Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

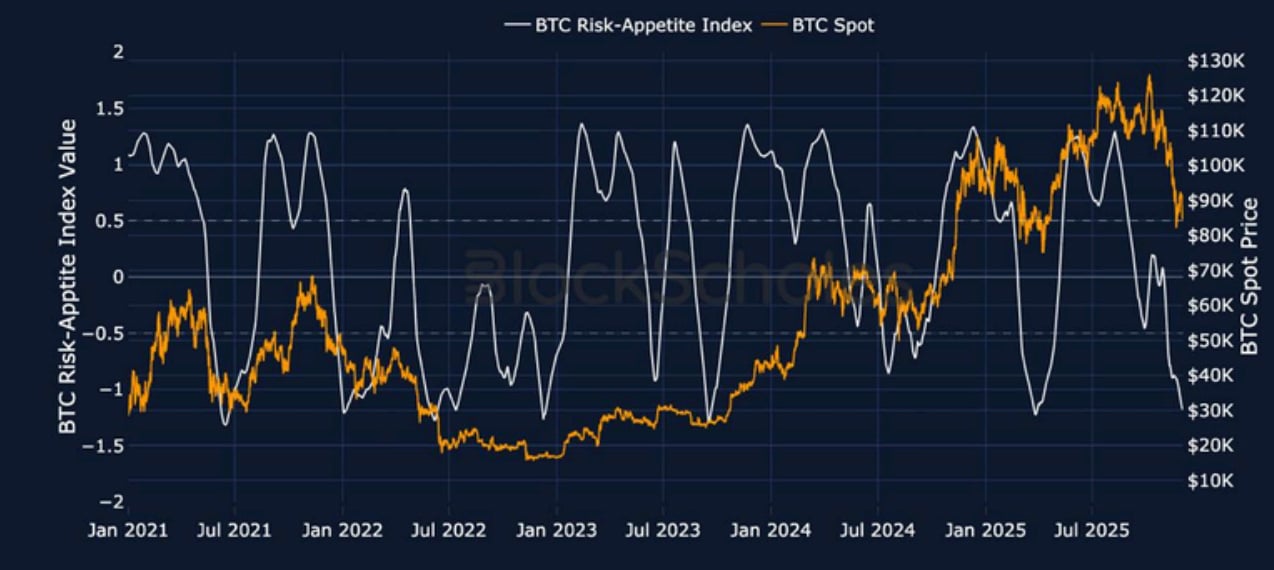

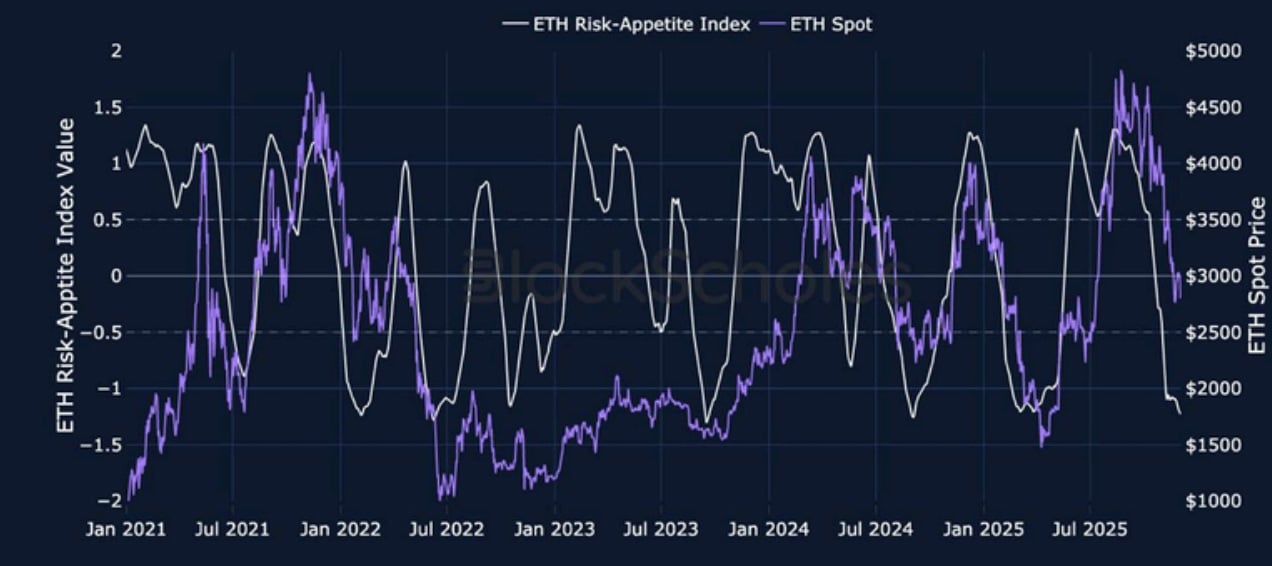

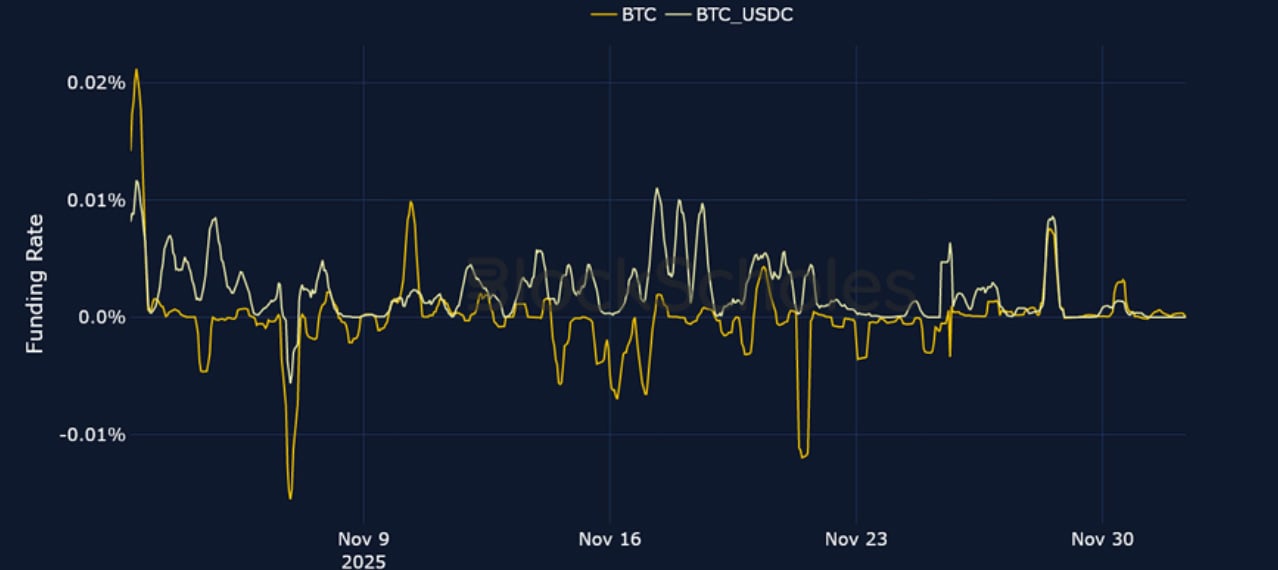

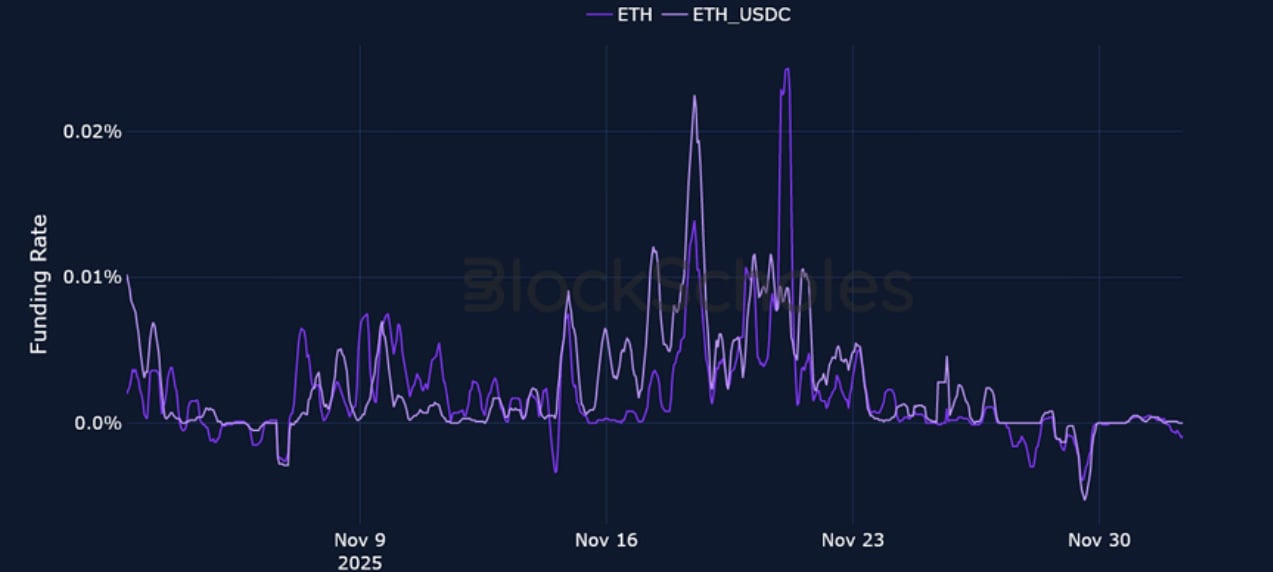

Last week ended with a modest recovery in BTC’s spot price to $93K following the Thanksgiving Holiday, in line with a move higher in risk-on US equities. That inspired a significant rally in BTC’s volatility smiles which priced out all of their defensive hedging, resulting in a modest-to-bullish put-call skew ratio. Funding rates shot up to just shy of 0.01%, showcasing some willingness from traders to partake in the upward spot move. By early Monday morning however, those gains were sharply lost, amidst hawkish comments from the Bank of Japan’s Governor indicating the central bank may be open to an interest rate hike. BTC and risk-on US equities subsequently fell lower and BTC revisited the $83K mark. Interestingly, derivatives markets are pointing to a varied picture on the outlook for BTC and ETH. Negative funding rates over the past week in ETH contrast the neutral/ moderately positive rates seen in BTC; while volatility smiles show a larger premium for short-dated OTM puts for BTC than seen in ETH options markets, suggesting a higher demand for options to hedge downside exposure in BTC.

Block Scholes BTC Risk Appetite Index

Block Scholes ETH Risk Appetite Index

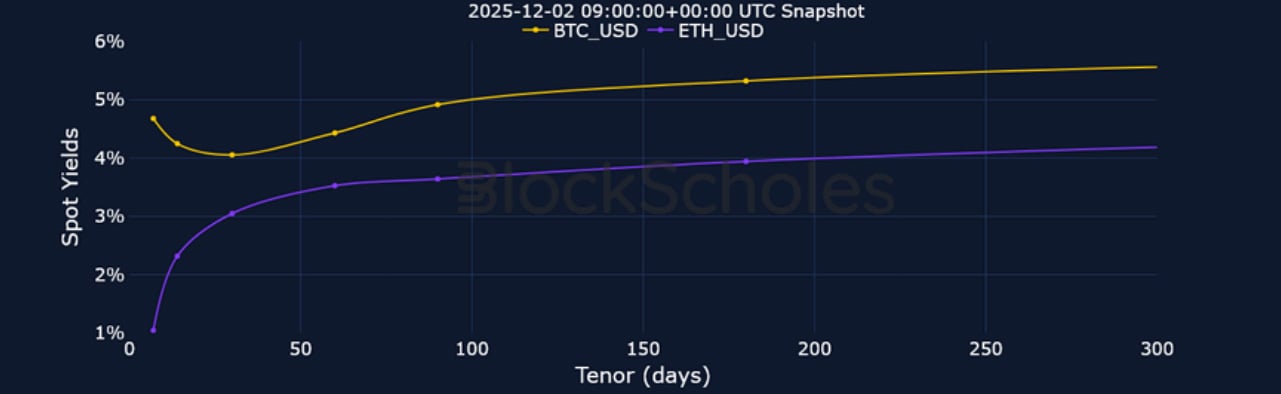

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

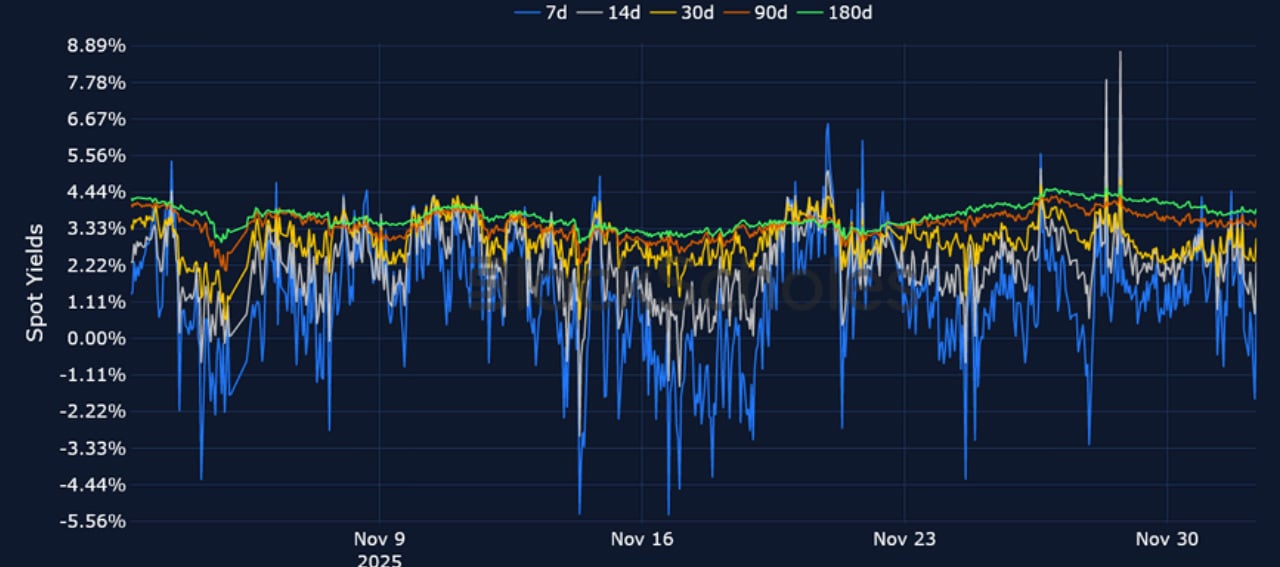

Perpetual Swap Funding Rate

BTC FUNDING RATE – Funding rates reached their high for the week on 28 Nov in line with BTC’s modest rally back above $92K. Spot price then subsequently fell to a low of $83K, bringing a return to neutral funding rates.

ETH FUNDING RATE – The negative funding in ETH contrasts the slightly less bearish positioning in its options markets relative to BTC.

Futures Implied Yields

BTC Futures Implied Yields – Since late Nov, the discount in futures prices to spot has abated, suggesting a more subdued demand for short positions.

ETH Futures Implied Yields – Short-dated ETH exposure on the other hand saw futures prices trade below spot several times in the week.

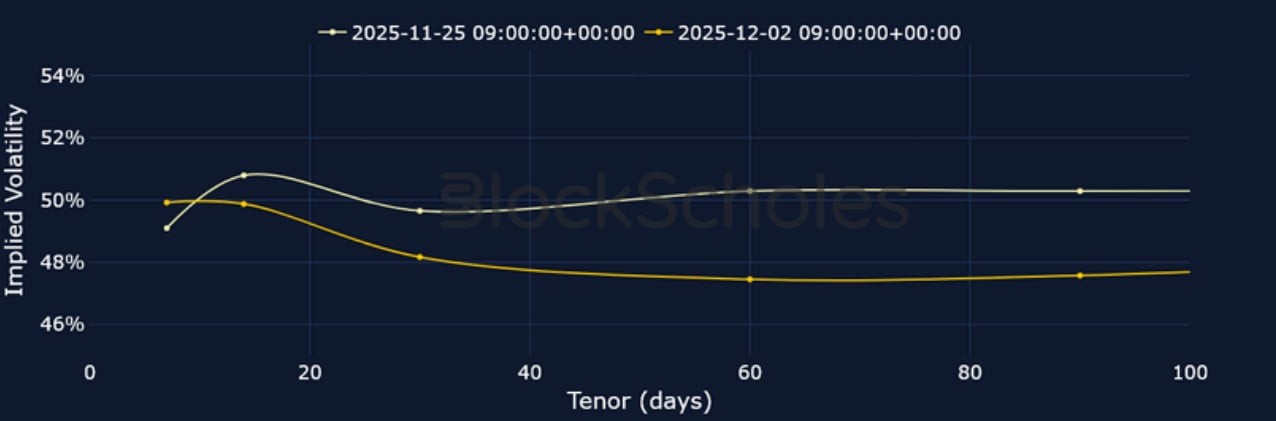

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – A visit to $83K inspired a temporary inversion in the volatility term structure.

BTC 25-Delta Risk Reversal – The recovery to $90K resulted in a neutral skew ratio, however traders are once more hedging against a drop in spot price.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – Front end volatility has plunged from its mid-November high of 95%.

ETH 25-Delta Risk Reversal – ETH smiles enter Dec with the same bearish positioning of Nov, as OTM puts command a 6 point premium over calls.

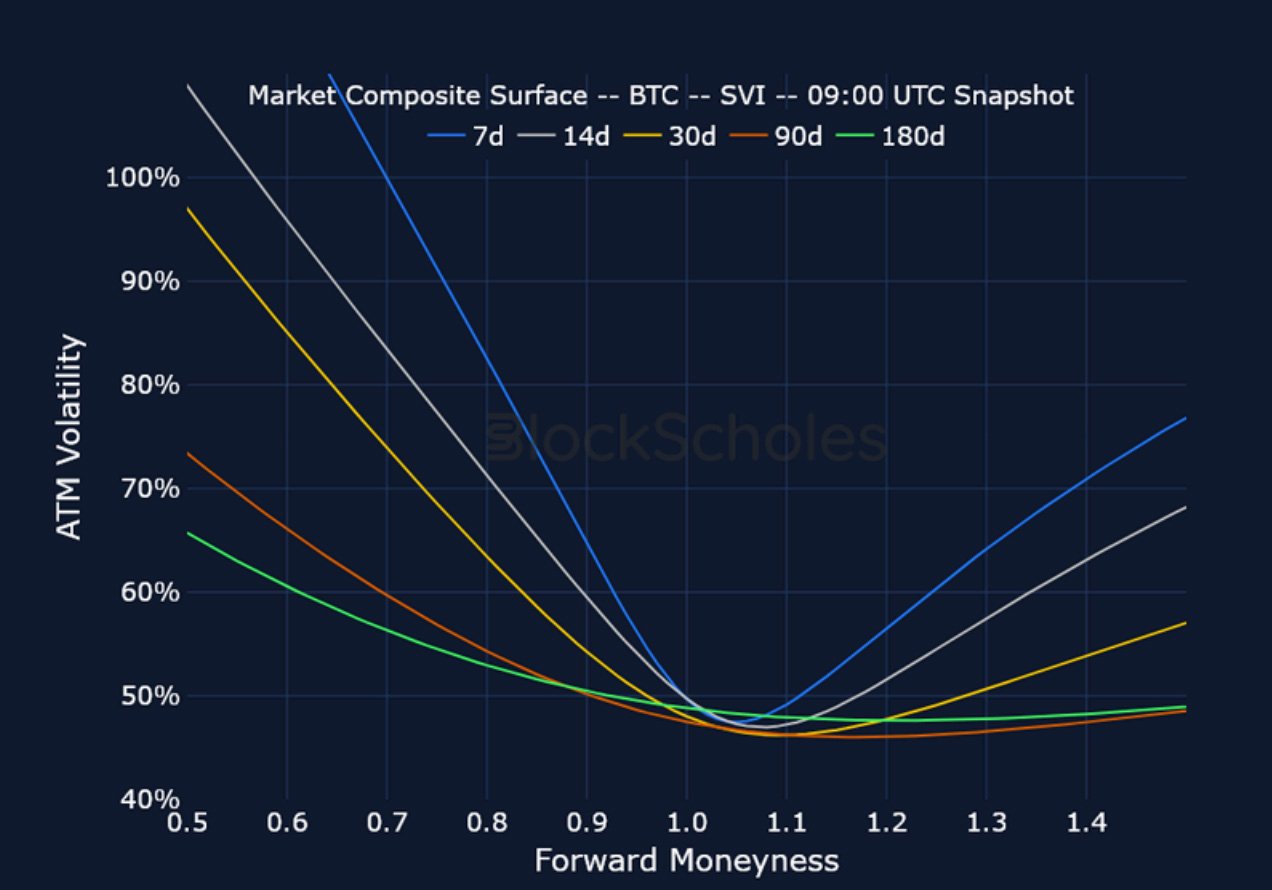

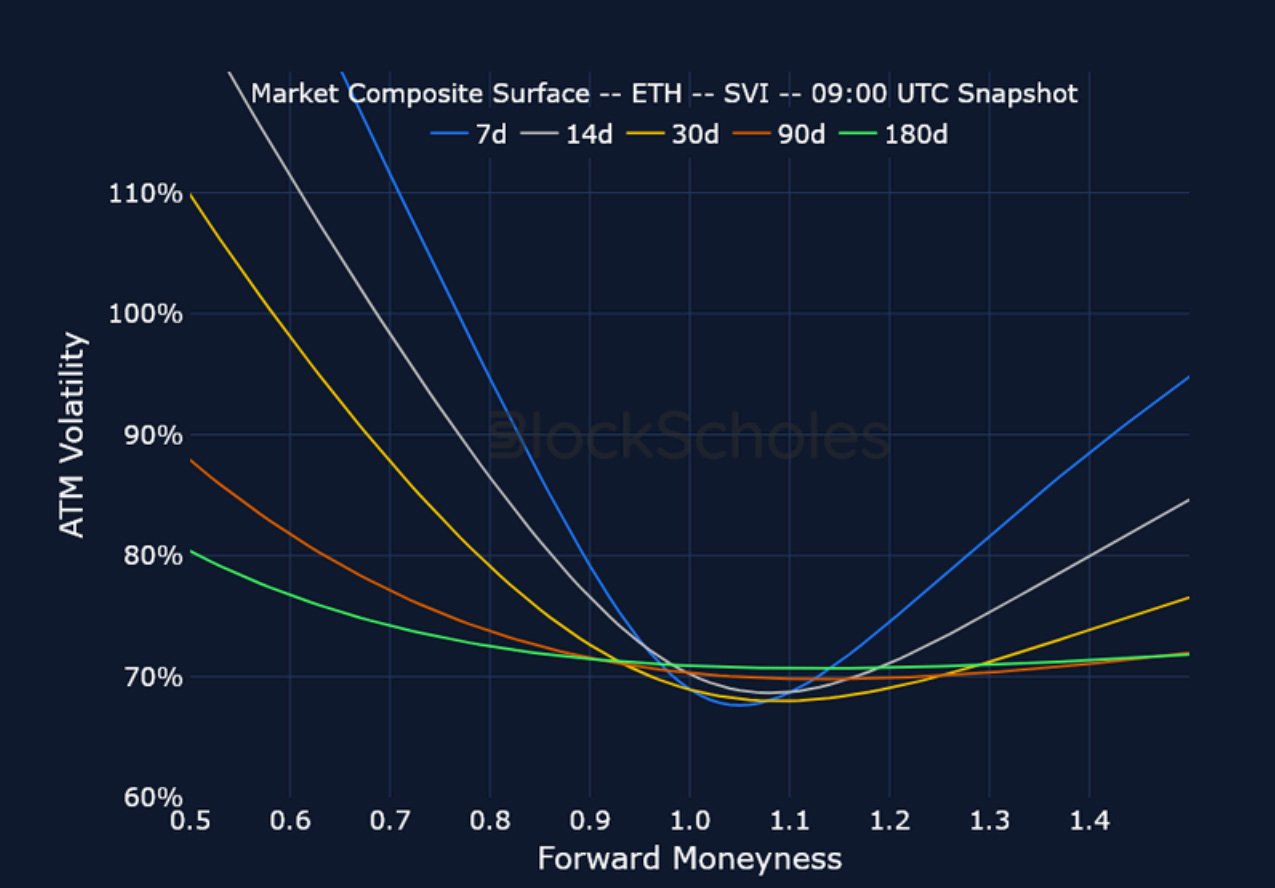

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

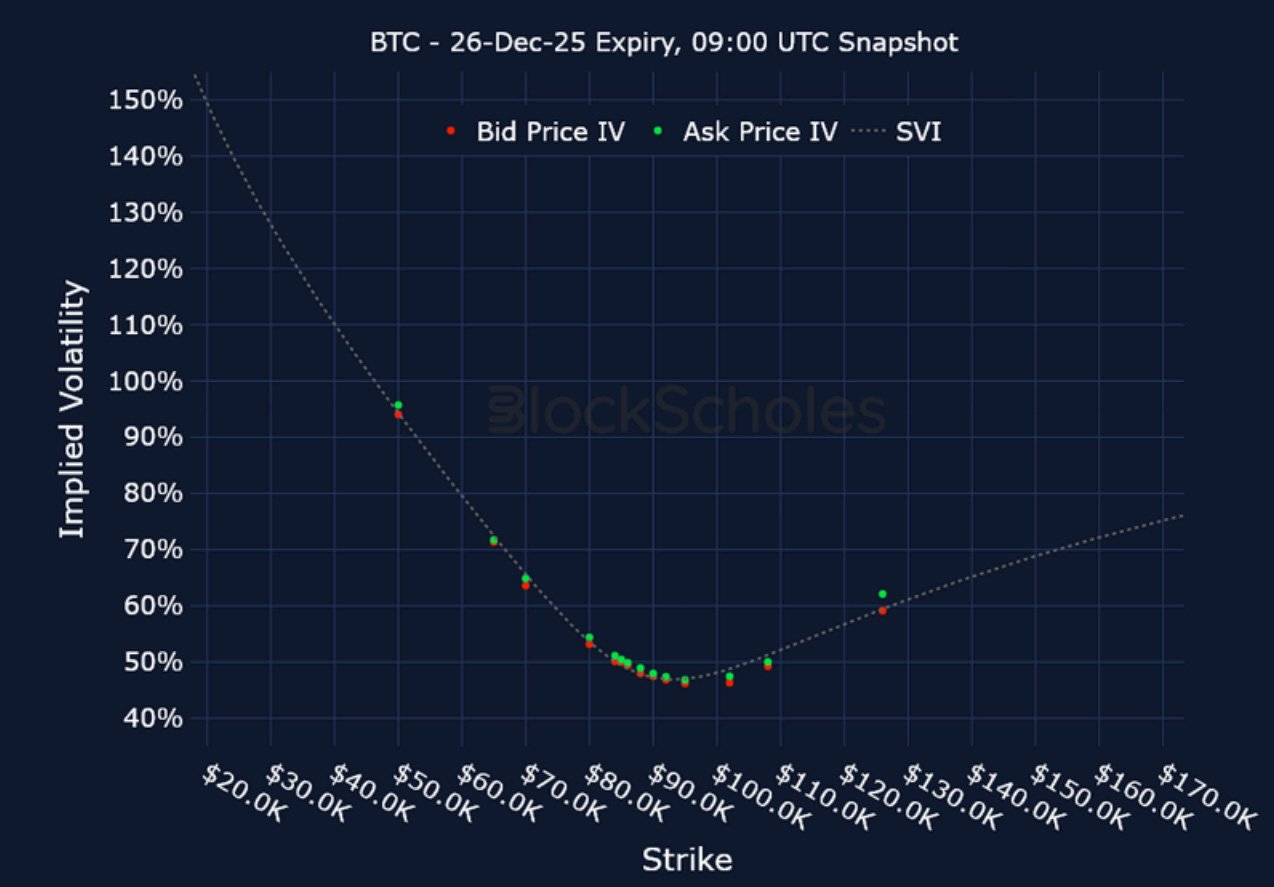

Listed Expiry Volatility Smiles

BTC 26-DEC EXPIRY – 9:00 UTC Snapshot.

ETH 26-DEC EXPIRY – 9:00 UTC Snapshot.

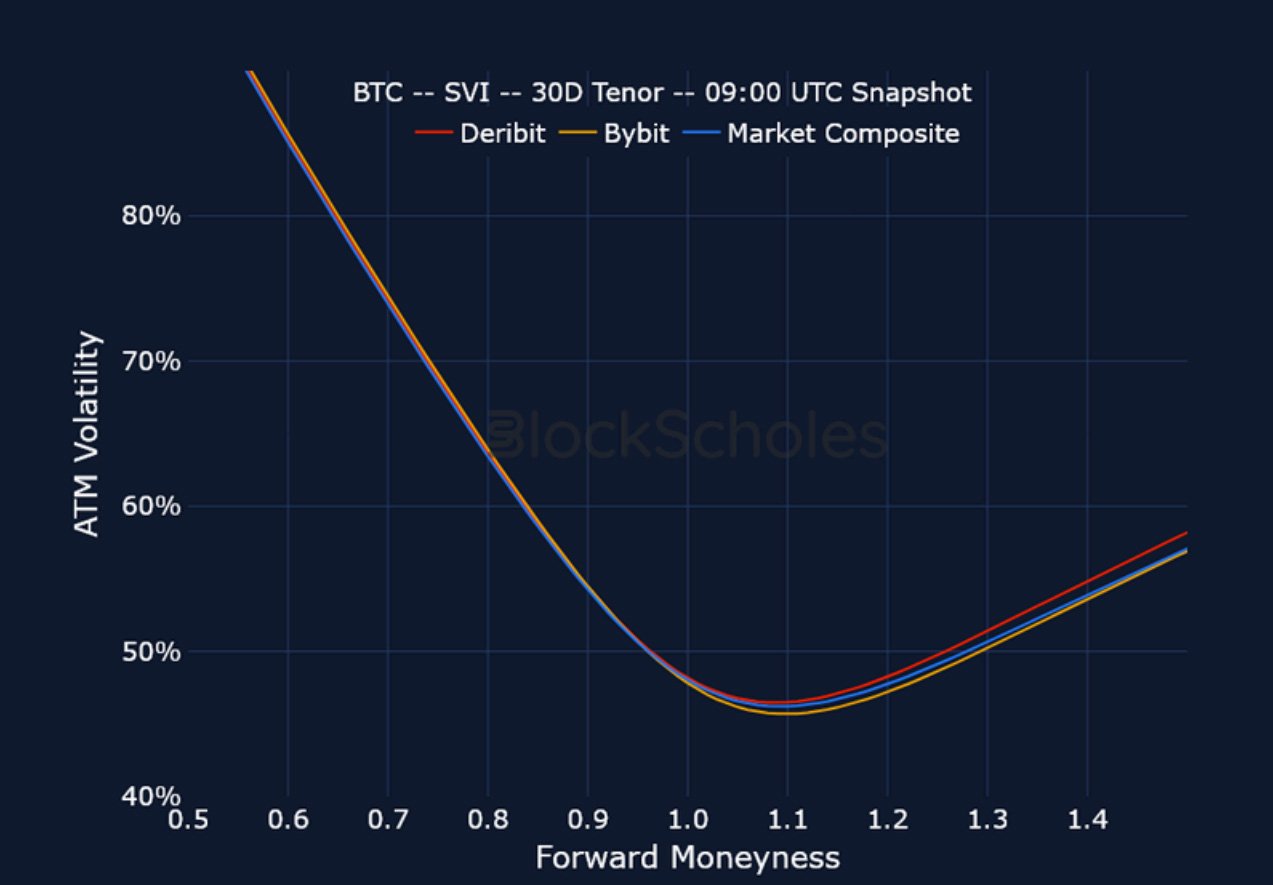

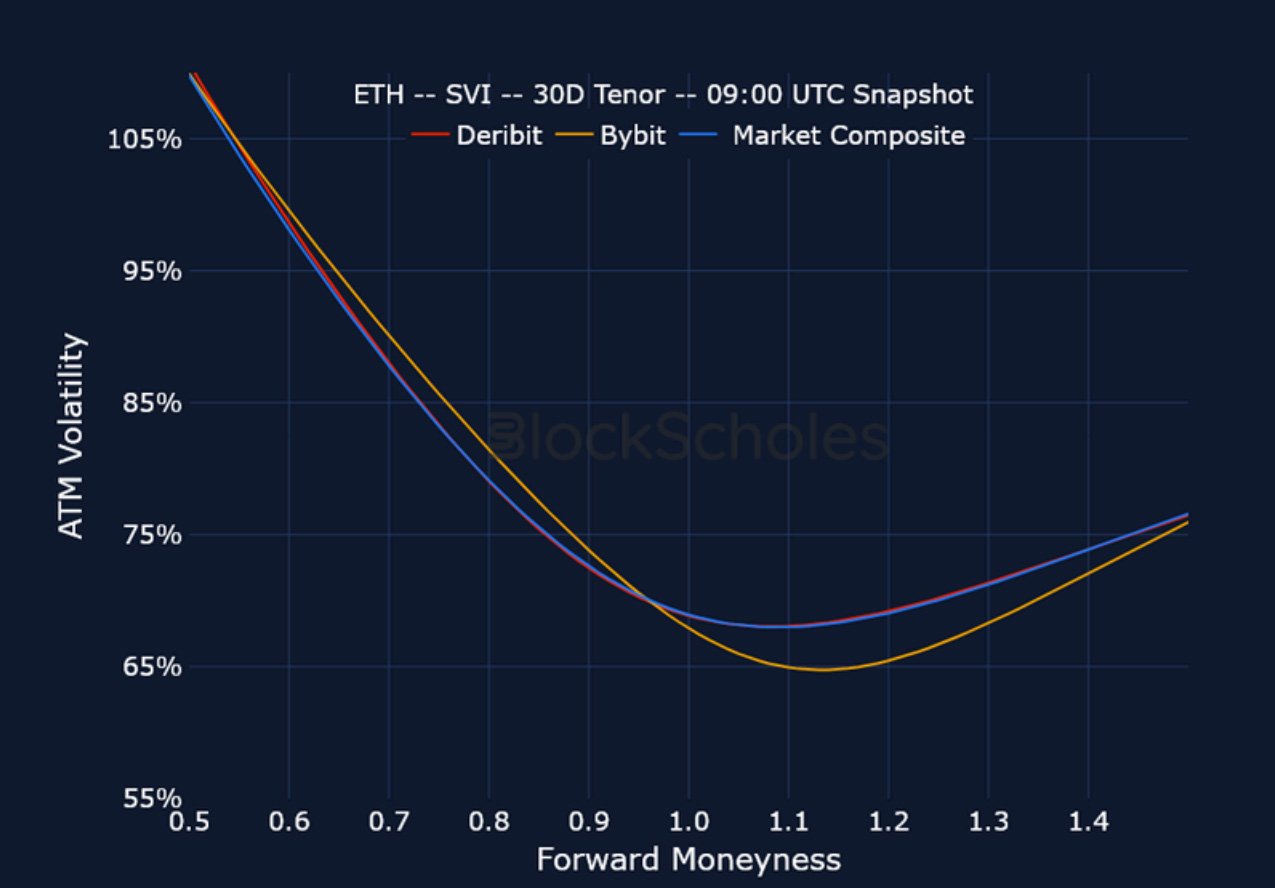

Cross-Exchange Volatility Smiles

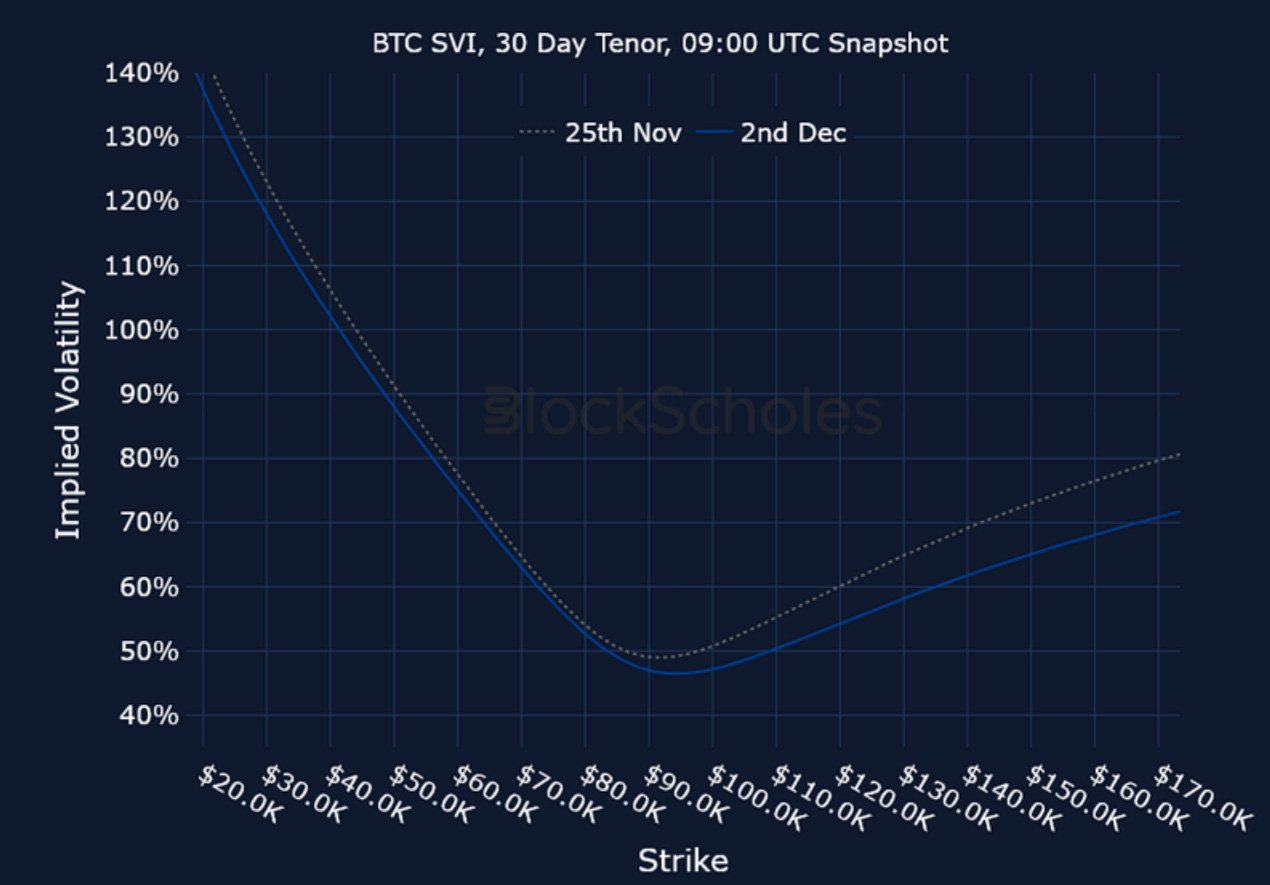

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)