Cumberland is commenting on the recent volatility and potential opportunities to take advantage of it.

For further information about Cumberland, please visit Cumberland website here.

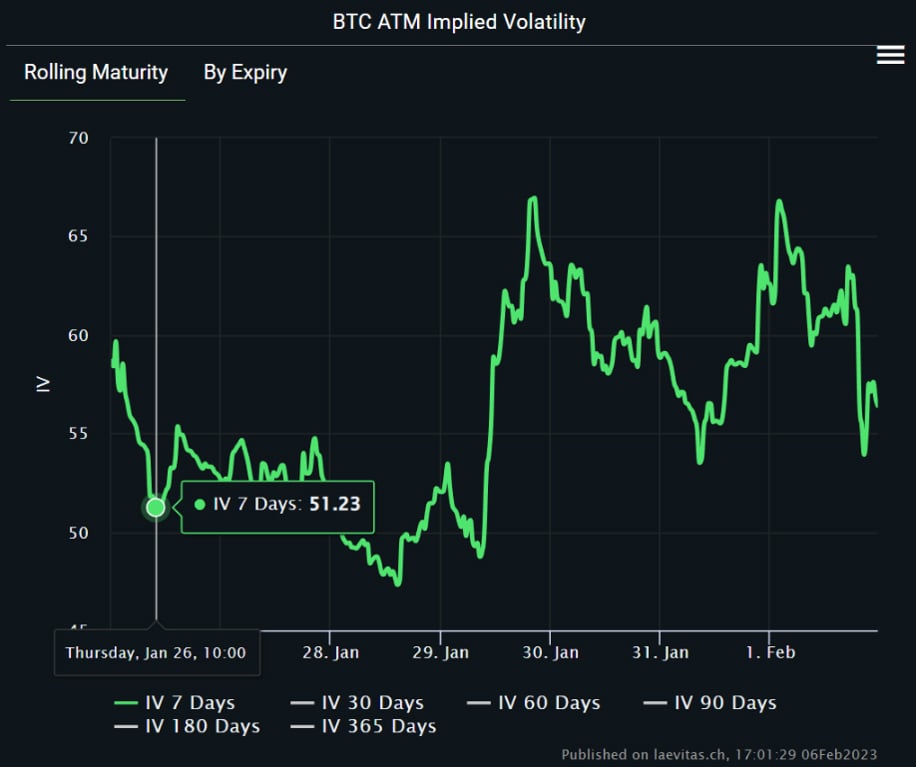

We start by reflecting on our last commentary, since this provides the theme for the ideas that we want to portray. On the 26th of January, we recommended buying gamma due to vol levels being depressed given the price action and narratives in play. At the time, 7 day implied vol was at 51 in BTC; however, this jumped up to 67 vol during Sunday’s rally before coming down and jumping back again to 67 during the FED meeting on Wednesday (see image below). These occurrences provided two opportunities to take profit on the trade, alongside the gamma hedging profit earned from the big moves in spot. The main themes to take away here are:

- There are natural vol sellers in the market that push vols down to low levels. Perhaps, the market is still fitting to the super low realized vol regime of December 2022, whereas we stated very early on that we are now in a different regime.

- This new regime is characterized by less liquid order books post FTX, which naturally lead to gappy moves. In addition, we have quickly changing macro narratives, new idiosyncratic crypto events and both retail/institutions coming back onto the scene. All these point to much higher probabilities of big moves than before, and we have seen this repeatedly in January.

Week Review

Last week saw a flurry of central bank meetings and economic data:

1. Wednesday saw an unexpectedly dovish performance by FED chair Powell. The market was expecting a repeat of his typical “inflation busting messaging”. This time, he portrayed a relatively more relaxed attitude, implying to the market that the FED believed the inflation fight was ahead of schedule. To give an example, when asked if the FED was worried about the recent easing of financial conditions (i.e. the fall in rates/yields reflecting the market’s disbelief in the FED December projections), the Powell of 2022 would have firmly stated “yes”. Instead, his comment on financial conditions having tightened rather than eased gave markets the impression of the FED believing their work was nearly done, and caused a risk asset rally. 2Y yields fell 12bps, whilst BTC and ETH rallied 5.2% and 7.3% respectively, rewarding those that held gamma going into the event.The dovish narrative continued into Thursday. The BOE hiked 50bps; however, they signaled that they may pause rate hikes soon depending on the strength of economic data, and 2 out of 9 policymakers actually voted to hold rates where they are. The ECB hiked 50bps and signaled another 50bp hike in March, but European stocks rallied and bond yields fell after the ECB failed to commit to more rate hikes after March.

2. Powell’s surprising dovishness was ironically followed by drastically hawkish jobs data on Friday. The January unemployment rate of 3.4% (3.6% expected) was the lowest since 1969. While YOY average hourly earnings was up 4.4%, last month’s number was bumped up from 4.6% to 4.8%, going against the perceived drop in wage pressures that had contributed to the market’s increasing confidence in a FED pivot. The most significant bit of data was the change in non-farm payrolls, which came in at 517k (189k expected, a big overshoot). This data underscores the fact that the labor market is still tight and thriving, meaning that it becomes increasingly dangerous to ignore the probability of a wage-price spiral reigniting the inflationary fire that seemed to be dwindling away. While interest rate markets have began to price in this risk (10Y yields are up 39bps since Friday’s data release), stocks and crypto have only seen very mild downticks, perhaps due to retail still spellbound by January’s euphoric rally. All else equal, we see room for risk assets to follow rates and retrace some of the recent gains.

Yet again we are placed in a two sided scenario, and next week’s inflation data (CPI and PPI) may sway the market either way. Hot data will reinforce last Friday’s jobs numbers and give the FED a strong reason to keep raising rates and holding them higher for longer. This could result in the rates markets rethinking pricing in of 2023 rate cuts; and thus, send risk assets back down. Low inflation numbers could greatly strengthen the market’s perceived probability of a soft landing (inflation coming down whilst the labor market and economy remains strong), leading to rates reverting last Friday’s move and giving investors confidence to allocate back into crypto.

3. We also point out the uptake in Ethereum on-chain activity over January, due to a rebirth in NFT activity. Daily transaction fees on the blockchain doubled last month, and 10k ETH has been burnt since mid January, meaning that the current ETH supply is the lowest it has been since the merge. Layer-2 technology continues to see rapid development, for example Optimism’s upcoming ‘Bedrock’ upgrade promises a cleaner and more efficient code stack which will lead to upgraded performance and lower fees. Of course, the elephant in the room is the mainnet Shanghai upgrade, which is just round the corner. The main theme here is that all these different narratives give crypto’s reflexive nature an opportunity to surface again. For example, an ETH rally will spur even more on chain activity, encouraging more staking post-Shanghai. More ETH is burnt as transactions mean burnt fees thus lowering the supply even further and creating larger demand/supply imbalances.

Vol Surface

Due to the natural vol sellers mentioned at the start of the commentary, as well as the fact that this week is relatively lighter on economic data (other than Michigan sentiment on Friday), screen markets have marked the vol surface back down to historically low levels. 10th February implied vols are 41.5 and 58.5 vols in BTC and ETH respectively (BTC/ETH ratio is 0.71), and the 29th Sep levels are 55.6 and 65.6 in BTC and ETH respectively (ratio is 0.85). It is not often that the ratios trade in such a distorted manner, implying ETH performance in the short term but BTC in the long term. If anything, we have seen BTC outperform ETH in January, and the density of ETH narratives in the coming months should favor holding ETH backend vol over BTC vol.

To summarize our thoughts:

- The dovish/hawkish contrast between last weeks events described in (1) and (2) creates the possibility of a shift in macro sentiment soon, which could change risk asset positioning (either up or down).

- We are no longer in December 2022, where the only narrative was “what are the consequences of FTX? Everyone should avoid crypto”. As described in (3), the upcoming upgrades/unlocks/regulatory clarity coming to the space means a possibility for reflexive moves.

- There is an argument that the crypto vol surface is still fitting to December 2022, and underpricing the macro and crypto arguments above. January’s big rally is evidence of this, there are too many angles and opportunities for unexpected events to justify such low vols. Looking at the vol surface now, we think BTC gamma and ETH backend vol continue to be attractive points to buy. One can score gamma pnl on big moves and then take profit via undoing the trades on the highs in vol and after the ratios revert.

Disclaimer

The information (“Information”) provided by Cumberland DRW LLC and its affiliated or related companies (collectively, “Cumberland”), either in this document or otherwise, is for informational purposes only and is provided without charge. Cumberland is a principal trading firm; it is not and does not act as a fiduciary or adviser, or in any similar capacity, in providing the Information, and the Information may not be relied upon as investment, financial, legal, tax, regulatory, or any other type of advice. The Information has not been prepared or tailored to address, and may not be suitable or appropriate for the particular financial needs, circumstances, or requirements of any person, and it should not be the basis for making any investment or transaction decision. THE INFORMATION IS NOT A RECOMMENDATION TO ENGAGE IN ANY TRANSACTION.

If any person elects to enter into transactions with Cumberland, whether as a result of the Information or otherwise, Cumberland will enter into such transactions as principal only and will act solely in its own best interests, which may be adverse to the interests of such person. Before entering into any such transaction, you should conduct your own research and obtain your own advice as to whether the transaction is appropriate for your specific circumstances. In addition, any person wishing to enter into transactions with Cumberland must satisfy Cumberland’s eligibility requirements.

Cumberland may be subject to certain conflicts of interest in connection with the provision of the Information. For example, Cumberland may, but does not necessarily, hold or control positions in the cryptoasset(s) discussed in the Information, and transactions entered into by Cumberland could affect the relevant markets in ways that are adverse to a counterparty of Cumberland. Cumberland may engage in transactions in a manner inconsistent with the views expressed in the Information.

Cumberland makes no representations or warranties (express or implied) regarding, nor shall it have any responsibility or liability for the accuracy, adequacy, timeliness, or completeness of, the Information, and no representation is made or is to be implied that the Information will remain unchanged. Cumberland undertakes no duty to amend, correct, update, or otherwise supplement the Information.

The virtual currency industry is subject to a range of risks, including but not limited to: price volatility, limited liquidity, limited and incomplete information regarding certain instruments, products, or cryptoassets, and a still emerging and evolving regulatory environment. The past performance of any instruments, products, or cryptoassets addressed in the Information is not a guide to future performance, nor is it a reliable indicator of future results or performance. Investing in virtual currencies involves significant risks and is not appropriate for many investors, including those without significant investment experience and capacity to assume significant risks.

AUTHOR(S)