In this week’s edition of Option Flows, Tony Stewart is commenting on havoc in delta1 markets and BTC/ETH ‘rotation’.

April 20

While unsubstantiated speculation created havoc in delta1 markets, creating >$10bn liqs, the Options market remained orderly.

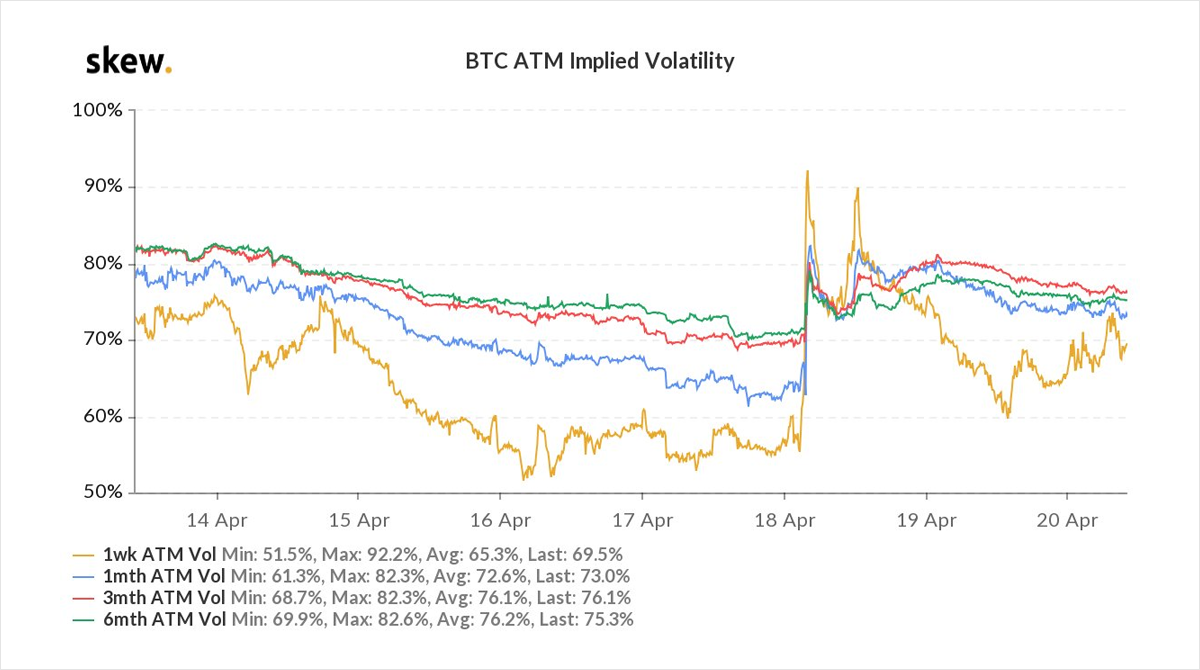

IV spike response was short-lived during unremarkable activity, dominated by Fast money; longer-term positioning remains intact.

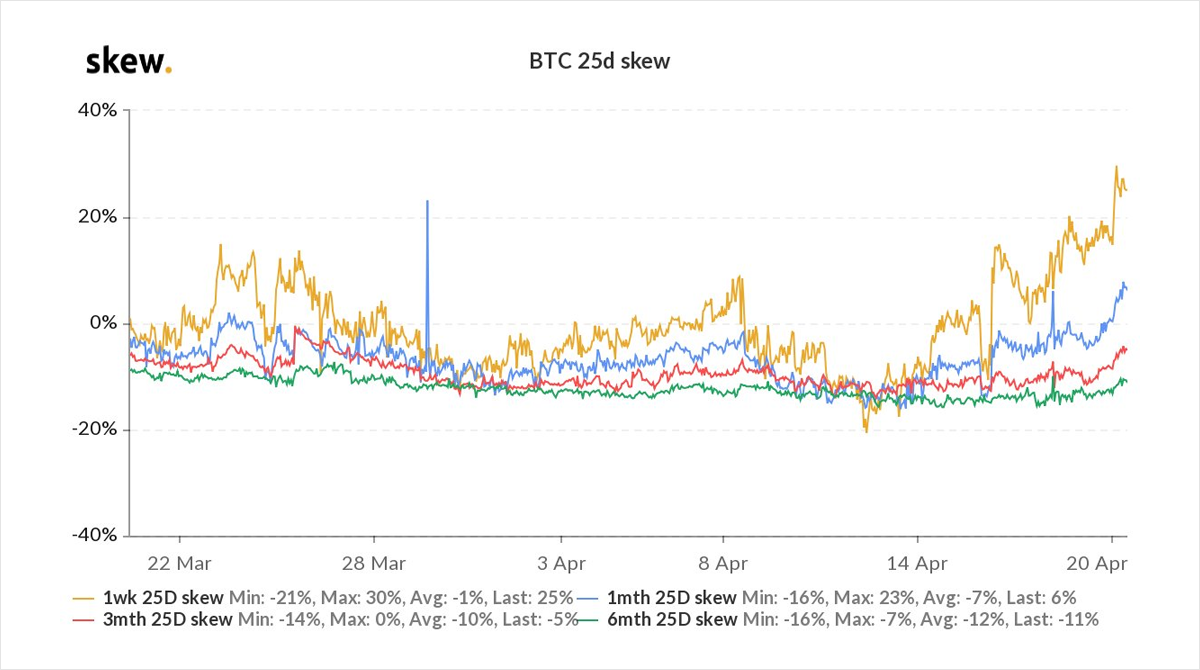

Skew=Near-term nerves.

2) Fast money Option trades have followed delta1, but the advantage of limited loss during wicks.

Example of Fast Money trade by one VHNW:

Pre-wknd buyer Apr16 60k Call x500 as spot <57k, sold as BTC>60k, then bought Apr 58k Put x500, wknd dump=profit. Now buying Apr 58k Calls.

3) An initial IV pump and Term Structure in backwardation, retraced fairly quickly as Option panic did not follow.

IV for BTC and ETH sits at around RV.

Put Skew however has remained high, and feeding to medium-term too, as an expected rally dissipated.

Represents some concern.

View Twitter thread.

April 22

Option flows supporting the BTC/ETH ‘rotation’.

ETH May 2.6-3k Strike Calls bought (bullish bias), but on the approach to BTC 53.5k support, observe May7 60+62k Strike Calls sold x500 and May28 50k Strike Put x400 bought (protective/bearish bias).

BTC diffident.

ETH robust.

2) IV in-line with RV.

ETH more interesting as ETH challenges ATHs.

BTC 1wk IV 60%, 1m 70%; RV 1wk-1m 70%

ETH 1wk IV 76%, 1m 82%; RV 1wk-1m 88%.

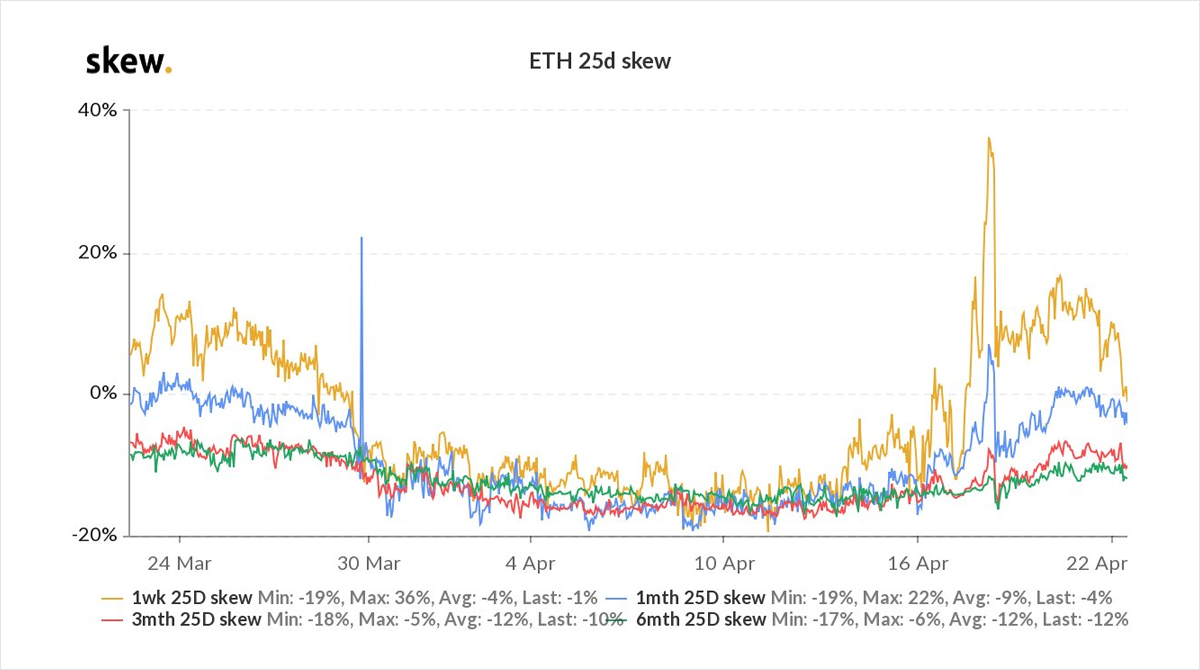

Impact of ETH-BTC move evident on BTC/ETH Skew.

BTC remains cautious, elevated 1wk 20% P>C.

ETH returning to +ve Call Skew post-wknd.

3) ..should read: ‘May*14th* 60+62k Strike Calls..’.

View Twitter thread.

AUTHOR(S)