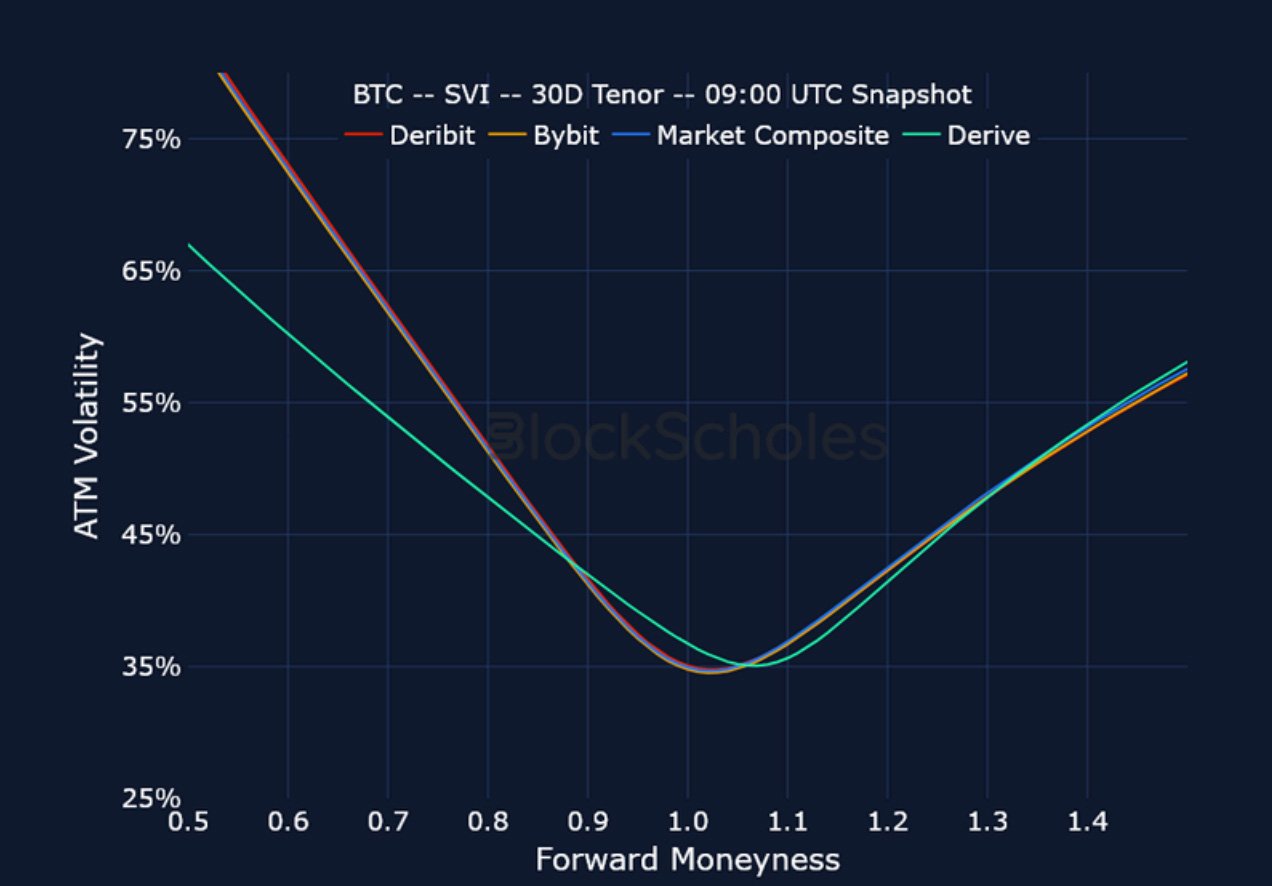

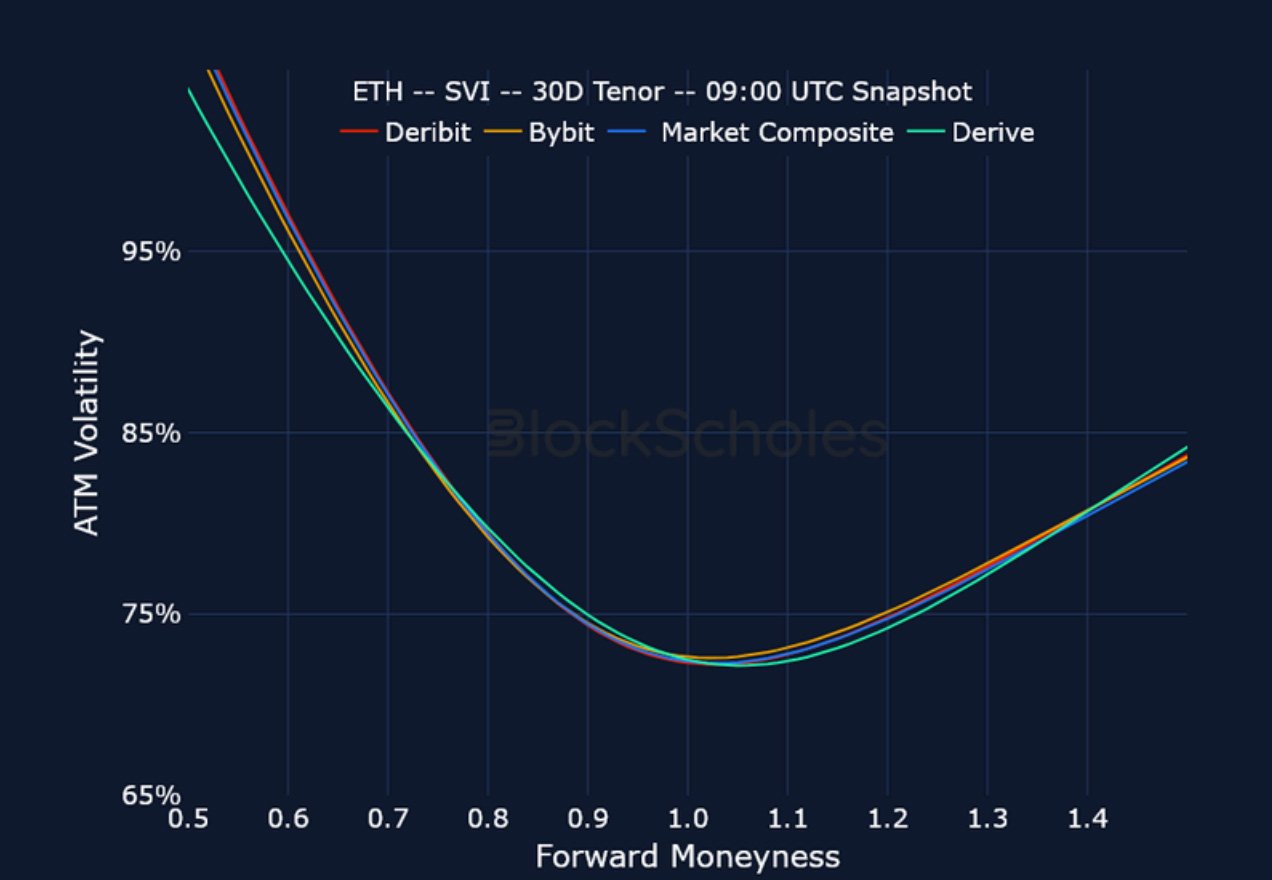

Cross-Exchange Volatility Smiles

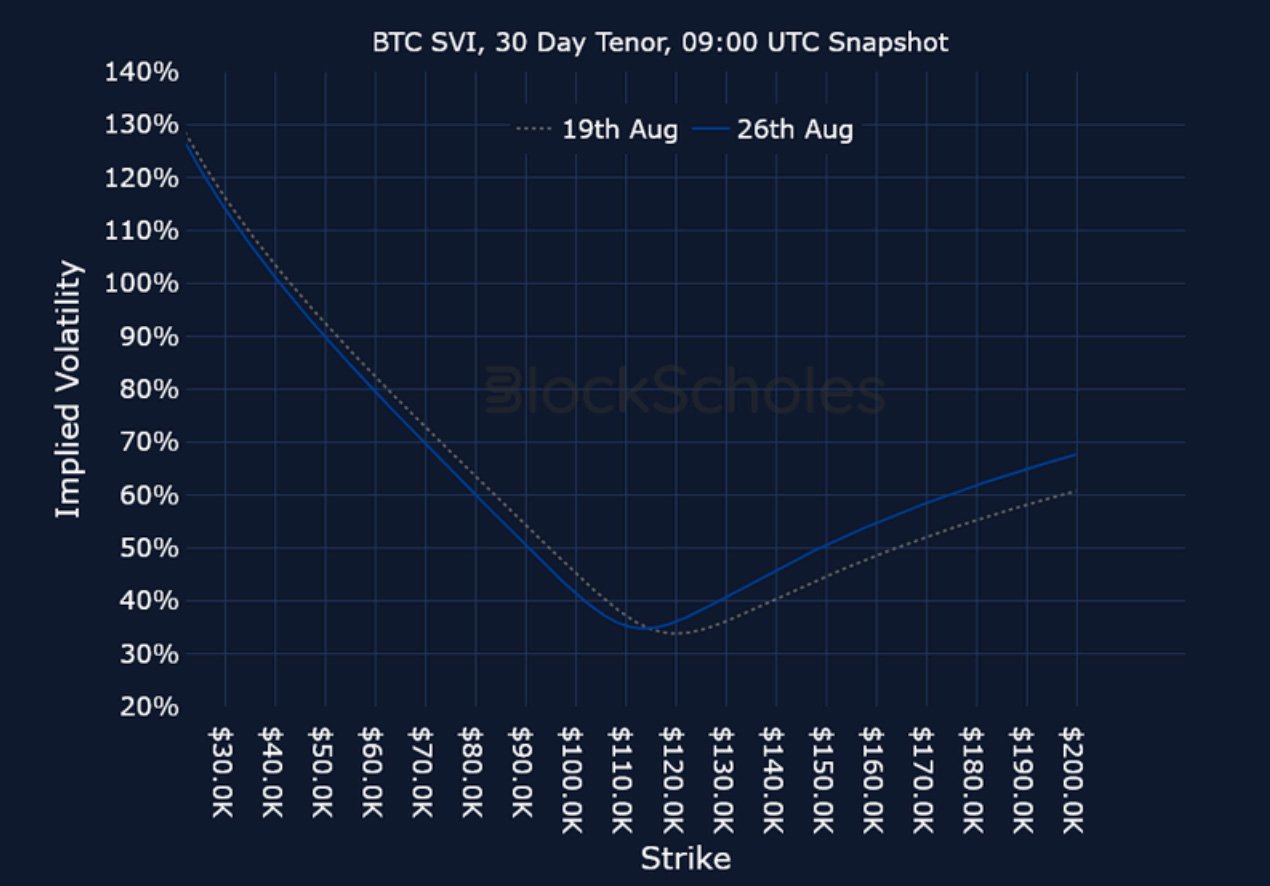

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

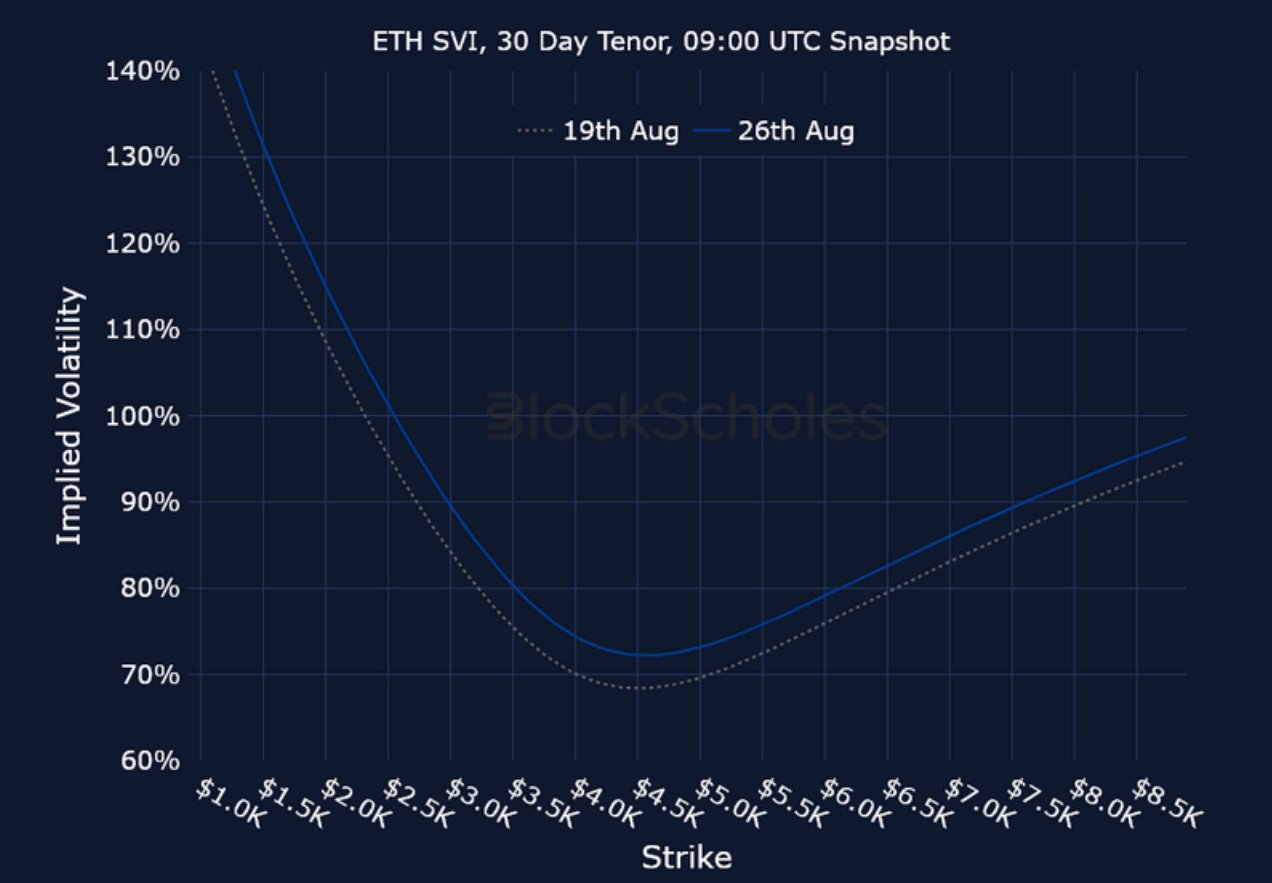

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)