In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

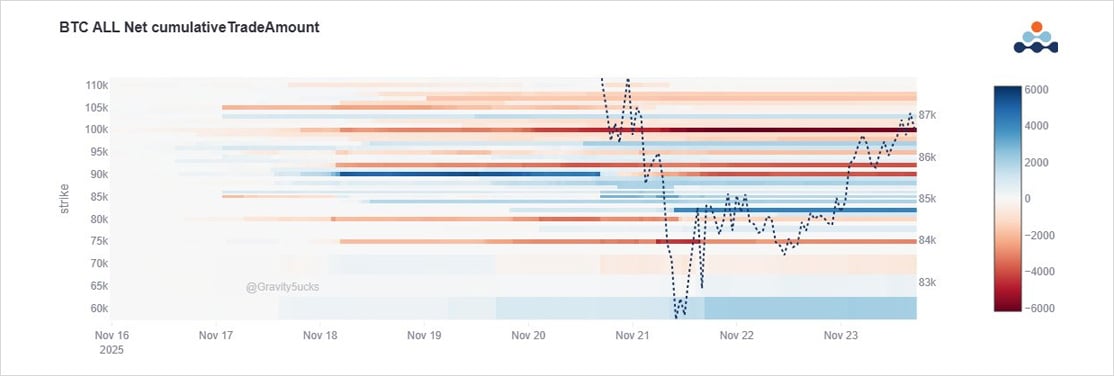

In the last month, BTC Options market flows have front-run the market moves.

Large entity Call selling, and heavy Put protection.

The OF entity has mysteriously disappeared from view, and the Put holders continue to TP but roll down notional, cautious of further downside.

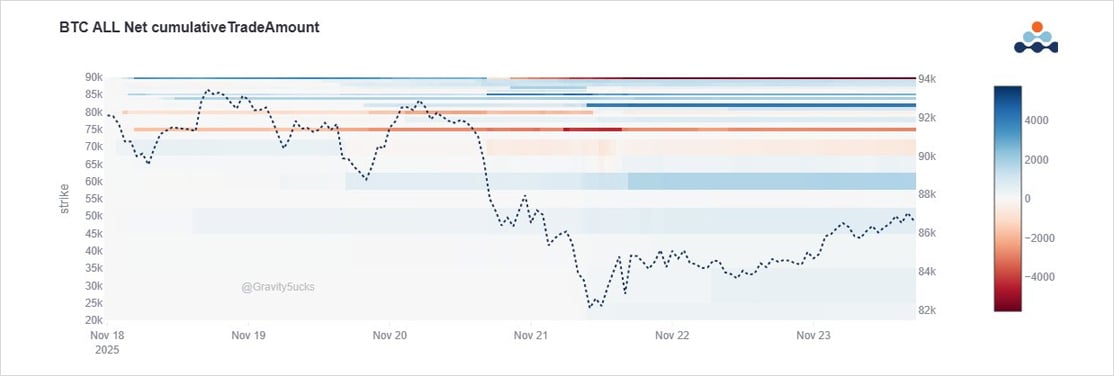

The Call Overwriting Fund (OF) was a conspicuous player throughout the summer (and post 10/10 too for conspiracists), but has been quiet of late.

The strategy of Call selling against a long BTC spot holding is a stacking strategy, but suboptimal during large 1-way spot moves.

This entity is widely believed to be a Fund with a partial Call over-writing strategy, but is also the kind of strategy employed by miners.

Other entities continue to sell Calls (in less size) on rallies, which have tended to be brief. Some Funds are selling OTM Call spreads.

Put buying has been prolific since Trump-Xi; BTC Spot >110k.

Initially 102-110k Puts in Nov, then as Spot dropped 100k-90k Strikes in Nov+Dec, TP and roll down of 106+108k Nov to Dec 85+90k Puts.

At one point >$2bn notional 85-95k Put OI.

This week roll 90k-86k to 82+80k.

There are several entities long the Puts, but a couple are prominent. Due to their execution nature, it is more likely that these are Funds protecting their AUM.

As the market falls, they have been TPing on their ITM Puts, and rolling notional Puts to protect AUM cautiously.

Ofc, some will also be playing the bearish take, with all sorts of FUD – OG selling, DAT, Quantum even.

Looking at Strike areas we often don’t consider, volumes have spiked in the 60k all the way down to the 20k Puts. While not large, and premiums are small, it’s not nothing.

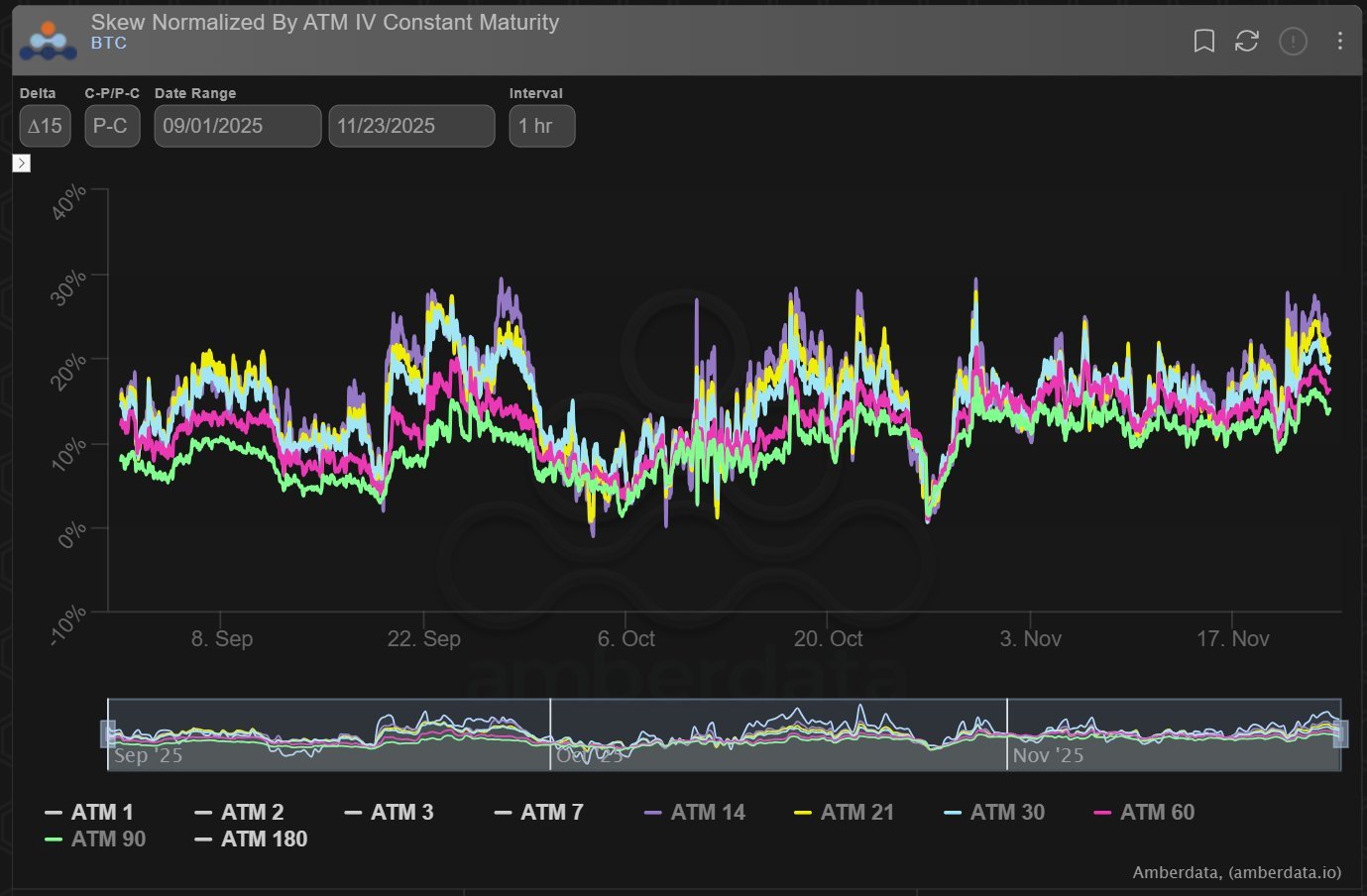

Without the abundance of natural Vol selling flows from the large OF seller, and now recent+consistent Put buying and increased Realized Vol, the Implied Vol has naturally firmed.

See the blip on 10/10 to the right, but also compare today’s vol with early 2025 and note order.

Put Skew is consequently elevated with Put buying and (at best) pressure on Calls, often funding the downside.

1-month proxy at 20% Put > Call for 15deltas is high, but hardly inconsistent with the last few months of worries.

On extreme past events we’ve observed far worse.

See original post on X here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)