Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

A weekend sell-off in crypto briefly inverted term structures of at-the-money volatility and skewed volatility smiles towards puts. Despite sideways spot price action in the days since, options markets have deepened their bearish pricing of volatility smiles, which are now decisively skewed towards OTM puts at short tenors for BTC and ETH. In contrast, BTC funding rates have remained positive throughout, marking an unusual divergence in sentiment away from the more bearish moves in options and futures markets. Despite the lift in front-end volatility, BTC options continue to price for historically low forward-looking estimates of volatility. BTC’s low levels are further contrasted against ETHs which, despite falling towards the lower end of their own historical distribution, remain close to twice that of BTC options at equivalent tenors.

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

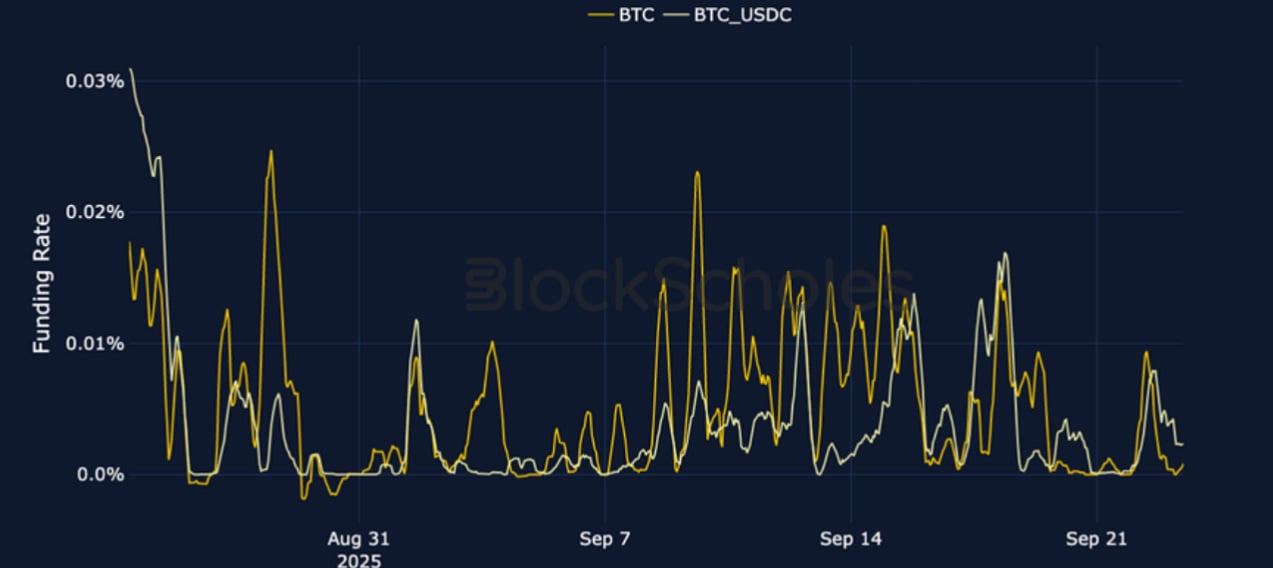

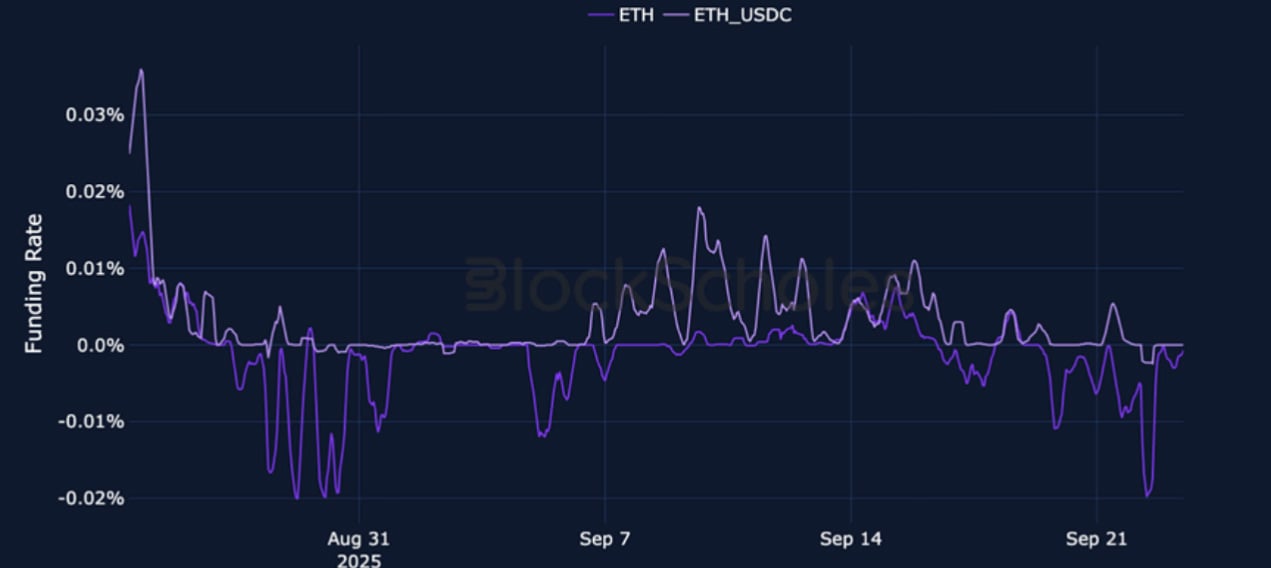

Perpetual Swap Funding Rate

BTC FUNDING RATE – Funding rates have been positive despite the weekend crypto selloff, and are now back near 0% in contrast to the put-skew of short- tenor volatility smiles.

ETH FUNDING RATE – ETH funding rates, in comparison to BTC, had declined significantly but have now reclaimed levels closer to 0%.

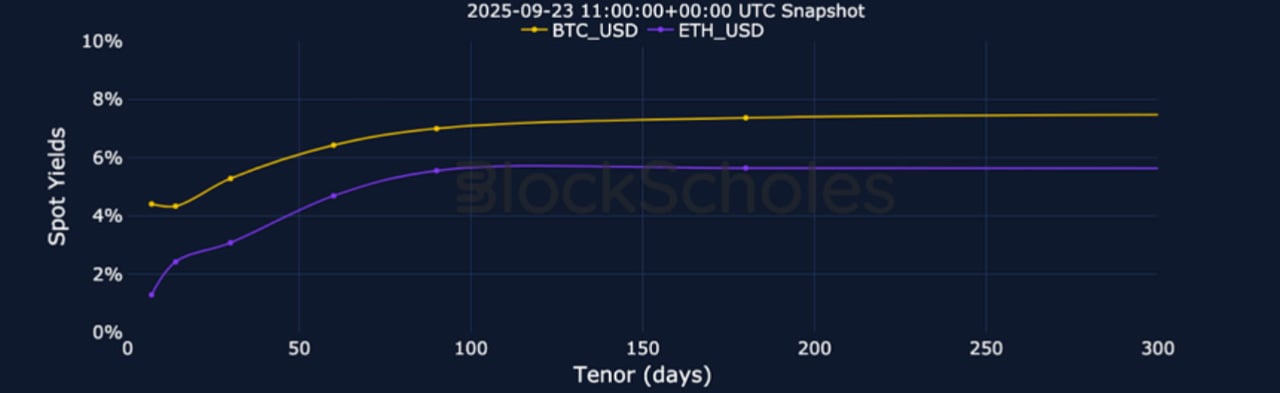

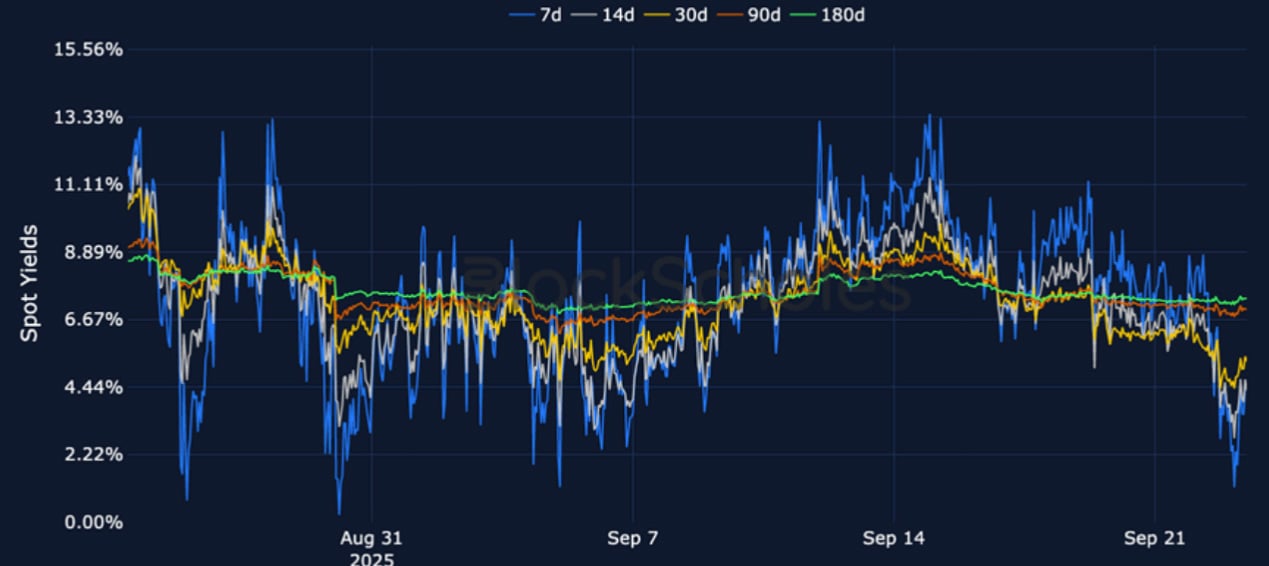

Futures Implied Yields

BTC Futures Implied Yields – Spot yields have declined sharply, falling from around 13% to below 2% following the weekend’s crypto rally.

ETH Futures Implied Yields – ETH’s futures yields have declined over the past week, briefly dipping below 0%, falling further than BTC’s.

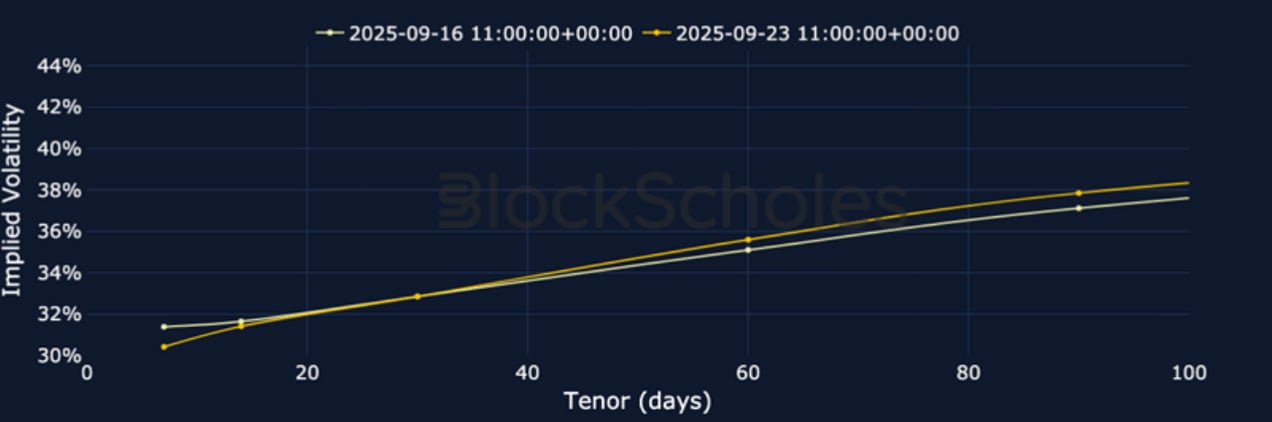

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – Short-tenor volatility hit its lowest since August after the FOMC meeting but has rebounded during the recent sell-off.

BTC 25-Delta Risk Reversal – Short-dated BTC’s skew has declined compared to last week, as downside protection sees increased demand.

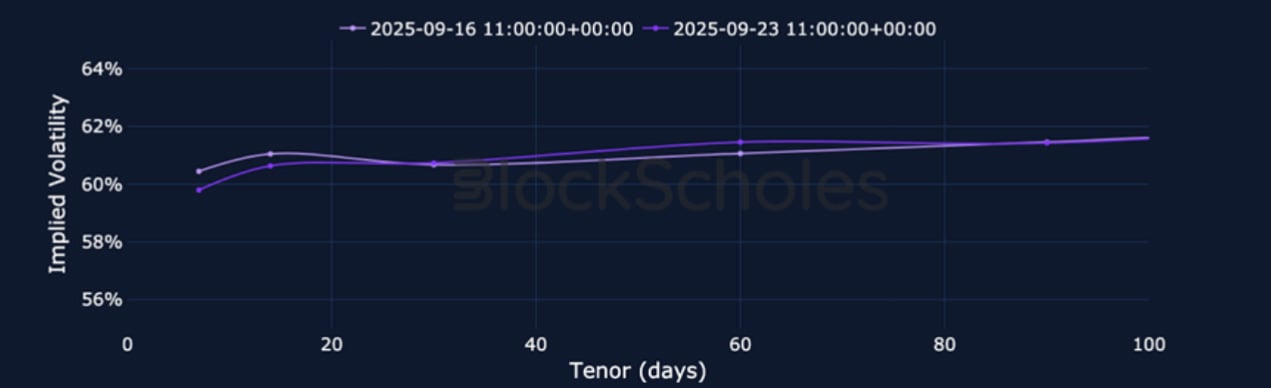

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – ETH’s ATM volatility has increased across all tenors following a weekend downturn, outpacing BTC.

ETH 25-Delta Risk Reversal – ETH volatility skew briefly flirted with neutrality, before continuing to price in bearishness at short tenors. Longer tenors remain slightly skewed towards OTM calls.

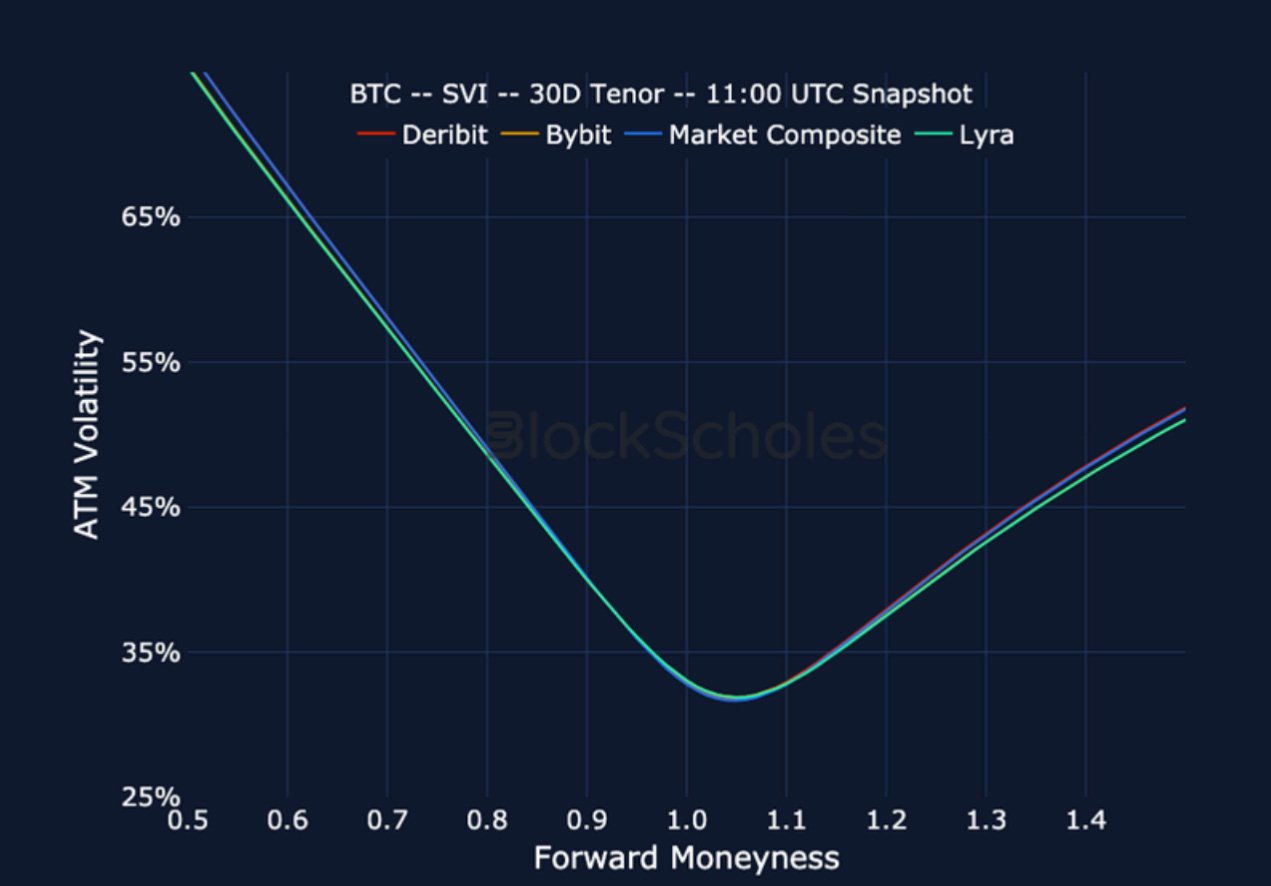

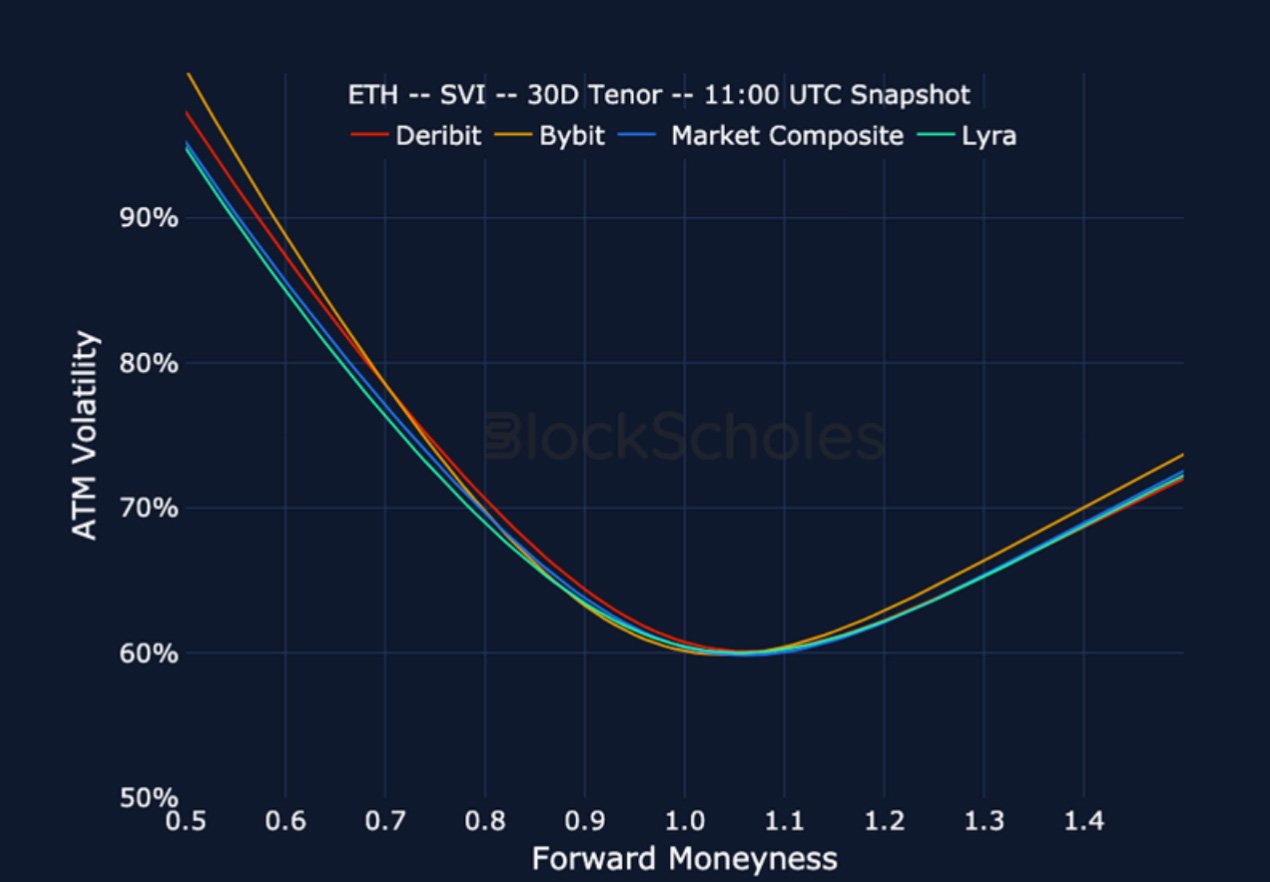

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

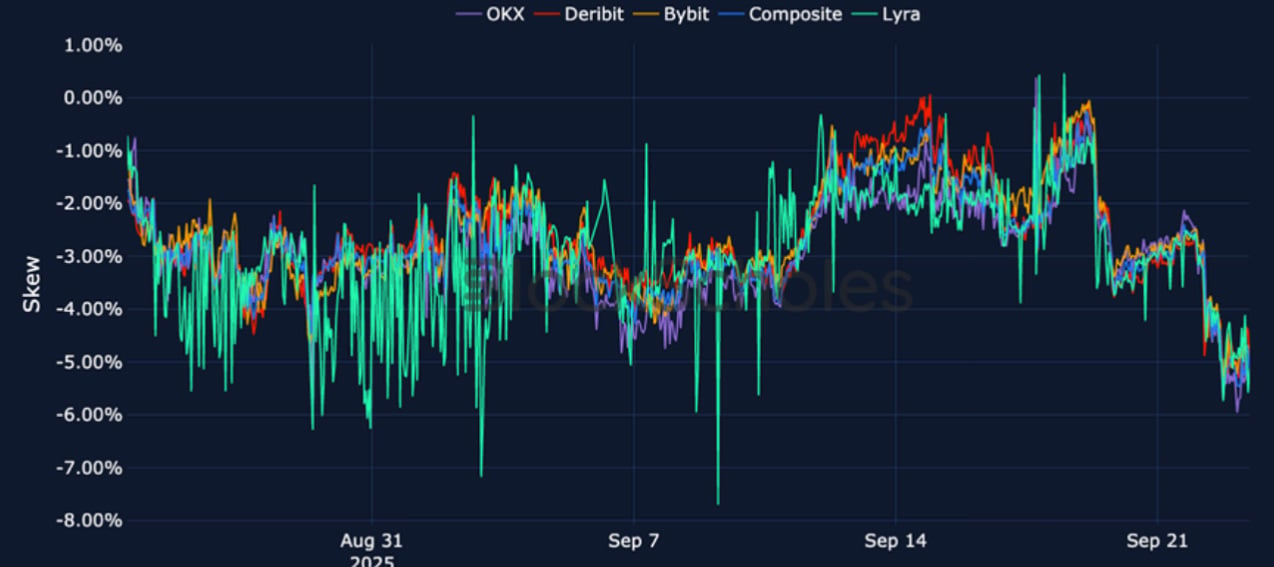

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

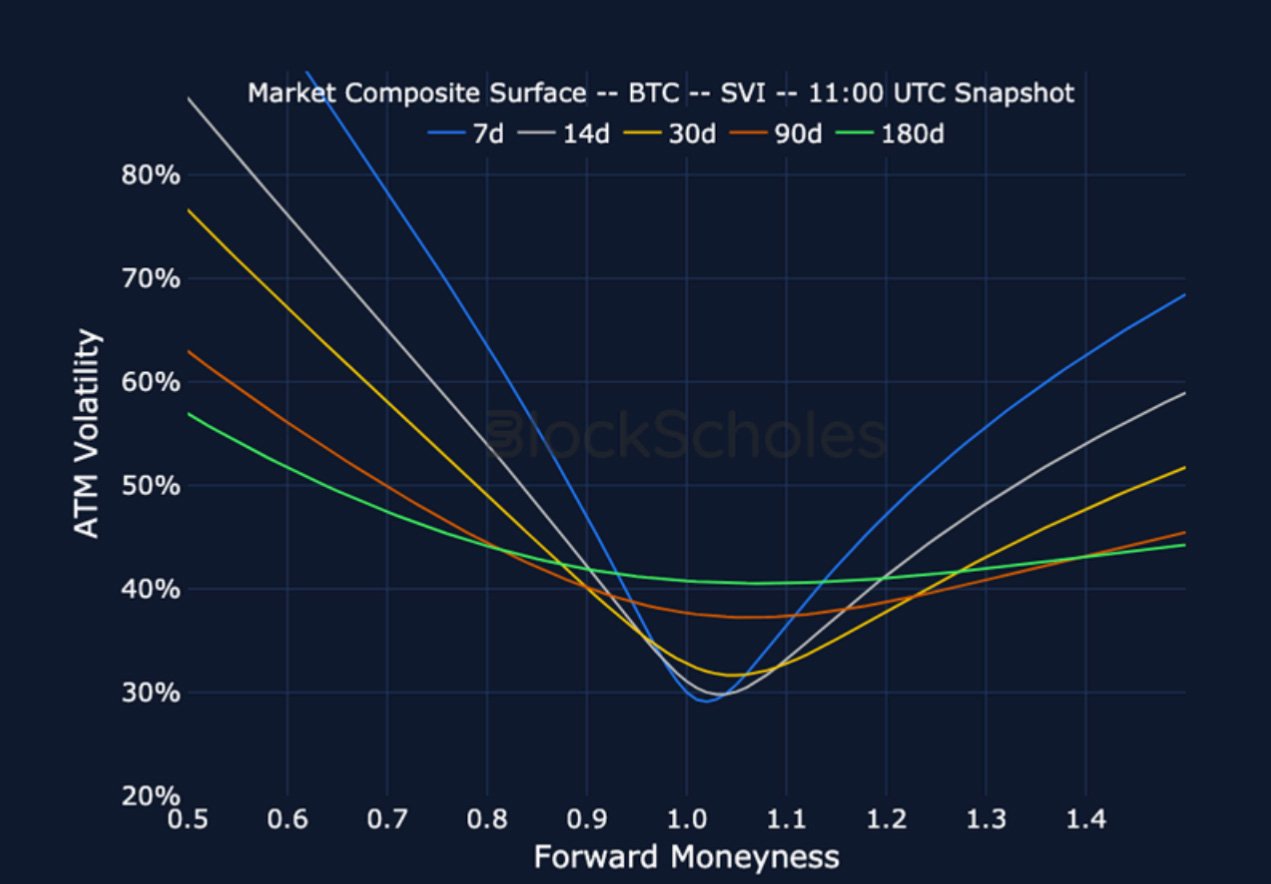

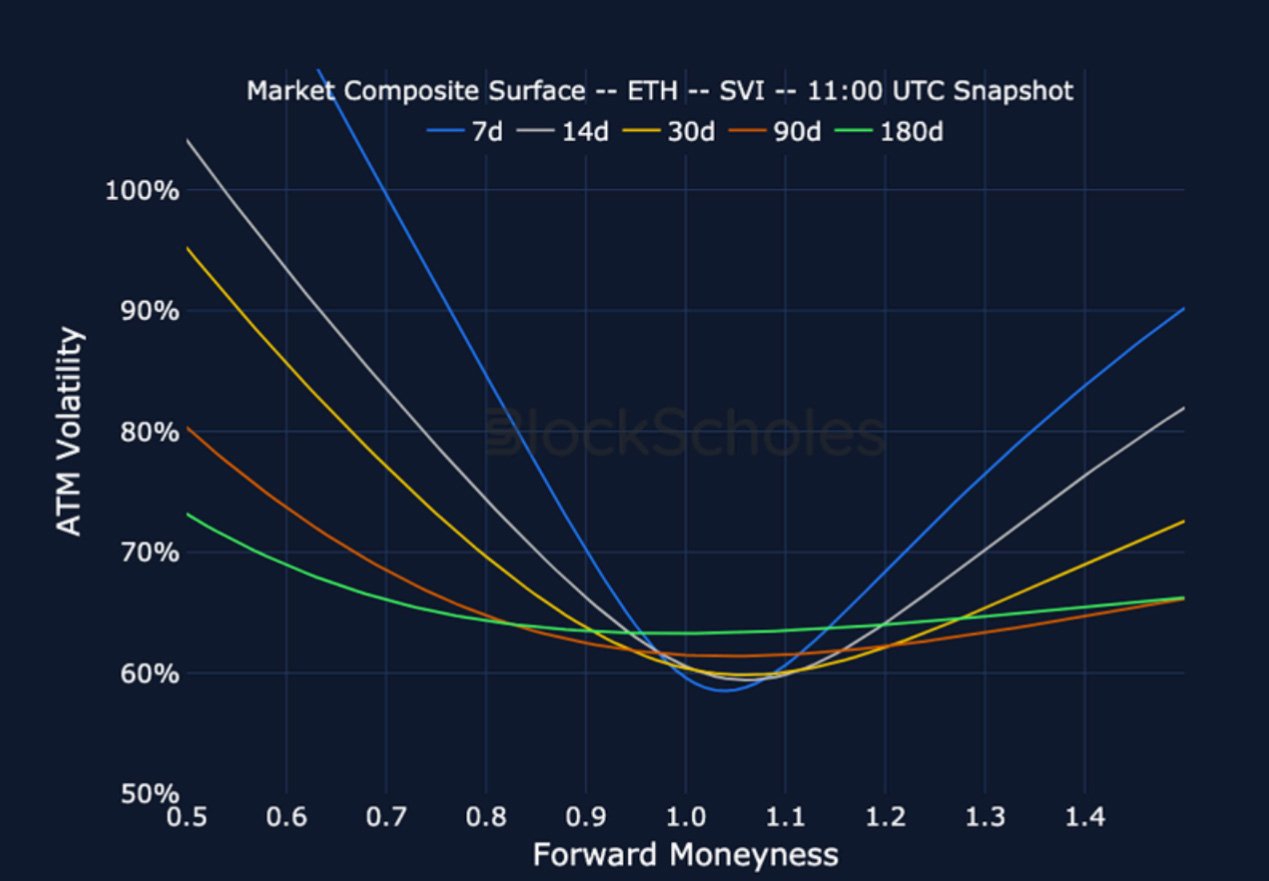

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

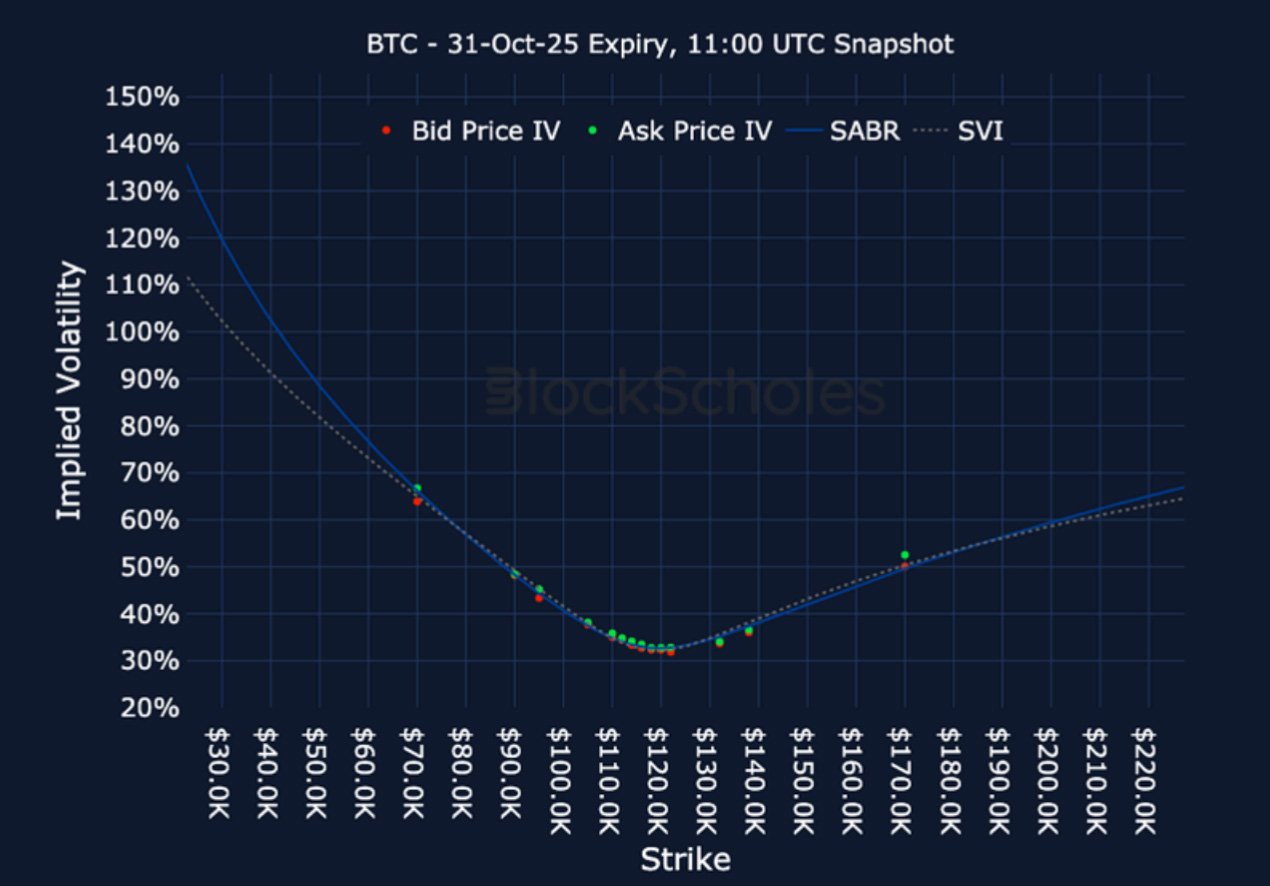

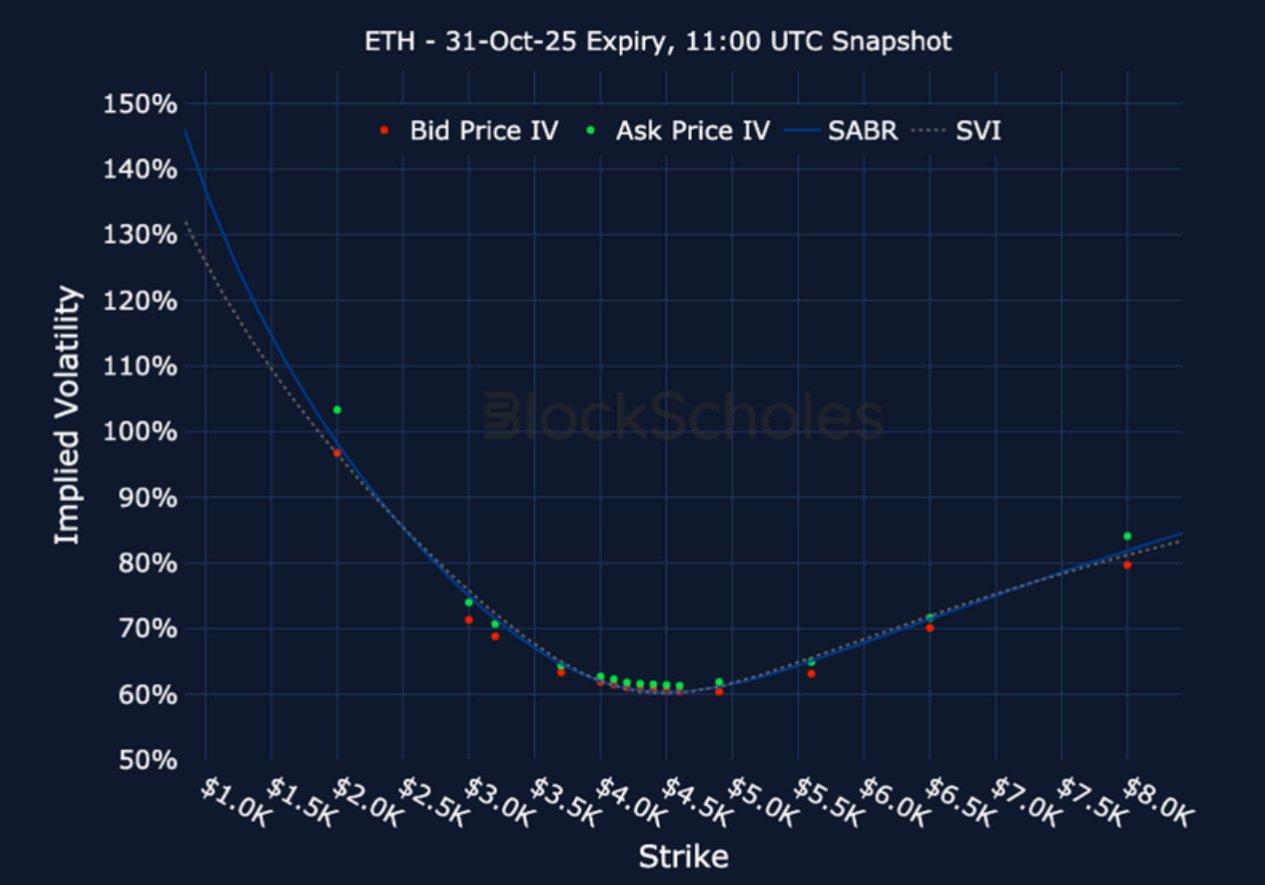

Listed Expiry Volatility Smiles

BTC 31-OCT EXPIRY – 9:00 UTC Snapshot.

ETH 31-OCT EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

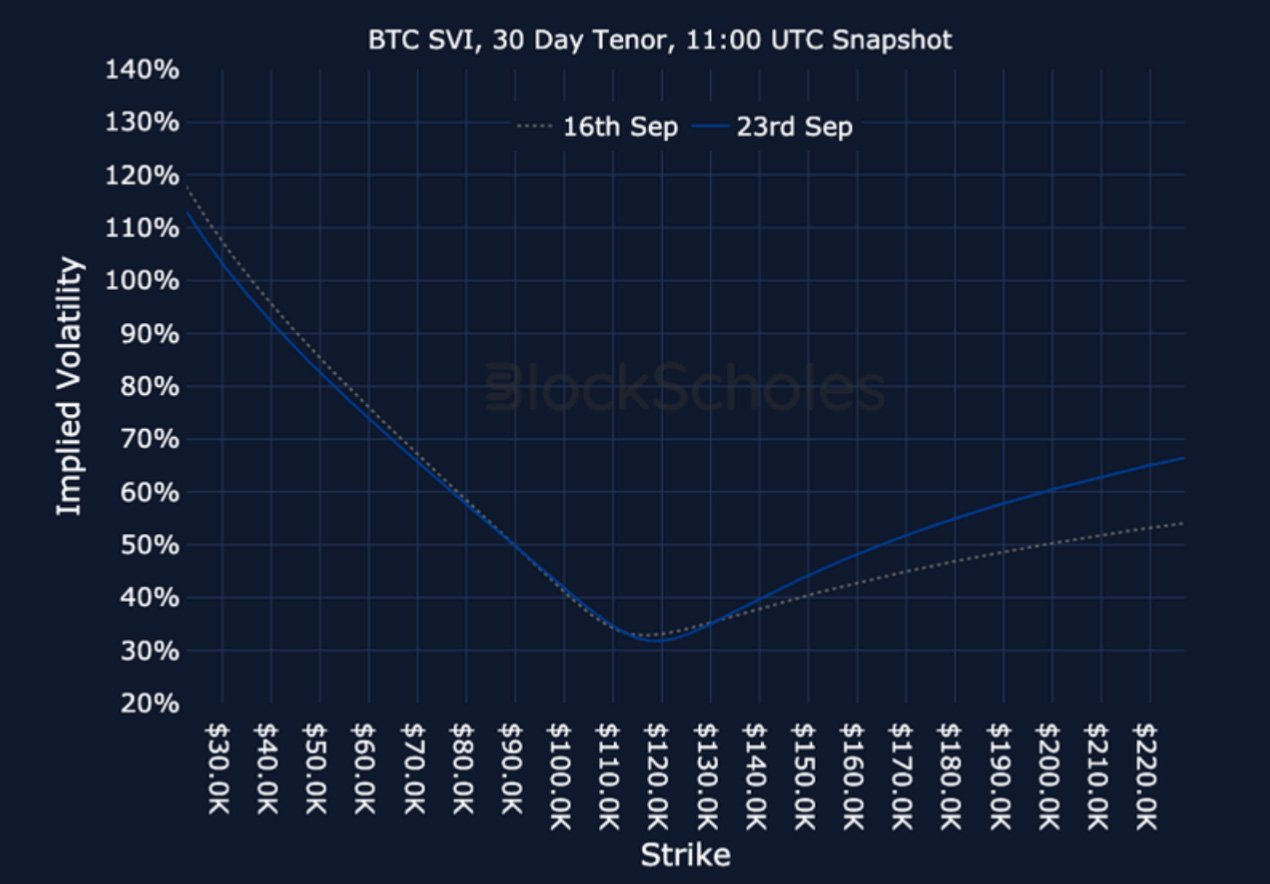

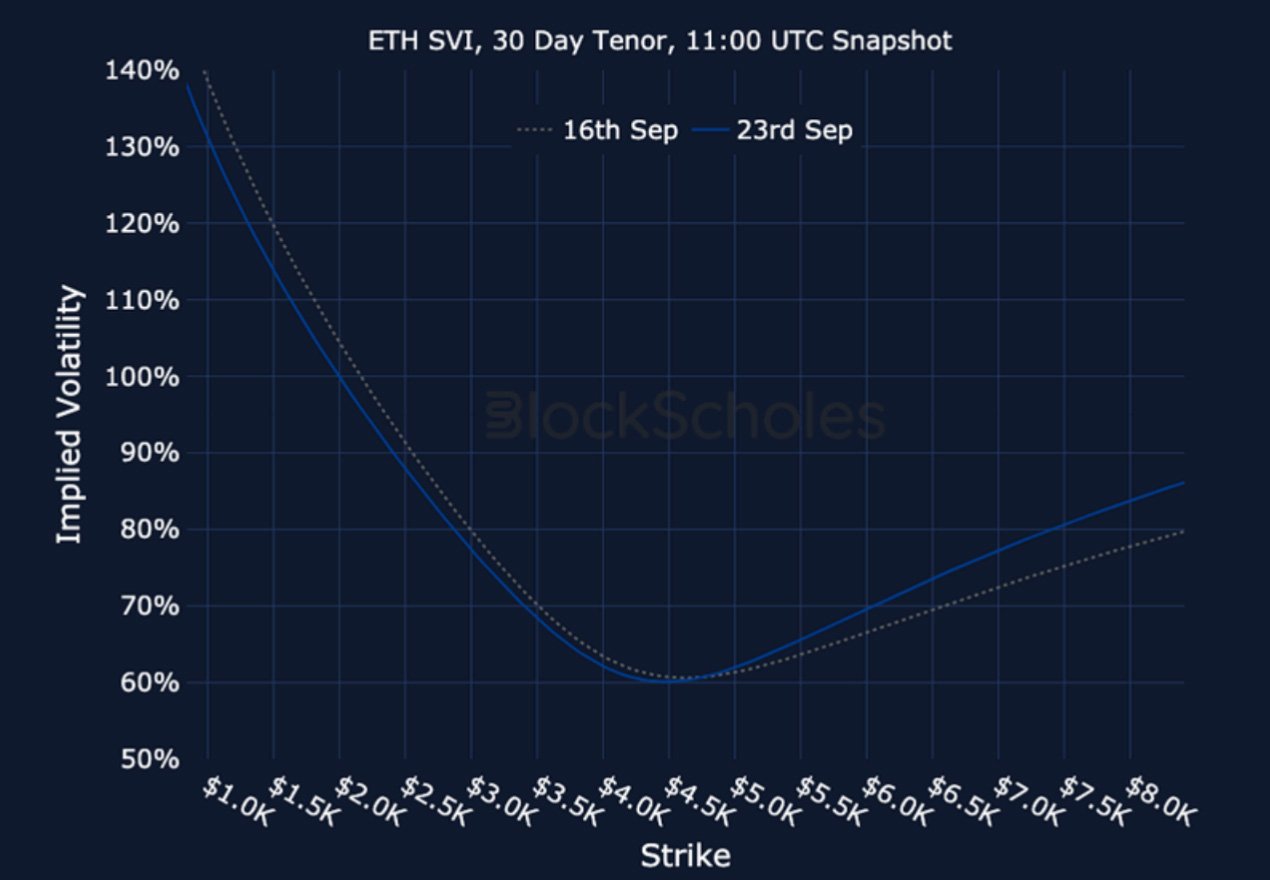

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)