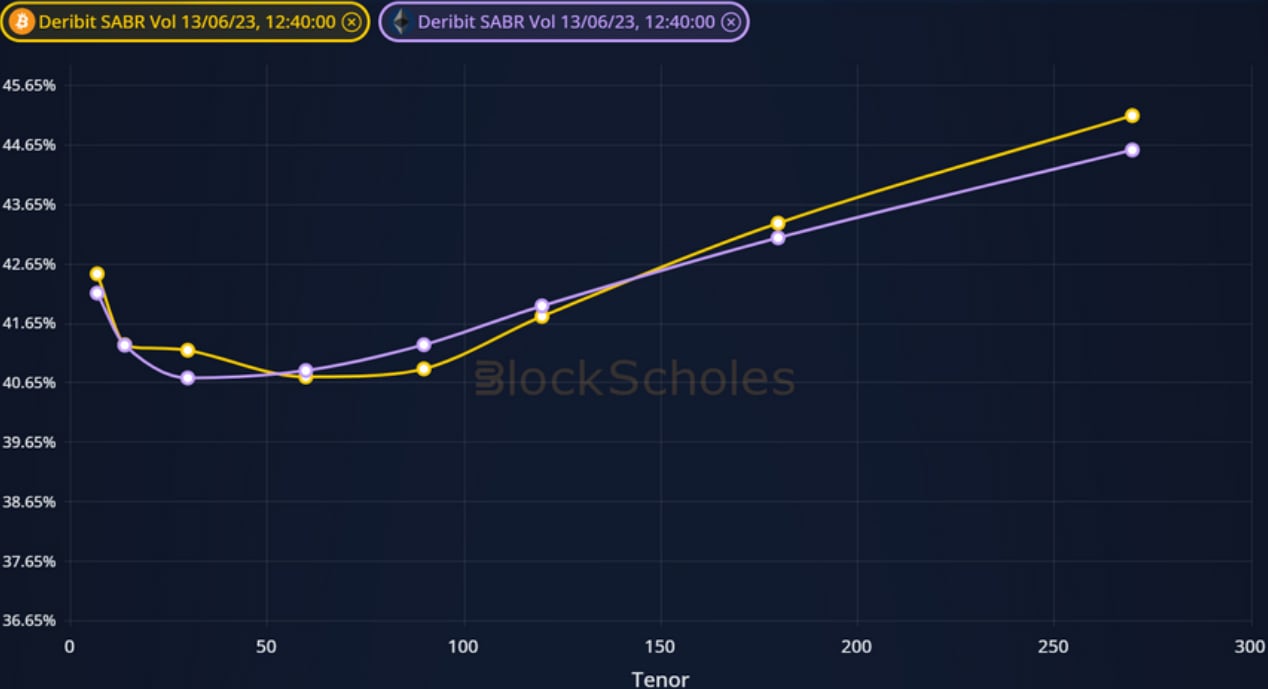

The term structure of ATM implied volatility is somewhat inverted, with short term volatility priced higher than at 1 and 2 months, with similar outright levels for both BTC and ETH. This follows a month of the latter asset’s implied volatility trading near to or below that of BTC’s in contrast to the years long trend of higher vol pricing. ETH’s smile is slightly more skewed towards puts, with the vol smiles of both assets at similar outright levels ahead of a big week of macroeconomic events.

Term Structure of ATM Implied

Figure 1 Term structure of BTC (yellow) and ETH (purple) ATM implied volatility at a 12:40 UTC 13/6/23 snapshot. Source: Block Scholes

- The term structure of BTC and ETH ATM implied volatility is somewhat inverted, with options at tenors shorter than 1 months at elevated levels.

- Options at tenors between 1 and 2 months are priced at the lowest levels of implied vol on the term structure.

- Outright levels remain near the lower bound of their historic range despite a recent pick up in realised volatility.

ATM Implied Vol Time Series

Figure 2 Hourly BTC (yellow) and ETH (purple) ATM implied volatility at a 1 month tenor over the last 30 days. Source: Block Scholes

- ETH implied volatility trades above that of BTC after reversing a years long trend of pricing for significantly higher volatility.

- The implied vol of both assets now trades between 40% and 45% at a 1 month tenor.

- These levels are similar to those that we saw in the days before the previous FOMC meeting in May.

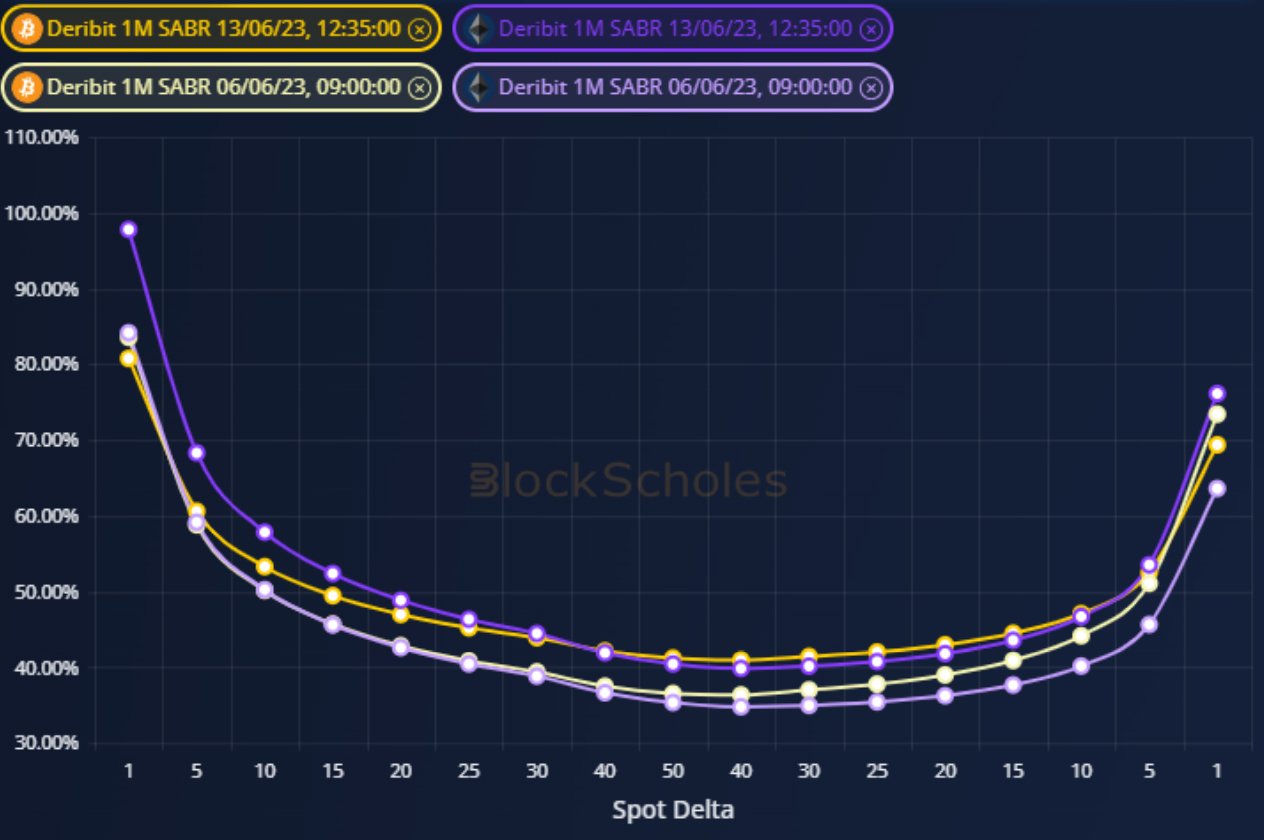

Vol Smile Skew

Figure 3 BTC (yellow) and ETH (purple) volatility smiles at a 1 month tenor, for a 12:35 UTC 13/6/23 snapshot and one week ago at a 09:00 UTC 6/6/23 snapshot. Source: Block Scholes

- The volatility smiles of the two assets are at higher overall levels than one week ago.

- Since then, ETH OTM puts have outperformed those of BTC, with their implied volatility ending the week slightly higher in the wings.

- However, the overall levels of implied volatility remain tightly linked for both assets across the delta domain.

AUTHOR(S)