Macro: Strategic Allocation Replaces Speculation

Bitcoin remains steady above $112,000 despite volatility flushes. Spot demand is firm-U.S. buyers are active, and corporate treasuries like Metaplanet are stepping in. Leverage has been cleared, leaving price anchored by accumulation rather than hype. Policy tailwinds (Fed cut, U.S. sovereign adoption chatter) support the longer-term bull case. The narrative is shifting: Bitcoin is increasingly seen as a strategic allocation rather than a speculative punt.

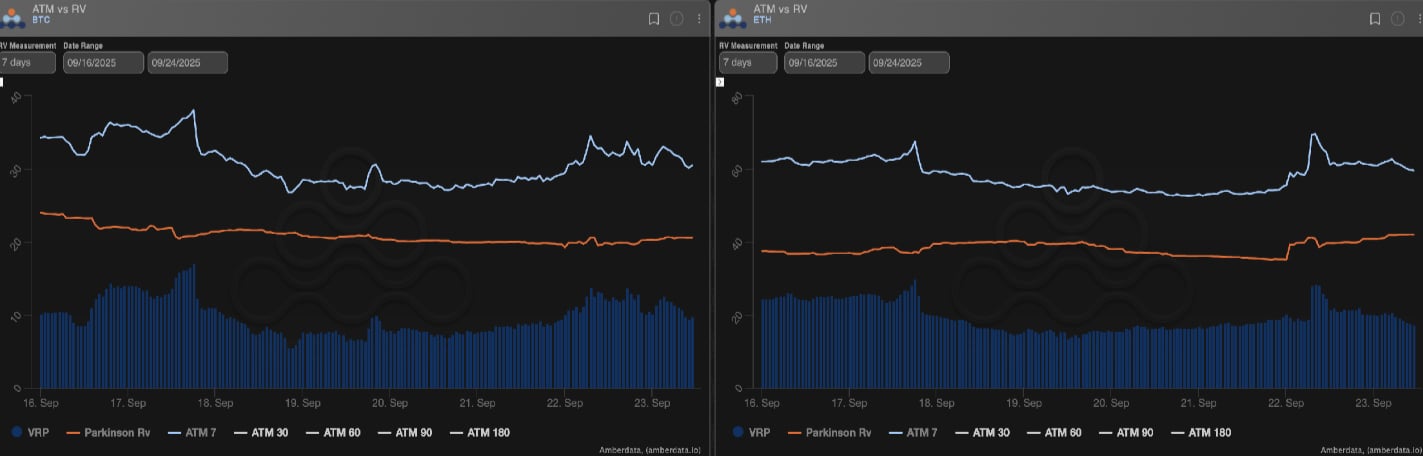

Volatility: Premiums Stay Elevated vs. Realized

BTC realized vol sits near 20, ETH around 40. Implieds hold a significant premium-10 vols in BTC, 20 vols in ETH-suggesting the market is either short gamma or bracing for movement. Recent price action tested downside levels, reinforcing the sense of latent stress beneath the calm.

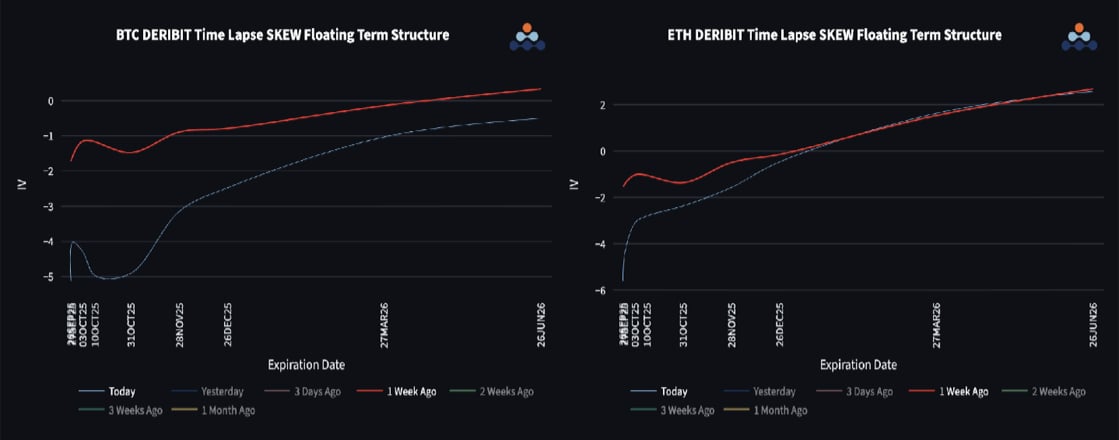

Skew: Puts Dominate as Protection Demand Builds

Put skew steepened across the curve. BTC front-end puts traded at a 5 vol premium, with longer expiries also tilting towards protection. ETH saw pronounced skew in 2025 expiries, though near-term overshot BTC. The message is clear: investors are paying up for downside insurance as spot repeatedly fails to break higher.

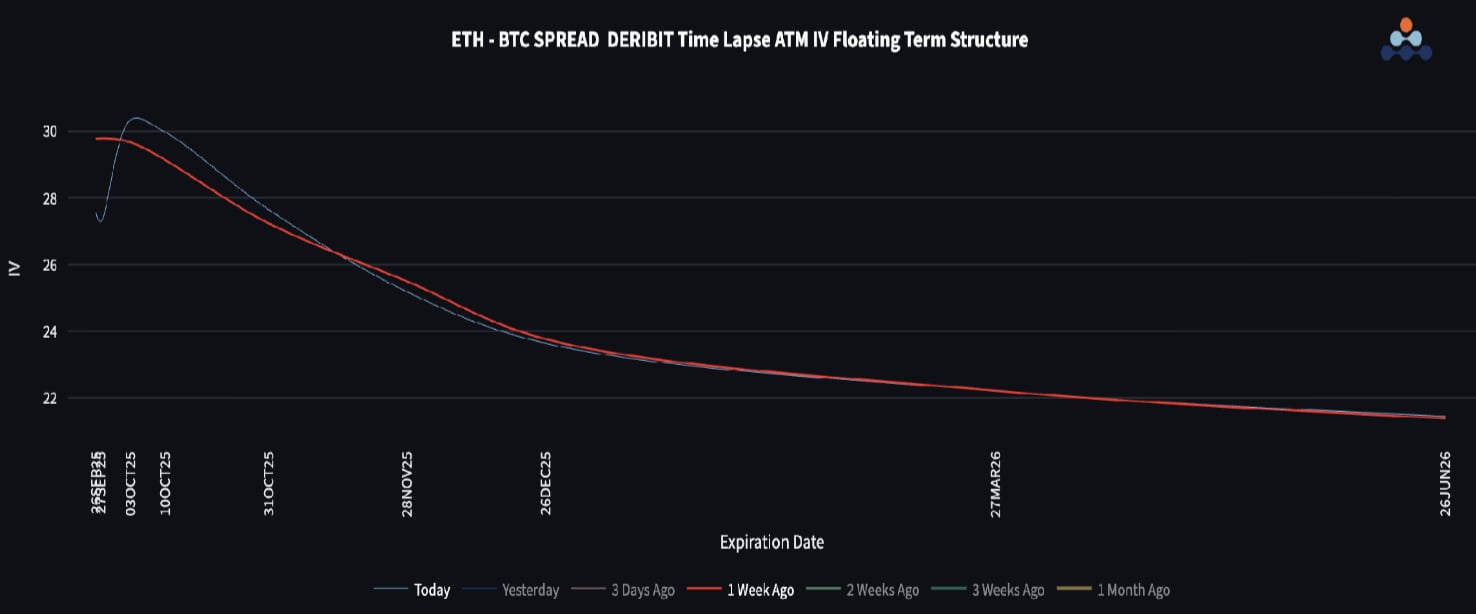

ETH/BTC Dynamics: Demand for ETH Gamma Persists

ETH/BTC trades at 0.037, sitting on key support. The vol spread remains stable at ~20 vols realized differential. Term structure inversion shows demand for ETH gamma, reflecting expectations that current muted dispersion won’t last. Front-end skew has converged as puts get bought broadly, but ETH retains a modest call bias further out in the curve.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)