For the crypto market, 2022 is destined to be an extraordinary year. In the first bear market period after traditional institutions entered the market on a large scale, we witnessed countless top crypto institutions and projects emerge and quickly become a page of history.

We also saw many projects that survived the bull market continue to iterate and innovate in the bear market, driving the crypto industry to develop tenaciously in the bear market. The crypto market will not die; it is just evolving.

Catastrophe

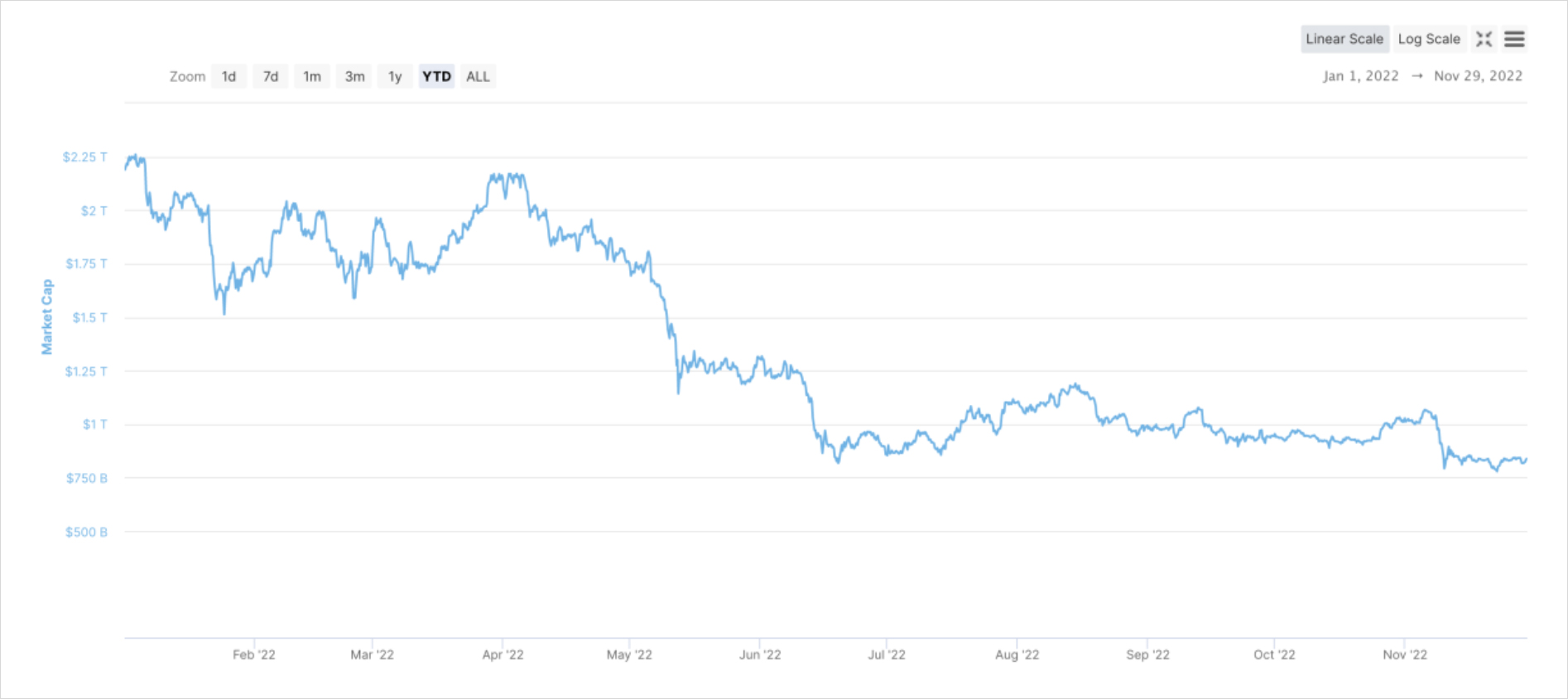

In 2022, some institutions have left an indelible mark on the historical data of the crypto market: the collapse of Luna, 3AC Capital and FTX pushed the crypto market capitalization from around $1.8 trillion to below $850 billion, and they caused three significant peaks in the volatility chart of the crypto market. However, many more institutions and projects only appeared in the news once or not; they were just insolvency and then disappeared, “gone with the wind”.

YTD changes in implied volatility of BTC options as of Nov 30, 2022. Source: AD derivatives (formerly gvol.io)

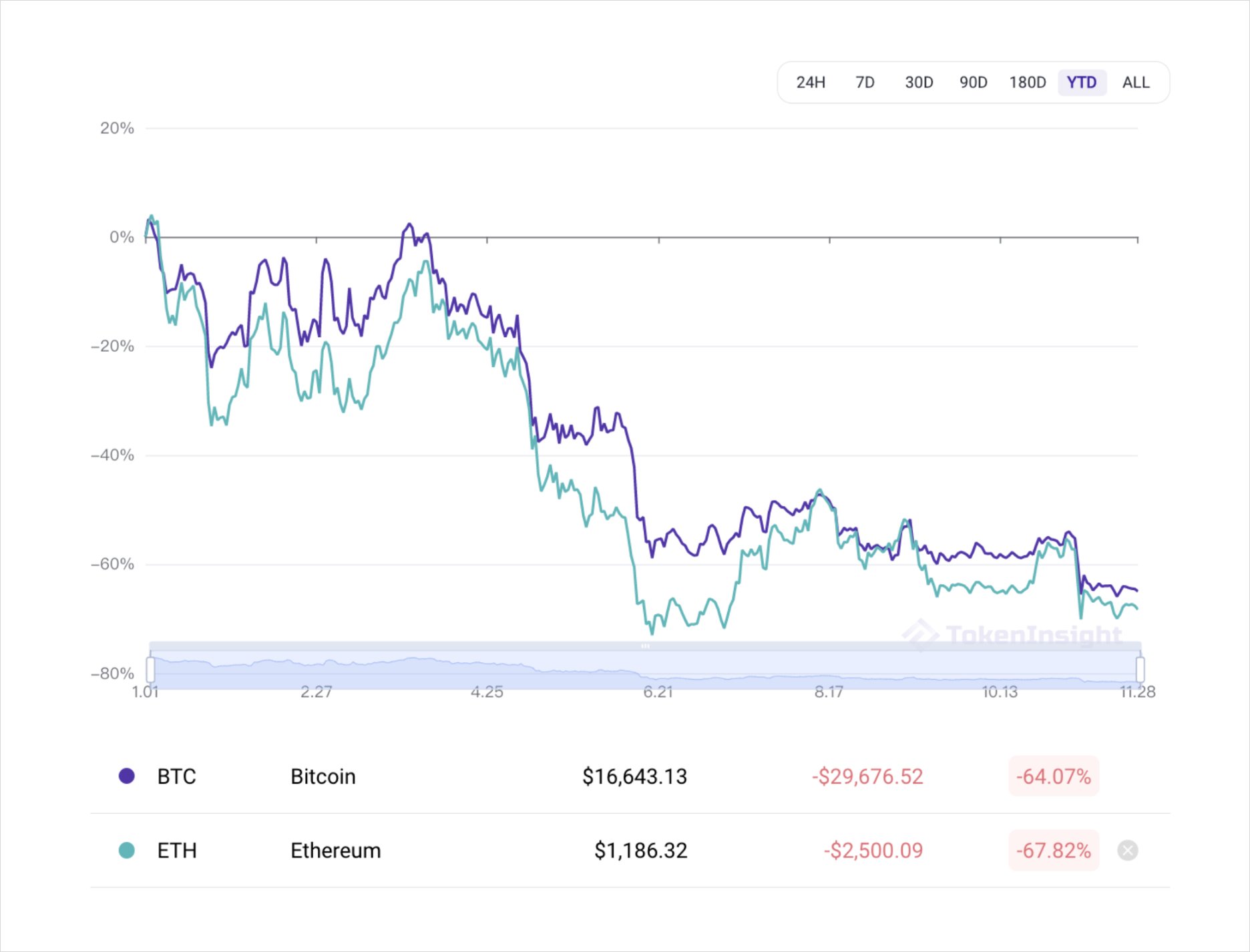

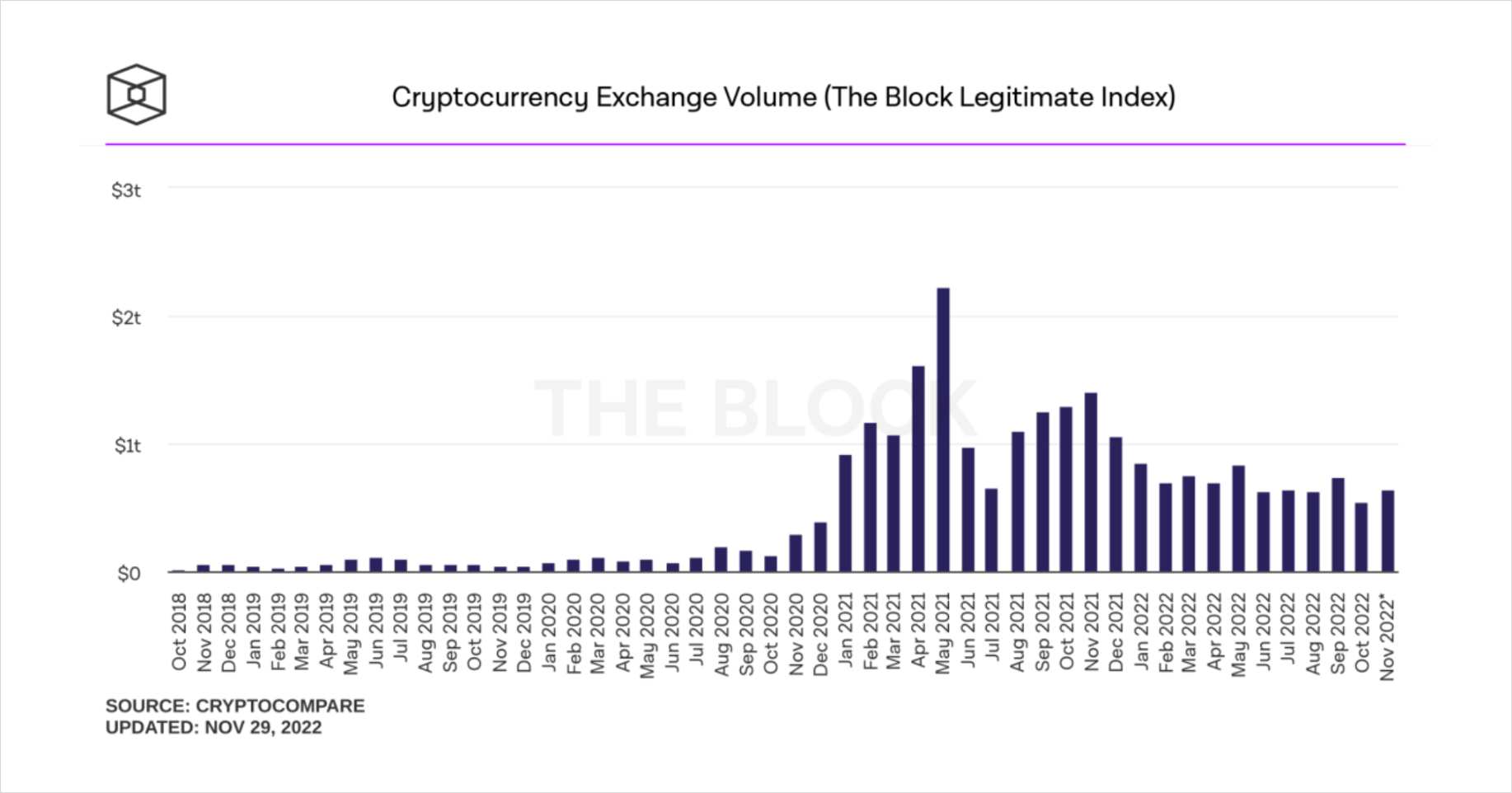

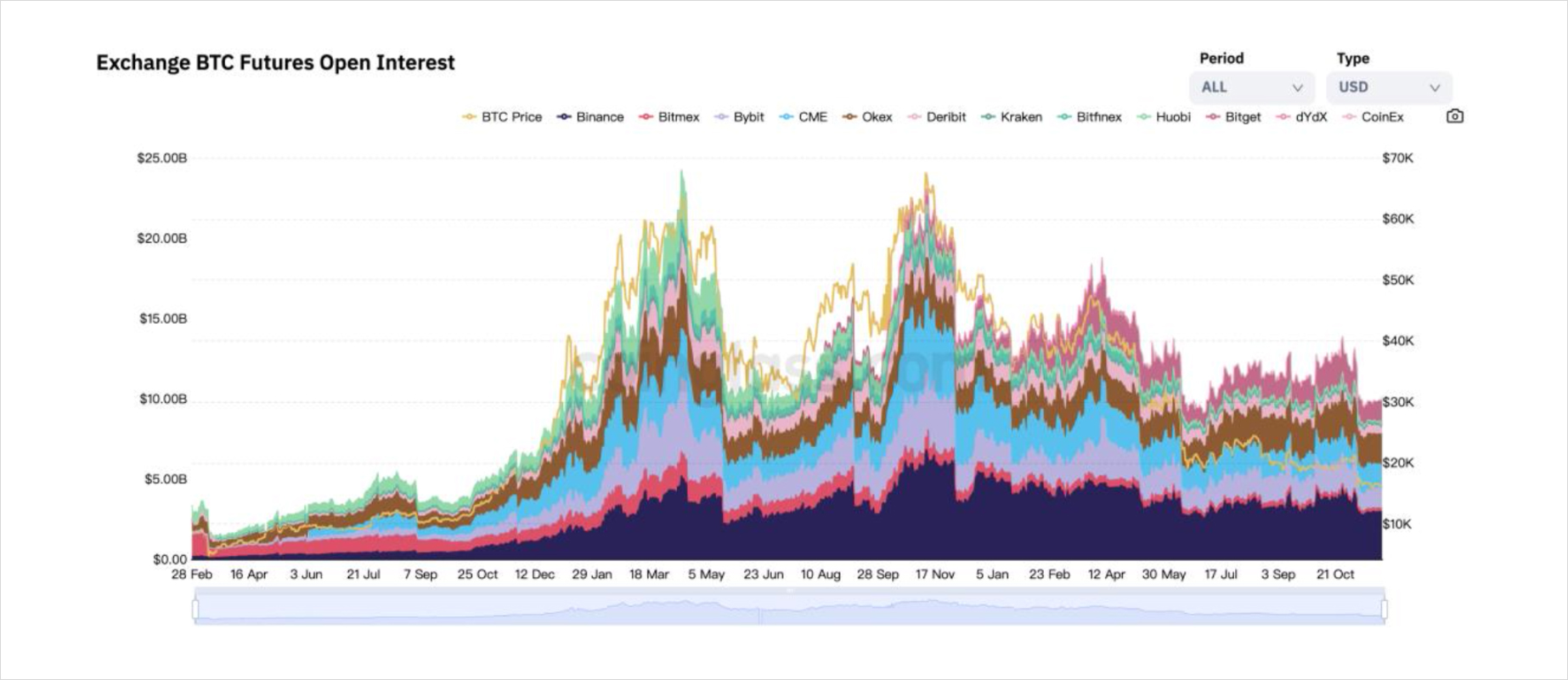

For individual investors and crypto market believers, the decline in crypto assets and a series of events have gradually made them tend to leave or wait and see, which directly led to a decline in trading volume and a reduction in market depth. At a time when the prices of BTC and ETH have fallen by more than 60% since the beginning of the year, in the Spot Market alone, on-exchange trading volume has fallen to the lowest level since January 2021. In the derivatives market, the open interest of BTC perpetual contracts and futures contracts also fell to the same period in Dec 2020.

Changes in crypto market capitalisation from the beginning of 2022 to the present, as of Nov 29, 2022. Source: AD derivatives (formerly gvol.io)

Price movements BTC and ETH year-to-date 2022, as of Nov 29, 2022. Source: TokenInsight

Changes in spot monthly trading volume in exchanges as of Nov 29, 2022. Source: The Block

Open interest changes in BTC futures and perpetual contracts as of Nov 29, 2022. Source: Coinglass

Judging from the data, perhaps many investors believe that the bottom is near now. The bankruptcy storm is in the past tense, while the dollar has begun to fall from its highs, and the Federal Reserve has also indicated that it may reduce the rate of interest rate hikes. However, it seems to be too optimistic.

From the perspective of macroeconomic conditions, the crypto market is still facing increasing liquidity pressure. Release of liquidity during the epidemic through multiple interest rate cuts and bailout policies to support economic stability during the epidemic.

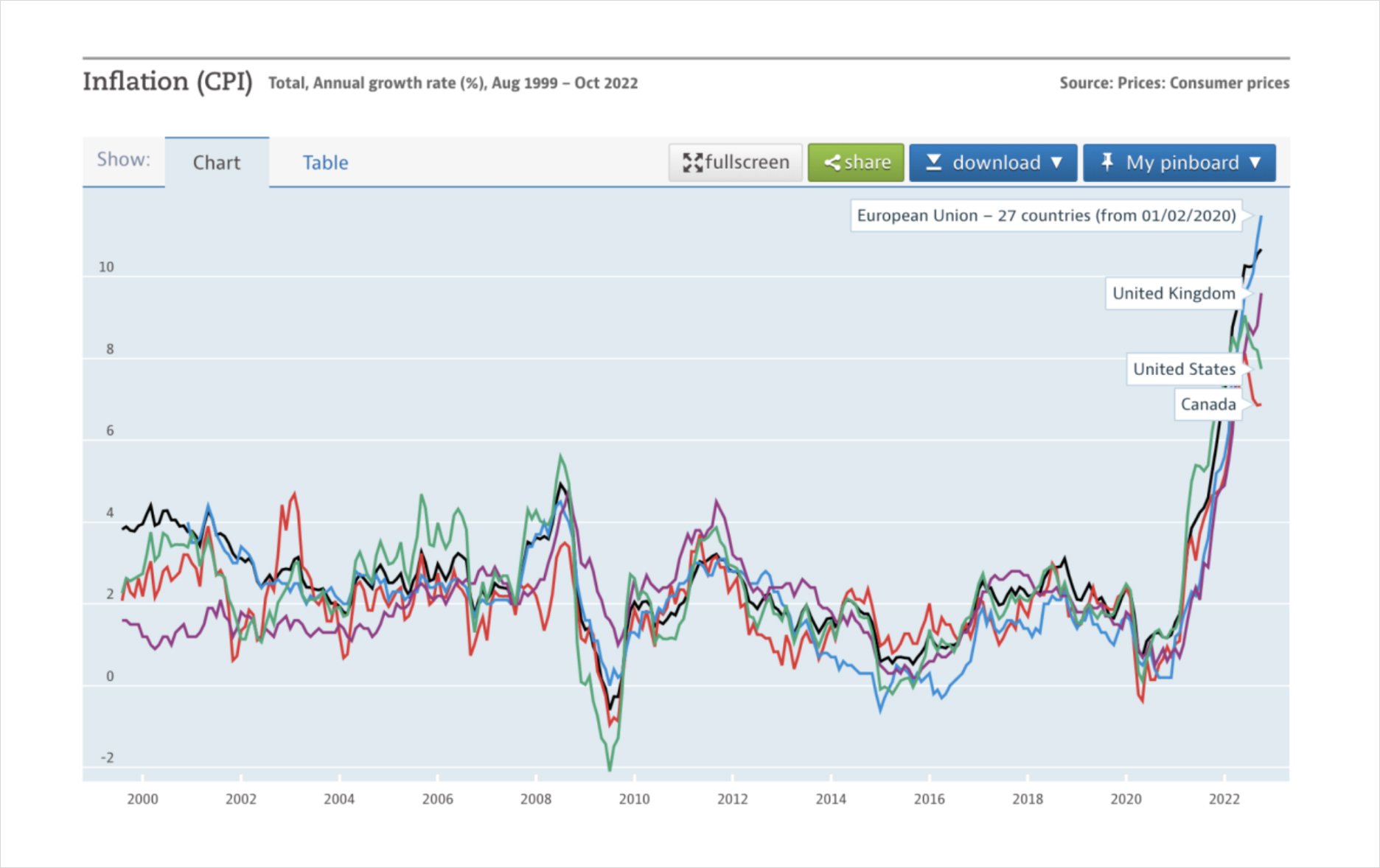

As most countries enter the post-epidemic era, the inflation caused by the previous release of liquidity needs to be addressed urgently. Although central banks in several major markets, represented by the Federal Reserve, have raised interest rates to relatively high levels, inflation levels are still relatively high:

Changes in inflation data for Europe, Canada, the United Kingdom, and the US as of Nov 29, 2022. Source: OECD Data

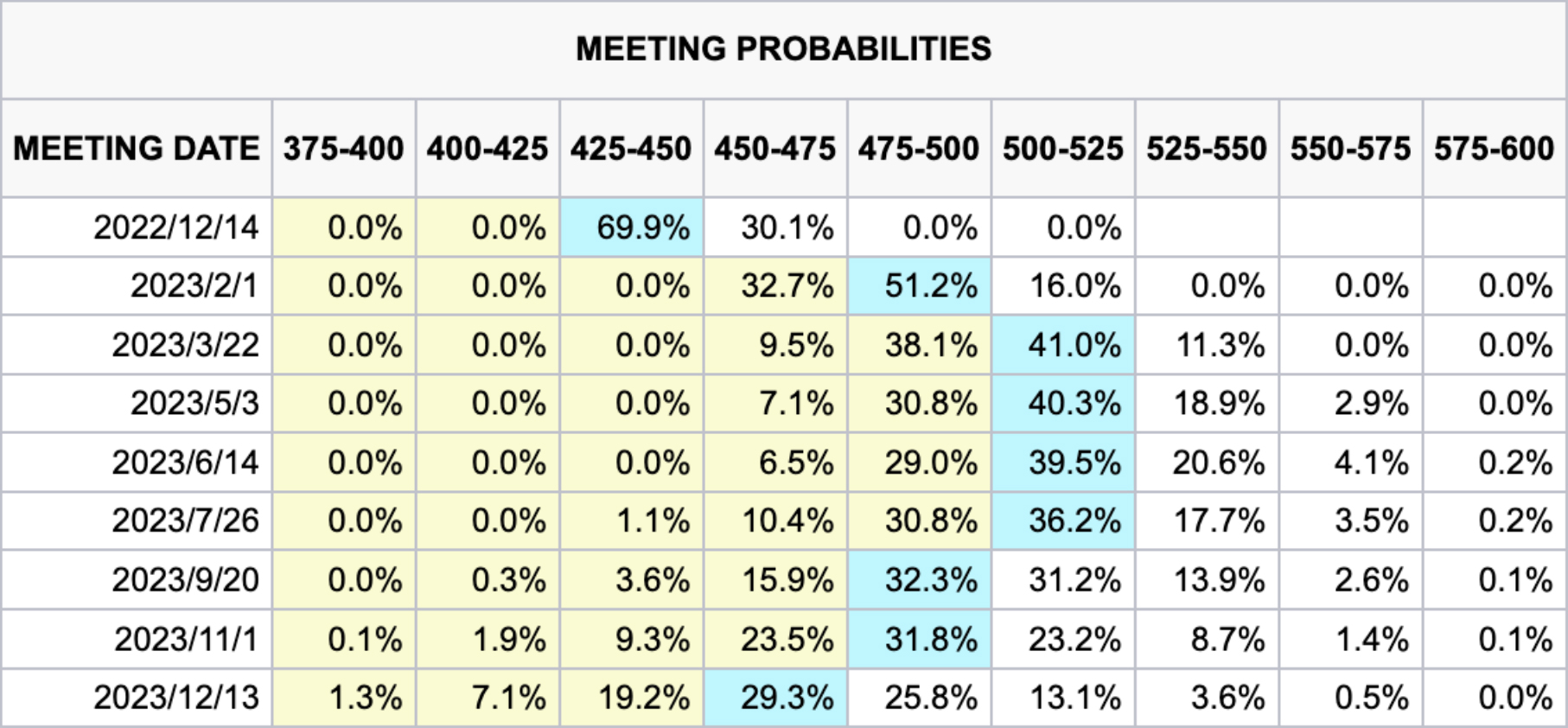

As a result, rate hikes still need to go ahead to keep inflation down. Fed officials and the president of the European Central Bank are emphasising the need for continued rate hikes and higher interest rates. In the interest rate market, traders have priced the Fed’s endpoint rate at 5% -5.25%, but that may not be enough. All in all, investors need to be prepared for higher interest rate peaks.

Changes in the expected peak of Fed interest rates as of Nov 29, 2022. Source: CME Group

One of the direct consequences of sharp interest rate hikes and high-interest rate peaks is economic recession. The suppression of inflation is the core goal of major central banks, according to the statements of central bank officials. However, it may cause deflation and recession.

Under the choice of “protecting the inflation target or protecting the economy”, they finally chose to guarantee the achievement of the inflation target. The spread between the 2-year and 10-year US Treasury yields has reached its highest level since 1980, and investors’ implied recession expectations are even higher than those during the Internet bubble bursting in 2000 and the 2008 financial crisis.

The yield difference between the 10-year and the 2-year US Treasuries, as of Nov 29, 2022. Source: TradingView

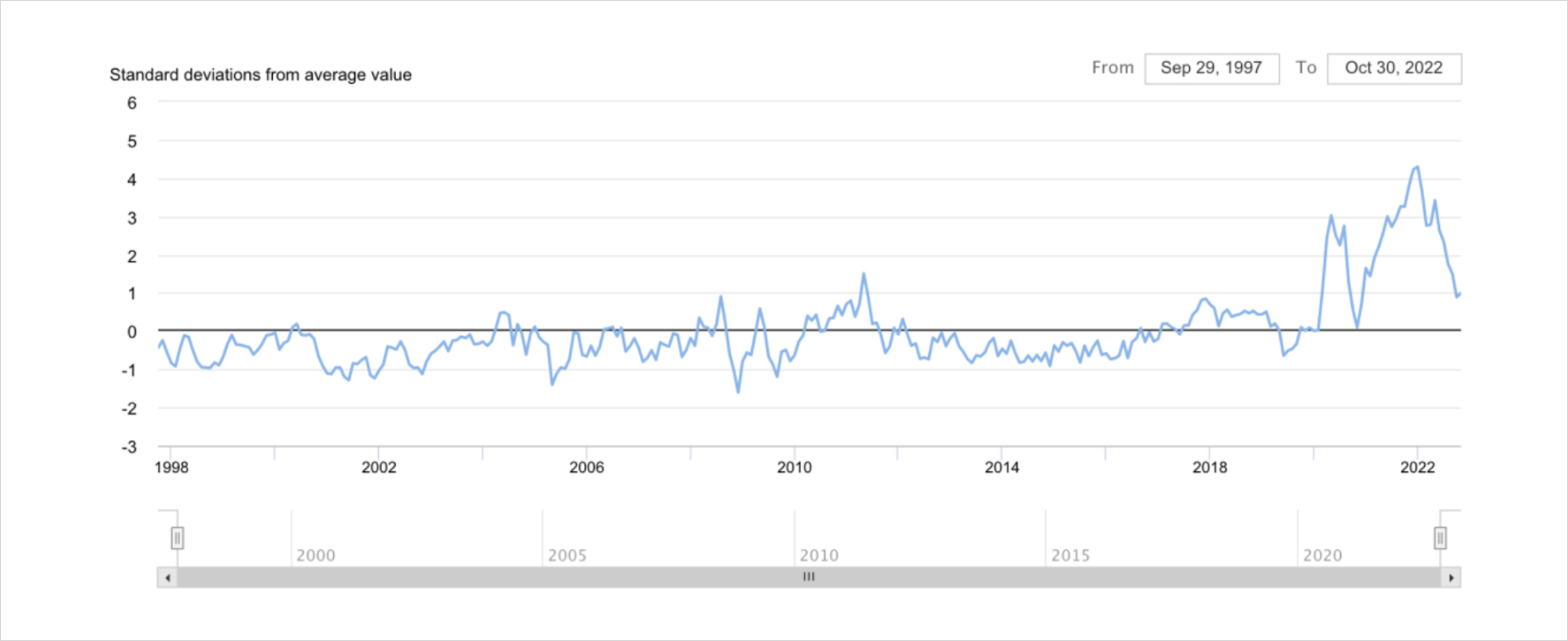

In addition to pressure from central banks, the epidemic’s impact and war cannot be ignored. The New York Fed produces a monthly Supply Chain Stress Index based on the performance of global supply chains. As the northern hemisphere enters winter, the COVID-19 pandemic in China peaked, while the war between Russia and Ukraine continues to pressure commodities such as energy.

Under the combined influence of the two above, the five-month supply chain stress relief has temporarily stopped, which means that supply-side inflationary pressures may affect the market again.

Global Supply Chain Stress Index, as of Nov 29, 2022. Source: New York Fed

The above situation is already unfavorable for the crypto market at the end of the liquidity of risky assets. With the return of liquidity in the distance, the risks within the crypto market are also rising:

- Insolvency of projects, institutions, and even the thunder of first-tier exchanges have disappointed many investors with the prospects of the crypto market and choose to leave at a low price level.

- The regulatory department has also accelerated the legislation on the crypto market and restricted certain development directions due to the enormous losses caused by various fraudulent behaviours and excessive leveraged transactions in the crypto market, further promoting the clearing of crypto market investors and funds.

Take BTC as an example. Generally, long-term holders hoard coins in the bear market and sell them in the bull market. Therefore, during the bear market period, the proportion of long-term holders increases steadily, while in the bull market, the proportion of long-term holders decreases. However, in May-July, the proportion of long-term holders dropped significantly, and a similar thing happened in Nov. Disappointed investors threw their chips and left the market.

The proportion of BTC long-term holders as of Nov 29, 2022. Source: glassnode

To sum up, the bear market cycle in crypto markets is far from over. In the series of shocks in 2022, some institutions are lucky to survive, while some large institutions are reeling and waiting to be rescued. No one knows who will be next; the market tells us that in a bear market “catastrophe”, it is often not the strongest that survive but the luckiest and prepared.

Survivors

Even though the crypto market is frozen, the bear market in 2022 is far from the end of the crypto market. Under the ice, crypto market developers and participants continue to be active. Technological change continues; VC and Angel Investors are still looking for projects that may break out in the next bull market. The fruits of Defi Summer before the last bull market and NFT Summer 2021 are still active in the crypto industry.

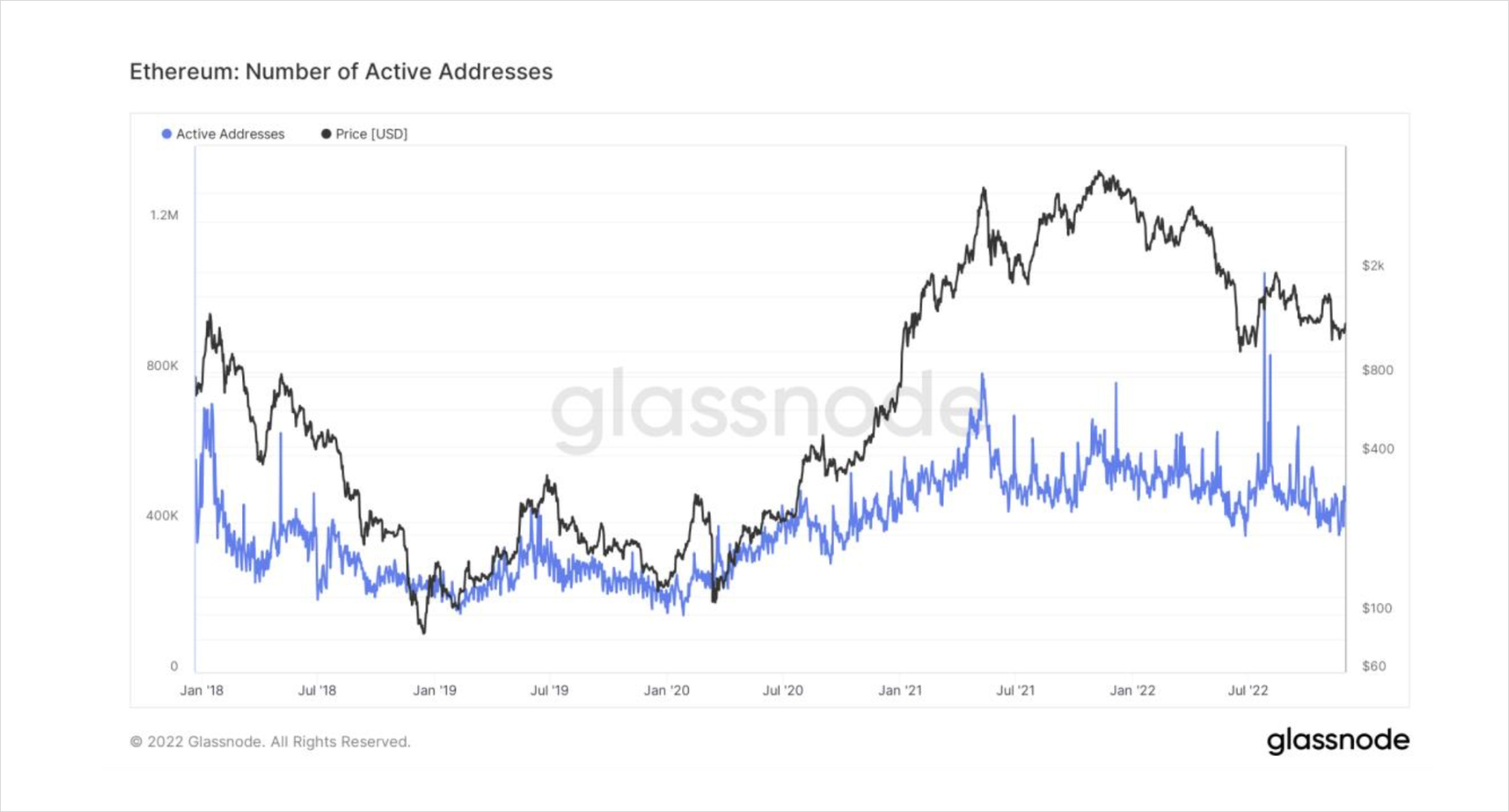

As one of the core infrastructures of Defi and NFT, ETH’s on-chain data is a testament to the resilience of the crypto industry to some extent: although the number of active addresses has dropped to its lowest level since Dec 2020, the proportion of active ETH tokens in smart contracts in the total supply of tokens has only dropped by about 3% from its peak, which is still not lost to the average level of the bull market period.

Changes in daily active addresses on the ETH chain as of Nov 29, 2022. Source: glassnode

At the same time, even after the impact of May and June, the proportion of active ETH in smart contracts has not dropped much, and the gap caused by ETH Merge has been filled quickly.

The percent of ETH supply in smart contracts as of Nov 29, 2022. Source: glassnode

For various projects in the crypto industry, a series of shocks in the bear market did not make them succumb. Even in a harsh market environment like 2022, the Defi market and the NFT market maintain a certain vitality.

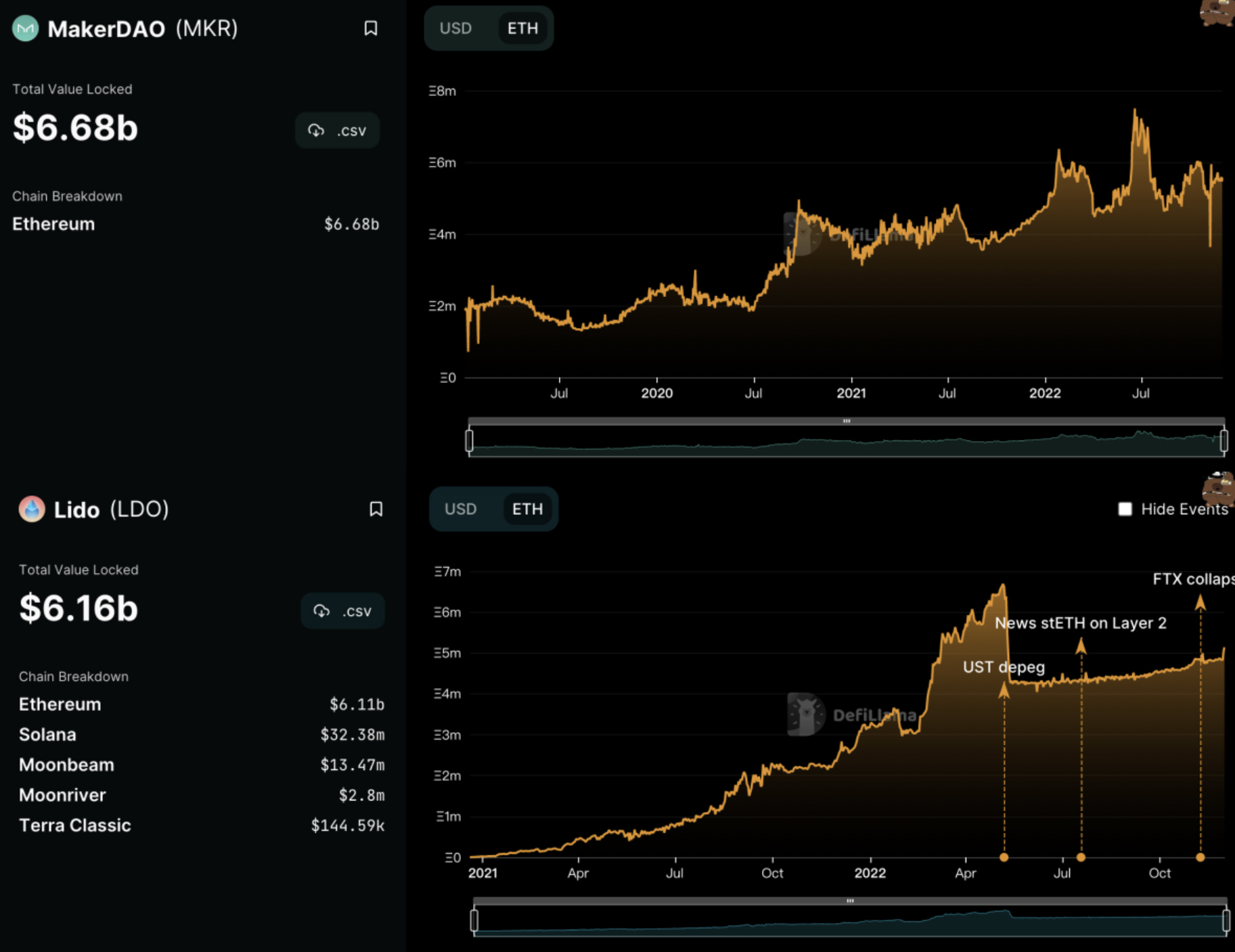

From the perspective of lock-up volume, if the crypto market itself is denominated in native assets ETH rather than US dollars, the TVL of top projects such as Maker DAO and Lido still achieve positive growth in 2022; even in US dollars, the Defi market still maintains a TVL of more than $40 billion, which is comparable to early 2021 and much better than before 2021, which means that the Defi market has become an integral part of the crypto market.

Maker DAO and Lido TVL changes (denominated in ETH) as of Nov 29, 2022. Source: Defillama

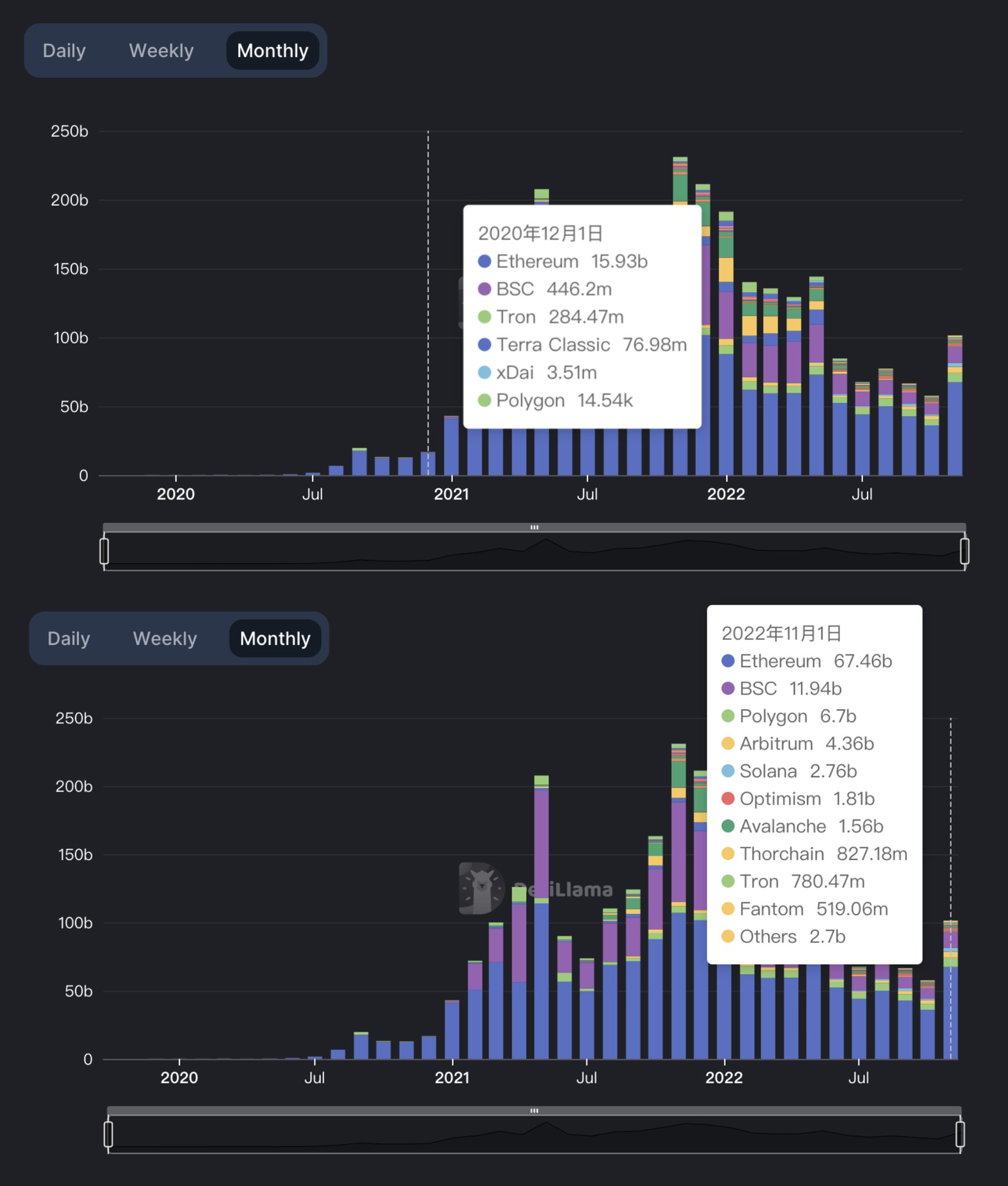

Changes in overall TVL in the Defi market (denominated in USD), as of Nov 29, 2022. Source: Defillama

The same is true for NFT markets. Crypto winter has not resisted NFT investors’ enthusiasm for trading: although it has not been able to compare with the previous boom period, in Nov 2021, the weekly sales volume of NFT is still the same as that of 2021q1, far more than before 2020. Transactions between investors are still ongoing – although not very active, the monthly turnover of top projects exceeds 20,000 ETH, which is unimaginable in the last crypto market cycle.

NFT sales volume changes as of Nov 29, 2022. Source: The Block

Nov trading volume of mainstream NFT products, as of Nov 30, 2022. Source: Nansen

In addition to ETH, other underlying public chains supporting the crypto market maintained a good development trend during the bear market. Unlike in Dec 2020, when ETH was dominant, by the end of Nov 2022, there were at least 10 mature public chains for developers and users to choose from.

Among them, mature Layer2 solutions such as Arbitrum and Optimism, and public chains such as Avalance and Polygon that emerged in the last round of the bull market, still have relatively mature user and developer groups, bearing a monthly turnover of more than $10b. There is no doubt that this has laid a solid foundation for the crypto market to thrive in the next round of the bull market.

Changes in monthly trading volume carried by different public chains from 2020 to 2022. Source: Defillama

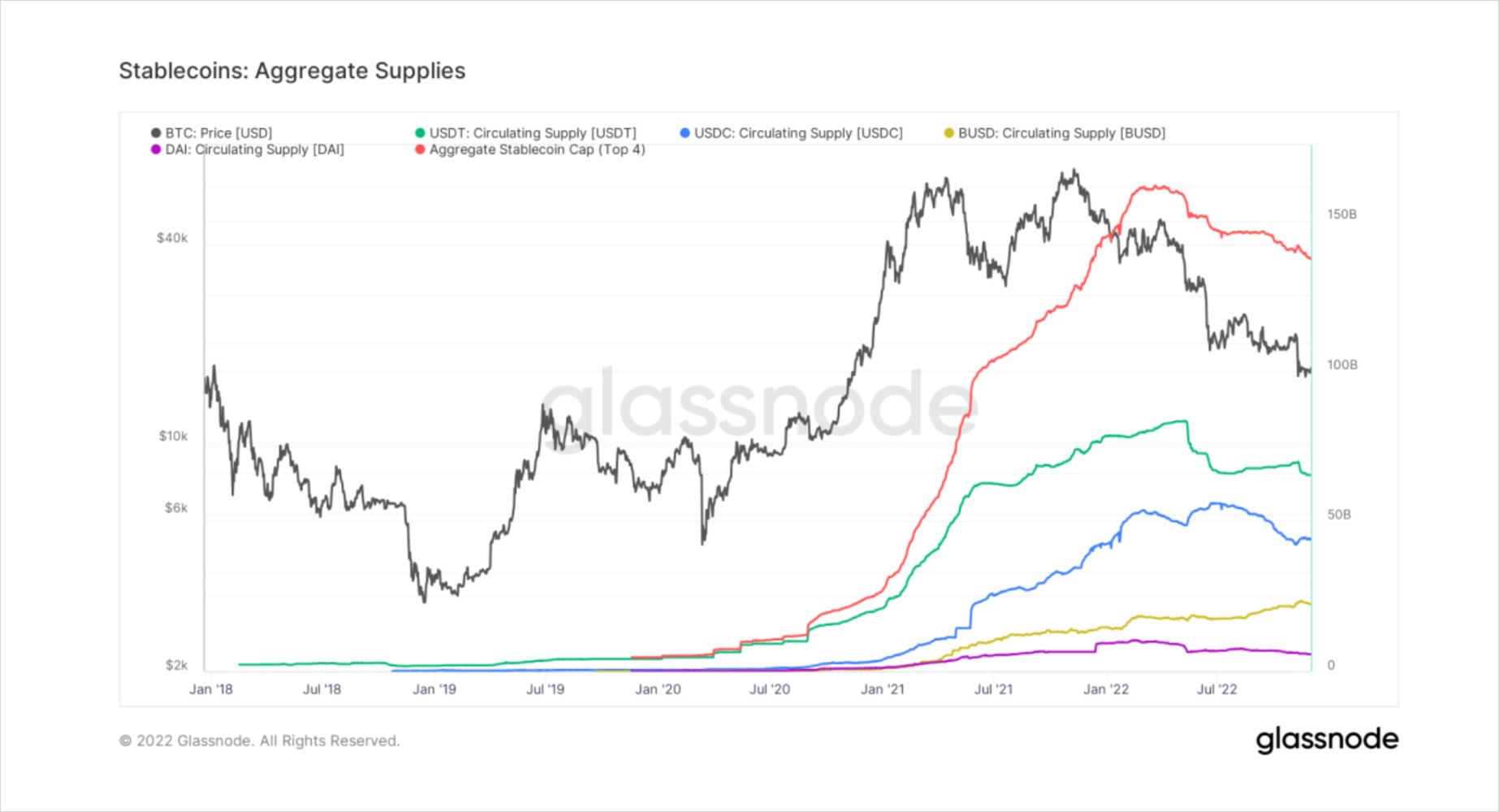

USDs stablecoins are also driving the crypto market to mature. Unlike the nearly “completely virgin” crypto market in 2018, the total supply of USDs stablecoins, as a channel and liquidity carrier between traditional finance and crypto markets, once exceeded $150b in 2022. Even in the market environment of Nov 2022, the supply of USDs stablecoins remained stable at more than $140b.

Changes in the supply of mainstream USDs stablecoins, as of Nov 30, 2022, source: glassnode

The number of traders holding USDs stablecoins is also on the rise. As of Nov 2022, the number of addresses holding stablecoins has easily exceeded 6 million, and countless retailers and institutions are linked to them. These stablecoins are widely used for on-chain trading, spot trading, and derivatives trading. Crypto investors have not stopped their trade because of the bear market.

Changes in the number of addresses held by mainstream USDs stablecoins, as of Nov 30, 2022. source: glassnode

Evolution

After experiencing the crash of “top-tier projects”, institutional insolvency, and the collapse of top exchanges, the remaining investors will no longer trust the project parties although they will still participate in the surviving crypto market – What investors believe now is only the wallets they hold.

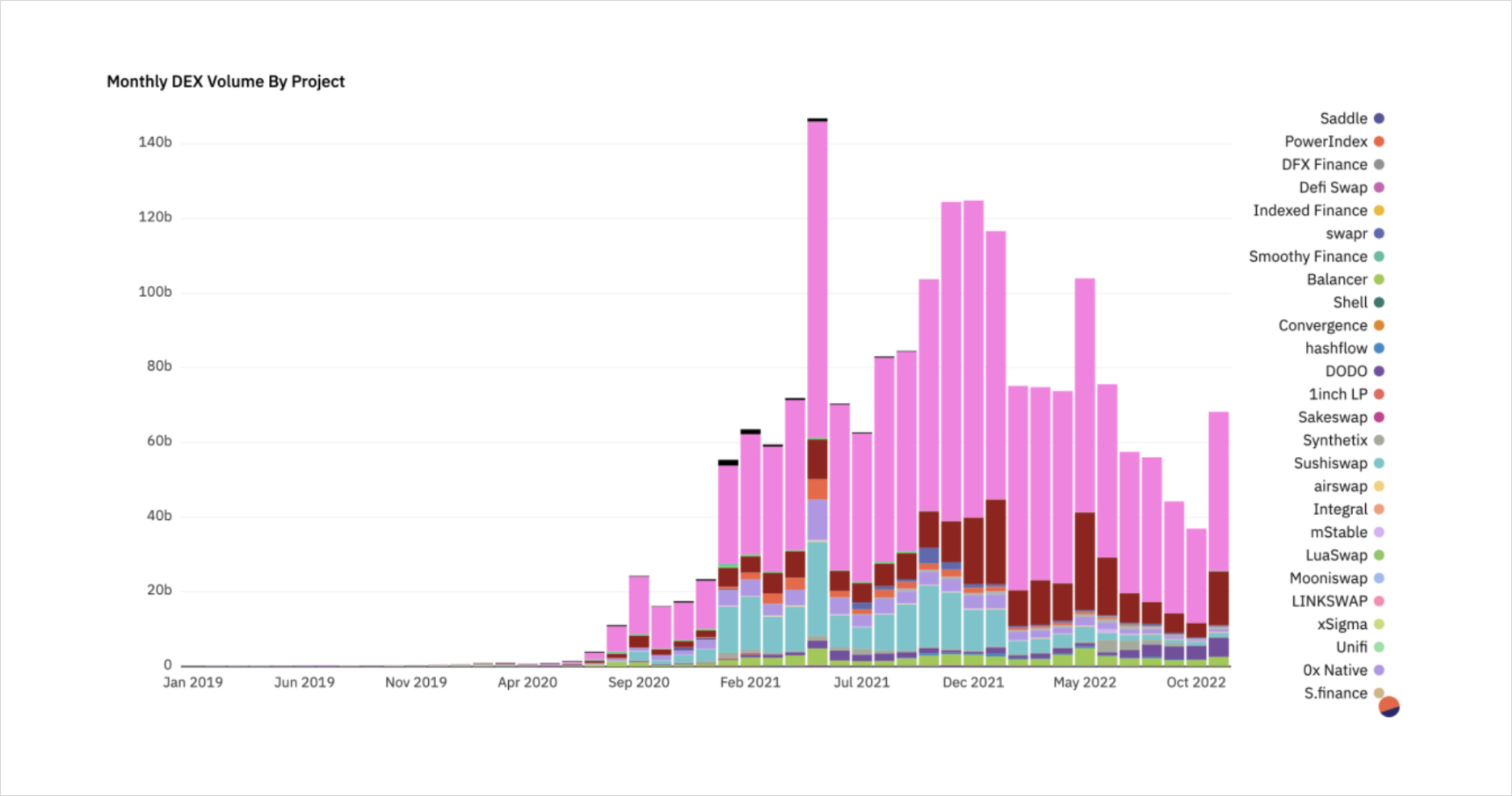

DEXes monthly trading volume changes as of Nov 30, 2022. Source: Dune

When investors gradually reached a consensus from the historical lessons of the crypto market, they turned back to DEX. Compared with October 2022, just a month later, the outbreak of the FTX collapse pushed the monthly trading volume in DEXes back to nearly $70b – almost doubling. The importance of wallets gradually became prominent, and wallet projects began to receive millions of dollars in investment from top institutions, becoming the next trend at the end of 2022.

However, the current user experience of wallets is poor. Frequent interactions bring a lot of transaction costs, and limited scenarios of wallet applications also lead to worse experiences for the users.

Imagine the following scenario: when investors find a preferred underlying asset or NFT, they find that the apps do not support the wallet they use. In a bull market, they need to find an alternative path, and network congestion brings disastrous experiences and “impressive” transaction costs to investors.

In the bear market, traders prefer to give up the deals:

- Their funds might be directly taken away by unscrupulous operators who lack compliance and professional ethics if tokens were deposited on some centralized exchanges. Nothing will be left except the announcement.

- Investors are usually not interested in paying too much time and cost by choosing the safer option. “One look is enough” – they are likely to say so.

For crypto market builders, the above situation branches a new direction for them:

- Build a better exchange, good enough to regain the confidence and favor of investors.

- Or, make a good enough wallet.

Developing wallets is not easy, but evolving in the direction of exchanges is even harder: rebuilding confidence that has been destroyed takes time. Investors have had enough of hide-and-seek; they want exchanges to do what they are supposed to do. Matchmaking, trading, clearing, and risk control, that is enough.

Public proof of reserves and Merkle trees are just the first step. We have seen the disastrous consequences of chaotic auditing and custody, and regulation departments will not allow it to happen again. Therefore, compliant custody and auditing of assets is a hurdle every existing exchange and new exchange must face; investors do not want to lose everything. Full license, qualified audit reports, and perfect custody are the prerequisites to winning back users’ trust.

The ratings of the underlying assets are also an essential part of the future. In the crypto market, retail investors often lack knowledge of the underlying asset they are trading; they rush into the market with the dream of getting rich and losing some or all of the principal they invested in. The rating can solve this problem: under a perfect rating mechanism, investors can understand the risk and potential return of the underlying asset before trading and make the most suitable choice after consideration.

For centralized exchanges, since investors trust their wallets more, with the gradual improvement of the public chain network, the solution of “faster and more solid on-chain exchanges” becomes more feasible: investors can trade with low trust or even without trust. The open interests of dYdX’s BTC and ETH perpetual contracts have exceeded $100 million, respectively, surpassing many small and medium-sized centralized exchanges. Large exchanges have also begun to try to move on-chain: exchanges such as Bybit have launched self-developed wallets, and we may see large exchanges further launch their own on-chain spot and derivatives trading platforms in the future.

Regardless of the bull market or bear market, the history of the crypto market has never been interrupted. Institutions lacking risk management and exchanges lacking compliance awareness disappeared in the bear market, providing survivors with enough space and new ecological niches to be filled.

At the same time, while “everything is waiting to be done”, the survivors also have the most complete and diverse construction foundation so far: a mature spot market and derivatives market, a comprehensive public chain network, and the tenaciously growing Defi and NFT markets, providing developers and builders with “almost unlimited” evolutionary directions and possibilities.

Let’s BUIDL now and wait for the next bull together.

AUTHOR(S)

THANKS TO:

Matt, CEO@Blofin