Weekly recap of the crypto derivatives markets by BlockScholes.

BTC

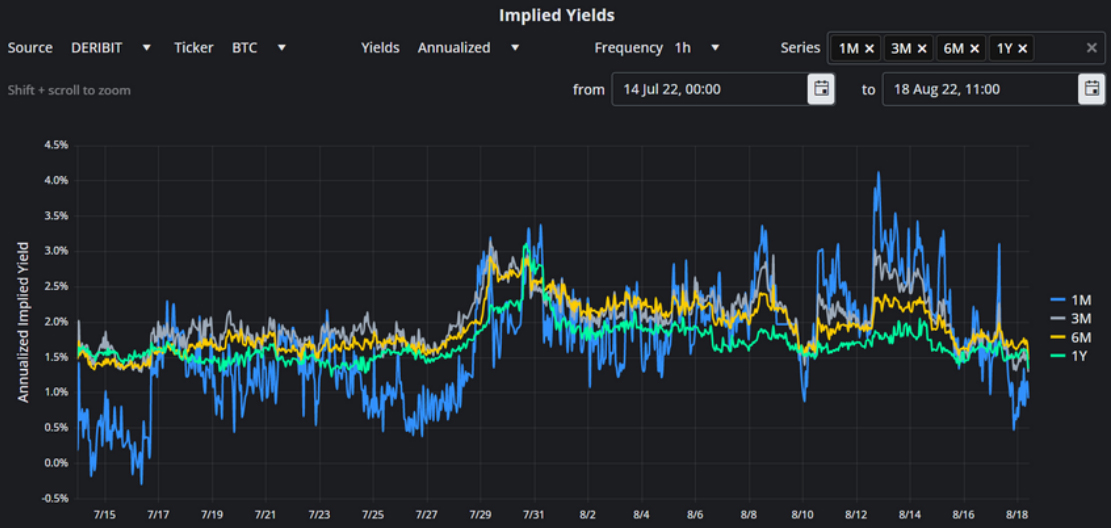

Implied yields at all tenors fall closer to zero as BTC’s spot rally fizzles out

BTC Annualised Futures Implied Yields Table

All timestamps 12:00 UTC

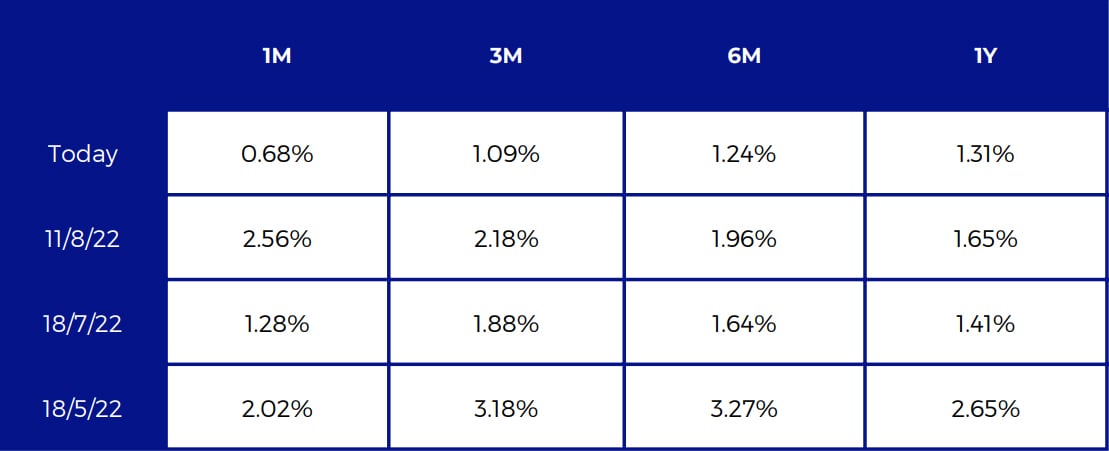

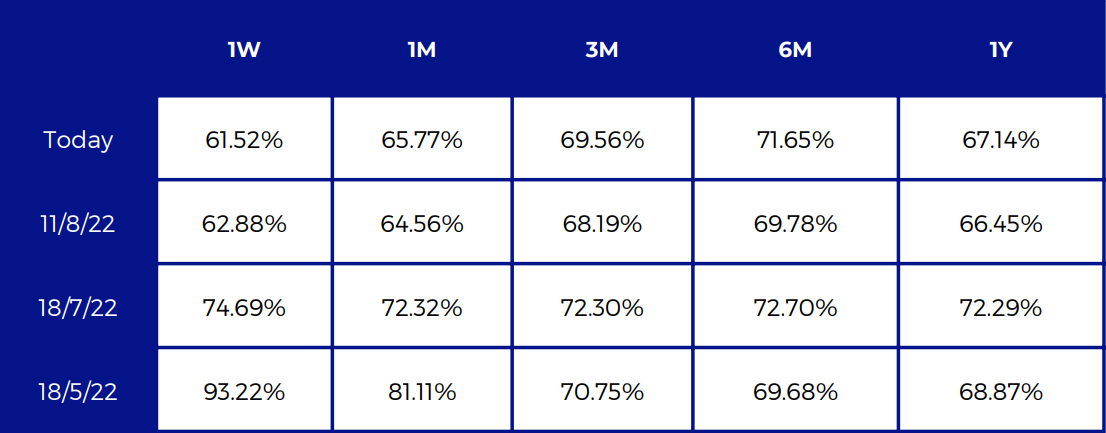

BTC’s ATM implied volatility trades sideways between 60% and 75% in contrast to heated demand in ETH derivatives

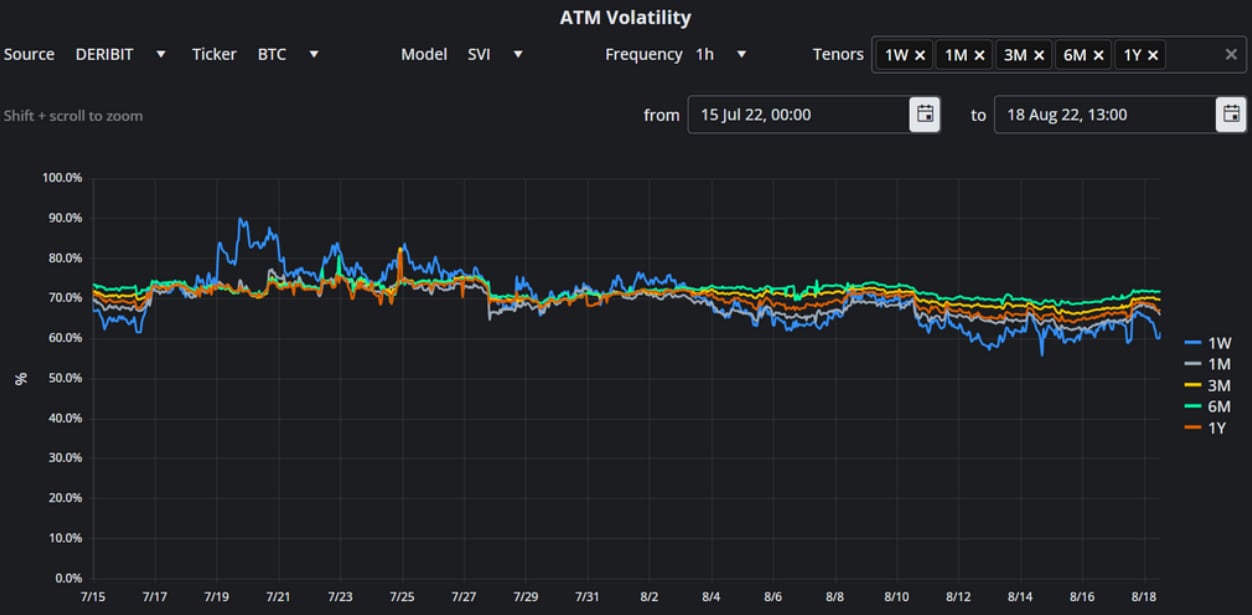

BTC’s 25-delta put-call skew reflects a lingering pessimism

SABR Smile Calibration

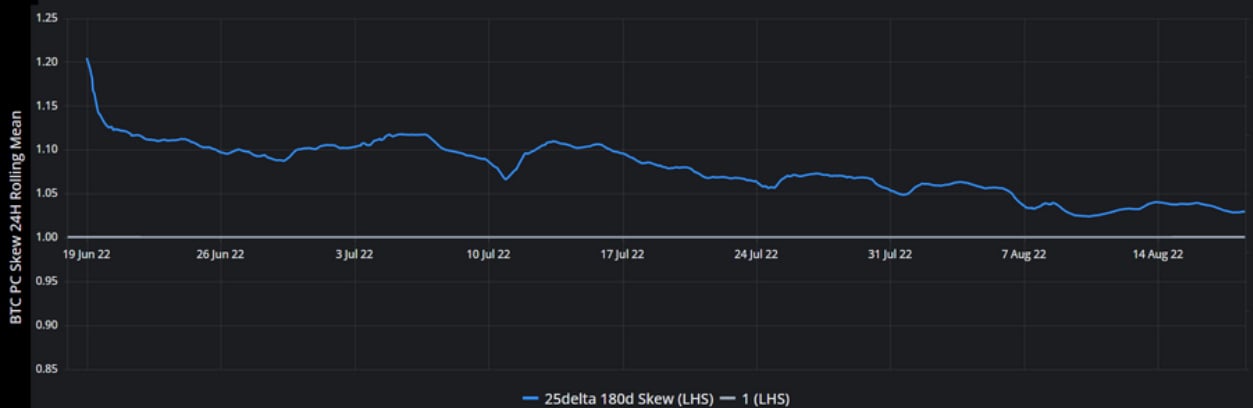

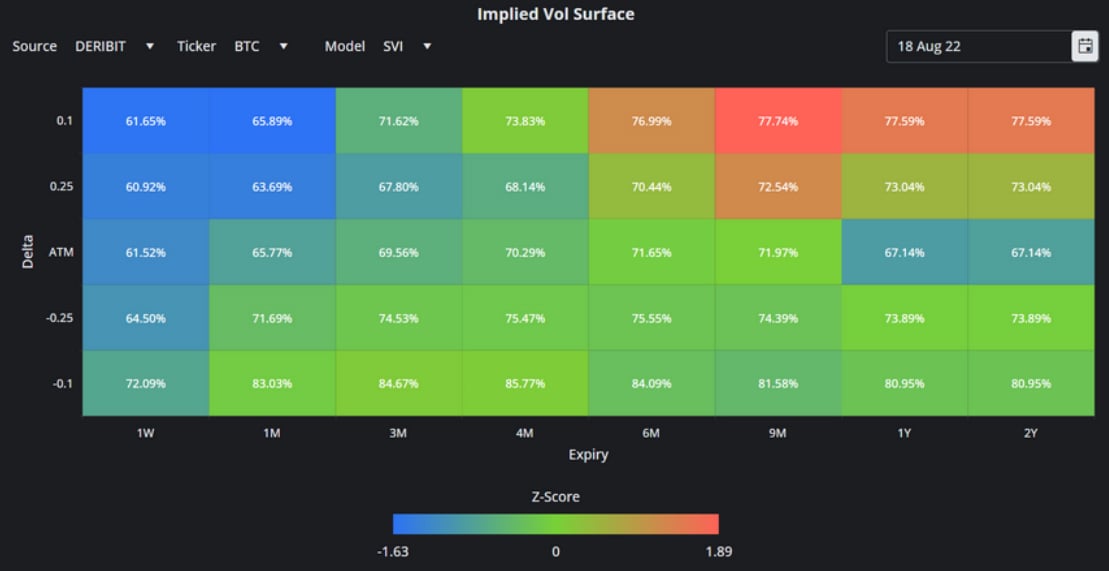

The IV of short-dated BTC calls cools further, showing the lacklustre support for the recent spot rally

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 12:00 UTC

BTC ATM Implied Volatility Table

All timestamps 12:00 UTC, SVI Smile Calibration

SABR and SVI Smile Calibrations, 30th September Expiry

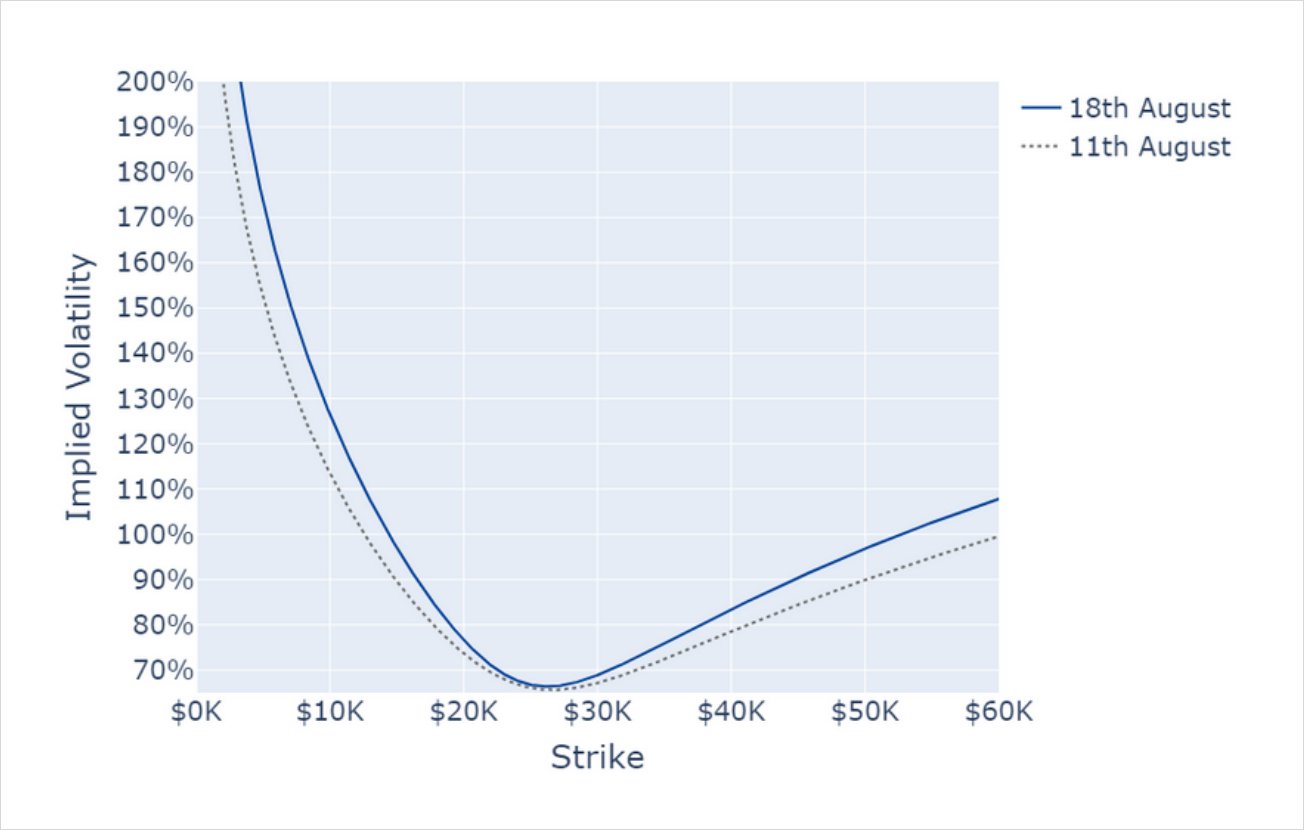

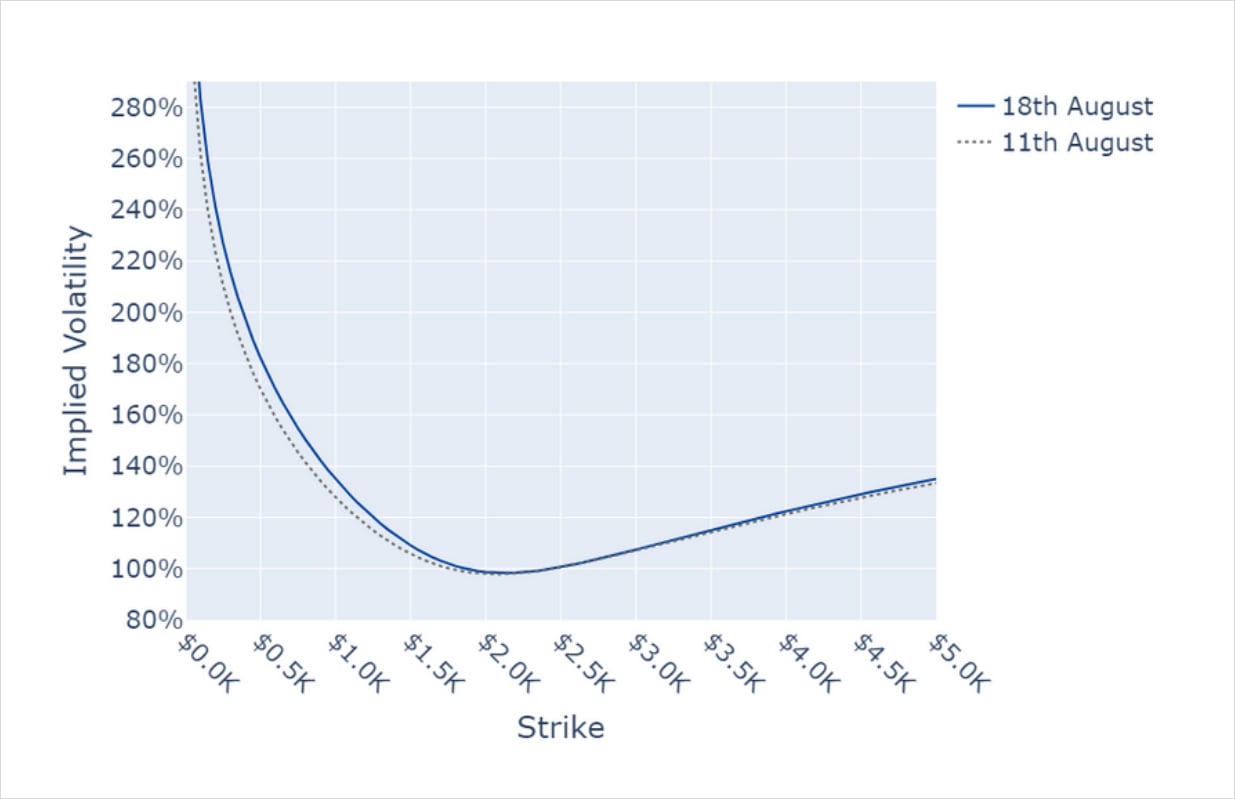

BTC’s volatility smile steepens in both OTM calls and puts, with ATM vols in a similar position as last week

BTC 1 Month SABR Implied Vol Smile.

ETH

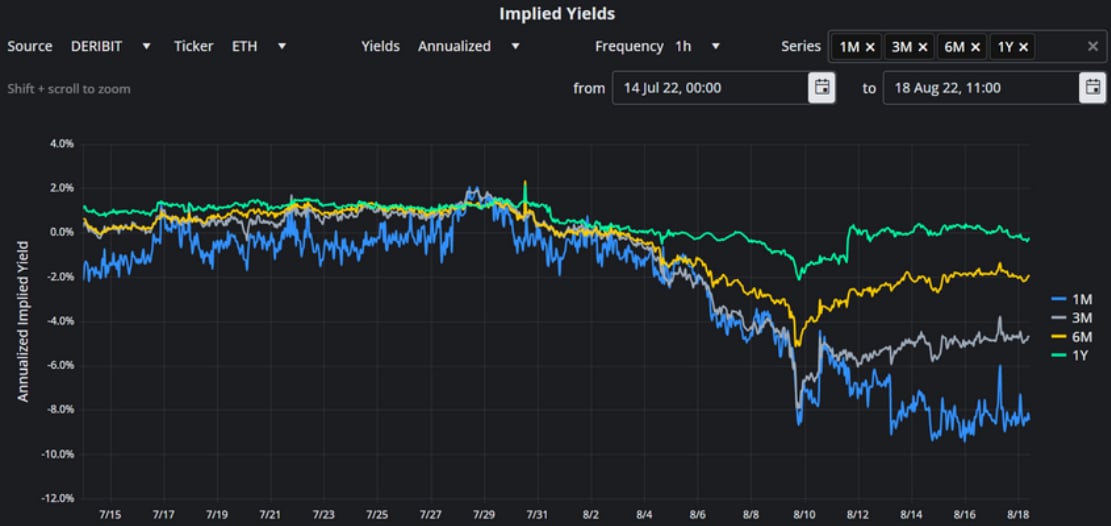

ETH’s annualised yields plunge further, as futures prices with tenors near the upcoming Merge event fall below spot

ETH Annualised Futures Implied Yields Table

All timestamps 12:00 UTC

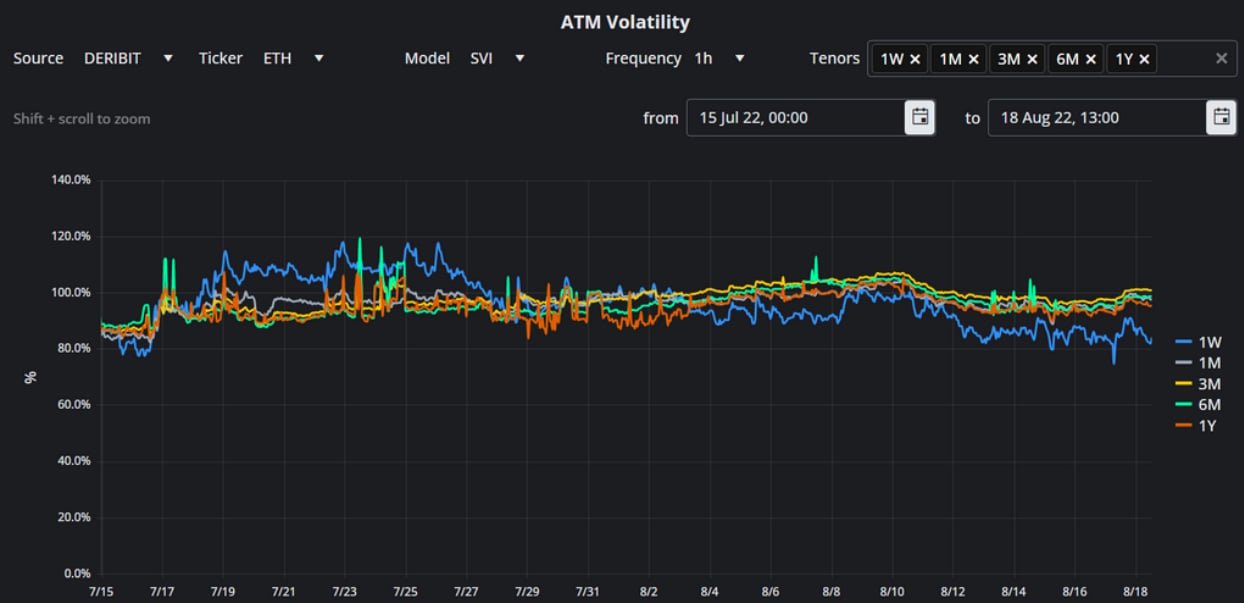

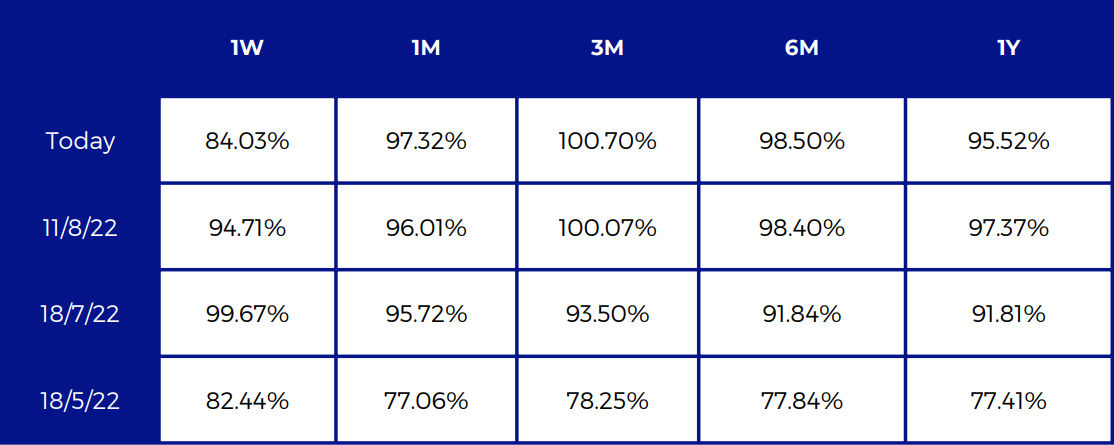

ETH’s short-term ATM implied vols remain stable at the elevated levels they have printed over the last two months

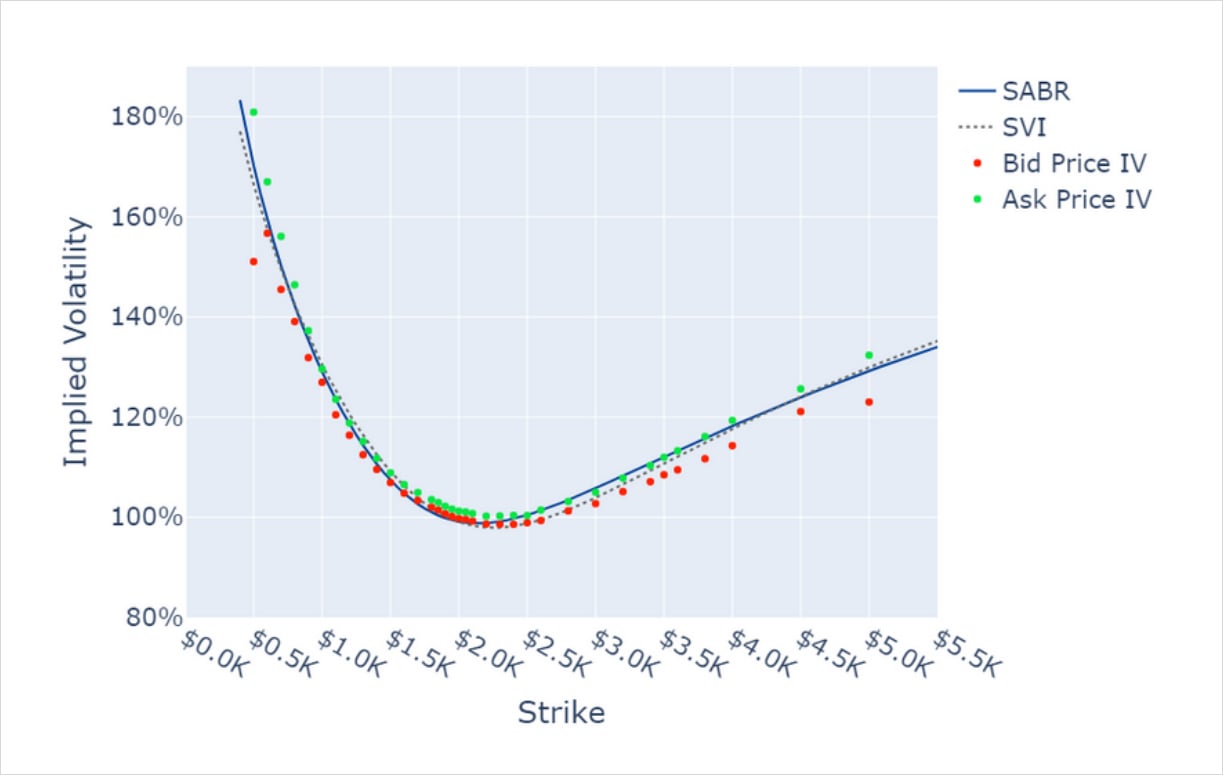

ETH’s 180d volatility smile remains skewed towards puts

SABR Smile Calibration

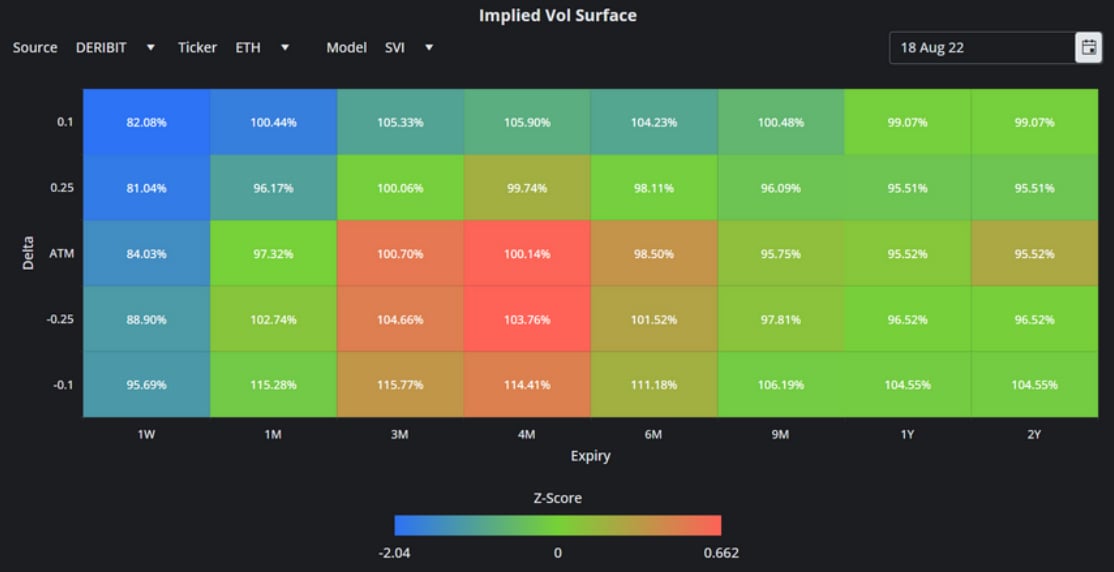

ETH Implied Volatility Surface

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 12:00 UTC

ETH ATM Implied Volatility Table

All timestamps 12:00 UTC, SVI Smile Calibration

SABR and SVI Smile Calibrations, 30th September Expiry

ETH’s vol smile remains static for all options except OTM puts, which steepen as downside protection becomes more attractive

ETH 1 Month SABR Implied Vol Smile.

AUTHOR(S)