This article will detail how a bitcoin miner can hedge their expected mining income using the derivatives on Deribit. The same principles will apply to currencies other than bitcoin of course, as long as derivatives are available for that currency.

Hedging is a way of limiting risk by utilising a secondary instrument. For example, if someone is holding a lot of bitcoin, their holdings will lose a lot of value if the price of bitcoin decreases significantly. This person may choose to hedge some or all of this risk by also entering a position that will make a profit if the price of bitcoin decreases. This profit will then offset the loss in value incurred from holding the bitcoin.

Why do miners hedge?

Bitcoin miners have costs, such as electricity, machine maintenance, new machine purchases, staff, rent etc. Their costs will most likely be charged in some fiat currency, for example USD, but the income their business receives comes in the form of bitcoin.

The bitcoin income received may currently be valued at more than their costs, but what happens if the price of bitcoin decreases significantly? The amount received may no longer be enough to cover costs when converted into the currency that their bills are charged in. The business needs to do something to protect against this scenario, and this is where derivatives prove themselves extremely useful.

What is a derivative?

Hedging is often achieved by using a derivative. A derivative is a contract that derives its value from an underlying asset. The underlying asset in this example is bitcoin. A derivative contract can take several different forms, and the two examples we will be looking at today are a futures contract, and a put option contract.

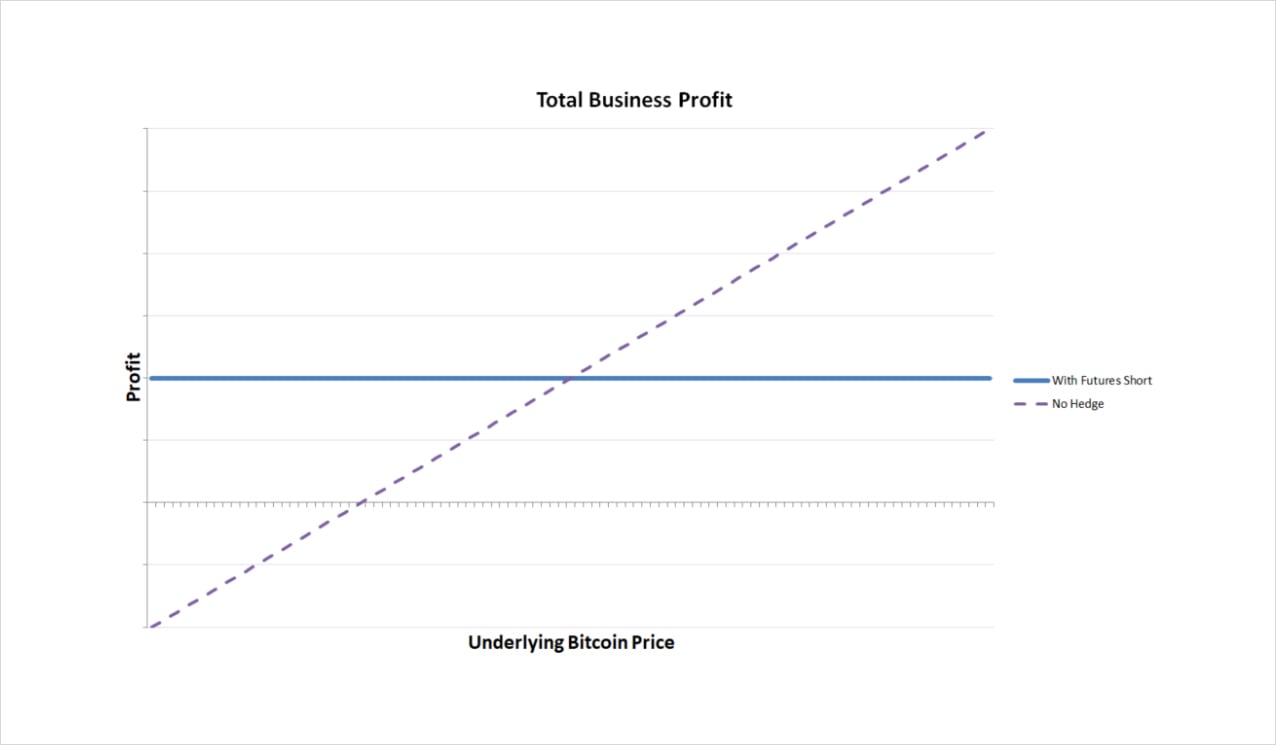

Hedging with futures

One way a miner can hedge their expected income against decreases in the bitcoin price is with a bitcoin futures contract. Specifically with a short futures position.

A bitcoin futures contract will eventually be settled based on the bitcoin price on some future date, when the contract expires. Not all traders will have the same motives for trading futures, with some using them to hedge and others using them to speculate. The futures contract will track the underlying price of bitcoin quite closely, but may deviate from the current spot price of bitcoin by a few percent. The size of these deviations will depend on how long is left until the expiry date of the future, as well as the average sentiment of the people trading it.

With a futures short there is no premium to pay, and the miner can be completely hedged against decreases in the price of bitcoin. However, enough margin must be kept in the trading account to support the futures position. If the price of bitcoin increases significantly, more margin may need to be added to the account in order to keep the futures short open. Even though they are going to receive more bitcoin in future, they need to post more margin immediately, which could lead to significant cash flow issues for the business.

The futures short then, while not initially requiring much margin to open, can quickly require more if the bitcoin price increases significantly.

The futures short locks in a dollar value for the bitcoin that the miner will receive at a later date. This is very desirable if the price of bitcoin decreases after the hedge has been placed, but may cause some disappointment if the bitcoin price increases instead. By using a future, the miner gives up any upside for the amount of bitcoin that is hedged.

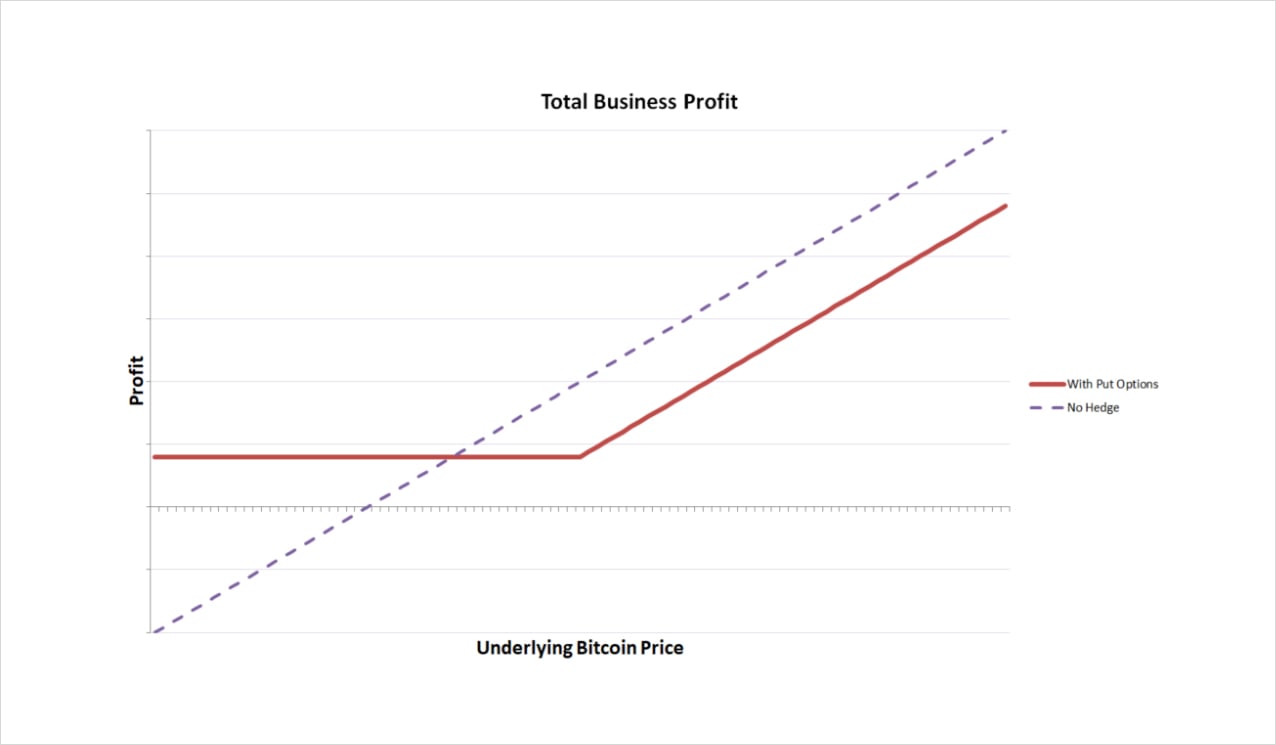

Hedging with put options

Another way a miner can hedge their expected income against decreases in the bitcoin price is with a bitcoin put option.

If the miner buys put options, they have the right to sell bitcoin at the strike price on the expiry date of the option.

Buying put options has an up front cost, this is the price (or premium) of the option. As this premium is the most that can possibly be lost though, once the put options have been purchased, there will never be any need to add further funds to the account to support the position.

It is also possible to choose from different strike prices. These will vary in price and give varying degrees of protection. The lower the strike price of the put option, the cheaper it will be, but the less protection it provides.

No matter which strike is chosen, the put option has an up front cost. However, this cost is known and fixed, making the puts an easier to manage hedge for the bitcoin miner.

One other benefit to using put options instead of futures to hedge, is that if the price of bitcoin actually increases significantly, the hedger will still benefit from this increase in value of their bitcoin. We will illustrate this further with a numerical example.

For a more detailed look at put options, check out sections 5 and 6 of the free Deribit option course here.

Example comparison

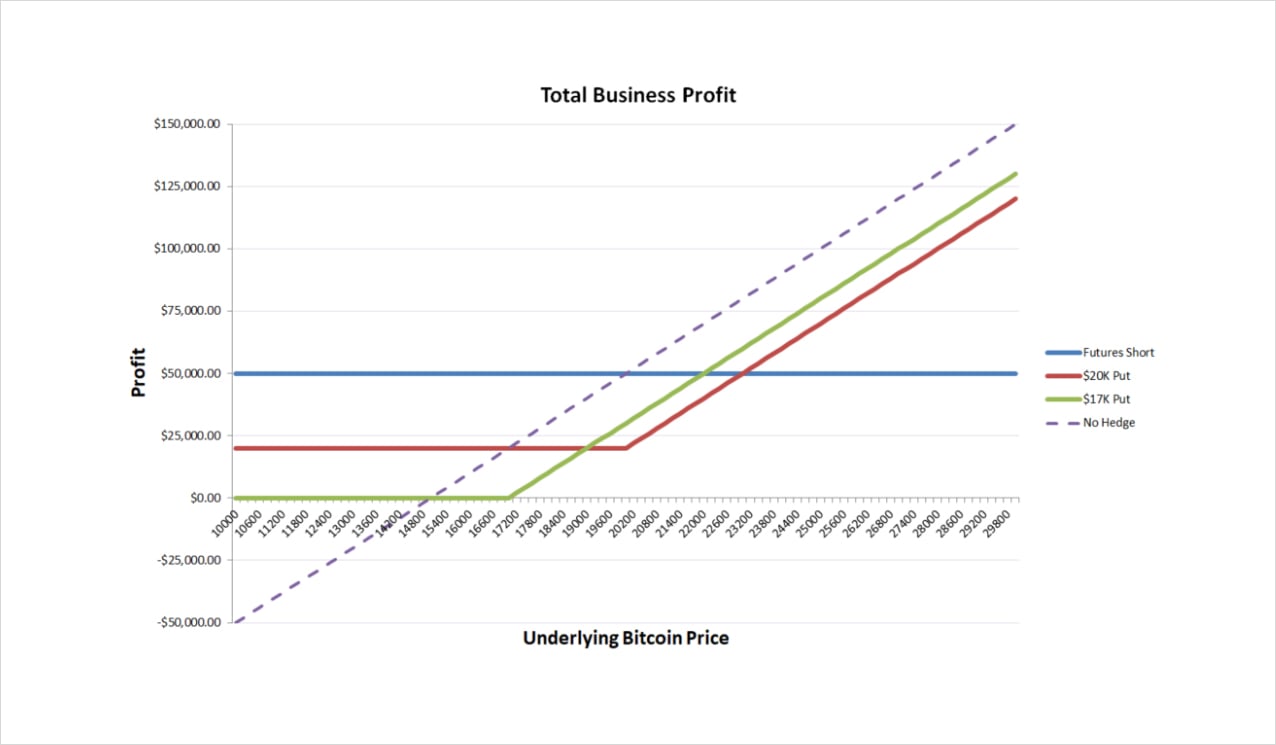

The best way to compare the two hedging strategies is to work through an example and see how they both perform in various scenarios.

Let’s assume we’re a bitcoin miner, and we would like to hedge the next 10 months of our expected income. We estimate that we are going to make 1 BTC per month from mining bitcoin for the next 10 months. Bitcoin is currently trading at around $20,000, and our monthly costs are $15,000. To keep this example simple, we will ignore mining difficulty adjustments and the cost of buying new machines etc.

Clearly with the current bitcoin price of $20,000, we expect to make about $5,000 a month in profit after our costs. Our costs will stay relatively stable, so if the price of bitcoin increases to say $30,000, this is great news for us as we will now make a $15,000 profit per month. However, if the price of bitcoin decreases to $10,000, we could be in some real trouble as we will start making a loss of $5,000 a month while the machines are running.

We need to protect against these possible losses by hedging our future bitcoin income somehow. We are going to compare the following three possible choices:

- A short position on a futures contract.

- Put options with a strike price of $20,000.

- Put options with a strike price of $17,000.

Each of these instruments expires in 10 months, and they have the following prices and position sizes when we open the hedge position:

- The futures short is opened at a price of $20,000 and with a size of $200,000. We will ignore contango in the futures contract to keep things simple.

- The $20,000 put costs 0.15 BTC (which is equivalent to $3,000 at the current price), and we will buy 10 of them for a total cost of 1.5 BTC ($30,000).

- The $17,000 put costs 0.10 BTC (which is equivalent to $2,000 at the current price), and we will buy 10 of them for a total cost of 1 BTC ($20,000).

Let’s look at what the dollar profit of the business looks like in a simplified example. In this example, we will continue to hold all 10 of the BTC we receive in mining income over the next 10 months in BTC. We will also hold 100% of our hedge until the end of the 10 months. At the end of the 10 months we then sell the 10 BTC into USD, close the hedge, and calculate our profit.

This chart shows the PNL of four different scenarios:

- Hedge with futures.

- Hedge with $20,000 put.

- Hedge with $17,000 put.

- No hedge.

The x axis shows the eventual bitcoin price at the end of the 10 months, and the y axis shows the total PNL.

No hedge

As we can see from the dashed purple line, without a hedge, our profit is a linear function of the underlying price of bitcoin. The higher the bitcoin price goes, the more profit we make, and the lower the bitcoin price goes, the less profit we make. Eventually once the bitcoin price moves below our monthly costs of $15,000, we start making a loss. The lower it goes, the larger the loss.

Futures hedge

At the other end of the spectrum, we have the futures hedge (blue line). By using the future we have locked in our profits of $5,000 a month for the full 10 months, resulting in a total profit of $50,000. We make this $50,000 no matter what happens to the bitcoin price.

The elimination of uncertainty around our profit, and certainly the avoidance of any losses, could be a very desirable feature of using the futures to hedge. However, there are a couple of things to bear in mind.

First, we no longer get any benefit if the bitcoin price increases. We have surrendered all our potential upside in order to gain stability.

Second, while there is no premium to pay to open the futures position, there will be margin requirements. We are required to keep enough funds in our Deribit account to meet the margin requirements of our position, and this includes any unrealised losses that the short position incurs. For example, if the bitcoin price increased quickly to $30,000 within the first month, we would need to have deposited at least $100,000 worth of bitcoin to cover the $100,000 in unrealised losses of the futures short.

If our business has plenty of excess reserves, this may still be a viable hedging strategy, but if we use any amount of leverage, then it requires monitoring and management so it may not be ideal.

Put hedges

The put hedges seem to get close to giving us the best of both worlds, though at a cost.

Because the put options don’t suffer any extra losses when the bitcoin price increases a lot, we are still able to retain most of the benefit of higher bitcoin prices. When the bitcoin price moves higher, PNL increases linearly, just as if we had no hedge. However, the PNL is always lower than the no hedge scenario by an amount equal to the cost of the put options.

When the bitcoin price decreases instead though, at first our PNL also decreases. However, once the bitcoin price has moved below the strike price of the put option, our PNL stops decreasing.

So, as with the futures hedge, we have put a floor on our PNL. This is of great benefit when the bitcoin price is much lower. Unlike the futures hedge though, we are still able to benefit when the bitcoin price is much higher.

The catch of course is that we must pay a premium for the puts up front. We can choose to pay a larger premium and gain more protection against price decreases (this would be the $20,000 put option in this example), or we can choose to pay a smaller premium which gives us less protection but also lowers the initial cost (the $17,000 put in this example).

Which choice is best?

It is up for each miner to decide which hedging strategy best suits them and their objectives. Some factors that will influence the decision include:

- Their risk tolerance (how much protection they want).

- Available capital.

- Their view on the market, if they have one.

- Their desire and ability to manage the hedge.

Other choices

To keep the example as simple as possible, the calculations were made assuming everything was held for the full ten months. In practice, a miner will likely do something with their income as they earn it, while also adjusting their hedge. For example, if after the first month we have indeed received 1 BTC in income, we could then sell this 1 BTC into USD and also sell back one of the put options, depending on which hedge we have chosen.

Or instead of closing this portion of the hedge entirely, we could roll it out to another expiry to hedge yet more of our expected future income.

We could also choose to hedge our income on more than one expiry. In the example we hedged using puts that all expired in 10 months, but there is no reason we couldn’t hedge next month’s expected income with an option that expires in 1 month. And hedge the income we expect to make in 3 months with a put that expires in 3 months etc. Doing so will require a little more trading, but it will also result in a much lower initial cost. This is because the 3 month option will be considerably cheaper than the 10 month option with the same strike price, and the 1 month option will be cheaper still.

Alternatively, if we are happy to give up some of our potential upside, we could fund the purchase of the put options by selling some call options above the current price, turning our hedge into a bearish risk reversal. This would cap our upside if the call strike is breached, but also dramatically reduce the cost of the puts, maybe even to the point where we are paid a small amount to put the position on. As with the futures short, this would require extra capital to use as margin for the short calls.

It is also possible to use a mixture of options and futures of various expiry dates and sizes. The hedge positions can be fine tuned to suit the needs and expectations of the business.

Summary

While also popular with speculators, derivatives like options and futures offer other market participants useful ways to hedge the risks faced by their businesses.

Futures contracts offer a way to ‘lock in’ a price at a future date, with no initial premium to pay. Though enough margin must be kept on the exchange to support the position at all times, and this amount can grow significantly if the position has unrealised losses. A hedge with futures may suit a miner who is bearish on the underlying price but has healthy cash reserves to support the futures short should the price increase.

Put options offer a way to buy protection from prices going below a certain level. This protection comes with an initial cost, but the maximum cost is known up front. With different strike prices and expiries to choose from, it’s also possible to tailor the hedge to meet specific requirements. A hedge with puts may suit a miner who wants a predictable fixed cost hedge that they don’t have to manage, and who wants to retain access to the benefits of the underlying price increasing.

AUTHOR(S)