Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Market uncertainty ahead of a pivotal FOMC meeting on Wednesday appears to have dissipated, as the probability of a 25bps cut becomes almost certain. Despite the injection of liquidity expected from the resumption of the Fed’s rate cutting cycle, sentiment in options markets remains tilted bearish. Volatility smile skews across the term structure are neutral-to-bearish, while a spike higher in future- implied yields has sharply reversed. Funding rates remain the outlier, indicating a persistent willingness to pay for long exposure despite a rangebound spot price in both BTC and ETH. Neither coin appears to have benefited from the new all-time highs registered in gold or US equity markets, and neither appears to hold particularly strong positioning ahead of Chair Powell’s presser on Wednesday.

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

Perpetual Swap Funding Rate

BTC FUNDING RATE – Funding rates have been consistently positive despite a rangebound spot and bearish skew in options markets.

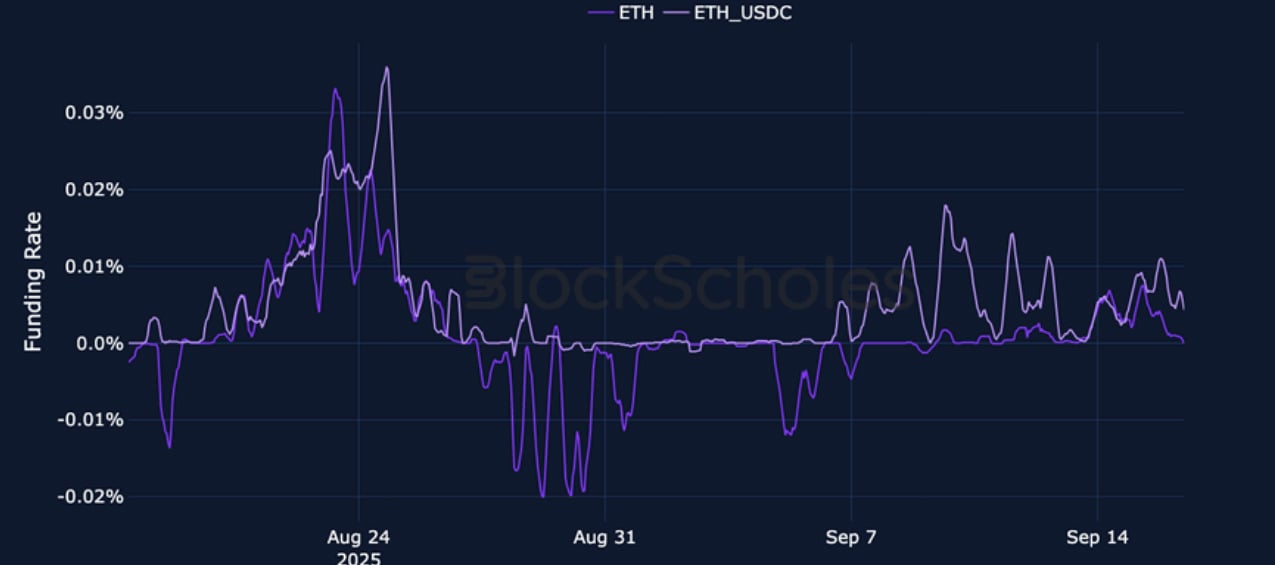

ETH FUNDING RATE – While not as positive as BTC’s, ETH’s funding rates have expressed a similar demand for long exposure despite a bearish skew in options markets.

Futures Implied Yields

BTC Futures Implied Yields – A spike higher in futures-implied yields has reversed at the beginning of this week ahead of the FOMC meeting on Wed.

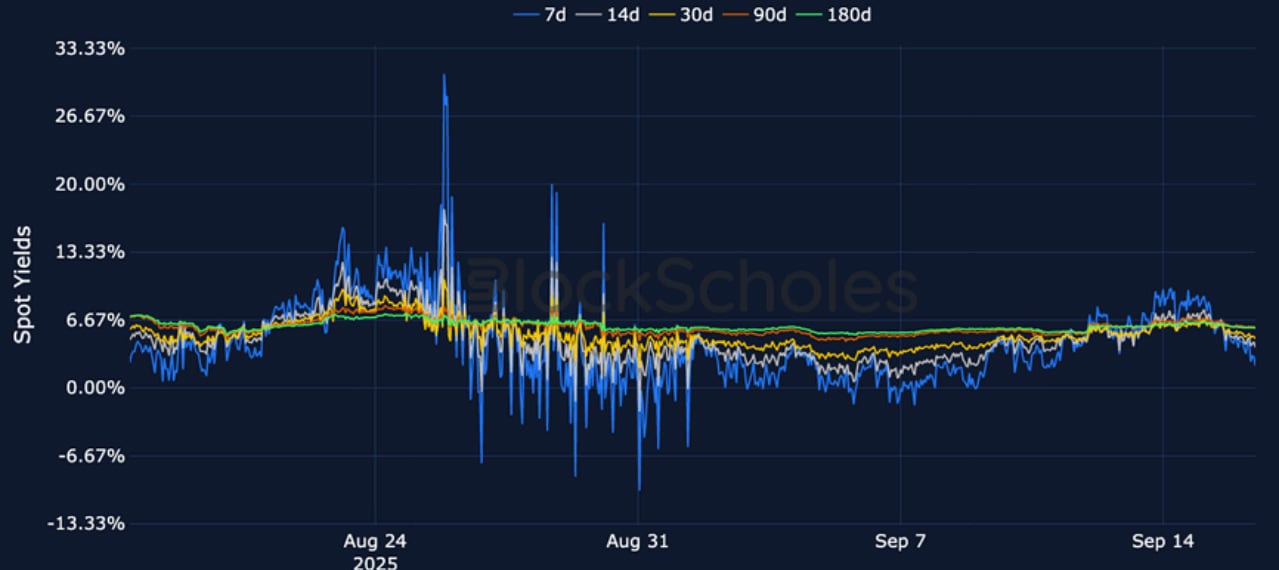

ETH Futures Implied Yields – ETH’s futures yields have fallen further than BTC’s, steepening the term structure dramatically.

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – The term structure of volatility remains far steeper than ETH’s as volatility levels drop across markets.

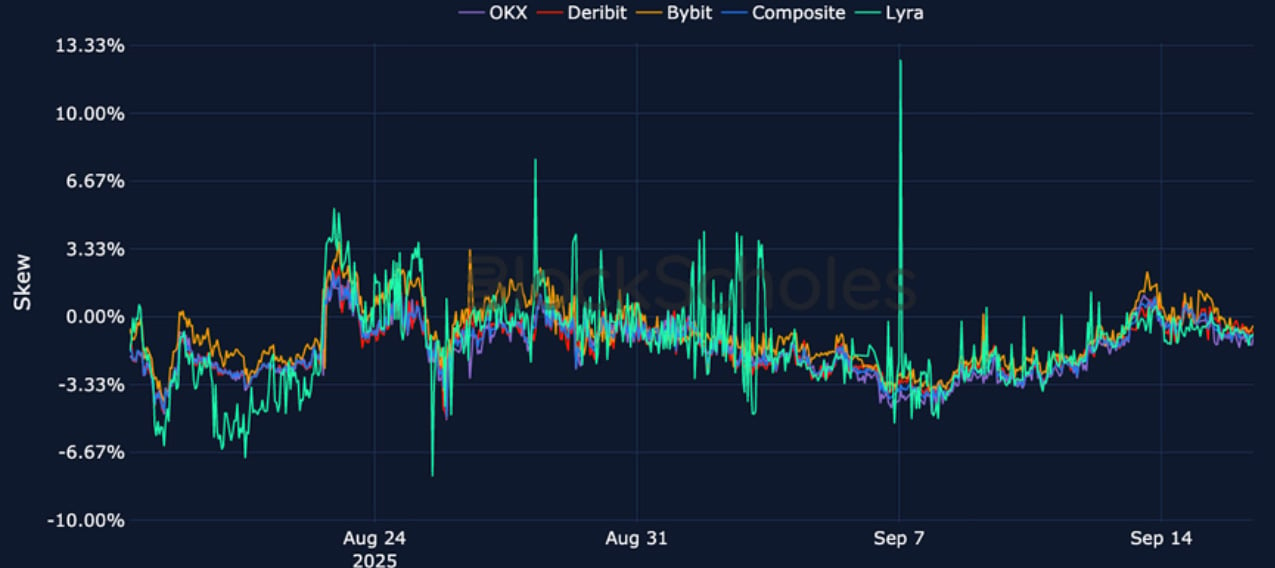

BTC 25-Delta Risk Reversal – BTC’s skew has retained its neutral pricing despite the resumption of bearish positioning in ETH options markets.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – Implied volatility levels have hit a month- long low across the term structure, despite an imminent FOMC meeting.

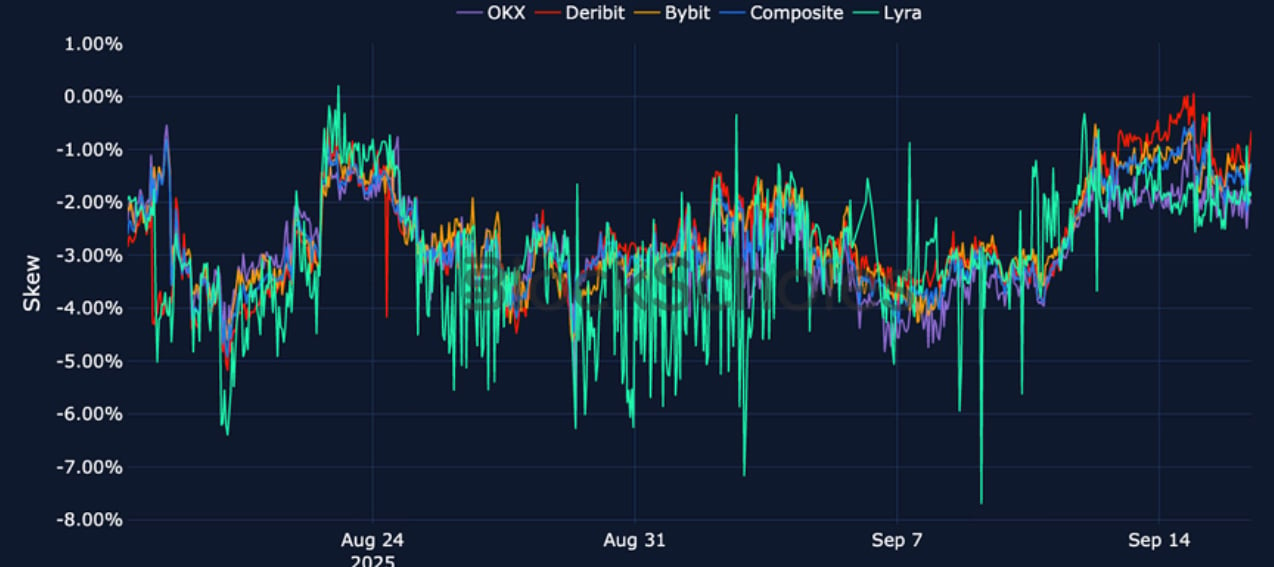

ETH 25-Delta Risk Reversal – ETH volatility skew briefly flirted with neutrality, before continuing to price in bearishness at short tenors. Longer tenors remain slightly skewed towards OTM calls.

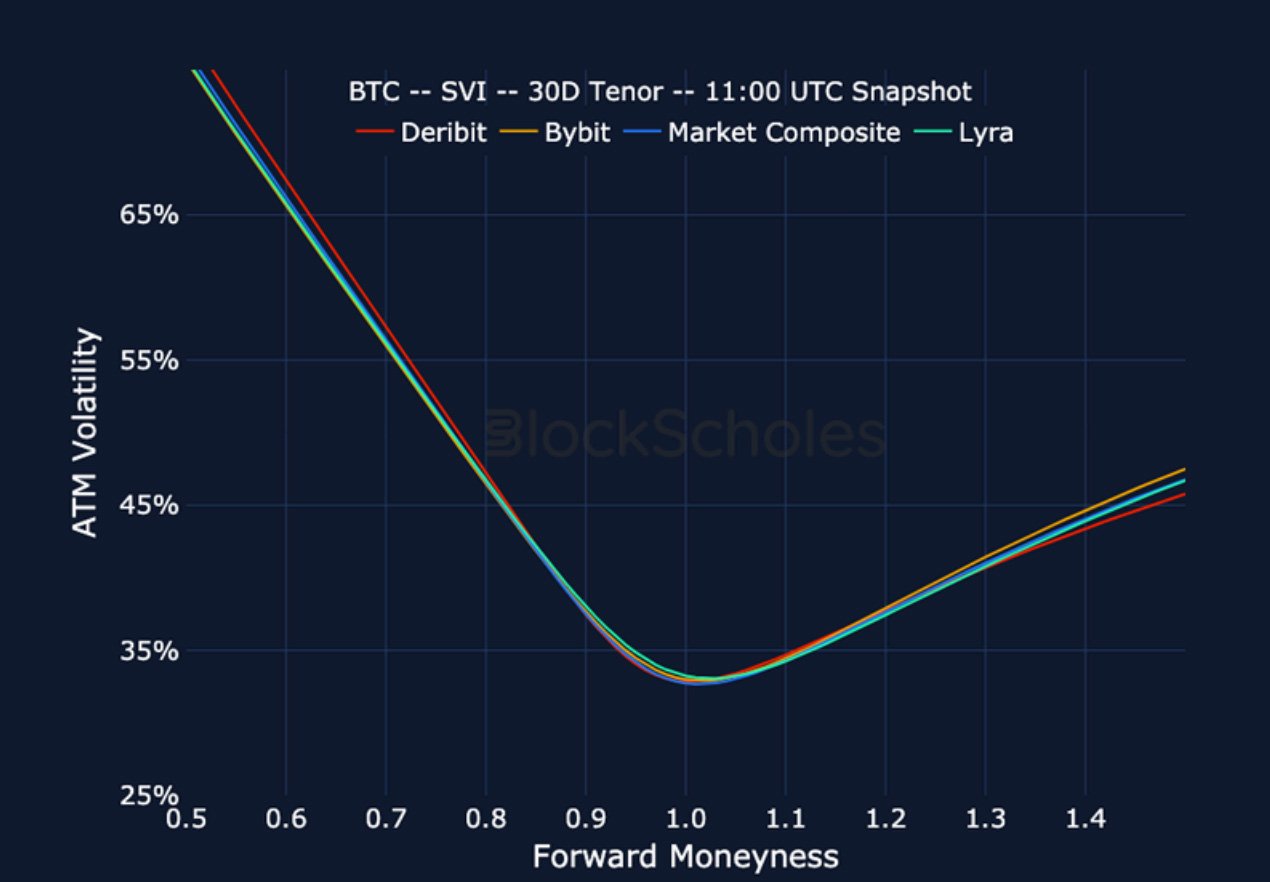

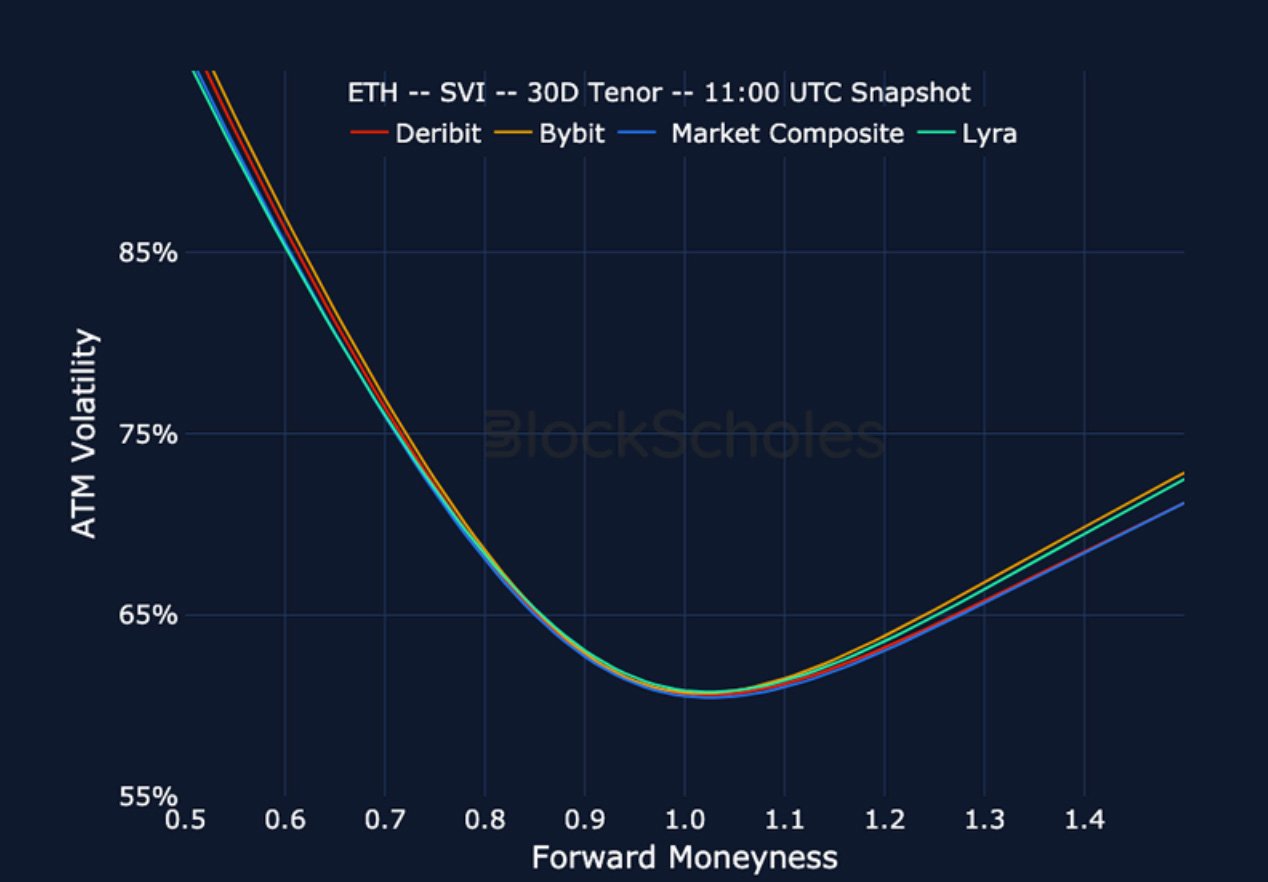

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

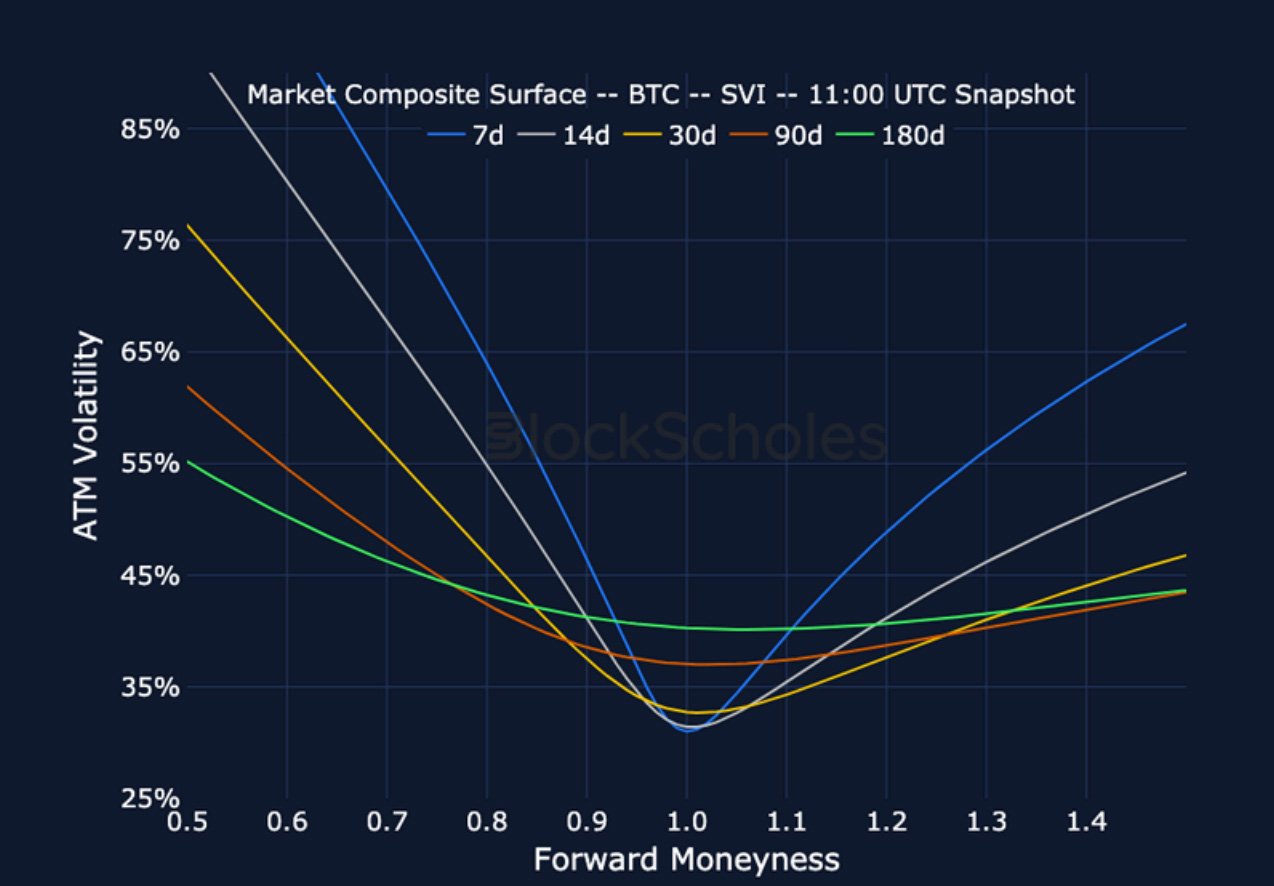

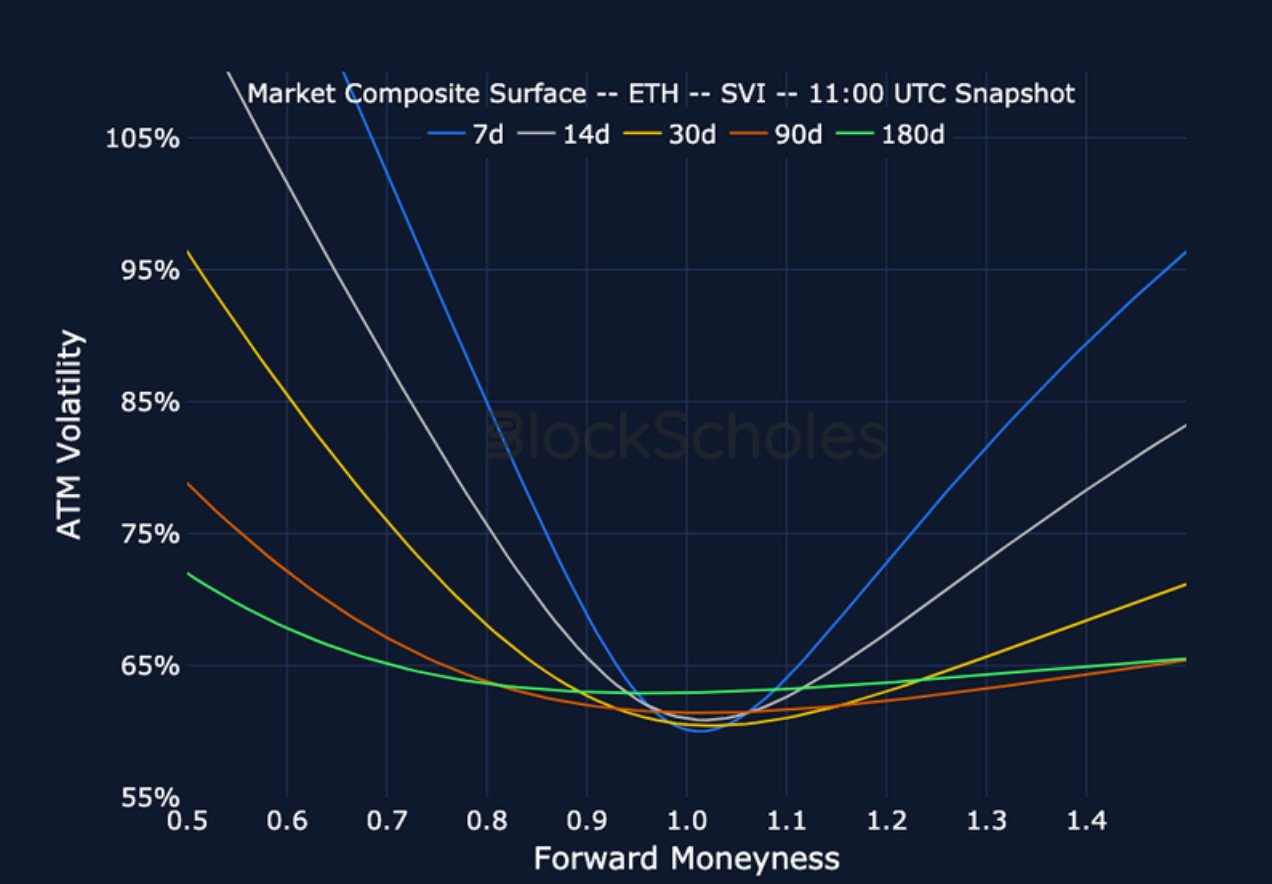

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

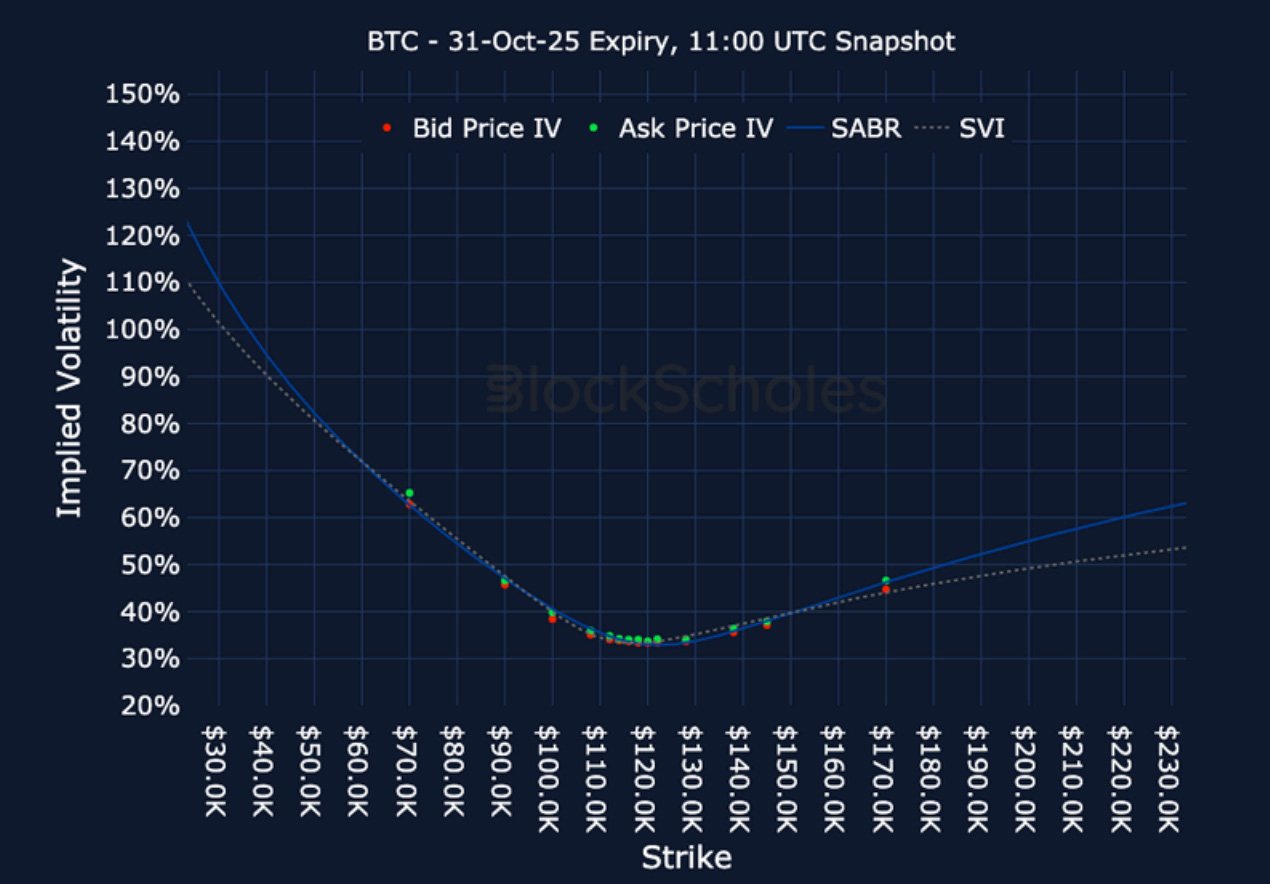

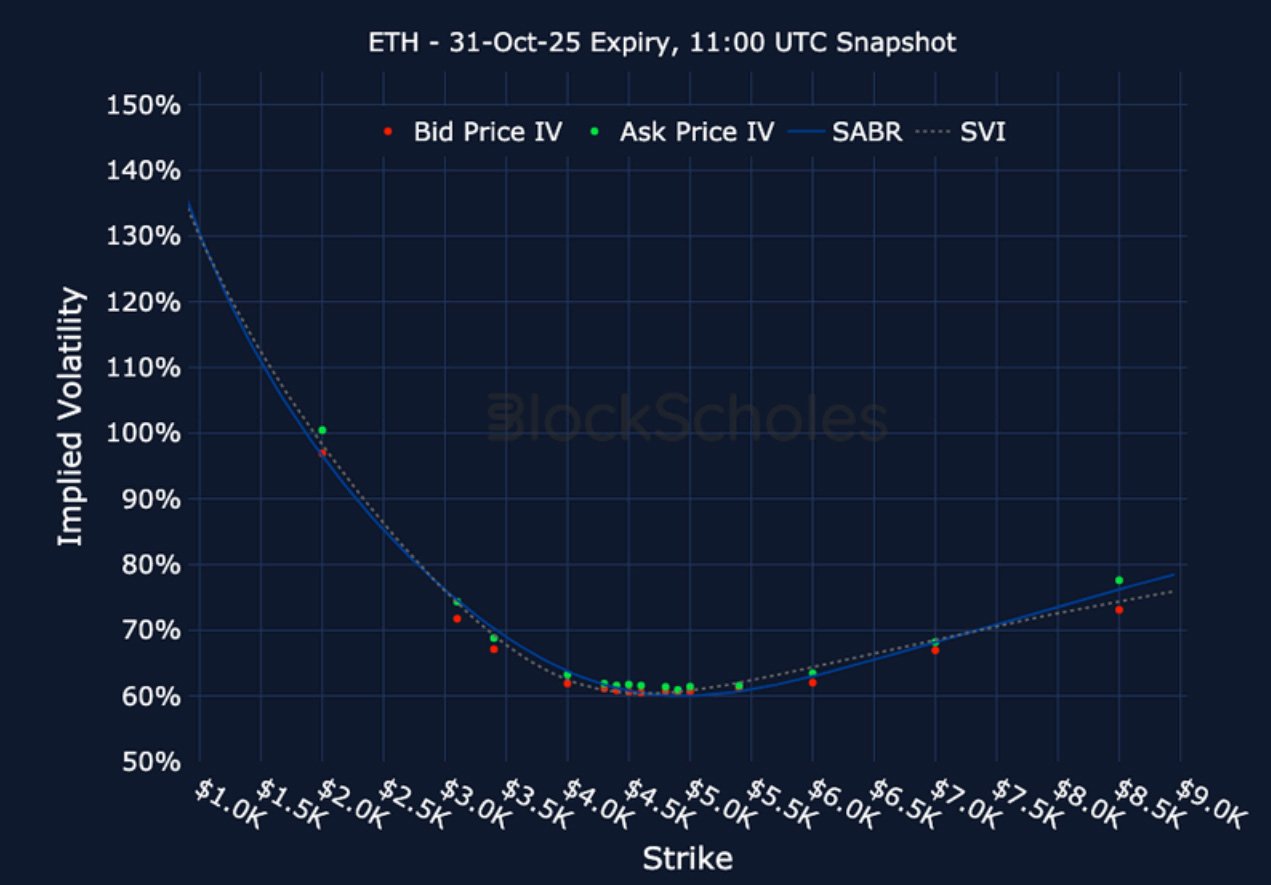

Listed Expiry Volatility Smiles

BTC 31-OCT EXPIRY – 9:00 UTC Snapshot.

ETH 31-OCT EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

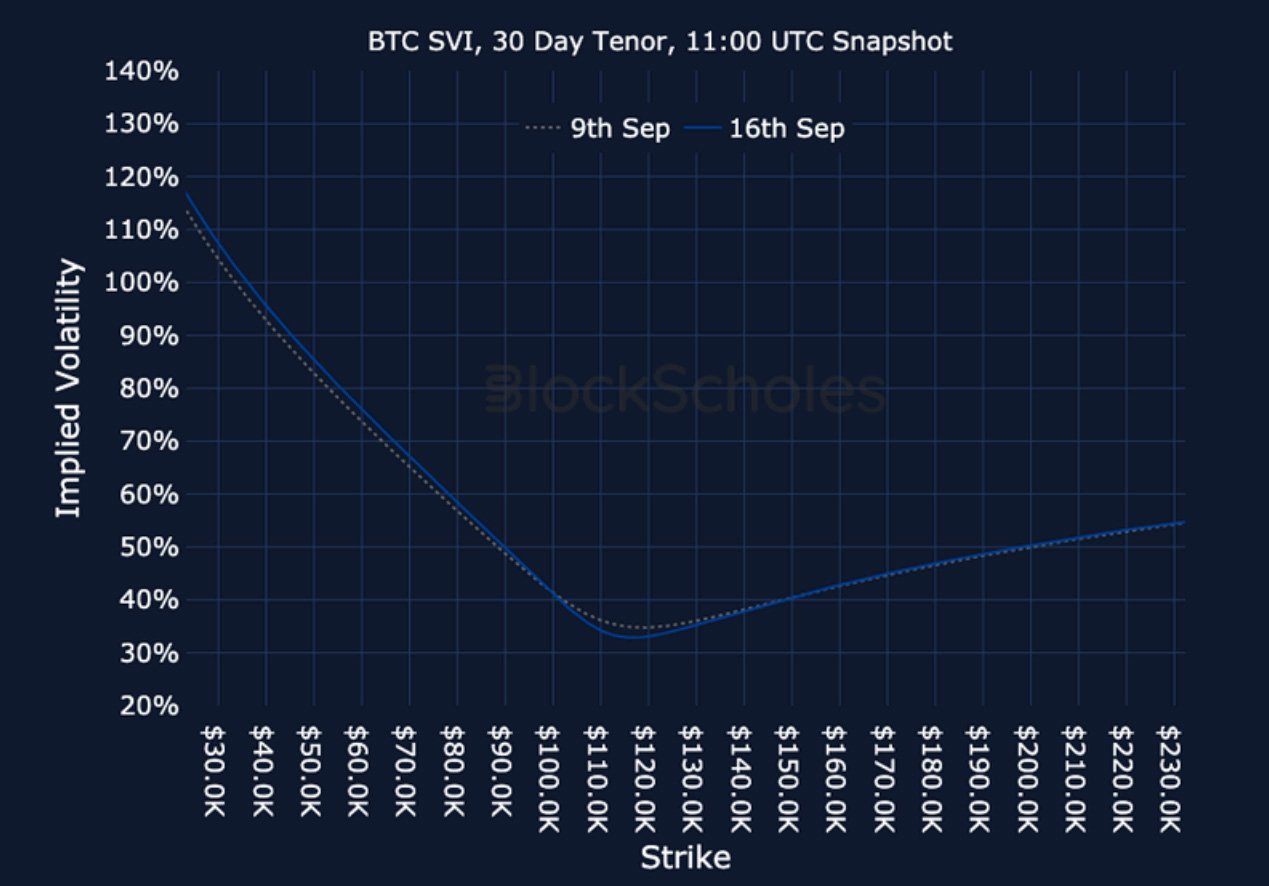

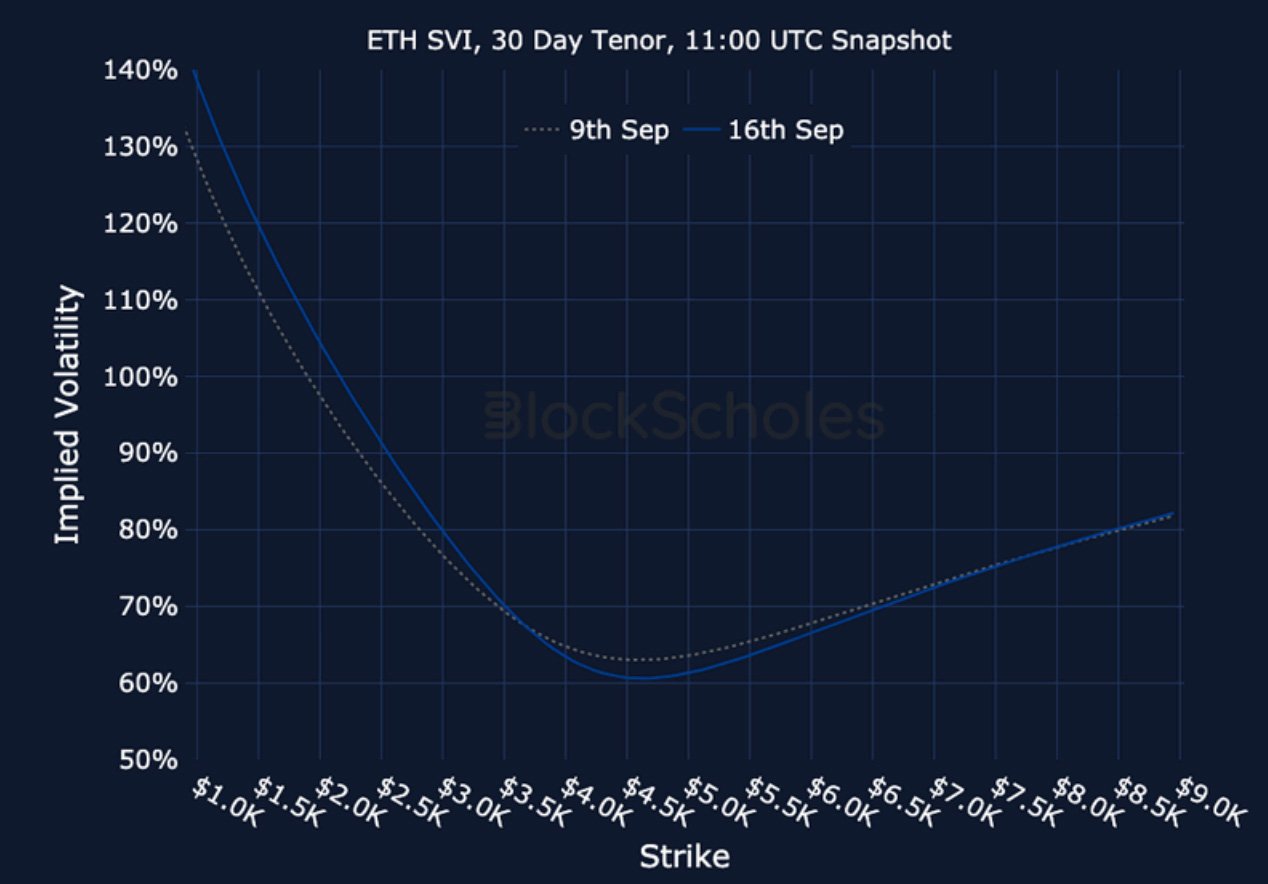

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)