Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

After a flush out of $19B in leveraged positions earlier in the month, the past week has seen BTC and ETH trade rangebound between $105K – $115K and $3,700 – $4,200, respectively. Despite ETH slightly outperforming BTC over the last 7 days, options markets currently price in a more negative put-call skew ratio for short-tenor ETH options than they do for similar-dated BTC options. ATM implied volatility levels remain elevated for both assets although their term structures of volatility differ – ETH is slightly inverted, while BTC’s has flattened. Interestingly, while crypto asset prices trade slightly lower on the week, risk-on US equity indices, such as the S&P 500 and Nasdaq-100 have continued to move higher in the past week. That’s amidst mixed signals from President Trump with regards to his tariff stance against China. Earlier in the week, Trump announced that the US is “considering terminating business with China having to do with Cooking Oil, and other elements of Trade” , though in an interview aired last Friday with Fox Business he claimed the touted 155% tariffs on China are “not sustainable”

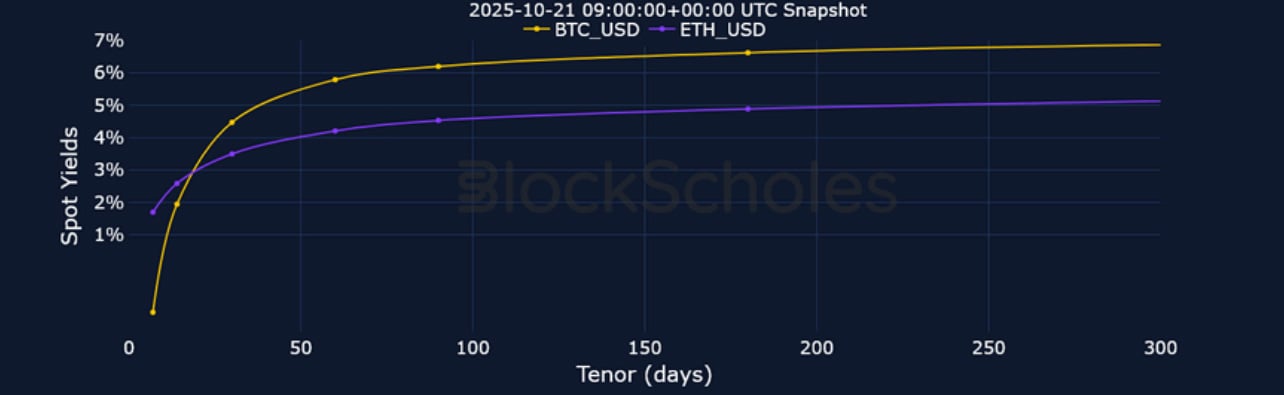

Futures Implied Yields

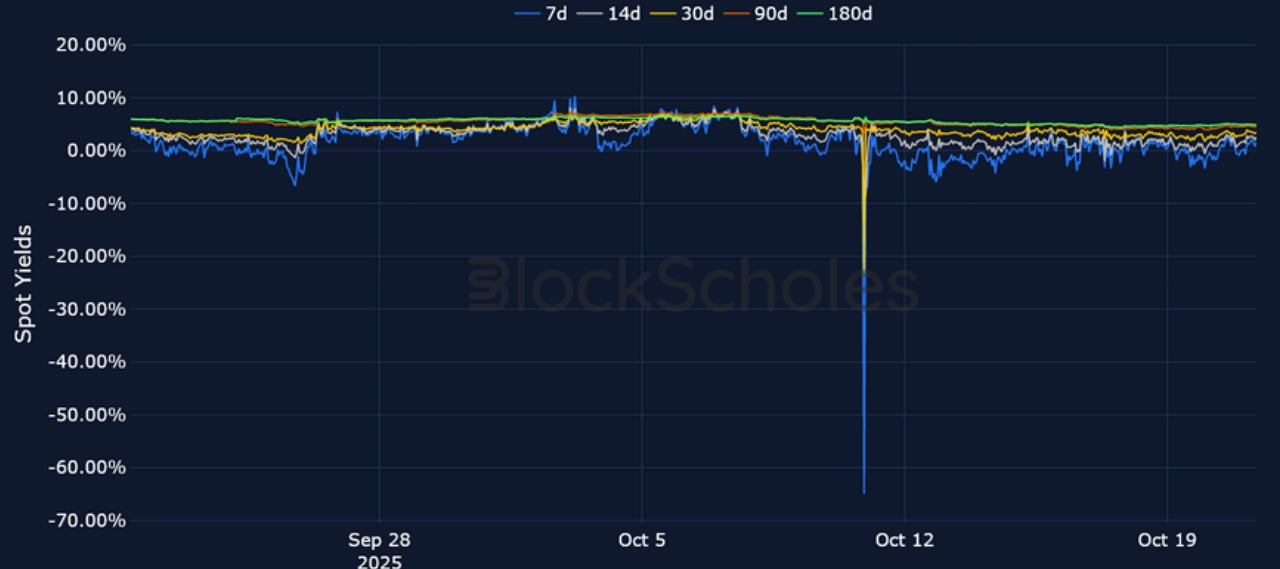

1-Month Tenor ATM Implied Volatility

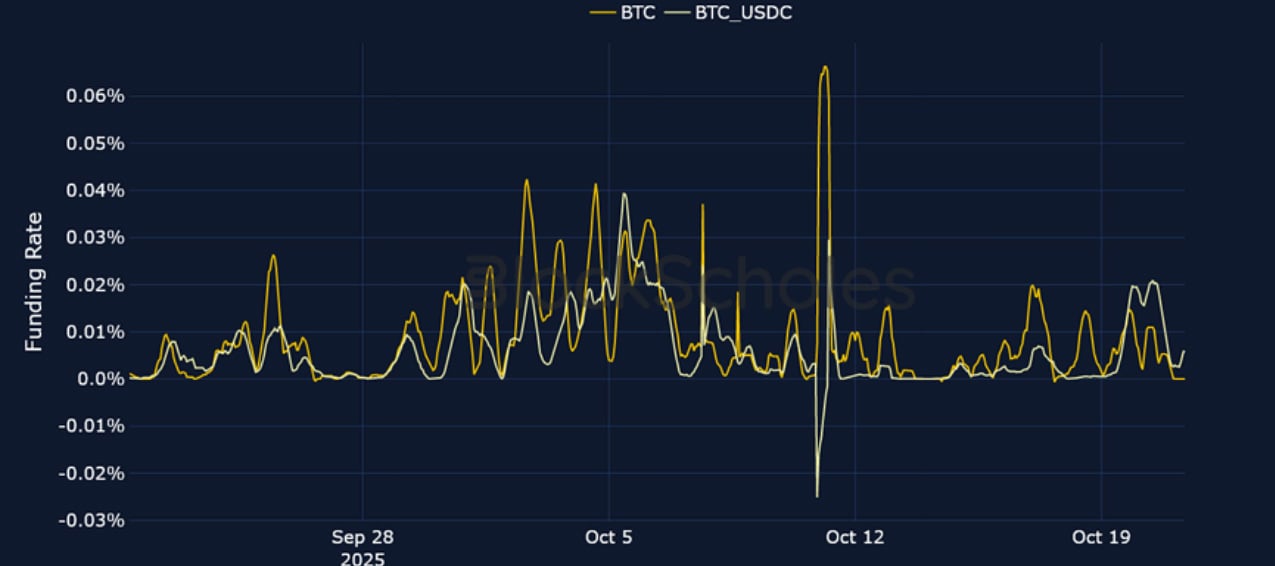

Perpetual Swap Funding Rate

BTC FUNDING RATE – The past week of bearish spot price action has been reflected in options markets via a skew towards puts, but not in perpetual swap contracts where funding remains positive.

ETH FUNDING RATE – ETH funding rates remain anchored around neutral levels amidst a rangebound spot price between $3,700 and $4,200.

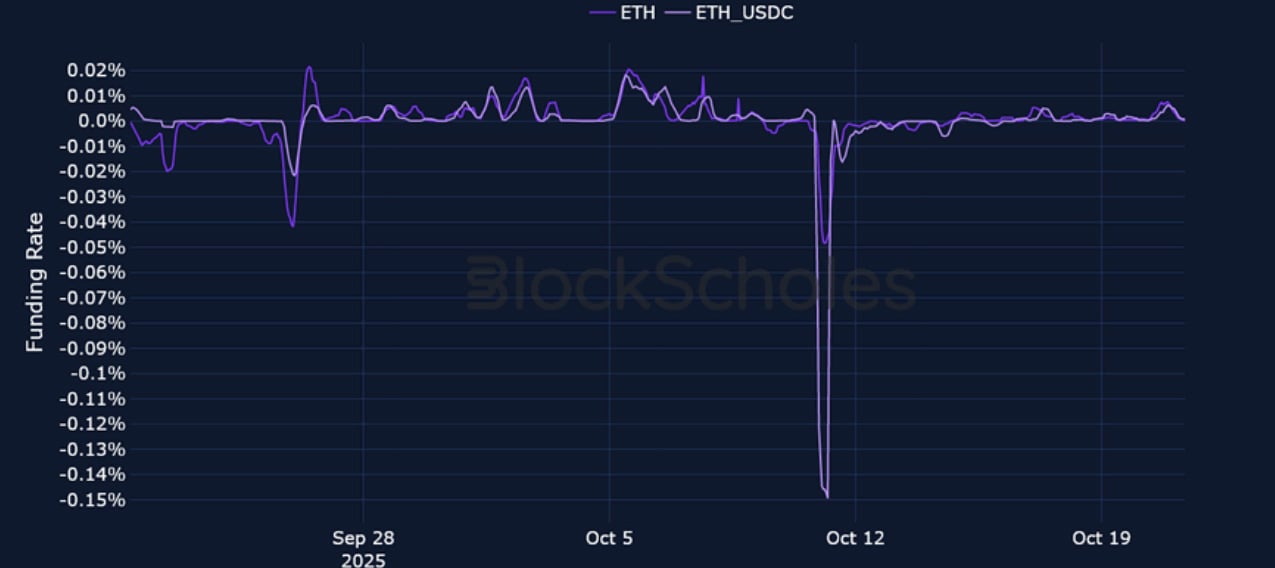

Futures Implied Yields

BTC Futures Implied Yields – Short-tenor futures prices continue to trade below spot, a sign of bearish sentiment in derivatives positioning.

ETH Futures Implied Yields – Unlike BTC, short-tenor ETH futures are not currently trading lower than spot.

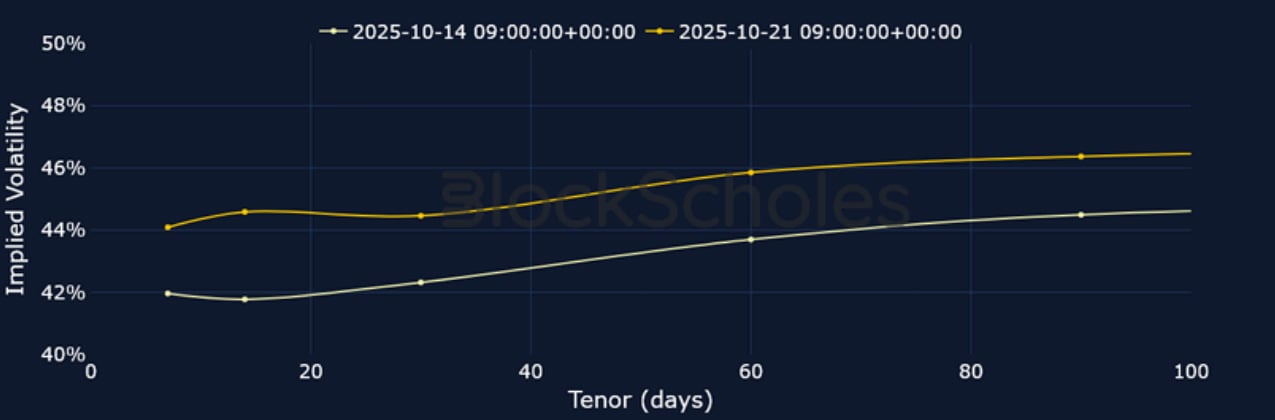

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – The term structure of volatility is flat, with IV levels trading at elevated levels relative to late September.

BTC 25-Delta Risk Reversal – Despite a weakening in the bearish sentiment since last Friday, options markets remain in favour of downside protection.

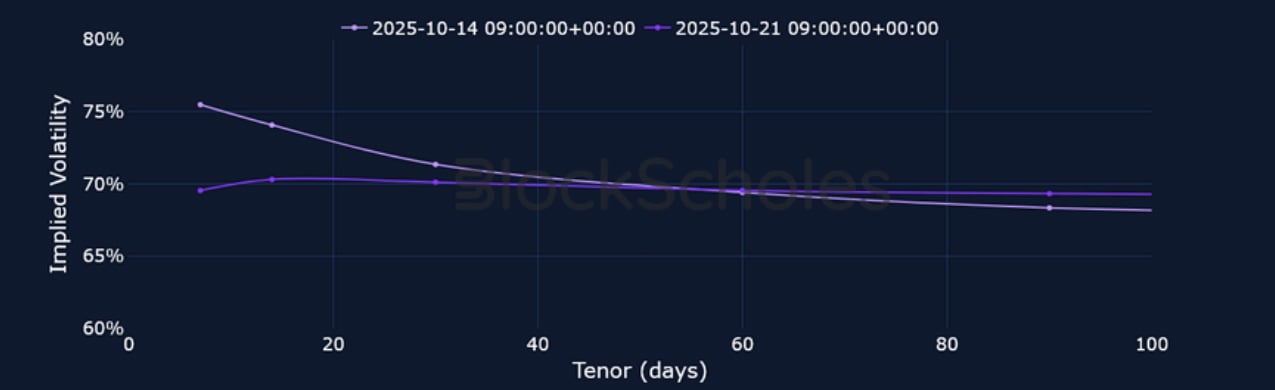

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – ETH’s term structure remains slightly inverted, contrasting the compressed curve in BTC.

ETH 25-Delta Risk Reversal – Despite a better performance over the past 7 days compared to BTC, put-call skew is more negative in ETH.

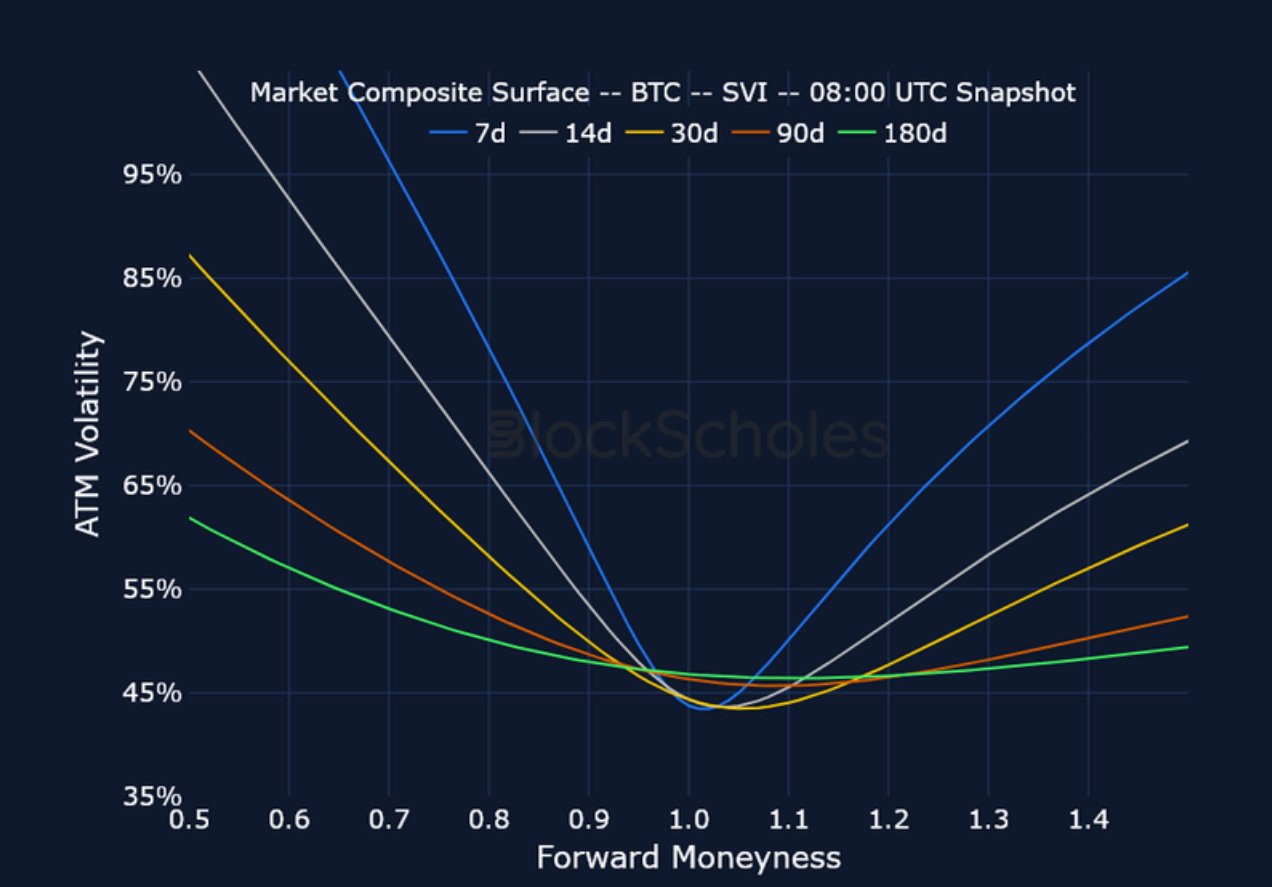

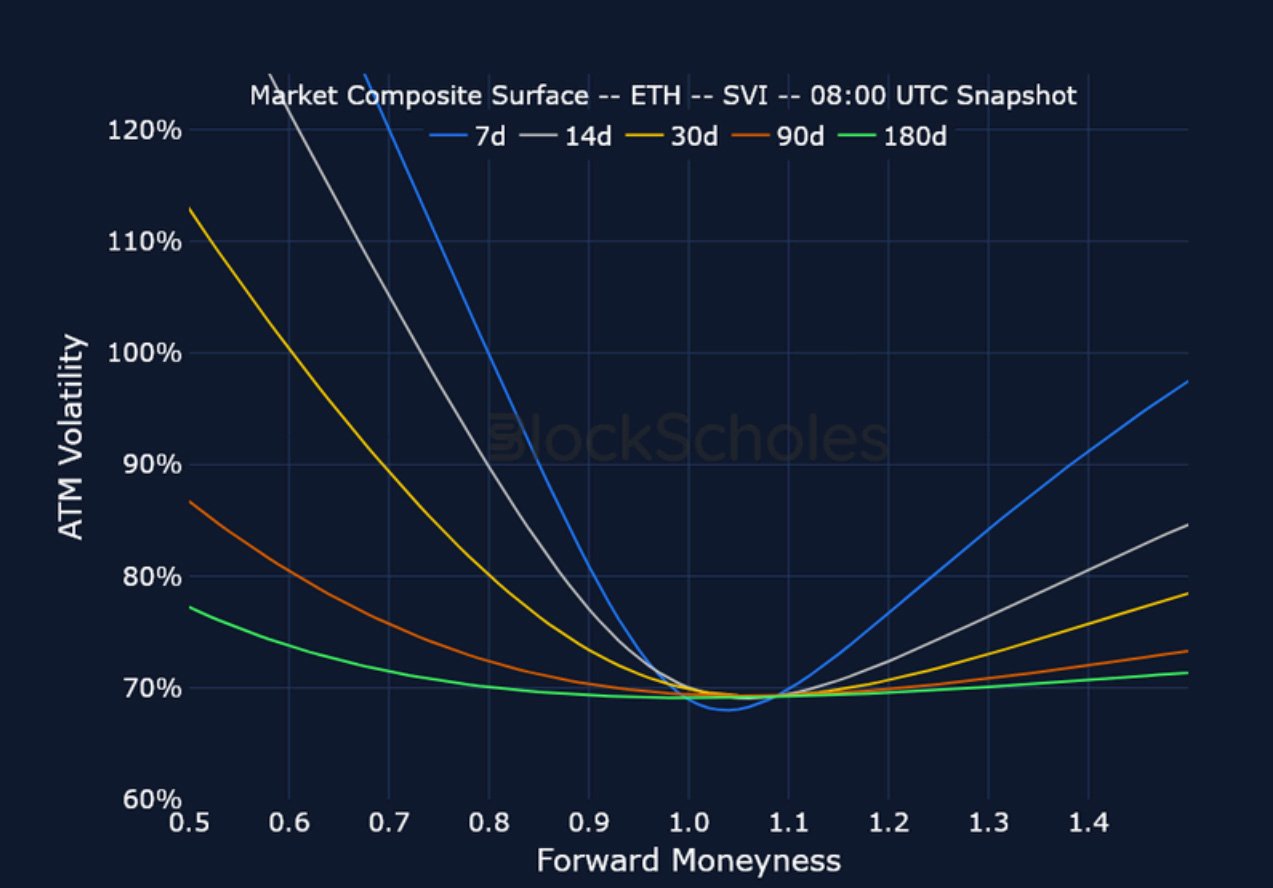

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

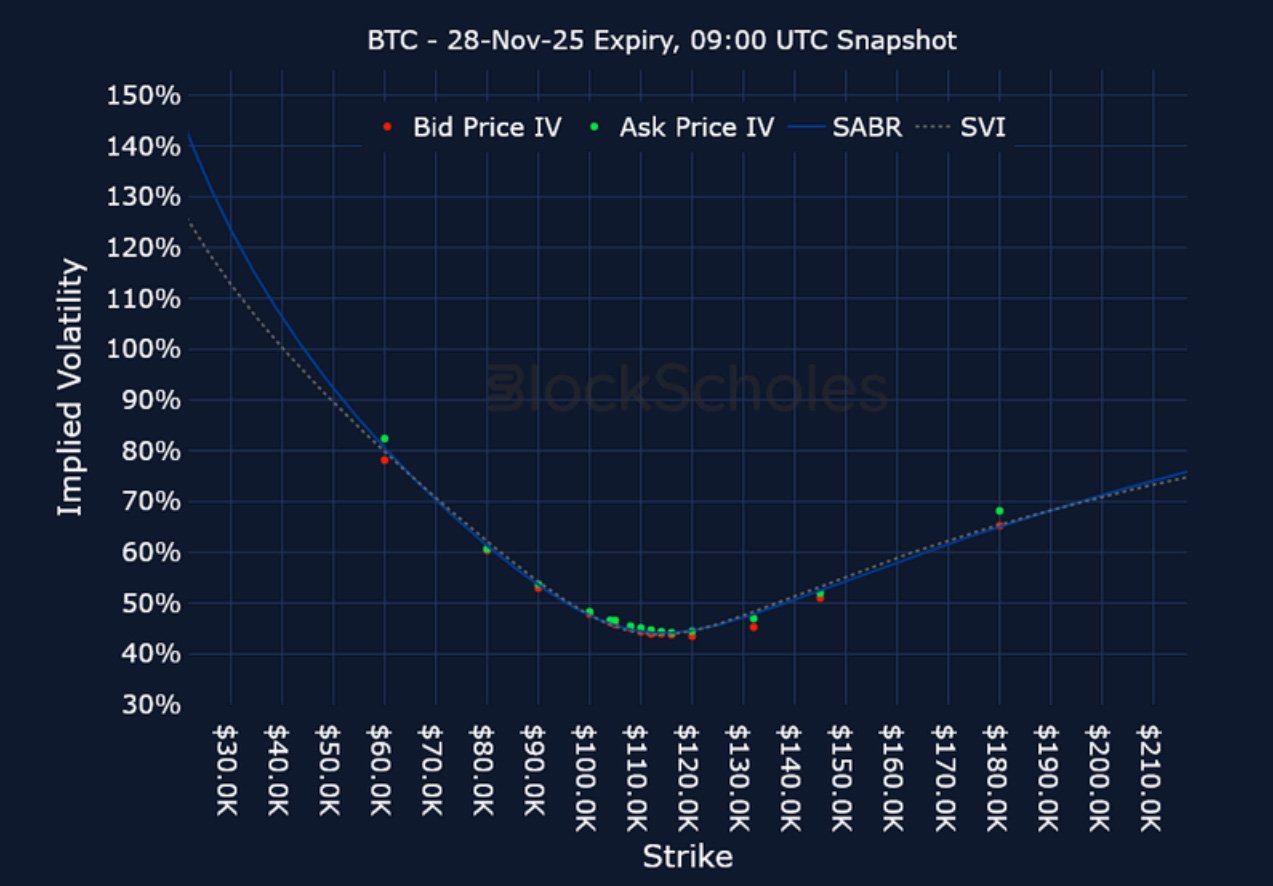

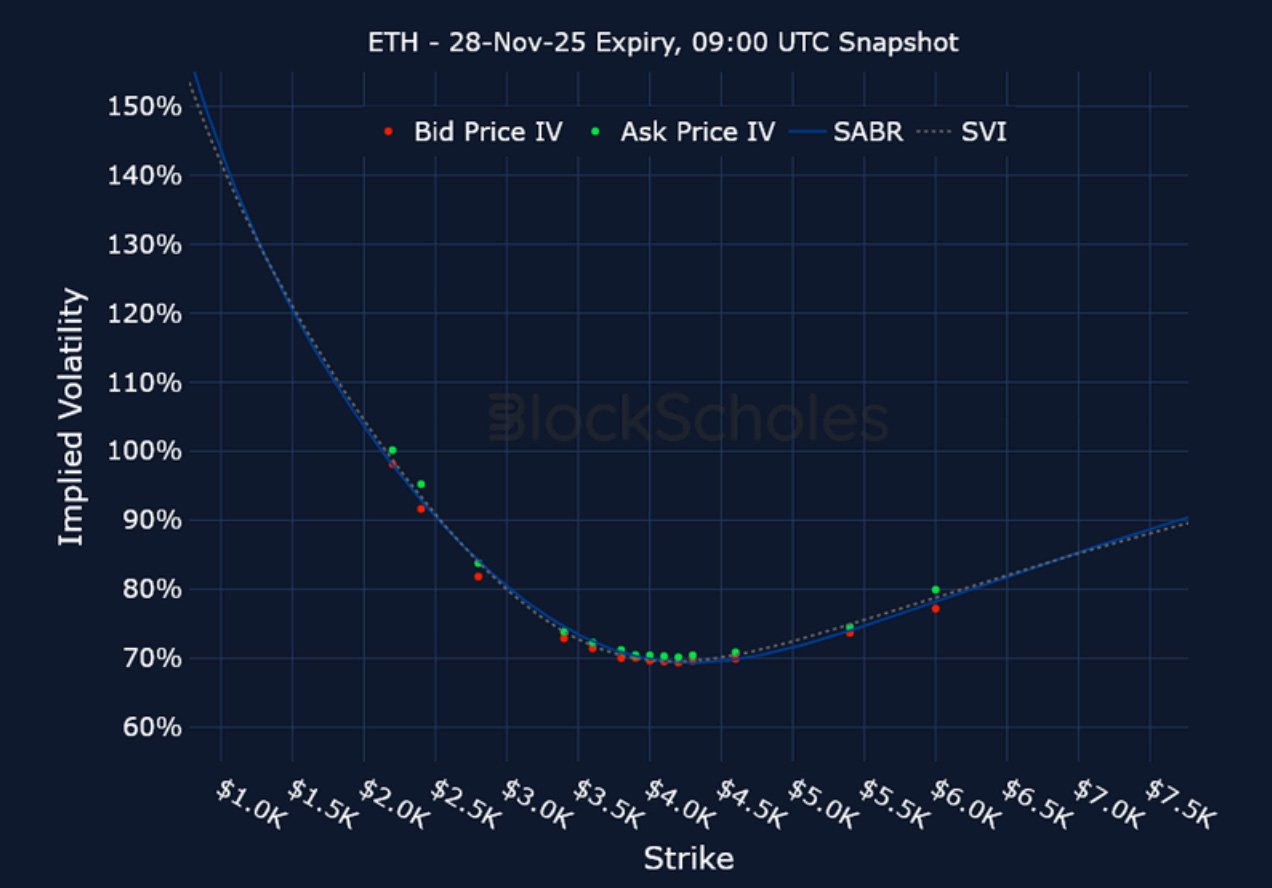

Listed Expiry Volatility Smiles

BTC 28-NOV EXPIRY – 9:00 UTC Snapshot.

ETH 28-NOV EXPIRY – 9:00 UTC Snapshot.

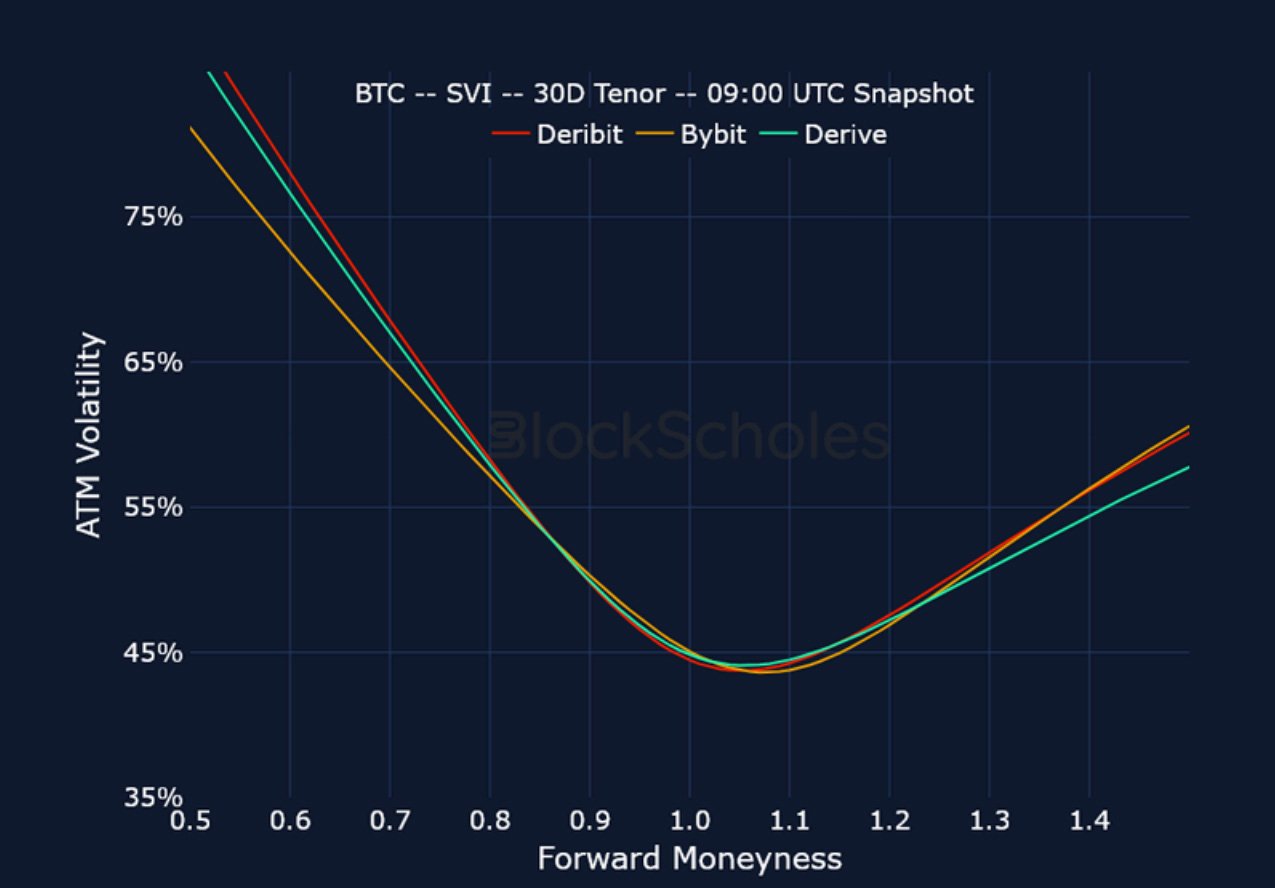

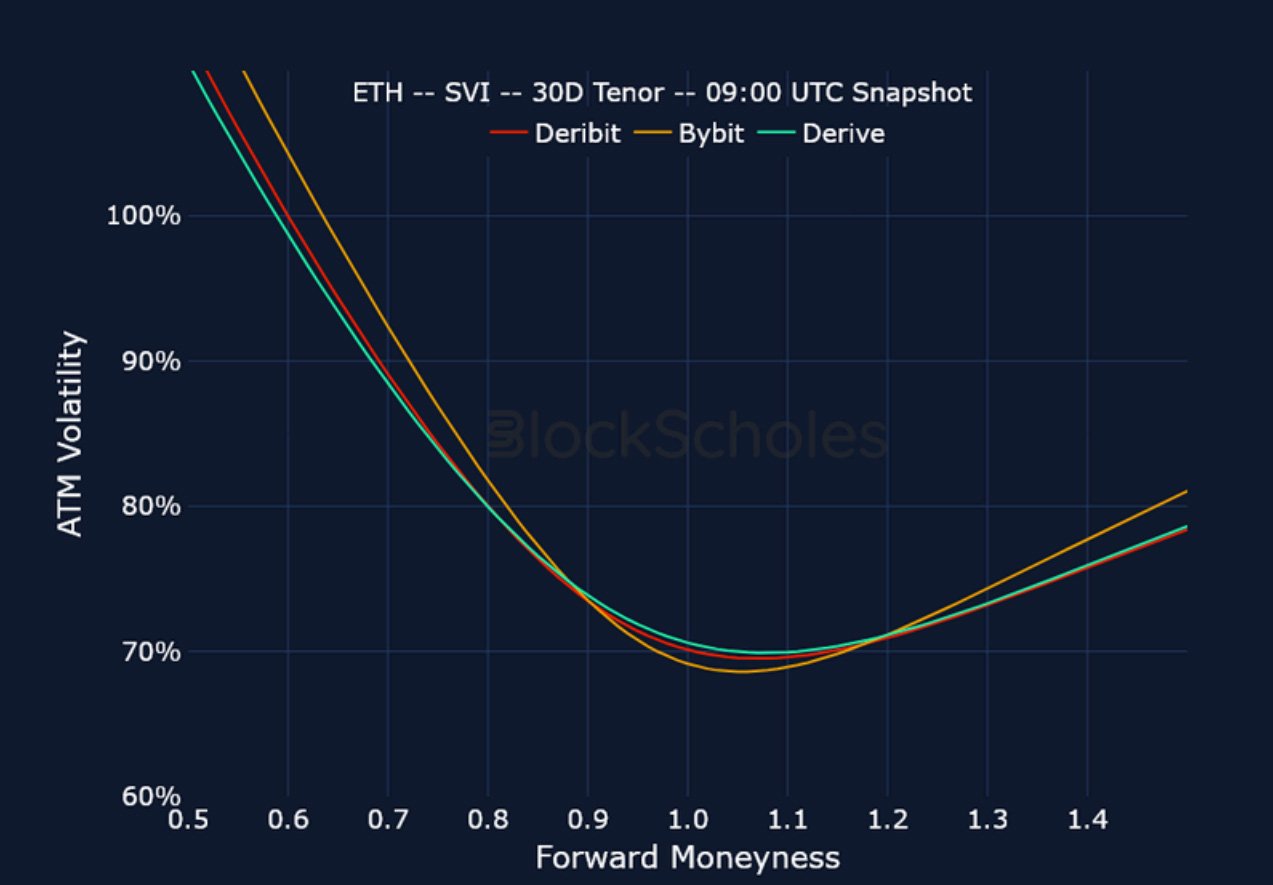

Cross-Exchange Volatility Smiles

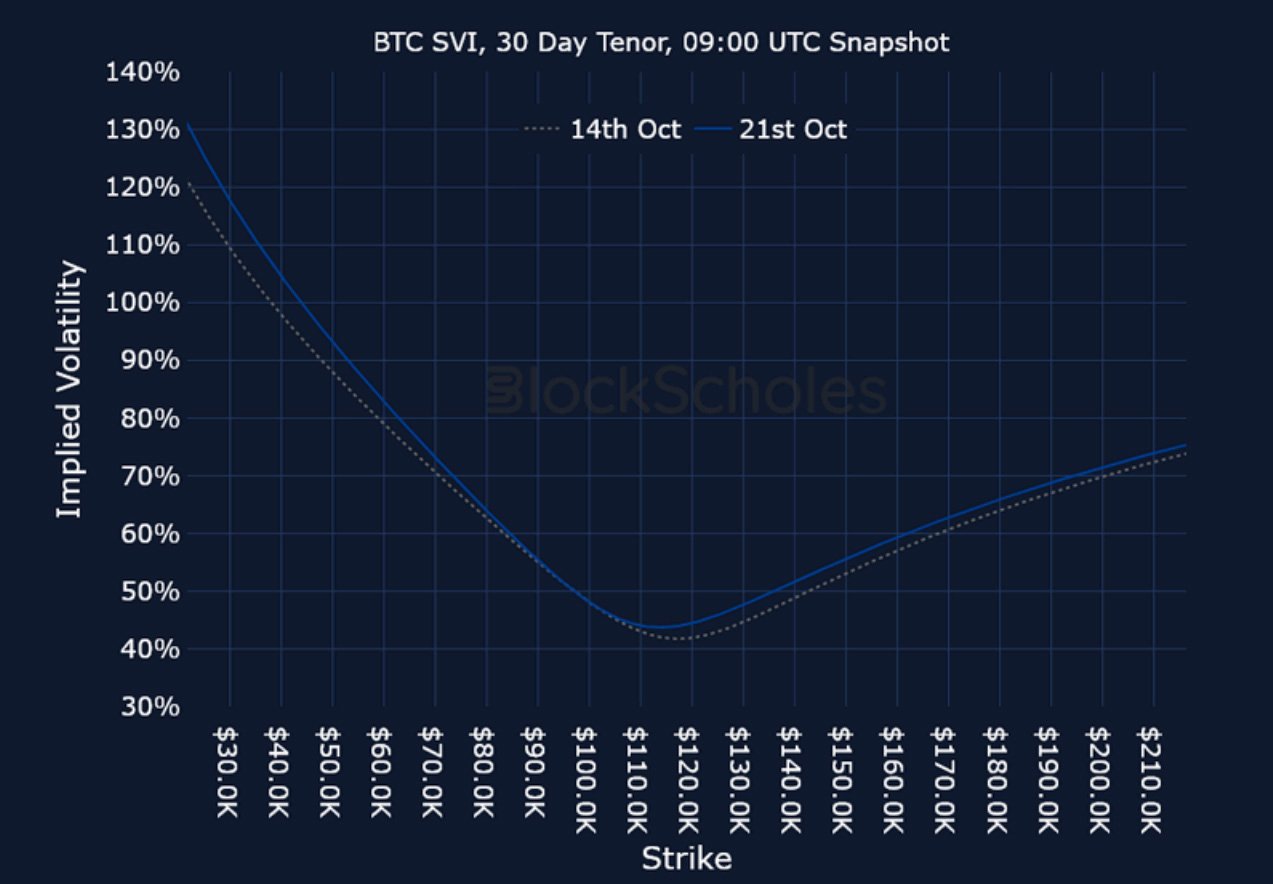

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

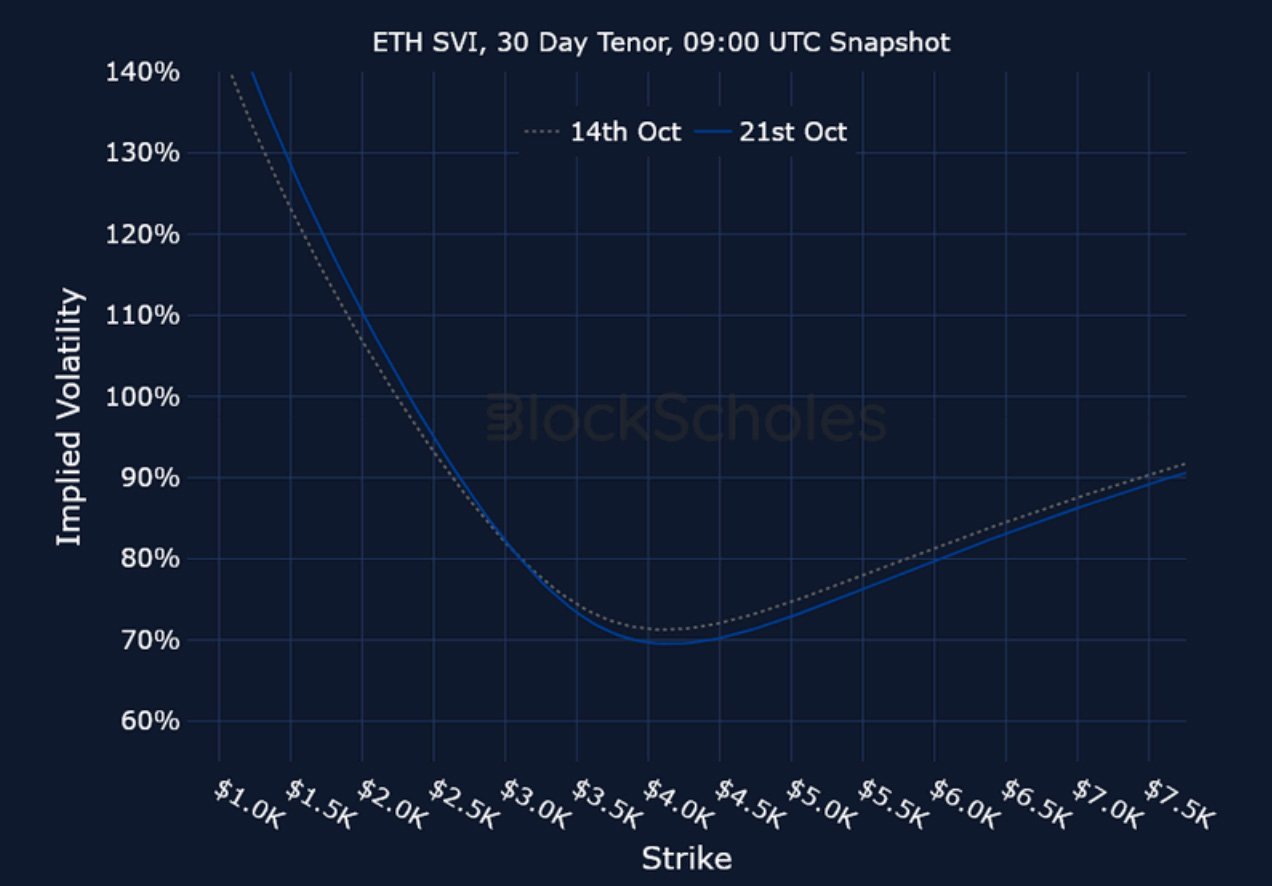

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)