In this week’s edition of Option Flows, Tony Stewart is commenting on BTC moving to 60k and ETH/BTC spot rotation.

April 3

BTC flirts with 60k.

Protection activity strike raised to 50k. Bullish bias as more Call spreads bought. Implied vols stable.

ETH/BTC spot rotation. ETH breaks 2k.

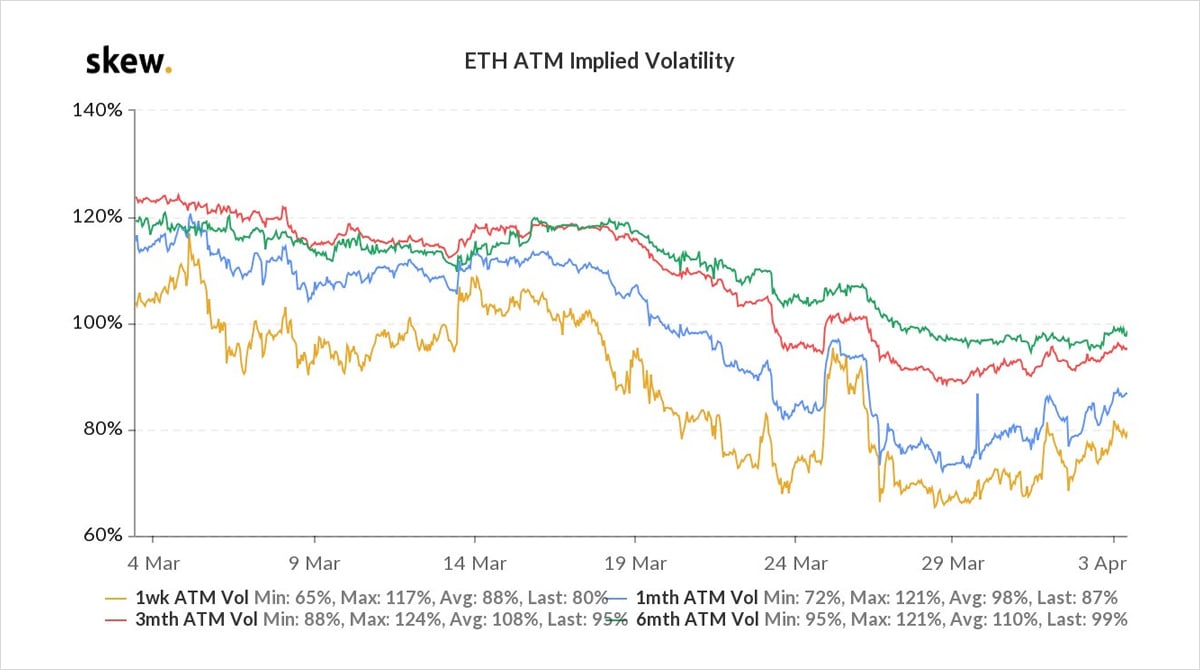

ETH options 2nd largest volume day; no outsized trades, but Implied vols firming into ATH spot price discovery.

2) Apr 50k Put strike becoming last month’s 40k crash protection strike, as 16+23Apr 50k trade x2k, materially from buy-side.

On the upside, the theme has returned to Call spreads, financing the near strike with far OTMs eg Apr9 64-70k, Apr72-May100k, May80-100k, net total 1k+.

3) ETH activity picking up.

Spot rotation, Defi/NFT strong, L1+L2 narrative.

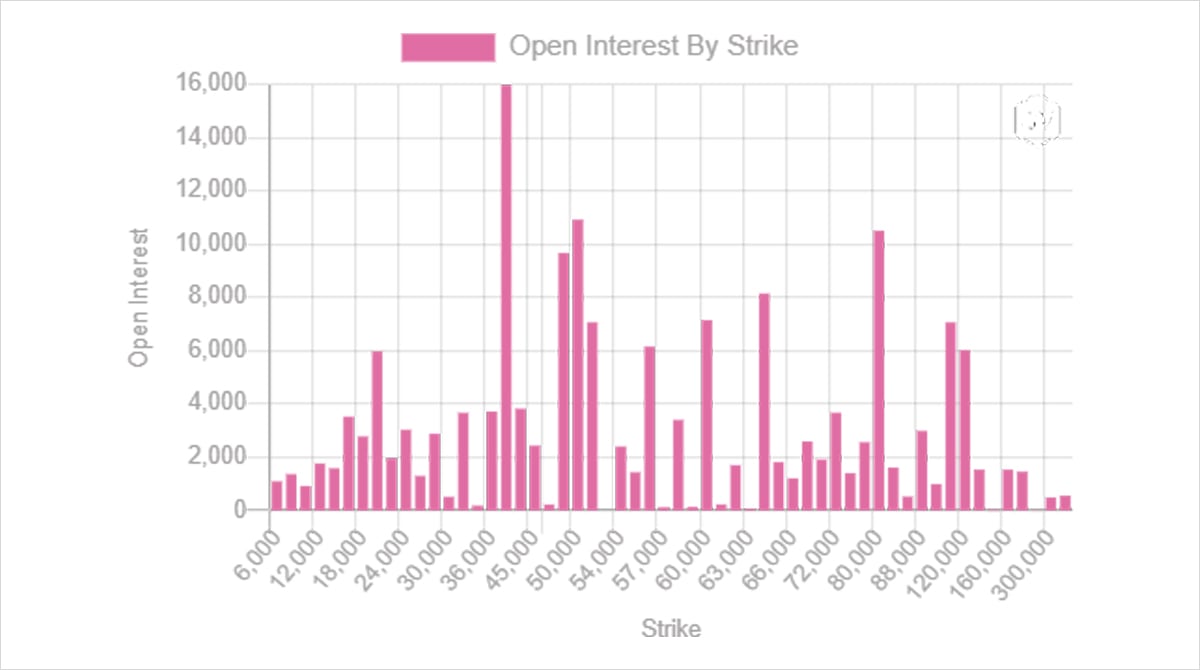

Calls+Call spreads bought, forcing IVs 5-10% off their lows. Activity in Apr30 2240+2280 strikes, but volumes are well spread; indeed largest block against the flow Apr 1920-2560 RR x3k, Puts bought.

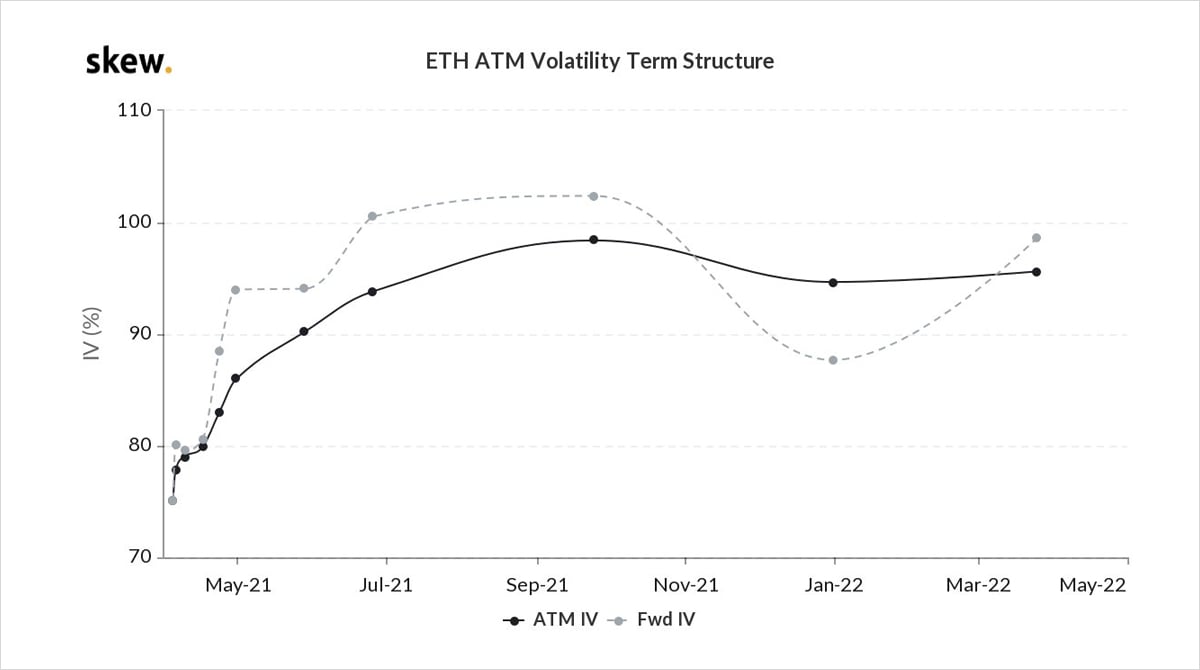

4) IVs sit comfortably.

Not enough RV to judge cheap, while spot level risk-reward insufficent to sell.

Skew+Term unremarkable.

Bullish bias in BTC+ETH certain, but flows not dominated by outsized Put sales or Call buys; spot dips and IV responses causing hesitation to ape-enact.

View Twitter thread.

AUTHOR(S)