The Quick Transition from SEC Concerns to ETF Pursuit

In light of BlackRock’s ETF application and the launching of the professional-grade EDX exchange, the cryptocurrency market continues to climb, with the anticipation of more institutional engagement serving as a significant catalyst. The past two weeks have witnessed an inflow of $334m into crypto products, led by Bitcoin, which remains a firm favourite among investors.

The announcement that Michael Saylor’s MicroStrategy had purchased an additional 12.3k BTC in Q2, and that Fidelity Investments has joined BlackRock in the pursuit of launching a Bitcoin ETF, has furthered fuelled the optimism around BTC and the broader crypto market.

Whereas the focus was previously on the potential impact of an SEC crackdown on the crypto industry, it has now moved to whether major institutional firms will dominate the industry and who else could benefit. This change is clear in the recent Bitcoin price movements.

Interestingly, Bitcoin has displayed a negative 30-day rolling correlation with U.S. indices, unseen since January 2021. This suggests that U.S. traders are specifically investing in Bitcoin for distinct reasons, the main one being they foresee increased institutional adoption due to diversification perks.

While there’s a growing interest in crypto and the stock markets look promising in July, we need to watch out for key macro news this Friday: the US NFP report. A consistently strong employment report may prompt the Fed to stick with its hawkish stance in their next FOMC on 26 July.

ETH Implied Vols Outperform As Realized Improves

As anticipated, last week saw a decrease in realised volatility leading into the expiry, with Bitcoin’s 7- day realised dipping into the 30s. Despite a brief uptick due to a decent rise in the spot price post- expiry, it faded as markets remained stable during the 4th July holiday. Overall, realised volatility fell by about 5 vols last week.

Short-term implied volatility in Bitcoin has gradually fallen over the week, though it rebounded slightly from its lowest point last Friday. Ethereum’s volatility is somewhat higher as it has seen more movement since Friday’s expiry, marking a notable improvement in realised volatility for the first time in a while.

Presently, Ethereum is displaying flat carry, while Bitcoin shows a positive carry of around 4 vols as realised volatility has declined but options buying has maintained a bid for implied volatility.

If the bullish price trend continues, we could expect volatility to remain steady, especially above 31k in Bitcoin and 2000 in Ethereum. However, if prices fall below these levels, volatility might take a hit after the US jobs data release this weekend.

ETH Term Structure Moves Up Uniformly

The Bitcoin term structure experienced minor changes this week, with a small decline at the front end while medium-term volatility edged slightly higher. Ethereum’s curve moved up almost uniformly due to improved realised volatility and the return of buyers.

The Ethereum/Bitcoin volatility spread recovered, notably in the front end of the curve where the 1- month Ethereum volatility has surpassed Bitcoin’s. However, the back end of the curve, remembering Bitcoin’s dominance, still has Ethereum trading under Bitcoin from December 2023 and longer maturities.

For Ethereum’s volatility to consistently trade above Bitcoin’s across all expiries, we would need to witness Ethereum outperforming in terms of realised volatility for several more weeks, leading the entire curve to normalise.

Skew In Call Premium Across The Curve

The Bitcoin skew remains in a call premium across the curve, though the front end is considerably flatter than the back. The long-term Bitcoin call skew reached a peak near 8, but has since returned to around 5 points. We believe the front end, closer to 2 vols, could easily flip back towards puts if we see Bitcoin drop below 30k.

Ethereum skew has exhibited a lesser call premium and maintains a flatter term structure of skew, with all expiries around 2-3 vols for calls over. Back-end call premium has been particularly erratic due to significant call flows affecting the market.

Given the flow of upside buying, we anticipate longer-dated call skew to remain solid across the crypto options markets. However, we believe front-end put skew is likely undervalued and could be highly sensitive to any decrease in spot prices. Although implied volatilities remain relatively low, we may see them react in either direction, though this year they’ve primarily spiked during rallies.

Option Flows And Dealer Gamma Positioning

Bitcoin option flows are starting to normalise as markets take a breather following the year’s largest expiry so far. However, a bullish bias remains, evidenced by significant outright call purchases across the 28th July (32k), 25th August, and 29th September (35k) dates.

In Ethereum, large buyers swooped in after Friday’s options expiry. The most substantial purchase was the 29th December 1900/2500 call spread, involving over 60k options.

Bitcoin dealer gamma pick back up towards flat following Friday’s massive expiry. The 30k strike had been a significant short strike, but now that it’s gone, open interest has been climbing higher in July expiries. This creates the condition where dealers to get shorter on Bitcoin’s upward trend.

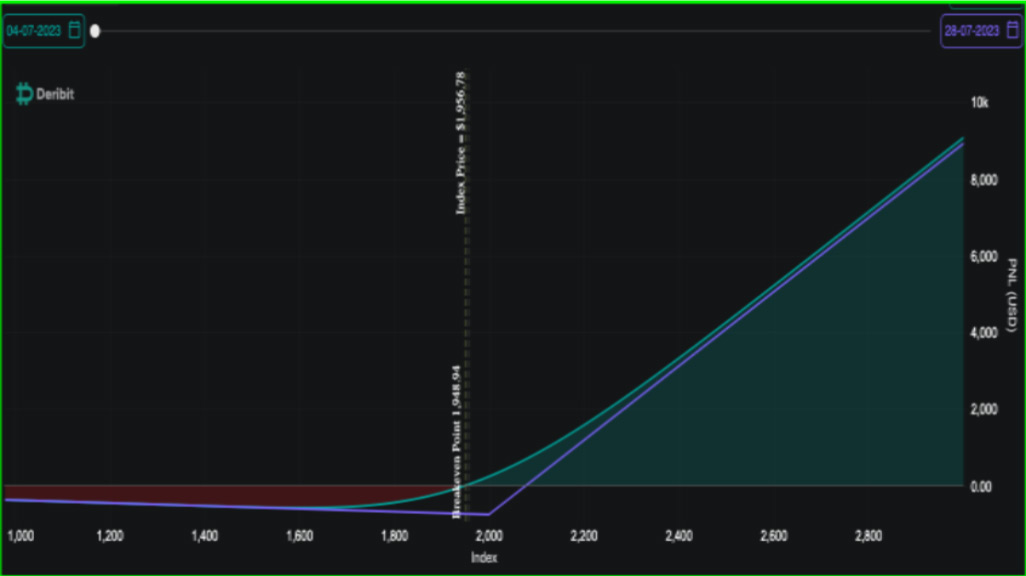

Ethereum gamma positioning has dropped to near zero after the 30th June 1800 and 1900 strikes rolled off. These strikes had been restricting Ethereum’s upward movement, but once the gamma was released, the market was able to swiftly surge higher, heading towards 2000. This now represents a considerable short strike for dealers.

Strategy Compass: Where Does The Opportunity Lie?

We think owning outright calls in ETH looks like a decent risk/reward as it still has plenty of room to catch up to BTC performance and there is less gamma overhang now. With the big boys getting involved in crypto, talk of an ETH ETF can’t be that far away.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)