Dated futures contracts premiums

Futures contracts often trade at a price several percent away from the current spot price. This difference can fluctuate wildly over the life of the futures contract, sometimes even moving all the way from a premium to a discount or vice versa.

In contrast to perpetual contracts, dated futures contracts have an expiry date. On the expiry date the Deribit futures are settled on a 30 minute TWAP of the index (i.e. the futures always eventually settle at spot prices).

As the time to expiry decreases so does the typical size of any price deviations away from the index, until eventually leading into expiry the futures price will usually be very closely tracking the index. As time to expiry tends towards zero, so does the difference between the futures price and the spot price.

The reason it does this is when the futures price is a certain distance away from the index price, it is possible for a trader to capture this difference in price without being exposed to price movements of the underlying asset. So if the price difference was large with hardly any time left until expiry, this would result in a very large return on what is almost a risk free trade. When there is easy money just sitting there, it will be picked off very quickly by traders eager for an easy return on their capital, which in turn of course keeps the price in line.

How are these price differences captured by traders?

It is most common for a futures contract to be trading at a higher price than the spot price of the underlying asset. When this is the case the future is said to be trading at a premium, also known as contango.

Imagine for example that the spot price of Bitcoin is $10,000, and the December futures price of Bitcoin on Deribit is $10,500. The December future is said to be trading at a $500 premium, and it is possible to capture this $500 without being exposed to the price fluctuations of Bitcoin.

In this scenario a trader can purchase 1 Bitcoin for $10,000 on a spot exchange, then short the futures with a position size of 1 BTC, which in this case is $10,500 on the December futures contract. When the futures contract expires in December the trader will be left with $10,500 worth of Bitcoin, which they can then sell back into USD on a spot exchange if they wish. This type of trade is often called a ‘cash and carry’ trade.

The key thing to remember is that it doesn’t matter what the price of Bitcoin is in December, the trader will still be left with $10,500. In this way they have captured the $500 premium.

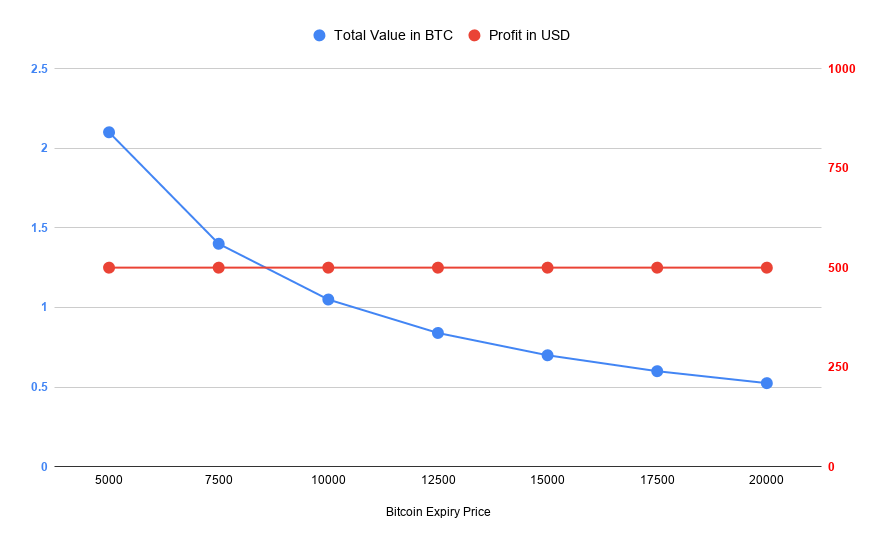

In this example, assuming the trade is closed when the premium is exactly zero, the following chart shows both the total BTC value of the account (in blue) and the profit in USD (in red), for various prices of Bitcoin when the futures contract expires.

As you can see the total amount of Bitcoin held will fluctuate depending on the Bitcoin price. However, as long as the trade is closed when the premium is zero, the profit in dollars remains constant at $500 no matter what price Bitcoin is at.

Tracking the futures premiums using Trading View

It’s quite simple to see what the difference between a futures contract price and the spot price is at any one time. All you need to do is simply check both prices on the Deribit website. It is much more useful however to chart this difference over time, and Trading View offers a great way to do this.

Trading View allows you to construct composite charts that include data from more than one instrument. You can also perform simple mathematical operations on them. In the box where you enter the ticker for the instrument you want to chart, instead of selecting a single ticker, you enter a formula.

Let’s take a look at some examples.

Absolute premium chart

First we’ll create a chart that shows the absolute difference in dollars between the Deribit Bitcoin perpetual contract and the December futures contract. So we want to see the December futures contract price minus the perpetual price.

We can enter the ticker as follows:

DERIBIT:BTC27Z19-DERIBIT:BTCPERP

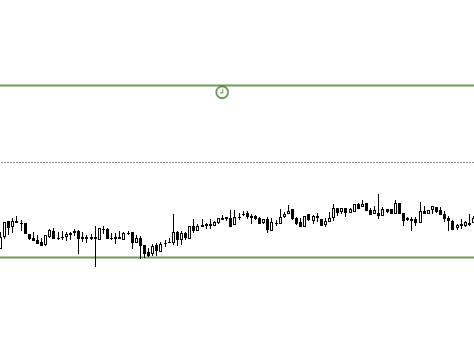

This will display a chart like this that shows the dollar difference between the two contracts over time:

It helps with these premium charts to add a horizontal line at zero, as has been done here. Zero on these charts of course being the point at which the price of the two instruments are the same.

While this is a useful chart in itself, a $100 difference when Bitcoin is trading at $2,000 is obviously considerably more significant than a $100 difference when Bitcoin is trading at $10,000.

Percentage premium chart

To take the underlying price into account it is useful to display this difference as a percentage of the current price. To do this we start with the same formula as last time, then divide by the current price and multiply by 100, like so:

(DERIBIT:BTC27Z19-DERIBIT:BTCPERP)/DERIBIT:BTCPERP*100

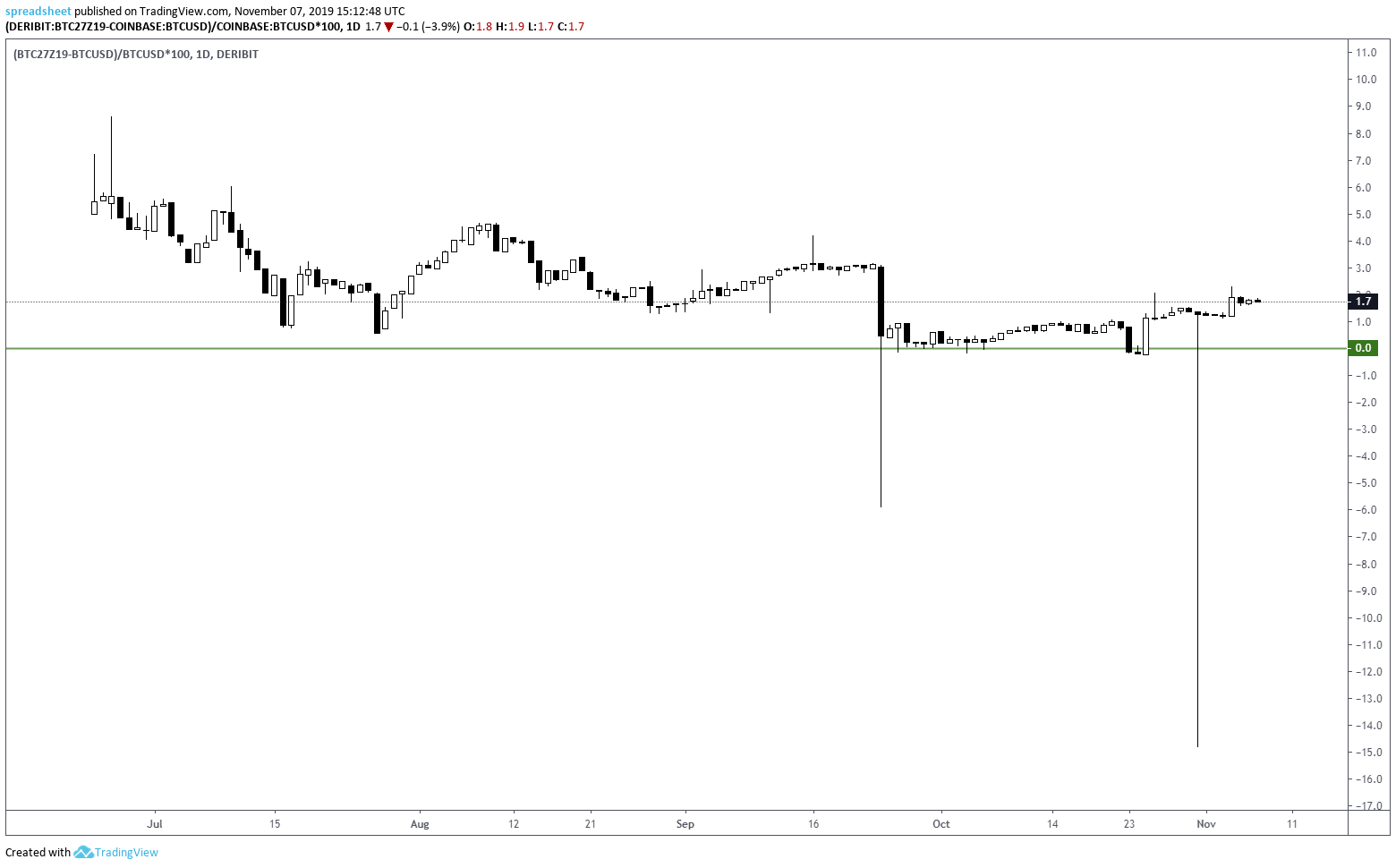

This will display the percentage difference between the futures contract and the perpetual over time.

You can now see how the two contracts have moved in comparison to one another over the life of the futures contract, as well as what typical peaks and troughs have been in percentage terms. This also allows you to see what sort of percentage return on your capital you could have expected to make at any given time by executing the cash and carry trade described earlier.

Using spot exchanges in the formulas

As it closely tracks the spot price, the perpetual contract offers a great way to trade the price of bitcoin with leverage. However the mechanism that keeps the perpetual tracking the spot price so closely also adds an unknown variable to the kind of small percentage, long time frame trades described in this article. That variable is the funding rate.

For this reason it will often be a spot exchange on one side of this trade rather than the perpetual. Thankfully this can also be added into the formula on Trading View. For example, to track the premium of the Deribit December futures contract over the Coinbase BTCUSD market you can simply swap the Coinbase ticker for the perpetual ticker like so:

(DERIBIT:BTC27Z19-COINBASE:BTCUSD)/COINBASE:BTCUSD*100

This will now show you the percentage premium of the Deribit December futures contract over the Coinbase BTCUSD spot market like so:

You can of course substitute any exchange that Trading View supports if you wish.

Changing futures contracts

Update 2024-03-21: This section has been updated to reflect the new syntax of the Deribit futures on TradingView.

Unlike with the perpetual contracts or spot markets, there are new dated futures contracts expiring and being launched every month. This means the relevant ticker will also be different for each futures contract.

On Trading View the Deribit futures contracts take the following form:

DERIBIT:CCCCCCDDMYYYY

Where:

C = the currency pair, for example BTCUSD or ETHUSD

DD = the day of the month the contract expires

M = the month code the contract expires

YYYY = the year the contract expires

For the month codes:

January = F

February = G

March = H

April = J

May = K

June = M

July = N

August = Q

September = U

October = V

November = X

December = Z

For example:

DERIBIT:BTCUSD29H2024 is the Deribit futures contract for Bitcoin that expires on the 29th March 2024.

DERIBIT:ETHUSD28M2024 is the Deribit futures contract for Ethereum that expires on the 28th June 2024.

Alerts on composite charts

Regular users of Trading View will likely already know that it is possible to set up alerts that let you know when the price of a certain asset reaches a chosen level. What some may not be aware of however, is that it is also possible to set alerts on the premium charts we have constructed as well. This is true for both the absolute premium chart and the percentage premium chart.

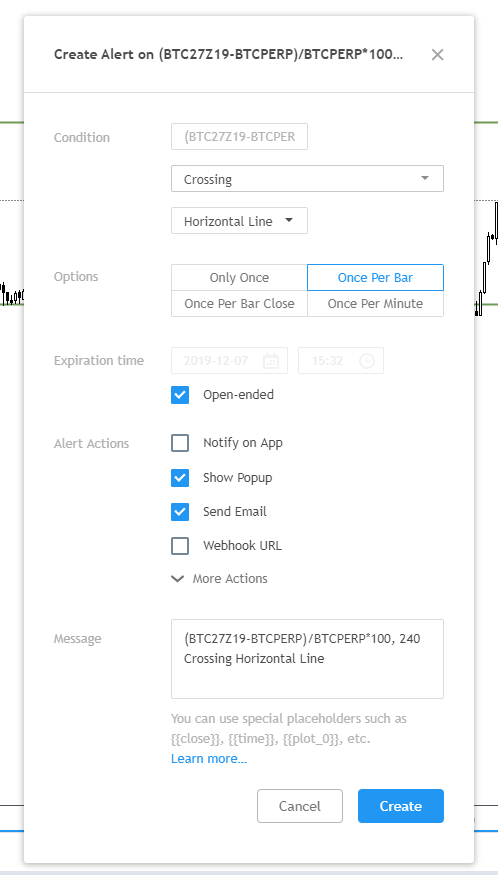

So you can have an alert that lets you know when the premium on a Bitcoin futures contract hits 5% for instance, or when the premium on an Ethereum futures contract hits $3. These alerts can be set to make a sound on your computer, notify you in the Trading View app or even send you an email notification.

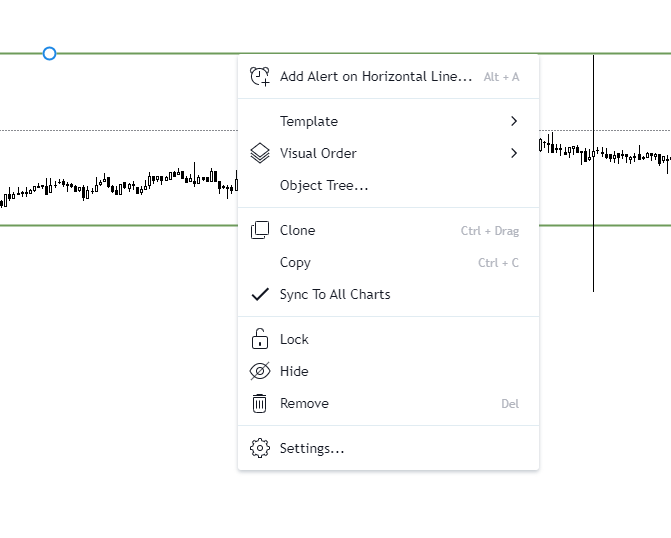

The simplest way to add these alerts is to add a horizontal line to the chart at the desired value, then add the alert to this line.

As a quick example, suppose you wanted to be notified when the Deribit Bitcoin December future was more than 3% higher than the Deribit Bitcoin perpetual.

1. Add a horizontal line at 3.0 on the chart.

2. Right click on the horizontal line to bring up the menu, and click ‘Add Alert to Horizontal Line’.

3. Choose your preferred alert settings. You can choose when/how/how often you want to be alerted. Then click ‘Create’.

4. You will then see a little clock underneath the line, indicating that you have an alert set on the line.

You now have all the knowledge you need to build composite charts on Trading View to track the premiums of the futures contracts on Deribit. We’ve used Bitcoin in these examples but this method works equally well for Ethereum as well. We will run through a full example of how to use these charts to help execute a cash and carry trade in a follow up article.

AUTHOR(S)