Once again, Ether’s volatility smile is skewed further towards OTM puts than BTC’s across the term structure. This divergence has been growing since the 5th May, having grown and resolved twice already in the past 30 days which reflects the ever-changing sentiment around ETH. The latest divergence is a result of an increased implied volatility in OTM puts, with the implied volatility of OTM calls priced at similar levels by the derivatives markets of both headline crypto-assets.

Vol Smile Skew

Figure 1 Term structure of BTC (yellow) and ETH SABR Rho parameter, a measure of the volatility smile’s skew towards OTM puts or calls at a 16:09 UTC 9 /5/23 snapshot. Source: Block Scholes

- The volatility smiles of both BTC and ETH options markets are skewed further towards OTM puts than OTM calls, expressing an overall negative sentiment about the underlying spot prices.

- Ether’s skew term structure shows a significantly stronger pessimistic sentiment, as downside protection trades at an implied volatility premium to upside optionality.

Developing Dislocations

Figure 2 Hourly BTC (yellow) and ETH (pale purple) 25-delta Risk Reversal, another measure of volatility smile skew, over the past 30 days. Source: Block Scholes

- We have seen the skew of these two assets diverge several times over the past 30 days, particularly at the beginning and middle of April.

- The post-Shapella rally saw ETH’s risk reversal reach 0% at a 1 month tenor, and the second divergence resolved with BTC’s skew trading sideways as ETH’s rose to meet it.

- The latest dislocation occurs as both assets are reporting a downwards trend.

Calls Stay Put

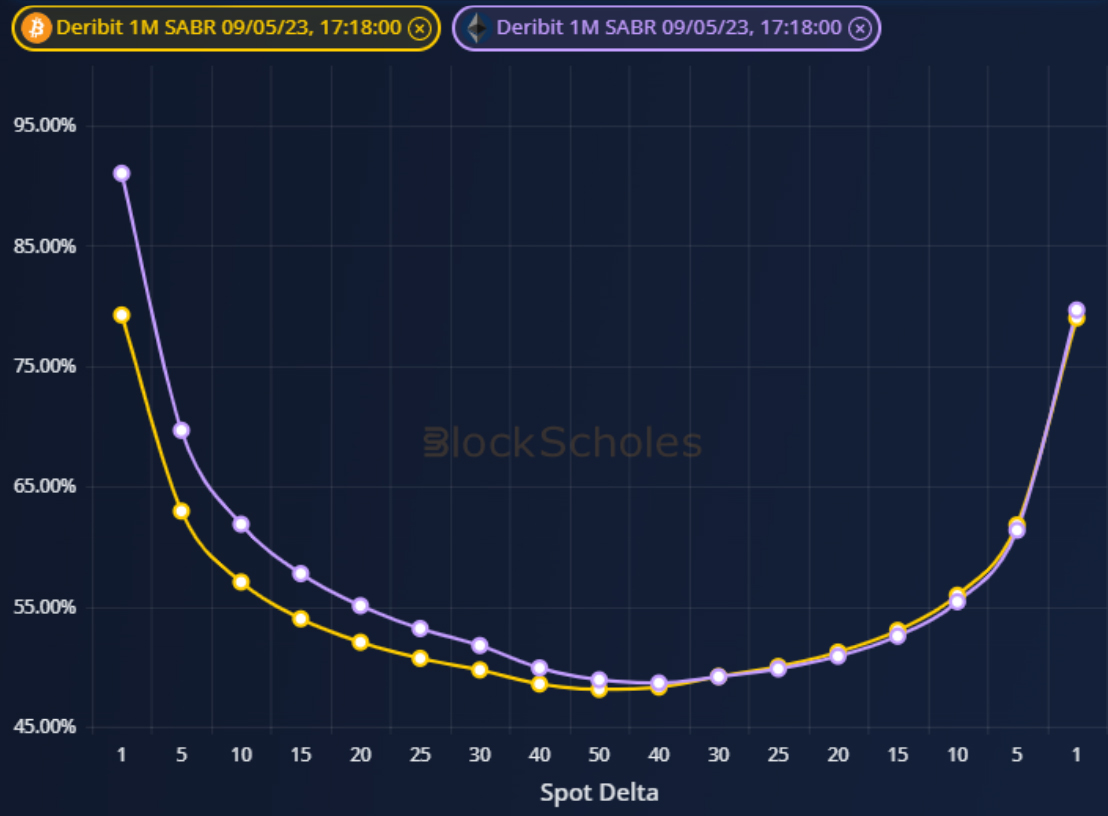

Figure 3 Volatility smiles in the delta domain for BTC (yellow) and ETH (purple) at a 16:18 UTC 9/5/23 snapshot. Source: Block Scholes

- The sharper skew towards OTM puts in ETH’s volatility smile is due to an implied volatility premium in it’s OTM puts compared to those of BTC’s.

- OTM calls are priced at similar levels of implied volatility for both assets.

AUTHOR(S)