The brief depeg of stablecoin TUSD’s price from the US dollar was exploited by onchain short sellers. Onchain data show that traders borrowed TUSD from Aave’s lending market in order to sell it short on centralised and decentralised exchanges. Following the depeg, traders were able to buy the token back at a lower price in order to repay their loan. TUSD’s price has since floated above it’s $1 price target, providing the opportunity for traders to perform the same trade should they hold the view that the peg will eventually be regained.

Depeg Volatility

Figure 1 Hourly spot price in US dollars of TUSD on centralised exchanges Source: CoinMarketCap.com

- Stablecoin TUSD saw significant price volatility around it’s price peg to the US dollar during the last month.

- This followed news that their asset custodian, Prime Trust, was seeking to raise $25M of emergency liquidity.

- Issuers TrueUSD have since reassured users of their diversified banking partners and alternative services for processing mints of new tokens and redemptions of existing TUSD.

- TUSD’s spot price has since stabilised close to its $1 peg.

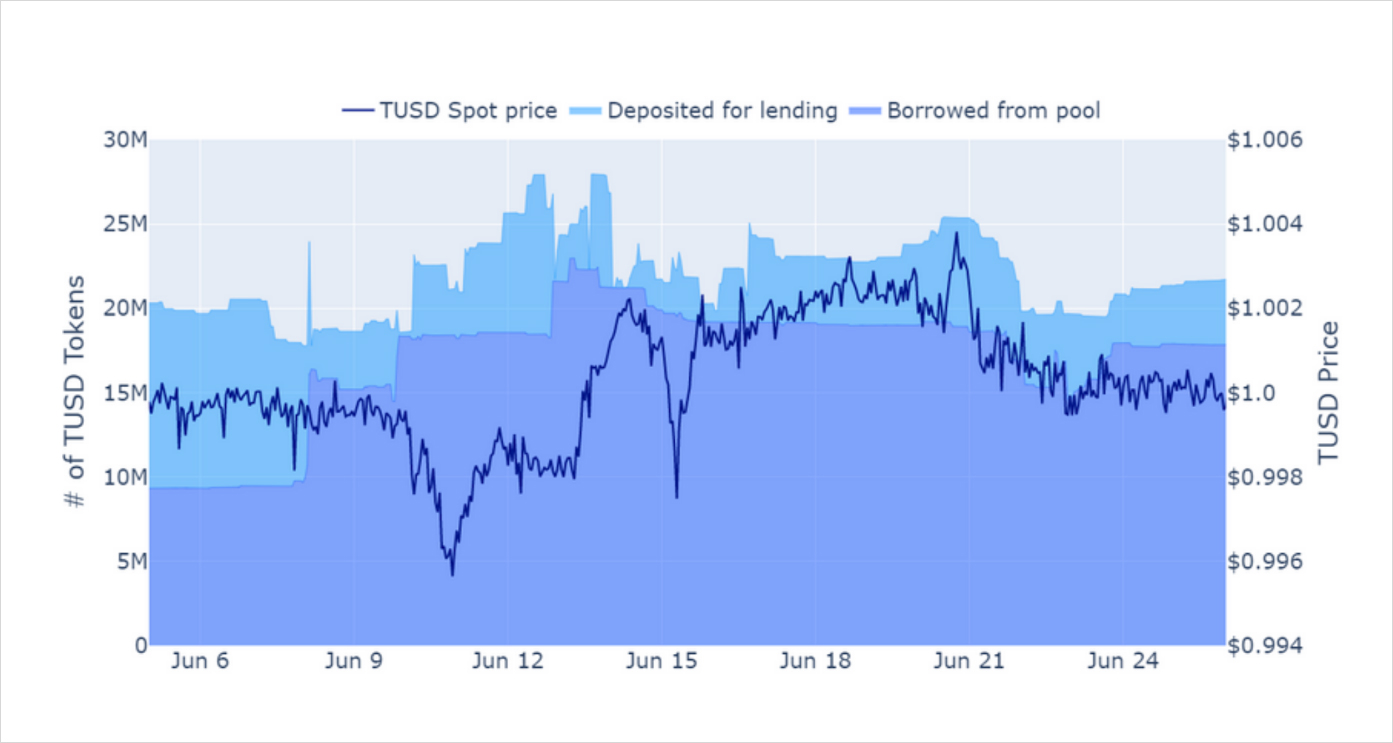

Figure 2 Hourly TUSD borrowed (dark blue area) from Aave’s lending market and TUSD deposited but available for borrowing (light blue) on a stacked area chart sine 5th June 2023, alongside the spot price of TUSD on centralised exchanges (dark blue line). Source: Aave, CoinMarketCap.com, Block Scholes

- Onchain lending data show that borrows from Aave’s lending pool totalled 15.4M TUSD tokens in the hours before the first significant depeg on the 9th June.

- We also find evidence that traders later borrowed TUSD in order to sell it short on decentralised spot exchanges – at times as late as the 21st June.

Spot Dexs

Figure 3 Hourly crvUSD (yellow) and TUSD (blue) reserve levels in Curve’s spot DEX pool since the 5th June 2023. Source: Curve.fi, Block Scholes

- Automated Market Makers (AMMs) quote prices for spot token pairs by considering the ratio of the reserves in its liquidity pool.

- The higher the supply of a token in a liquidity pool, the lower the price that it quotes.

- Figure 3 shows the price of TUSD against crvUSD, Curve’s own stablecoin.

- The price on Curve’s pool moved fast alongside the fall in price across other exchanges as recorded by CoinMarketCap’s market index on the 10th June.

- This is because the higher price on the DEX was exploited by arbitrageurs who bought at lower prices on CEXs and sold at higher prices to the pool, increasing its supply of TUSD and pushing down it’s price.

AUTHOR(S)