Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Derivatives market metrics report mixed sentiment across instruments for both assets. ATM implied volatility continues to sag lower, visiting all-time lows in the low 30s for ETH and nearing all-time lows for BTC. The skew of the latter asset’s volatility smile joins ETH’s in assigning a volatility premium to downside protection, whilst both perpetual swap contracts imply excess demand for long exposure through the derivative contract by reporting positive funding rates paid by long position holders.

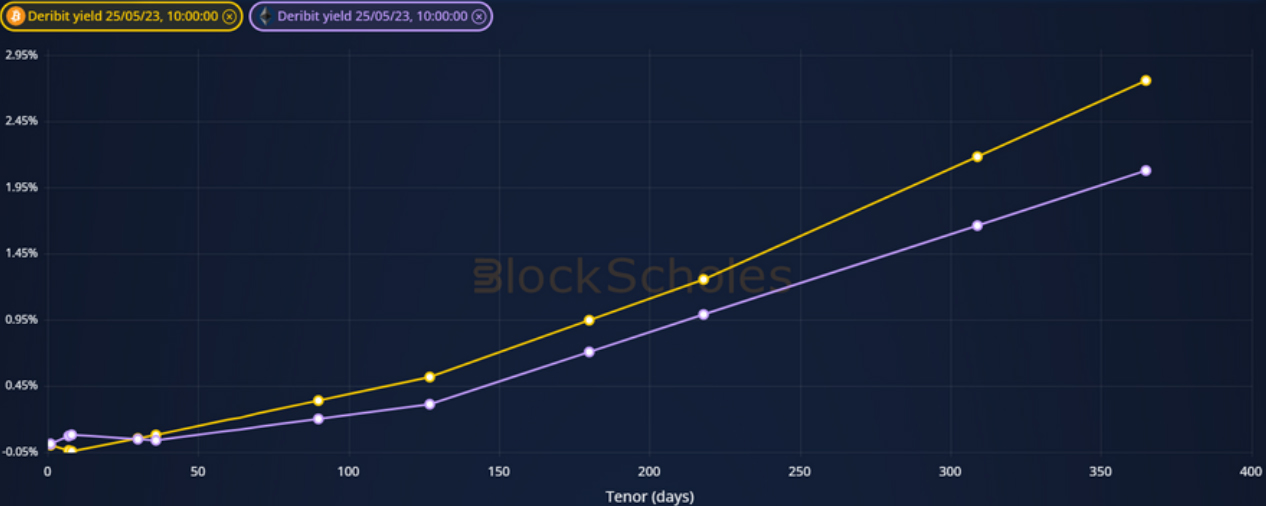

FUTURES IMPLIED YIELD TERM STRUCTURE.

VOLATILITY SURFACE METRICS.

All data in tables are recorded at a 10:00 UTC snapshot unless otherwise stated.

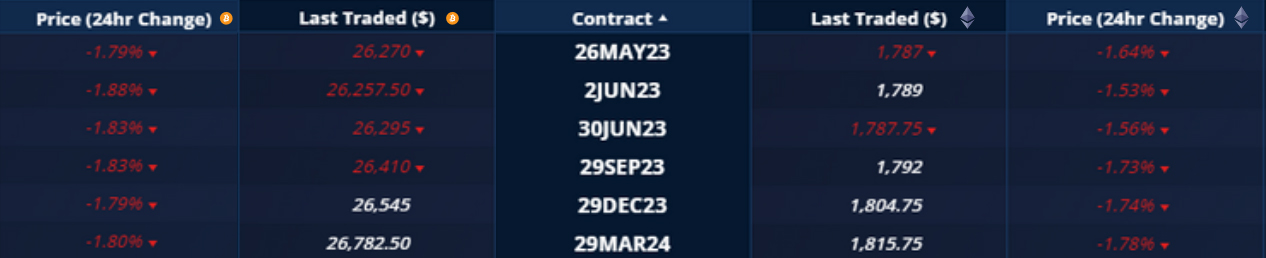

Futures

BTC ANNUALISED YIELDS – short term yields saw strong volatility this week, rising strongly before turning negative in the last 24 hours.

ETH ANNUALISED YIELDS – have moved inversely to those of BTC in the last 24 hours, reporting positive yields at shorter tenors.

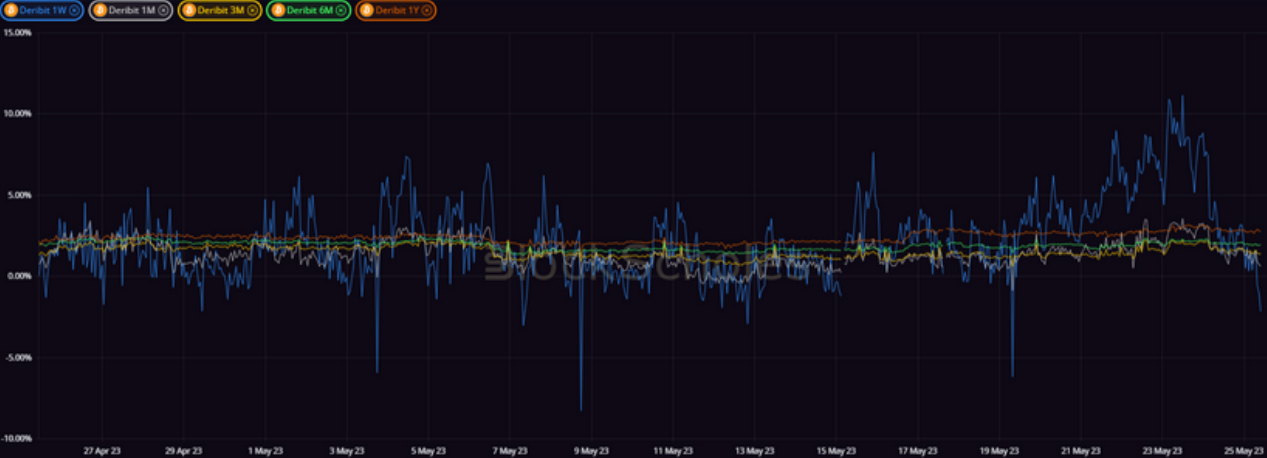

Perpetual Swap Funding Rate

BTC FUNDING RATE – sees a strong positive spike this week in contrast to its meagre values over the past 30 days.

ETH FUNDING RATE – also implies excess demand for long exposure through the perpetual swap, but records a lower funding rate than BTC.

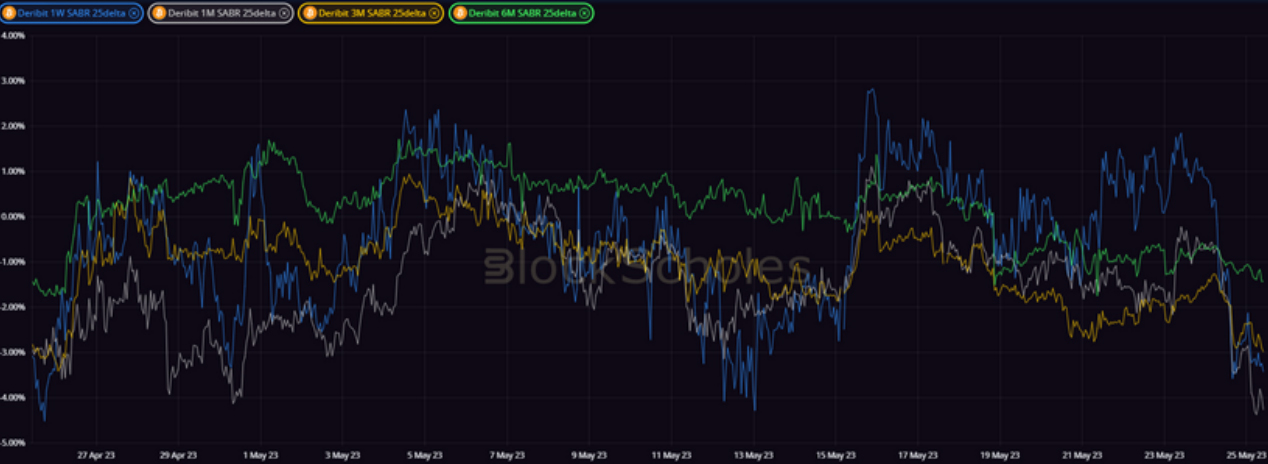

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – continues to trade in a tight range between 40% and 50%, near to all-time lows.

BTC 25-Delta Risk Reversal – has reversed a skew towards OTM calls at shorter tenors to trade negative across the term structure.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – drifts lower still, with shorter tenors dipping into the low 30s this week.

ETH 25-Delta Risk Reversal – also trades negative, but with a trend towards a neutral skew at shorter tenors recorded in the last 24 hours.

Volatility Surface

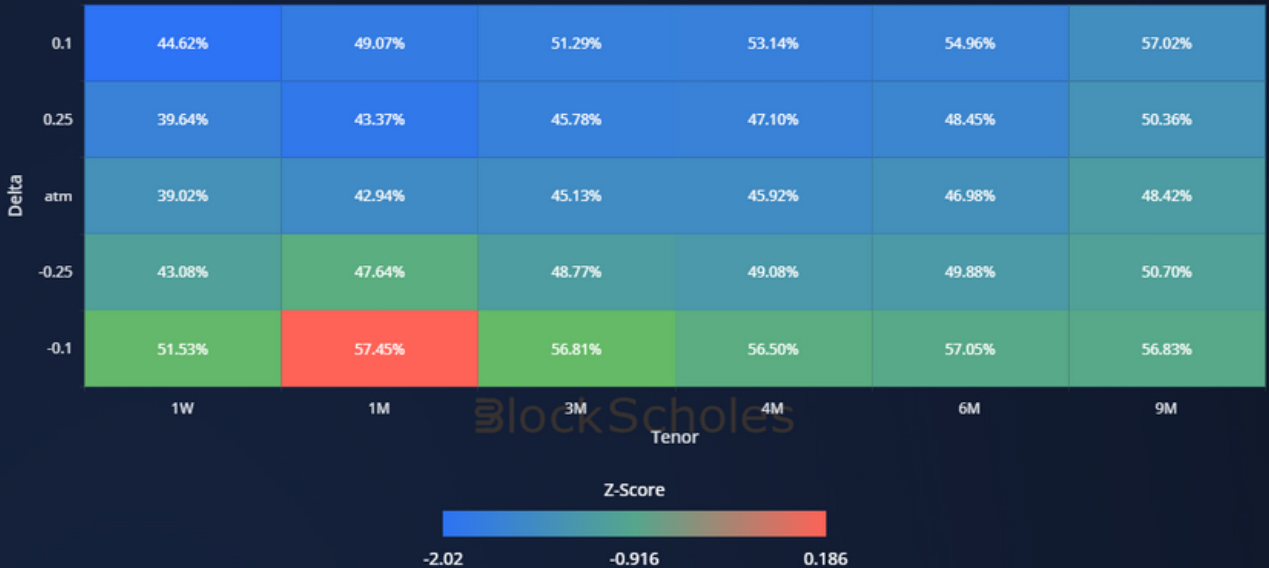

BTC IMPLIED VOL SURFACE – cools at all points on the surface except OTM puts, which see a small increase in implied volatility at a 1M tenor.

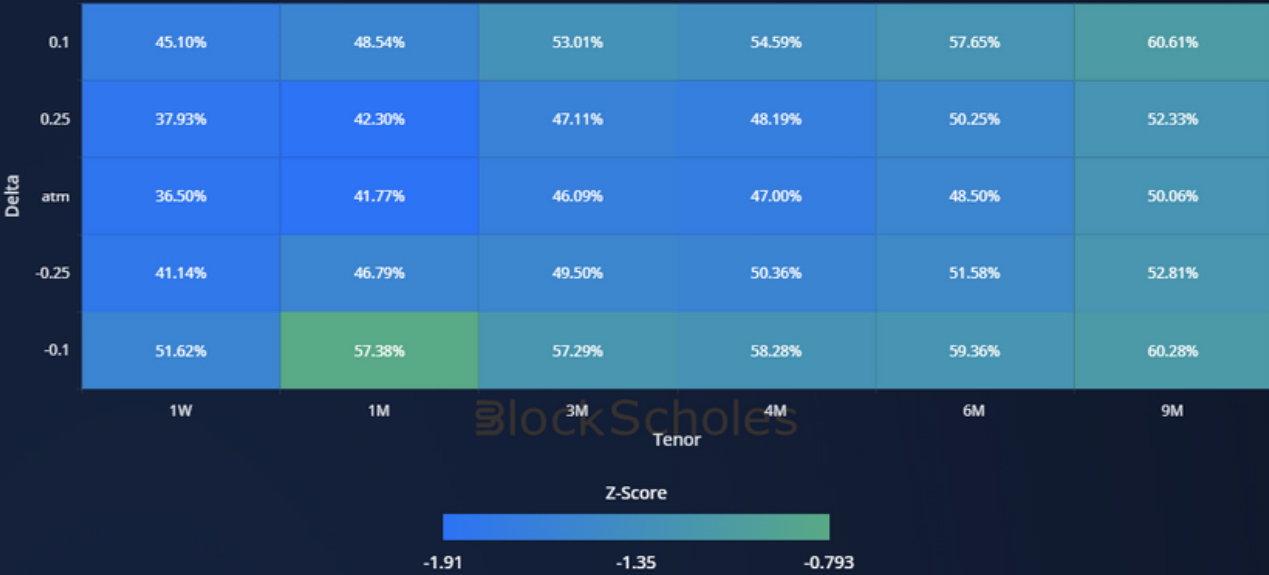

ETH IMPLIED VOL SURFACE – reports the weakest decrease in implied vol at a 1M tenor, 10-delta put, but with a fall in IV elsewhere.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration

Volatility Smiles

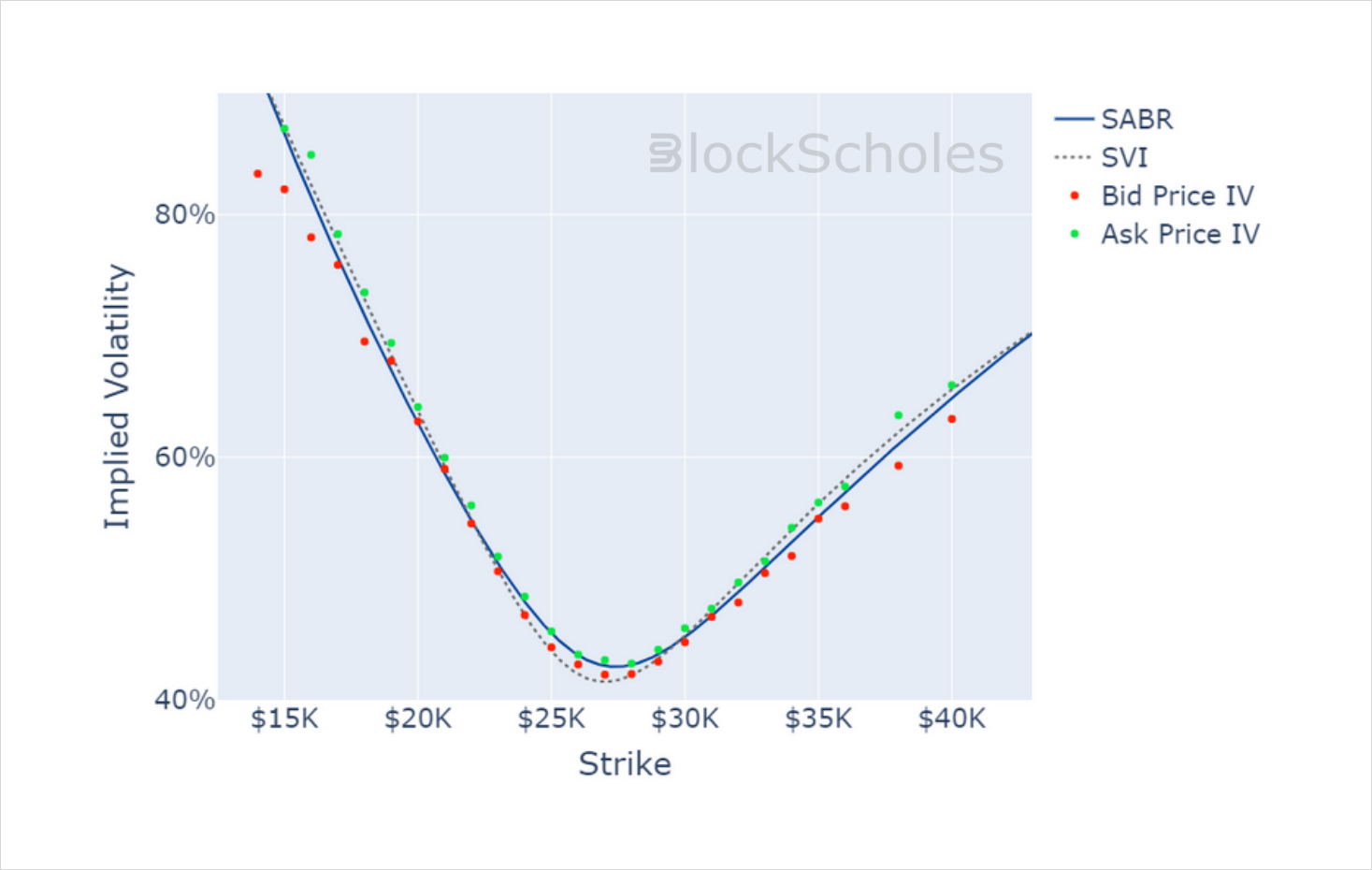

BTC SMILE CALIBRATIONS – 30-Jun-2023 Expiry, 10:00 UTC Snapshot.

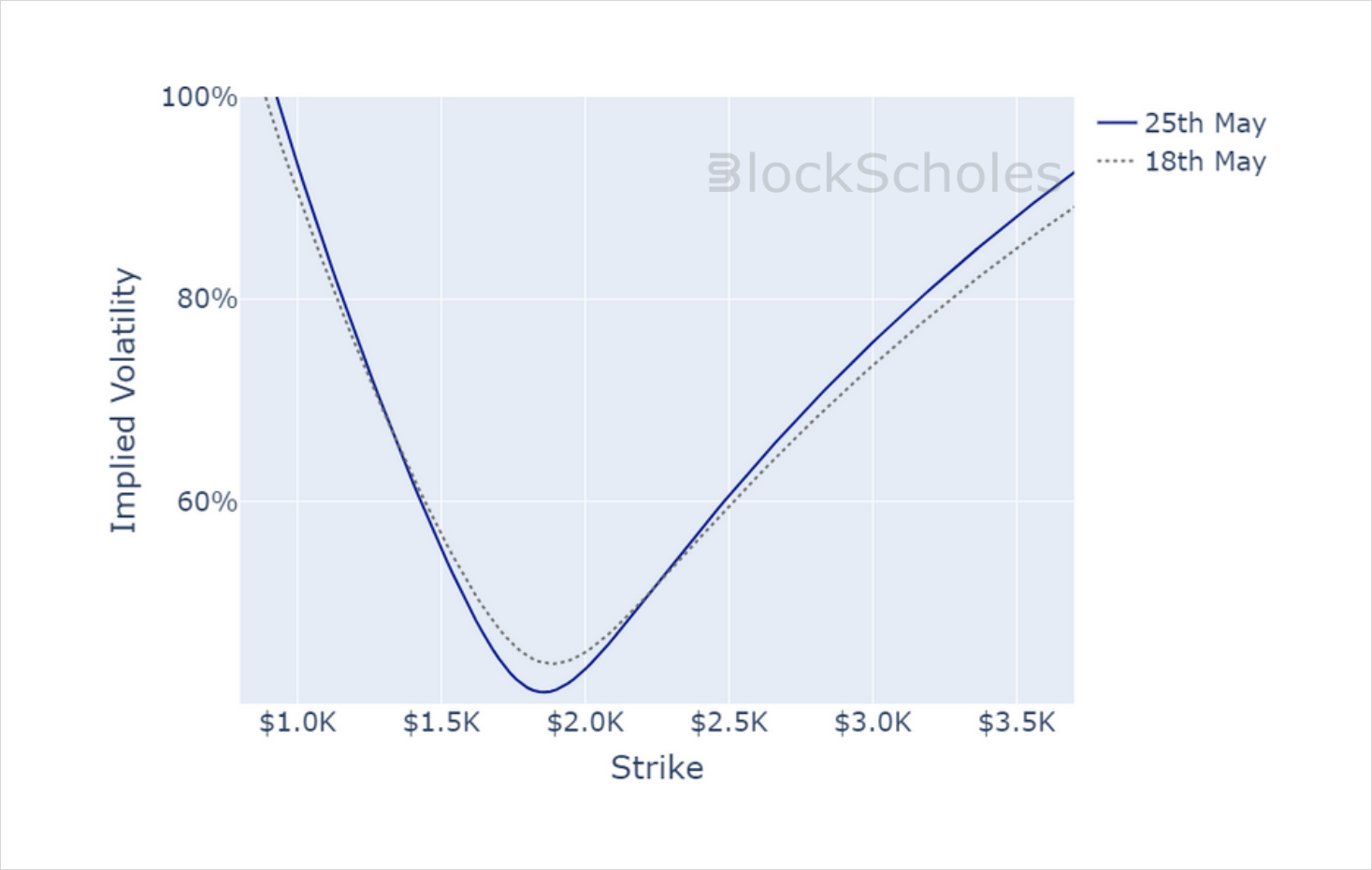

ETH SMILE CALIBRATIONS – 30-Jun-2023 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

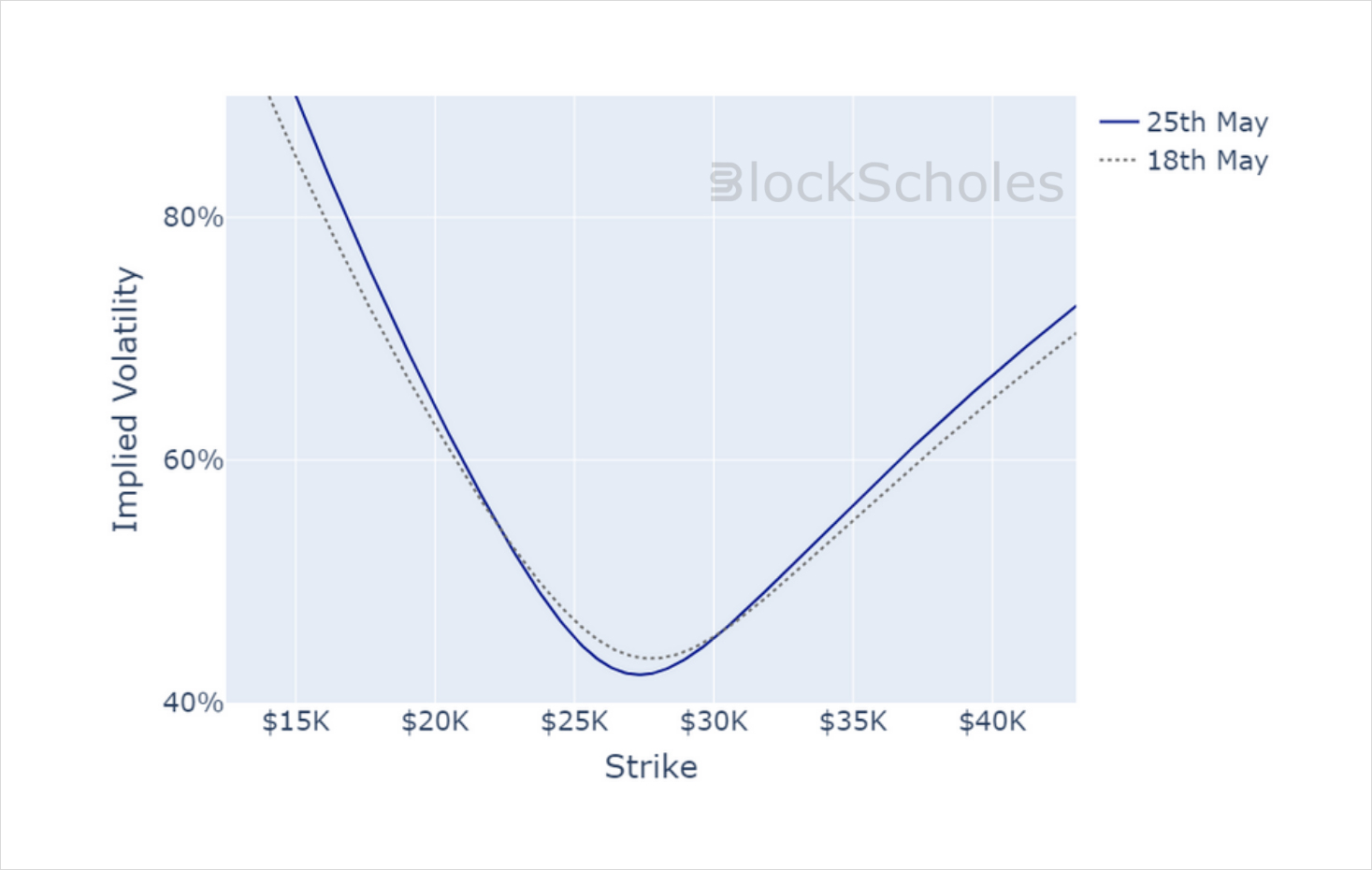

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)