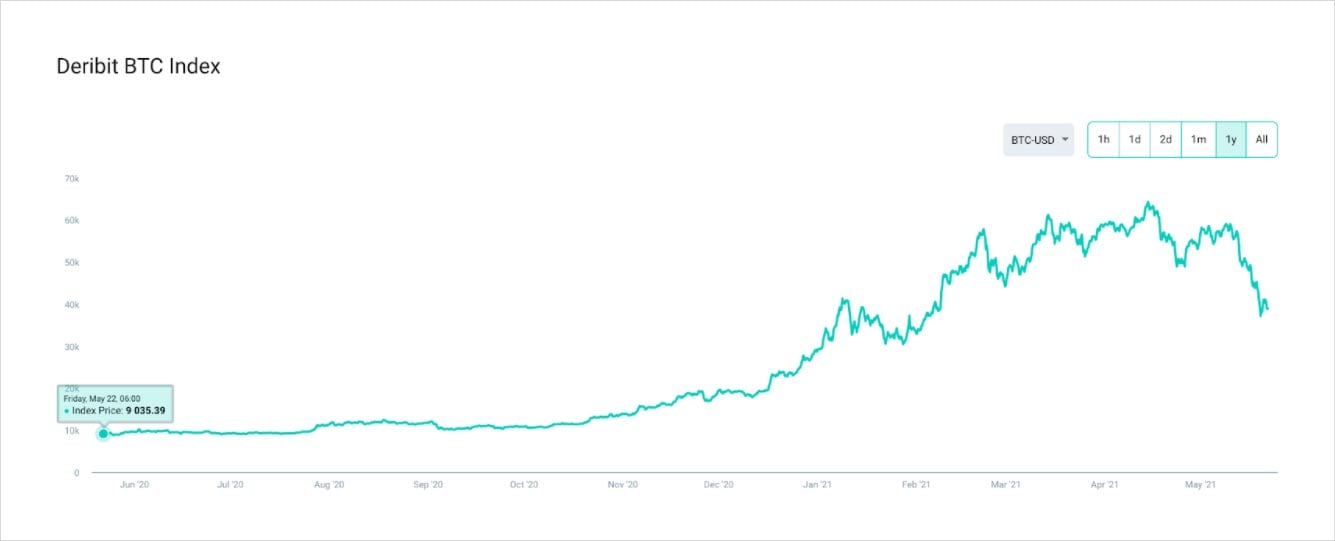

After numerous months of continuous growth, a retracement was expected. However, few could foresee the magnitude of it.

At the end of April, we already encountered the first mini-crash that most saw as a sign of market consolidation before the next rally. And while the crypto community was euphoric and expecting the bull run to be only in its early stages, on May 19, 2021, crypto markets experienced the largest flash crash since March 2020. With more than a 46% decrease in ETH value and a 32% decrease in BTC value in less than 12 hours, it was disastrous to many. The market has already started to recover, with the BTC trading above USD 37,000 and ETH above USD 2,500.

Despite the significant price decrease, BTC and ETH have still shown remarkable growth with a 35.3% increase in BTC and 250.3% in ETH YTD. A yearly chart shows an even more promising picture with a 289% annual increase in BTC and 1086% in ETH. While BTC in the derivatives market dropped below USD 30,000 and ETH below 2,000, both assets have already bounced back by more than 20%, signalling that these might not be the end days of the crypto after all.

What Triggered the Crash?

The first two weeks of May shook the consumer confidence with multiple unexpected news and events:

- Beijing banned banks and payment firms from providing services related to crypto transactions and warned about the speculative nature of crypto.

- Elon Musk expressed his concerns over BTC’s environmental impact, leading to Tesla no longer accepting BTC as a payment method. However, Musk reassured the market that they have no intention of selling the BTC on their balance sheet.

- Tether demonstrated “unrivalled transparency” by revealing the Tether reserves, of which only a very limited percentage turned out to be cash or cash equivalents.

- Extended tax deadline.

Separately these announcements would have had a small short term impact, however, as they accumulated, so did their impact on the market, which was further exacerbated by a newcomer selloff (Into The Block reports that currently, more than 69% of all the BTC addresses are in the money) and highly leveraged derivatives positions. As the prices were rapidly going down, even some of the most conservatively leveraged trades, if improperly managed, hit the maintenance margin. This resulted in 296 bankruptcies on Deribit in ETH and 609 in BTC. Altogether, positions valued at more than USD 8 billion got liquidated across all crypto markets.

Deribit Performance

Market crashes test traders, but even more – exchanges. Despite the rollercoaster of prices, we are very proud that we processed more than USD 13.5 billion notional turnover in 24 hours – a new Deribit record that is even more special, as we did not experience any unexpected downtimes. For crypto exchanges running 24/7 it can be challenging, and while some of our peers struggled, we are happy to see that the lengthy upgrades of our systems now can be also appreciated by our users. Besides system performance our deposit and withdrawal abilities were not impacted either.

Circuit Breakers

Flash crashes, or very rapid price drops, have in the past caused a cascade of liquidations and massive sell-offs across multiple exchanges. To avoid too fast and unnecessary liquidations, Deribit introduced a form of circuit breaker that was first tested in the crash of March 2020.

A circuit breaker is a trading halt triggered by a specific price change, as set by the exchange. This is done to avoid massive sell-offs and allow market participants to catch up with the market during highly volatile periods. The crypto markets have also suffered from external market manipulations or internal errors in the past that have caused liquidations not caused by the market. To minimize such risk, Deribit introduced a circuit breaker that is triggered if the Index Price moves by more than +/-2.5% per second (increased from +/-1.5% in 2020). It got triggered a few times during the night in March last year and again was triggered a few times on May 19, locking the platform for 30 seconds and allowing the market to stabilize. Contrary to previous occurrences, this time, it was the rapid drop in the ETH Index that caused the circuit breaker to trigger. In these situations, only the market for the specific asset (ETH) gets halted rather than the whole platform.

As there is no dedicated message for this trigger, traders might have seen a maintenance announcement during these 30 second periods. However, no maintenance was performed, and it was the circuit breaker working as intended.

More Efficient Trading

In a fast-moving market, meeting the margin calls can make all the difference between a complete recovery or painful liquidation. Therefore, in markets where prices can move by more than 2.5% in a second, transactions taking multiple hours can be detrimental. To solve this problem, Deribit introduced an off-exchange settlement facilitated by our custody partners – Cobo and Copper. By using an off-exchange custody solution, traders can benefit from an instant collateral allocation that is never transacted on-chain rather in the off-chain custody environment. This ensures that traders can always top up their Deribit balance without incurring hefty on-chain fees or significant transaction times at peak volatility. Moreover, to benefit from the best latency in the market, traders no longer need their own servers in the same data centre as Deribit. Virtual solutions by UltraFX VPS, Liquidity Connect or Beeks will make your latency comparable to the largest market makers in the industry.

This was the first significant crash since institutional money started to enter the crypto. However, it does not seem that it in any way minimized their ever-growing interest in the market. Wells Fargo, previously an opponent of crypto, just announced that it would also start offering crypto investments to its clients. As fundamentals remain strong and exchanges are becoming more efficient, we remain optimistic about the crypto future!

Read more about our connectivity and custody partners here.

AUTHOR(S)