In this week’s edition of Option Flows, Tony Stewart is commenting on the market movements, and what to expect with the upcoming CPI.

September 13

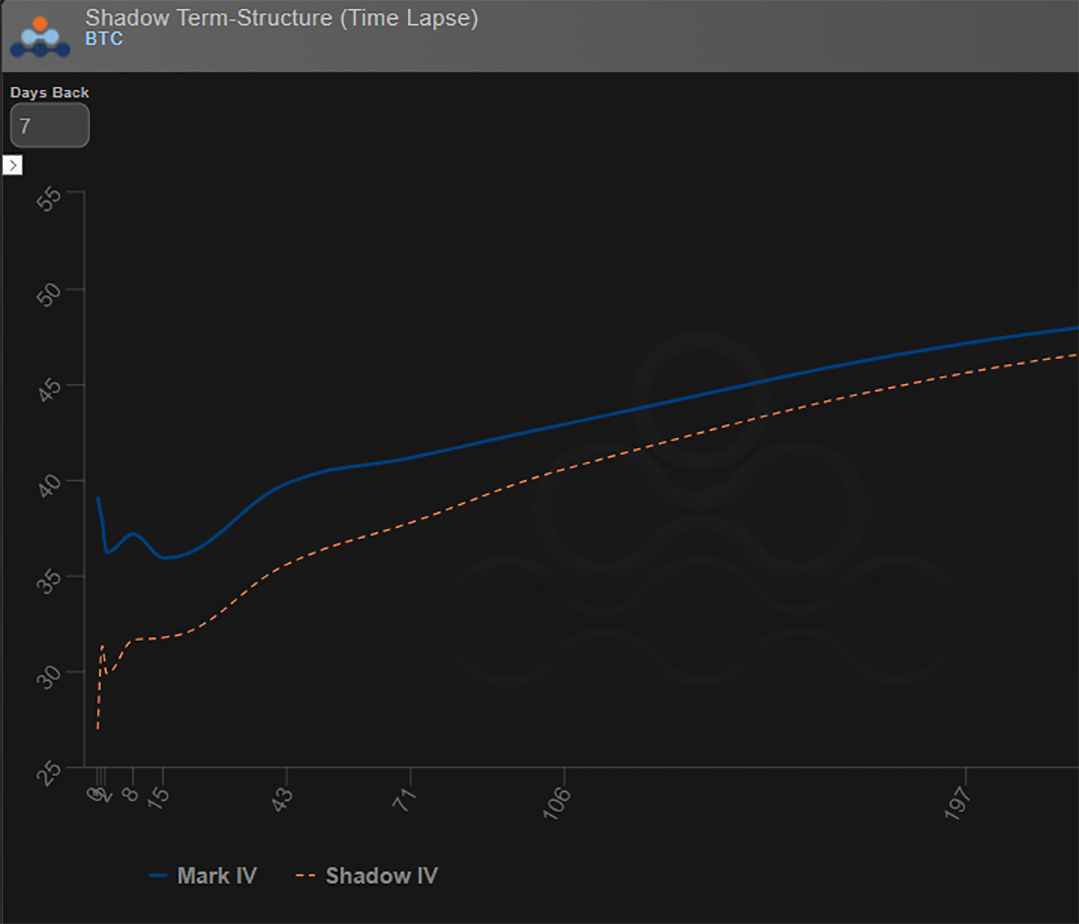

Reminder of how Vol markets are supposed to act with Spot markets moving and Implied Vol responding.

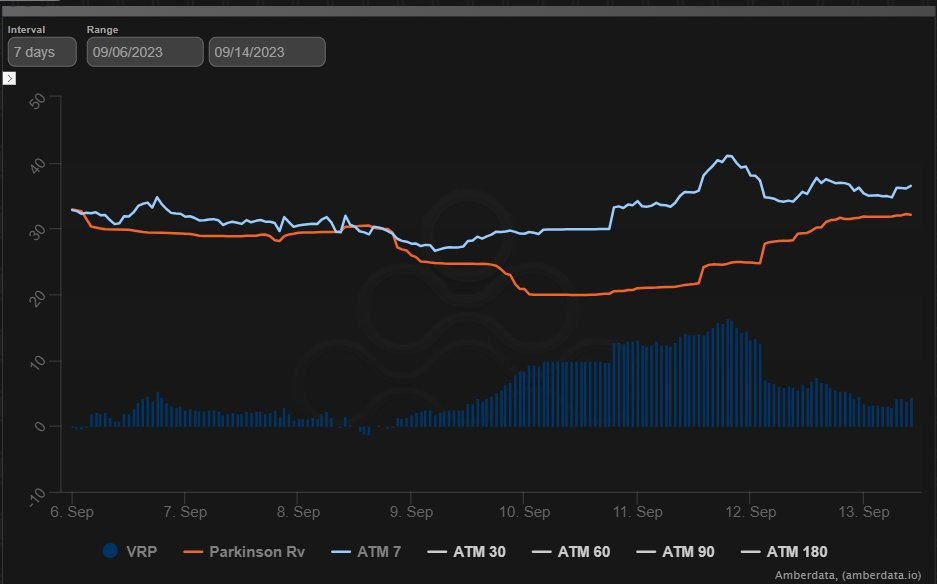

Continued buyers from fast money accounts, buying Sep Puts on breaks and Sep Calls on rallies.

Some may be MM scrambling for Gamma as the Oct Call buyer adds OTMs.

CPI next.

2) Last week’s buyer of OTM Oct 28-32k Calls has continued, but aimed higher at 31-33k Calls, less size than last week, but squeezed MMs shorts as BTC round-tripped 2.5k points around 26k level.

That’s Short-Gamma pain, and furthermore, front-month expiries have squeezed higher.

3) Adding to that, US CPI to be released within the hour has created some long Option punts, and forced short-covering of Gamma by MMs.

Looked at closely by the FED, this data is rarely material enough to make a decisive change in policy, but the market attaches a move (threat).

4) In sympathy, the rest of the term-structure has risen, despite far less Option demand.

Given this area in Nov/Dec/Mar expiries is where LPs are long from the OWE (Over-Write-Entity) we await if this move is sustained should MMs get back their short-gamma and relax again.

View Twitter thread.

AUTHOR(S)