Synopsis: The Fed has been on hold since July 2023. When the Fed paused the hiking cycle in 2019, Bitcoin prices rallied +400%.

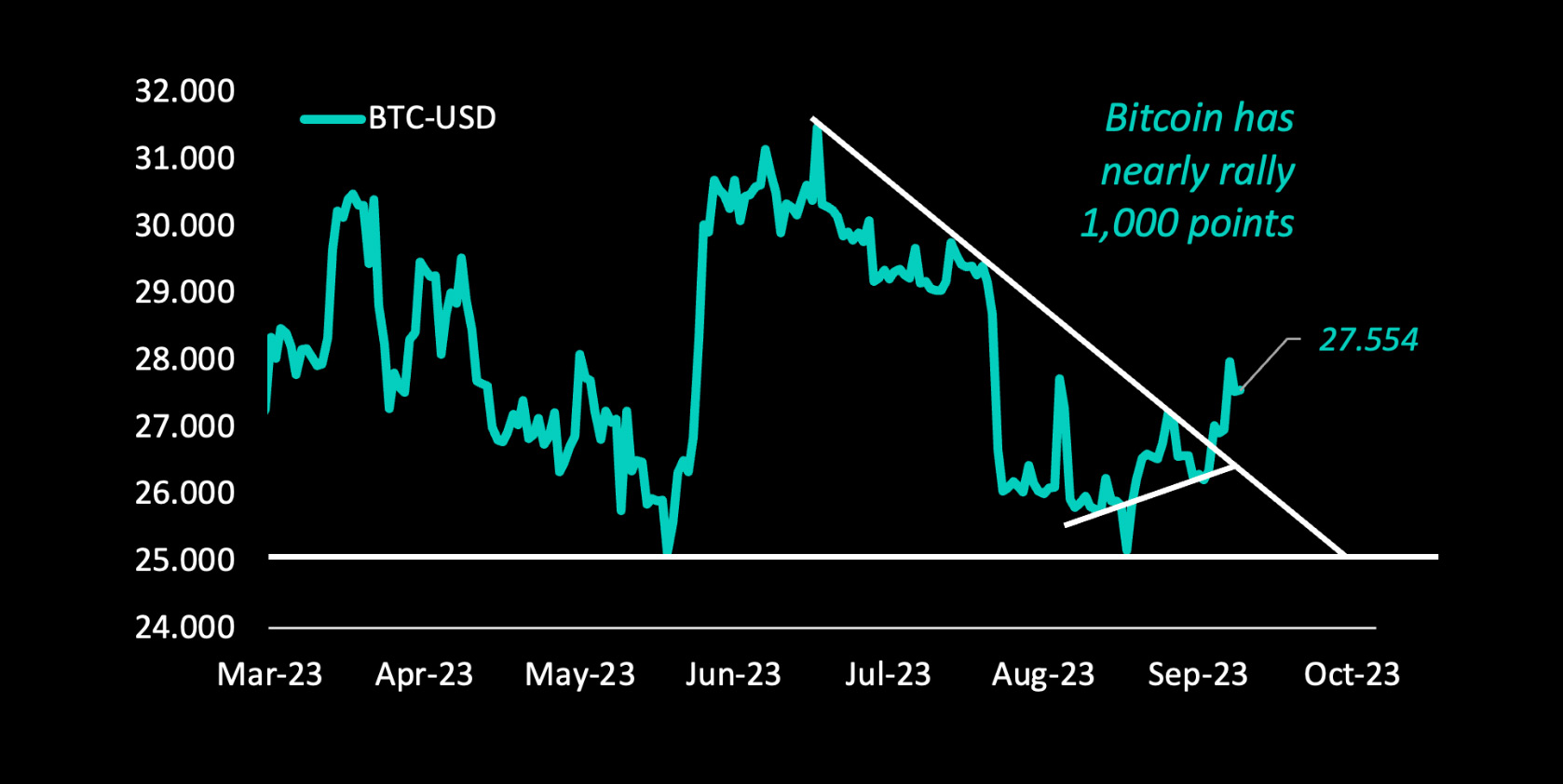

As expected last week, Bitcoin prices have broken out of their short-term downtrend and could potentially target the 31,500 year-to-date highs. Higher oil prices and the relentless rise in US 10-year treasury yields could threaten financial markets as US central bankers might verbally pressure markets to expect hawkishness from the Fed.

But with inflation (3.67%) trading already materially below the Fed Funds rate (5.25%-5.50%), we would expect that the Fed would remain on hold for the next 1-2 quarters and assess the impact of their rate hikes on the economy.

Buying short-term call spreads (29,000 / 32,000) might be the optimal strategy for the next month-end expiry on October 27, 2023. The 29,000 calls are priced with an implied volatility of 33.4%, while the 32,000 calls are priced at 39.4% vol.

During the last FOMC meeting, central bankers were hawkish and managed that markets would remove their “priced-in” rate hike expectations for 2024. With 2-year yields (5.1%) still below the Fed Funds rate, we have to expect that the Fed has finished this hiking cycle and will remain on hold for an extended period.

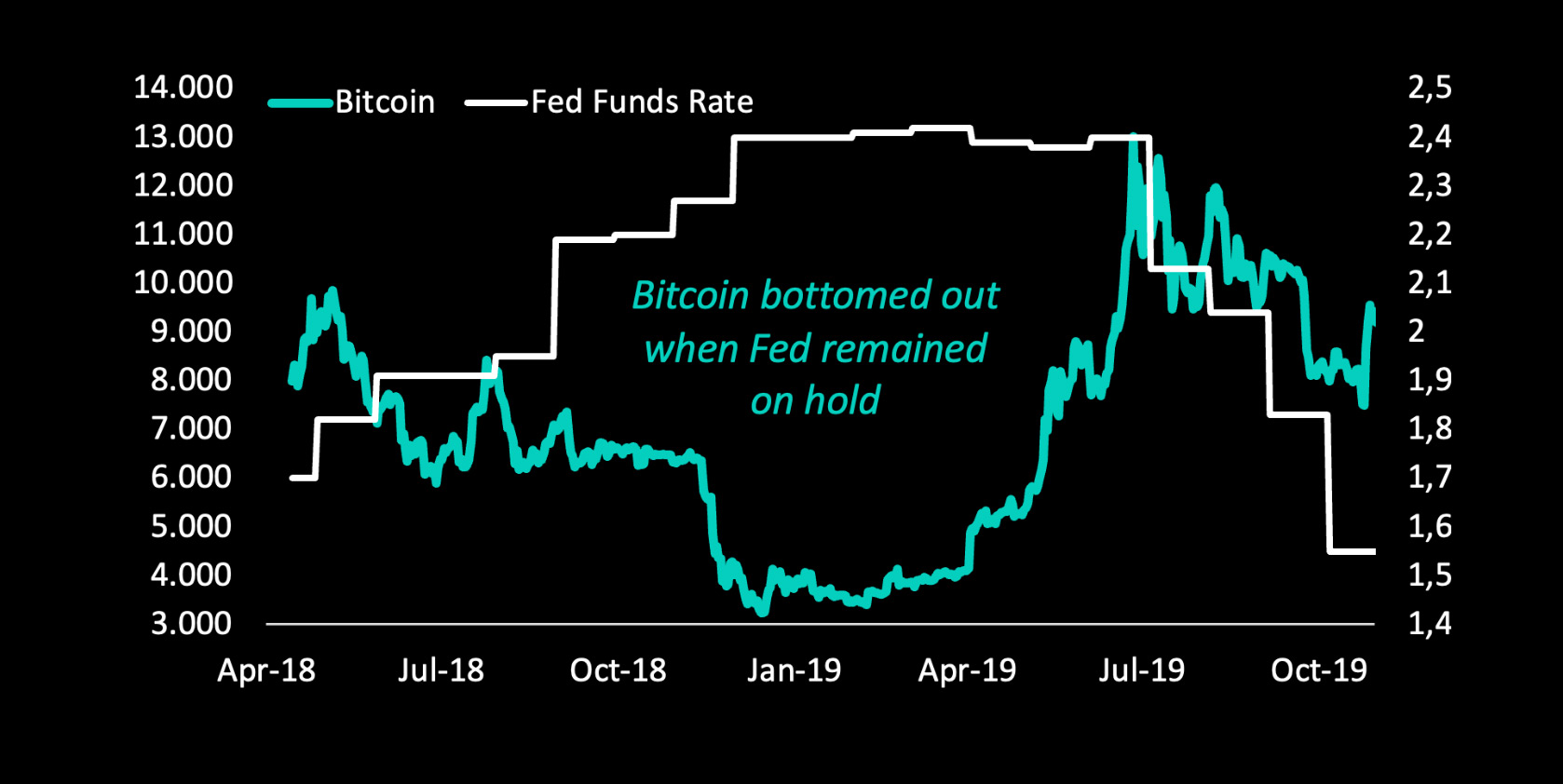

If history is any guide, this could provide Bitcoin and Ethereum the opportunity to restart the bull market. After several rate hikes in 2018, the Fed paused for seven months in January 2019. During that time, Bitcoin prices rallied from 3,000 to nearly 13,000 by July 2019 – a rally of +400%.

Ethereum prices rallied from 85 to 336 during the same time – a nearly +400% rally. Once the Fed started to cut interest rates, citing “implications of global developments for the economic outlook as well as muted inflation pressures” and leaving the door open to future cuts, saying it would “act as appropriate to sustain the expansion,” Bitcoin prices corrected by nearly -40% over the next four months.

So, it was not the rate cut that caused the rally; instead, the Fed “pausing” their rate cycle was the trigger, and once the global economy showed weakness and the Fed cut rates, crypto prices corrected. If this cycle repeats, crypto markets might have entered a bullish period since the July 2023 FOMC meeting when the Fed paused, and Bitcoin traded at 29,200.

Traders should now look for “soft” stimulus from central banks regarding liquidity injections but fear that the Fed will cut due to global economic weakness. Germany’s year-on-year GDP growth has printed below zero (-0.2%, and economic contraction) for three consecutive months while the ECB has kept hiking interest rates even in their last meeting on September 20, 2023 – two months after the Fed had already paused their hiking cycle despite US GDP (+2.4%) being materially higher than that of Europe’s largest economy (Germany).

China’s central bank is ramping up liquidity injections to support the economy as the PBoC is constrained to lower interest rates as the Chinese Yuan trades at a new 17-year low. Historically, some of this liquidity found itself in overseas assets, and crypto traders should monitor any impact this might have on crypto prices.

Bitcoin markets might use the current calmness and try to rally, but traders should monitor the shifting macroeconomic landscape. Crypto might continue to climb higher if the Fed cuts due to lower inflation data. If the Fed cuts due to economic weakness, Bitcoin might enter an elevator-type correction. But first, use the Fed “pause” to position for the upside – still, we would recommend using options to manage your risk.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)