Ahead of the Fed’s June rate hike, May CPI data, which “set another record high”, pushed up panic in the crypto and the risk asset markets. The large-scale selling has caused the overall performance of crypto assets to fall back to levels around the beginning of 2021.

Since the existing rate hike does not control inflation significantly, the possibility of the Federal Reserve continuing to raise interest rates in the second half of 2022 is gradually increasing, and the FOMC meeting on Thursday may further indicate the follow-up liquidity contraction path.

As the long-term expected returns of the crypto market continue to be lower than the risk-free returns, the crypto market may face a long-term liquidity outflow.

Liquidity Crisis: ‘The Tide is Fading’

The crypto-asset market crash triggered by the LUNA event in early May took a toll on the confidence of crypto-asset investors. After a month of repairing, the crypto-asset market has only “just eased”. However, due to the outflow of retained liquidity, the impact of the liquidity shortage in the crypto-asset market has become more apparent, and the damaged market confidence is still far from recovery. The crypto market needs good news to ease its liquidity dilemma.

Therefore, “whether the liquidity contraction process will slow down” has become a vital issue for investors after entering June. Suppose the Fed’s previous policy of raising interest rates can ease inflation. In that case, the Fed may hold off on raising interest rates in the fourth quarter due to recession risks, which will bring necessary liquidity to risk asset markets.

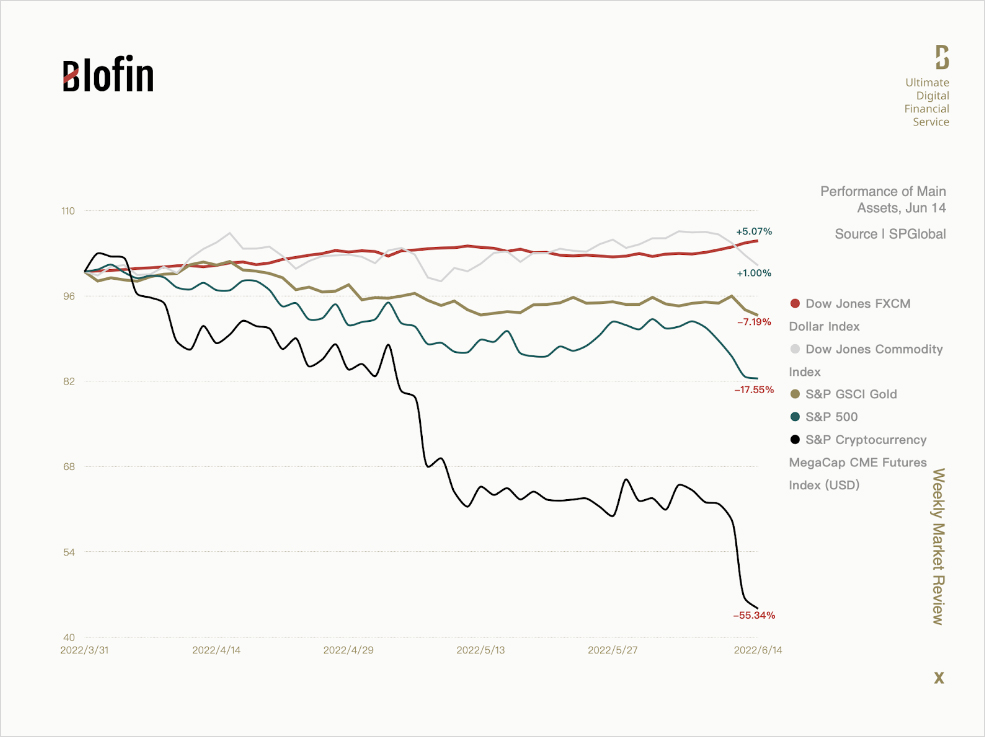

However, the May CPI data dispelled their illusion. The inflation data that broke the record again shows that the Fed’s previous series of interest rate hikes, balance sheet reductions, and expectations management failed to achieve the desired effect. Prices of daily necessities are still rising; commodities still lead the capital market performance in 2022, leaving stocks, crypto assets, and other risky assets far behind. On June 13, traders predicted that the rate hike in June would increase to 75 basis points and began to sell all assets except the dollar, and global assets had a rare synchronized decline.

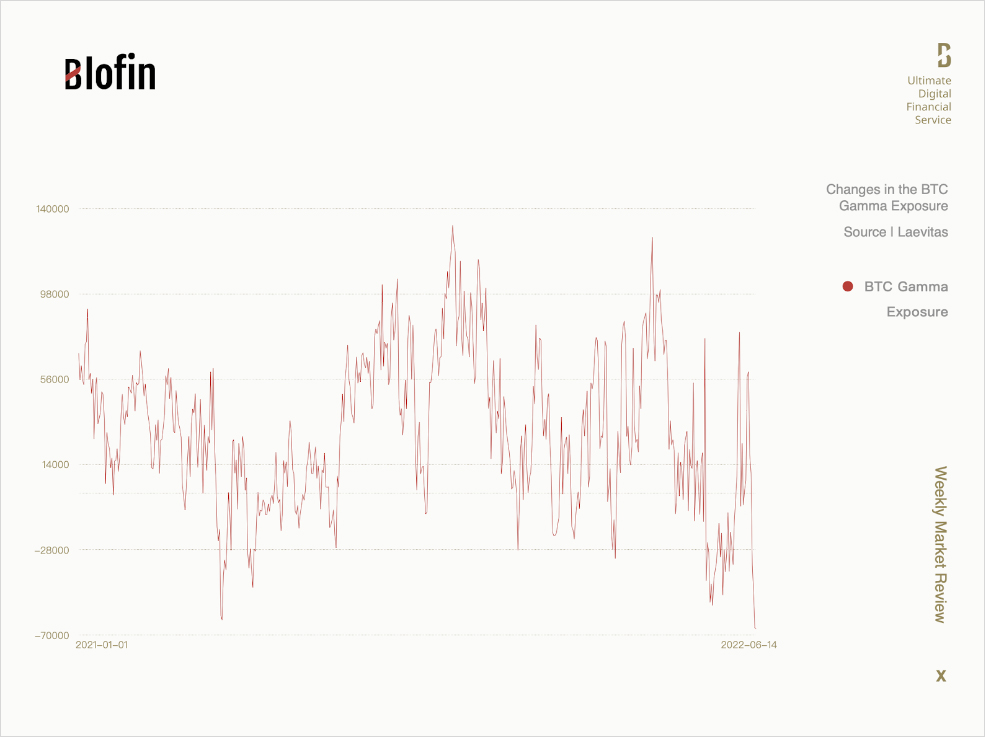

Crypto markets seem to be reacting one step faster than traditional markets: The options market’s bearish sentiment suddenly intensified around June 10, the option delivery date, resulting in a sudden and significant negative gamma exposure on BTC. A sudden decrease in gamma exposure before the delivery date is uncommon; this means that market risk is starting to get out of control, and a significant change may happen.

After the release of the U.S. CPI data, investors began to gradually sell crypto assets starting the weekend to reduce the risk of their investment portfolios due to the high risk of crypto-assets. A concentrated sell-off was on June 13. According to Laevitas, the negative gamma exposure of BTC hit a new high on record since June 2019, and risk exposure of the crypto asset also reached its highest level ever. The total market capitalization of the crypto market also fell below $1 trillion as of the continued sell-off, a similar level in early 2021.

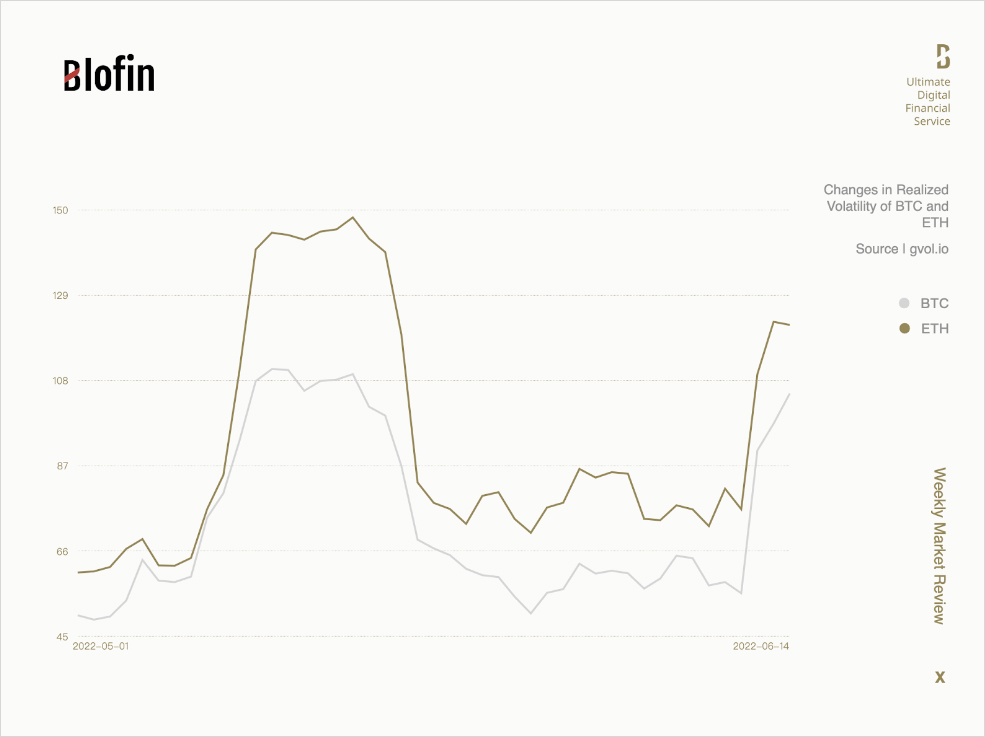

While every Fed meeting triggers a significant fluctuation in crypto markets, from the perspective of volatility, the outflow of liquidity has amplified the fluctuation so much that previous levels of volatility are not even worth mentioning compared to today.

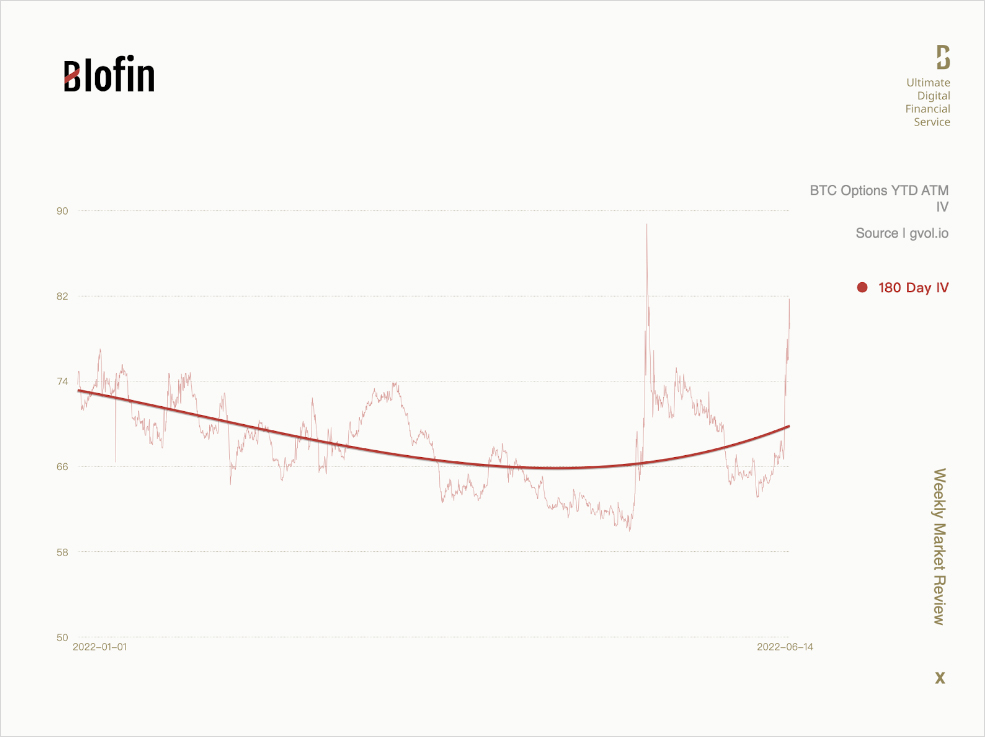

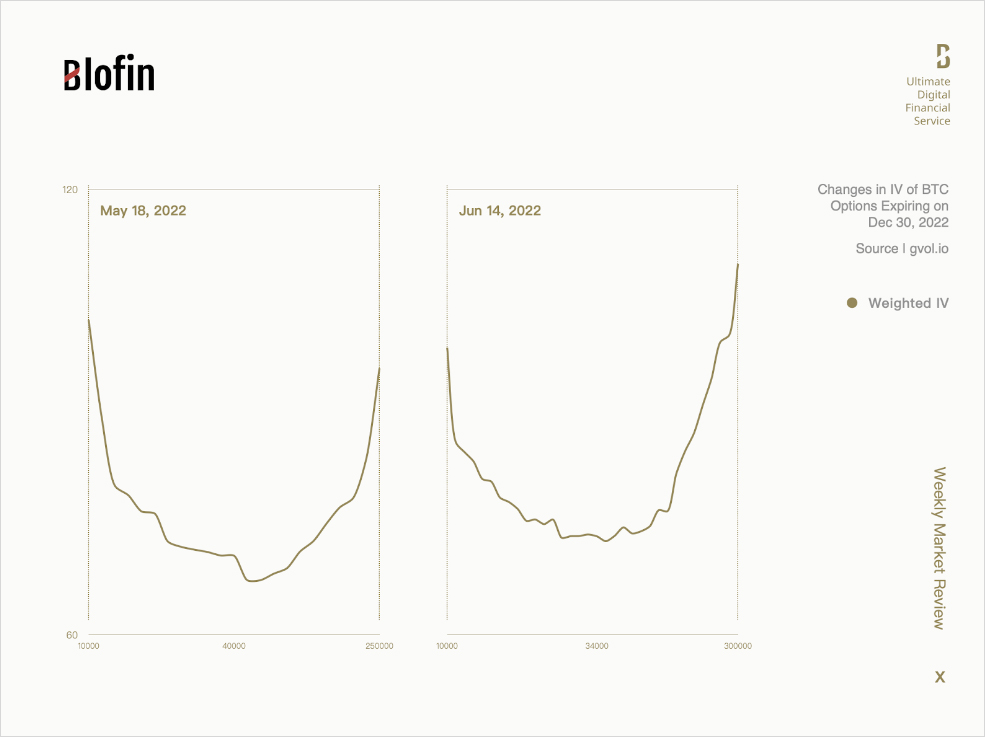

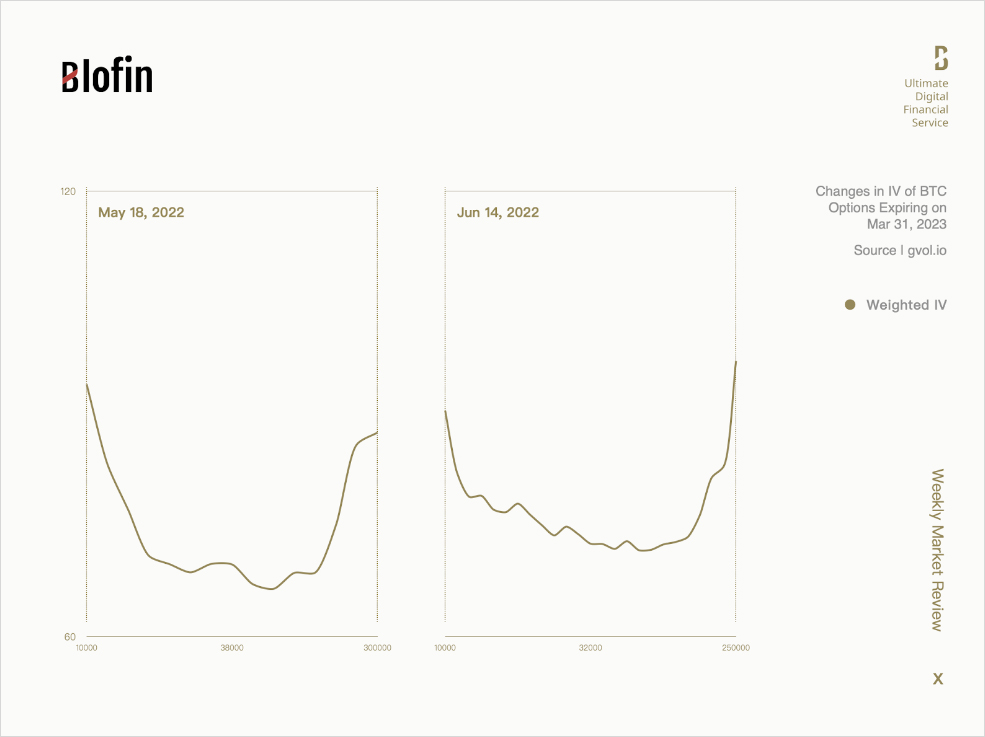

If we further observe the implied volatility of BTC far-month options, it is not difficult to find that the outflow of liquidity from BTC has increased investors’ concerns about long-term risks and finally promoted the rise of the implied volatility surface of BTC. Considering that the implied volatility of ETH had already shown signs of rising at the end of May, it can be regarded that the liquidity crisis has now spread to the entire crypto market.

FOMC is Approaching Again: When Will the Liquidity Return?

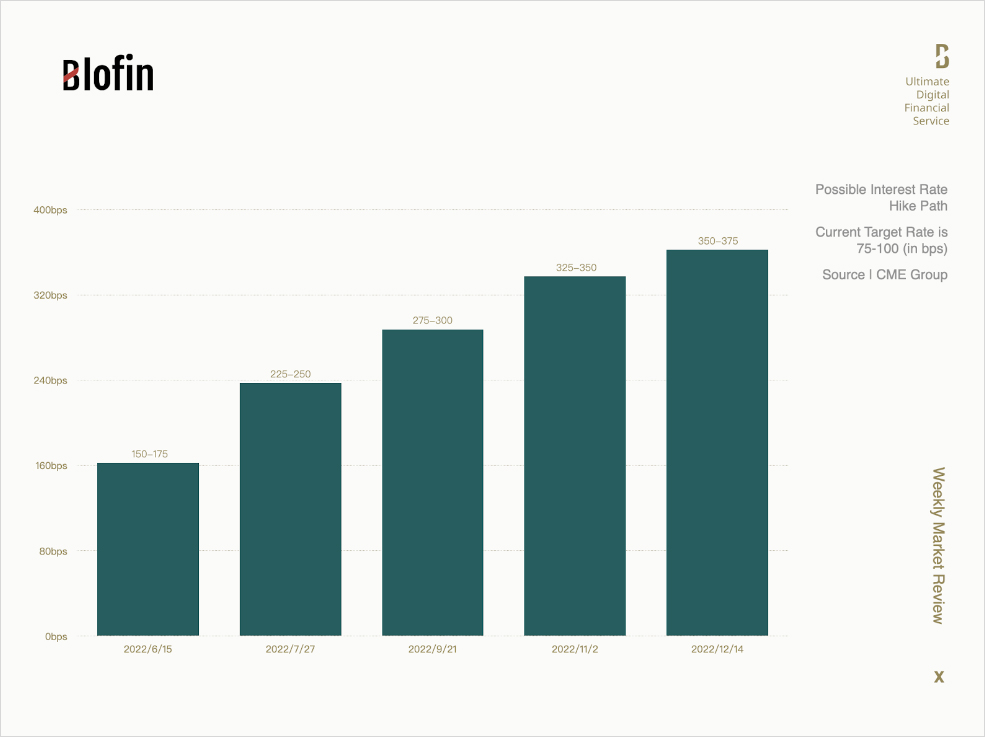

Considering the current deteriorating inflation situation, the Fed seems to have no choice but to increase the rate of interest rate hikes further and push up the risk-free rate by continuing to raise interest rates. According to CME Fed Watch data, the Fed may raise interest rates by 75 bps in June and July and 50 bps in September and November. Undoubtedly, this will worsen the already contracted liquidity in the crypto market.

The continued downturn in forward expectations for the crypto market is even more fatal. Affected by the sell-off, the far-month futures premium rate of mainstream encrypted assets has been significantly lower than the risk-free rate of return in the traditional market, which has made the accelerated withdrawal of liquidity. There is no better way at present.

It doesn’t look like liquidity is coming back anytime soon. However, from a macro perspective, changes in U.S. bond yields and the U.S. mid-term elections may lead to a turnaround in the performance of the crypto asset market.

The performance of U.S. bond yields is one of the signals of a turnaround in the performance of crypto assets. The 2-year U.S. Treasury yield has been high due to the hawkish attitude of the Federal Reserve this year, and the decision of the FOMC meeting on Thursday is an essential factor in the future performance of the 2-year U.S. Treasury yield. Once the 2-year-10-year U.S. Treasury yields show a steady inversion, a recession will appear and continue. Under the circumstance that raising interest rates has proved difficult to control inflation, the Fed may adjust the plan to solve the inflation problem from other perspectives, such as the supply chain.

So, when will this happen? The U.S. midterm elections in November 2022 could be a critical point. If inflation is still out of control at this time, voters may question the economic performance of the Biden administration, which is what they do not want to see. At this time, the recession caused by the increase in interest rates may be close to the limit that the people can bear. Consumer confidence in May was already below the level before and after the 2008 economic crisis, and further rate hikes are only likely to cause more negative impacts.

In addition, the Fed has also partially achieved its goals: the ACWI index, which reflects the level of liquidity in the global capital market, shows that as of mid-June, liquidity has shrunk to the level of late 2020, which means the overflowing liquidity during the epidemic has basically recouped. The Fed only needs to wait for the supply chain to recover and inflation to naturally fall before declaring that inflation “has returned to normal levels under policy control”.

Therefore, the December Fed meeting will be an essential node for whether liquidity will return. It is worth noting that in the crypto market, the implied volatility of BTC far-month call options significantly outperformed put options, and the volatility surface began to slope in the direction of higher prices; this phenomenon did not appear in May. Changes in the volatility surface of far-month BTC options suggest that some investors expect the Federal Reserve to loosen monetary policy from December, and the crypto market may usher in a return of liquidity from the end of the year.

At the June FOMC meeting on Thursday, the rate hike may exceed expectations, and the market is desperately digesting the Fed’s more aggressive tightening policy. The crypto market will still face significant selling pressure given the risk exposure from the rate hike and the upcoming semi-annual derivatives delivery. In the near term, risk-off strategies such as risk-reversal portfolios will be the best choice.

AUTHOR(S)