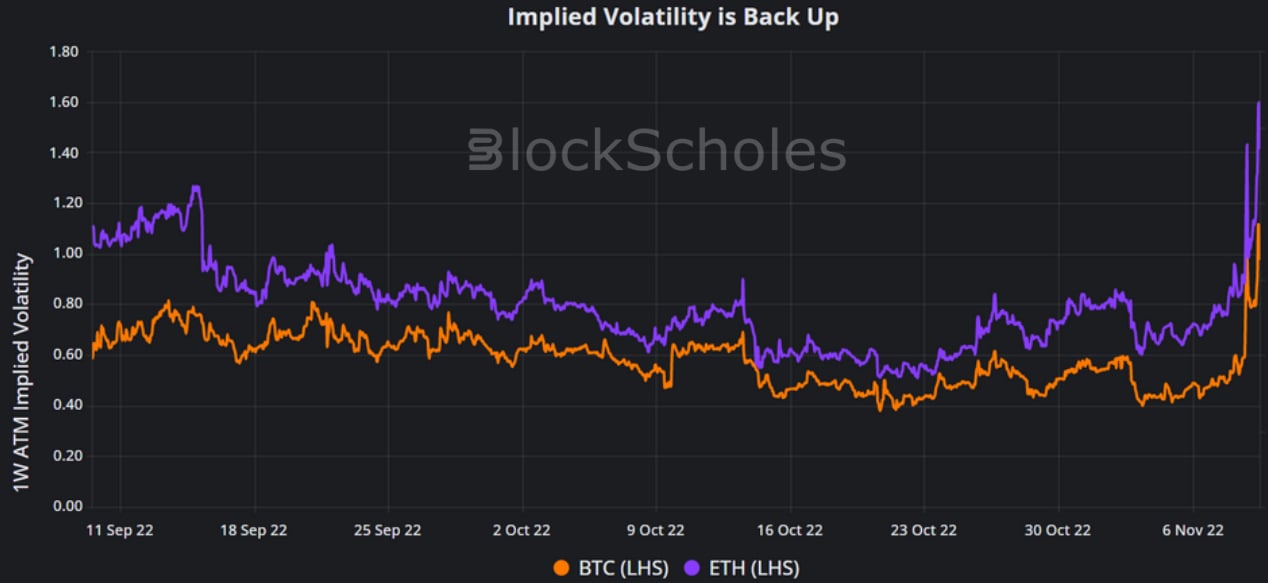

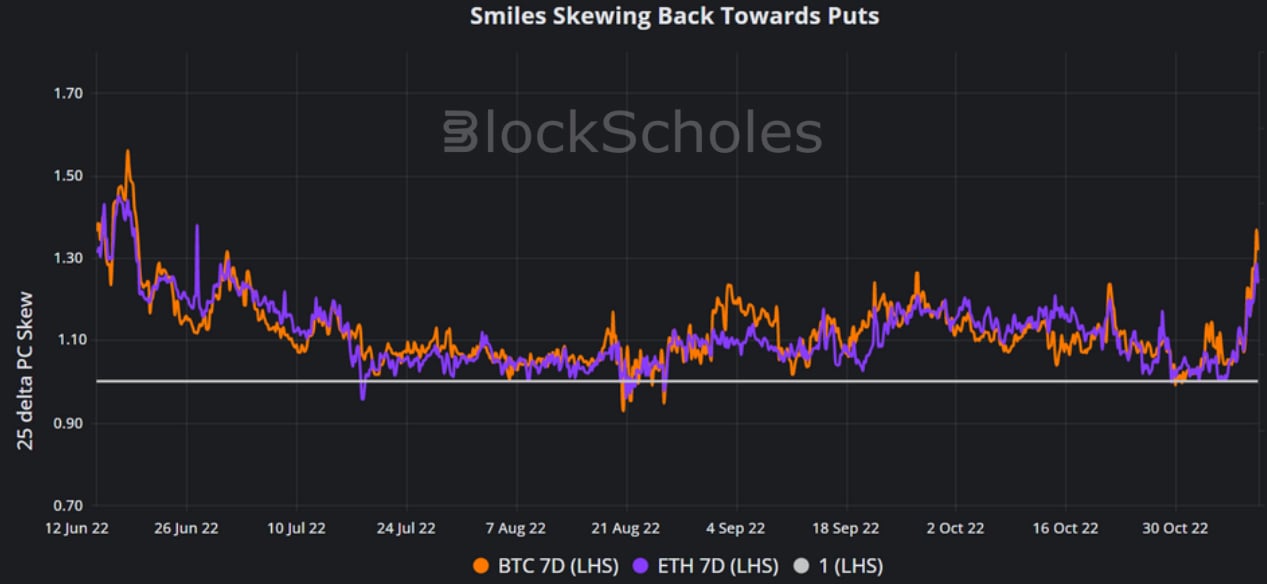

Crypto-assets’ implied volatility has spiked in response to the latest liquidity crisis. Fears of contagion to other crypto-assets, such as BTC and ETH, have resulted in a sharp increase in their put-call skew to the highest levels since June 2022.

This means that BTC’s and ETH’s volatility markets are much closer to the levels implied by their historical relationship to equities, with a skew that appears unlikely to relent.

Fear, Uncertainty, and Due Dilligence

In a Block Scholes insights report published last week, we commented on the unusually low volatility implied by BTC and ETH options when compared to that of equities and its own (already low) delivered volatility. We proposed that either this marked the beginning of a decoupling of crypto-asset volatility to the VIX, or would be resolved with crypto-asset implied volatility rising to match that of equities

Figure 1 Hourly BTC (orange) and ETH (purple) ATM implied vol at a 7-day tenor Sep 2022. Source: Block Scholes

The result was the latter. In the past week, another crypto liquidity crisis has seen the delivered and implied volatilities of BTC and ETH jump quickly as traders grow increasingly concerned about the contagion to other digital assets. This is not necessarily the trigger we were expecting, and is very much a crypto-specific event.

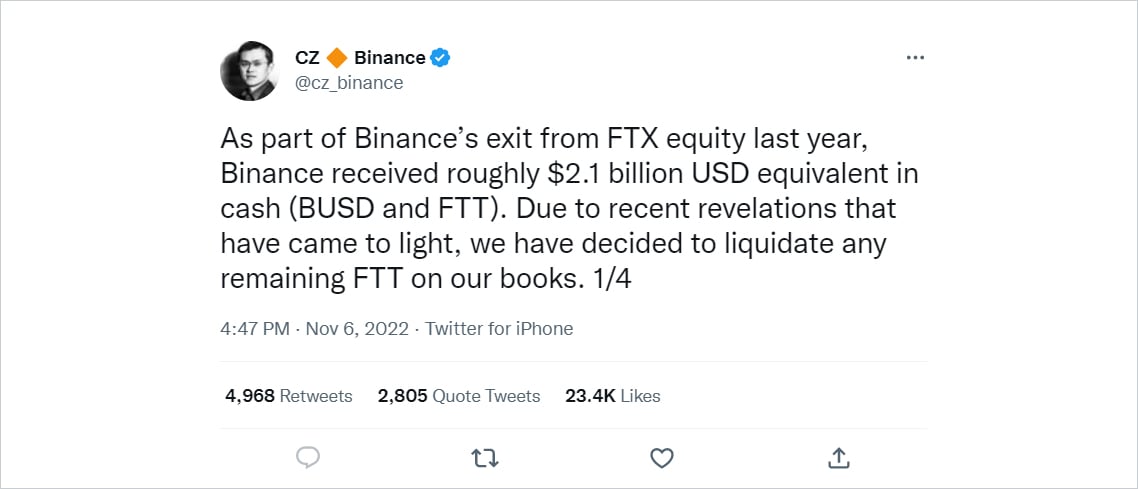

Both FTX and its sister company, Alameda Research, were rumoured to hold a significant amount of FTX’s own exchange token, FTT, on their balance sheets. This token is not a stablecoin, but rather a utility token whose value is supported in part by a periodic buy-back by FTX. Soon after the release of that report, Binance CEO Changpeng “CZ “Zhao announced their intention to sell $580M of FTX’s exchange token, FTT.

Figure 2 Tweet by Changpeng Zhao (@cz_binance), Binance CEO, announcing the sale of FTT tokens, 6/11/22. Source: Twitter

In response, Alameda Research CEO Caroline Ellison offered to buy Binance’s tokens OTC at $22 per token in order to minimise the market impact of the sale. Whilst FTT traded at this price for some time, in the early hours of the 8th Nov, the $22 price level broke and FTT’s spot price fell by 30% in just a few hours.

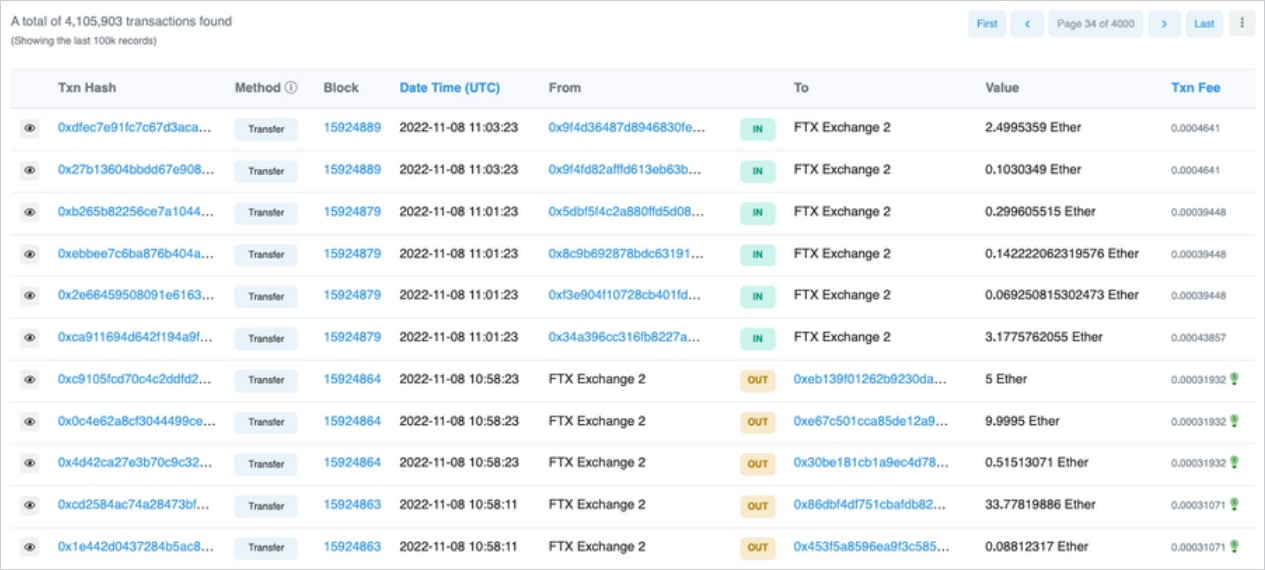

Figure 3 FTX Exhange’s ingoing and outgoing transactions. Their last outgoing transaction can be observed at 10:58:23 UTC. Source: Etherscan

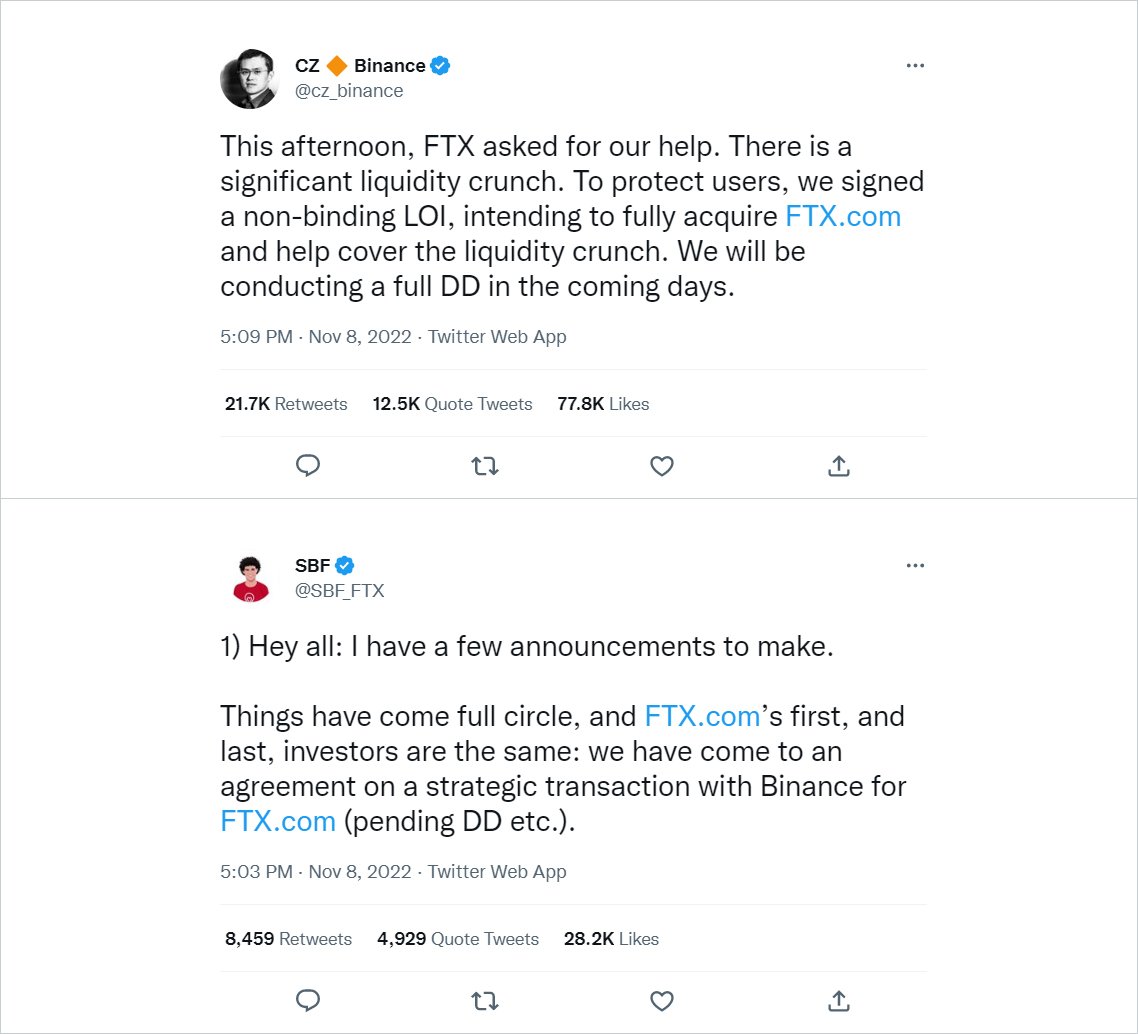

Soon after, onchain evidence showed that FTX had halted withdrawals from the exchange without an announcement or communication to its users. After several hours of confusion and radio silence, both CZ and SBF (FTX’s CEO) tweeted to announce that Binance intended to acquire FTX.

The sharp increase in implied volatility was focused on downside protection, as the downside moves were not limited to FTT. Both BTC and ETH have recorded losses of 14.4% and 21.65% respectively since the early hours of the 8th of November, despite an initial recovery following the acquisition announcement. Binance has since pulled out of the acquisition deal following only one day of due diligence. This has only exacerbated the pessimism in the market as worries about FTX’s balance sheet grow more severe.

Figure 5: Hourly BTC (orange) and ETH (purple), 25-delta put-call skew since June 2022. Source: Block Scholes

The implied vols of 25-delta puts are now 1.3 times that of 25-delta calls at a one week tenor, their sharpest skew since the Celsius and 3AC liquidity crises in June. This event has left the volatility smile higher and much more skewed than it has been in months.

Where do we go from here? The correlation between the implied volatility of crypto-assets and the VIX might have been reinstated, but for crypto-specific reasons. We would expect those reasons to develop given the continued threat of Alameda Research’s credit risk and the shattering of consumer confidence following the collapse of one of the largest exchanges. With more uncertainty to come, will the skew towards puts continue?

Figure 6 SABR Vol Smiles for three key dates. Source: Block Scholes

AUTHOR(S)