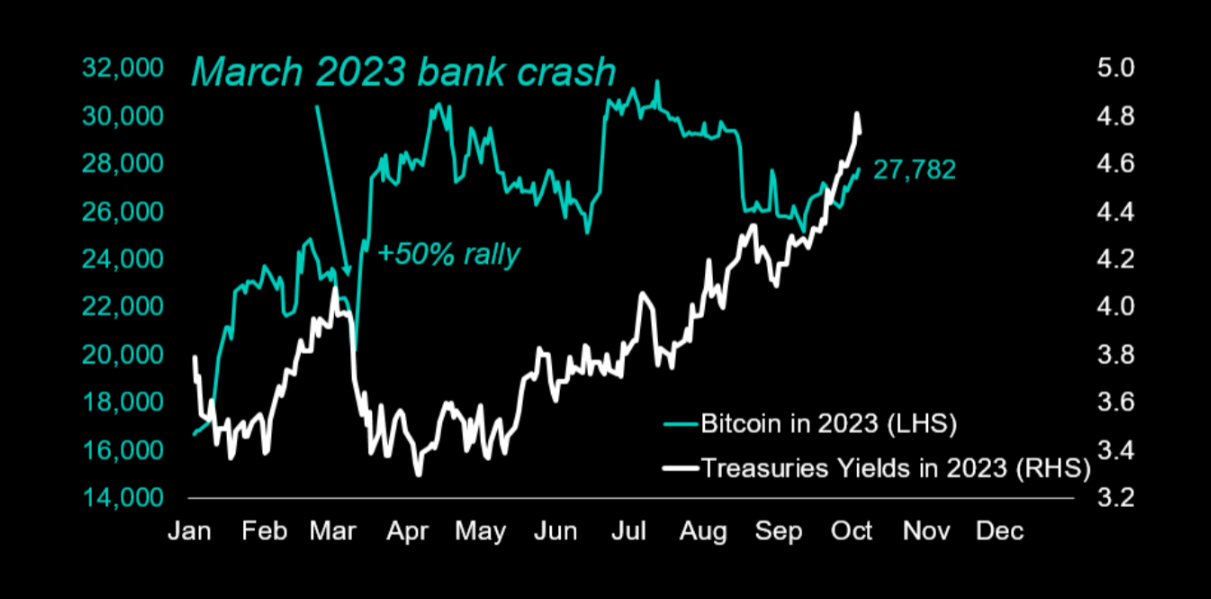

Summary: Bitcoin was the beneficiary during the March 2023 banking crash, and with at-the-money call options trading at only 30% implied volatility for the October 27, 2023 expiry, traders could buy those options as a ‘hedge’ if a 1987-style crash gets triggered due to higher bond yields.

The ADP nonfarm employment report showed the weakest job growth since the COVID-19 crisis. Instead of the forecasted 153k new jobs, only 89k were added. On Friday, October 6, the government survey-led Nonfarm payrolls report will be released.

While a weaker nonfarm payrolls report could set expectations that the Federal Reserve has finished its rate hiking cycle, market participants could also speculate that the lagged impacts of the previous rate hikes would severely impact economic growth. This could re-awaken the animal spirits that expected a recession to occur earlier in the year, but this appeared less likely without the labor market breaking. Things might have changed, and this labor market report could set the tone for the rest of the month.

Since May 2023, 10-year treasury yields have increased from 3.30% to 4.72% – an increase of 1.42%. Traders should remember that when Silvergate Bank, Signature Bank, and Silicon Valley Bank failed due to large bond losses in their portfolios, the 10-year treasury yield stood at less than 4.00% and is currently materially higher.

The FDIC had warned that US banks had $600bn of unrecognized losses on their ‘underwater’ securities on their books. But the situation could be worse now as bond yields have climbed higher. The US High-Yield Corporate Bond ETF (HYG) trades below the level reached in March 2023 when those three US banks went under. The US regional banks index is re-testing those March 2023 lows. The situation looks, at best, fragile.

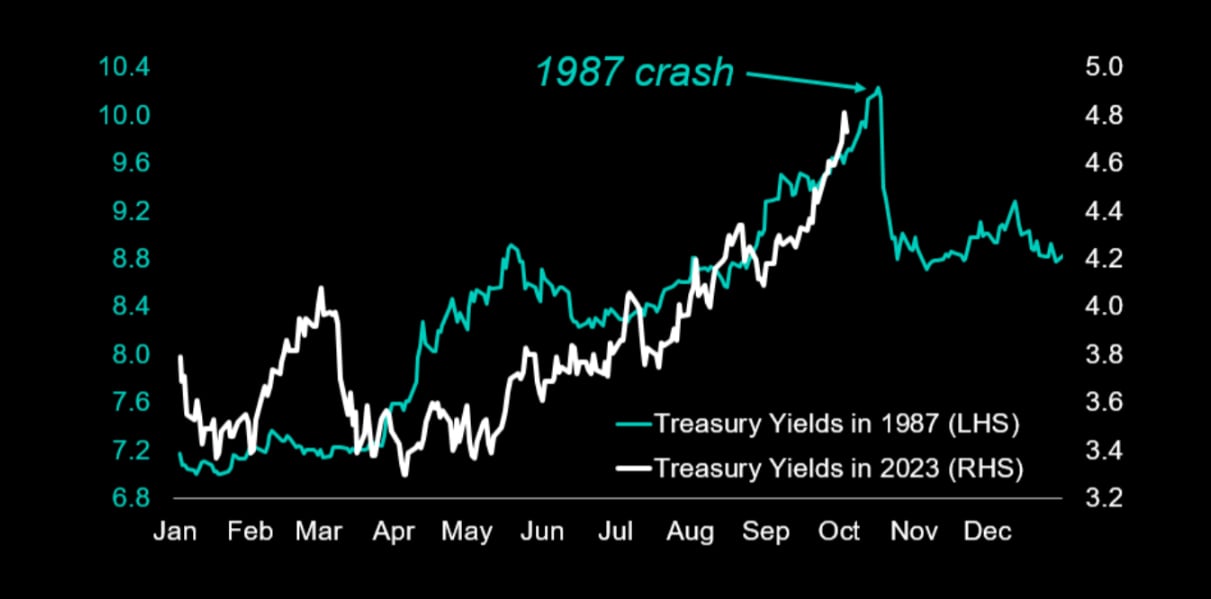

The US financial markets crashed on Monday, October 19, 1987. The reasons were an overvalued stock market, persistent US trade and budget deficit, and rising interest rates. This all sounds familiar. But most crucial is that 10-year bond yields had been rising all year in 1987, with an acceleration from 8.3% in July 1987 to 10.2% in October 1987. This resembles today’s situation, with bond yields accelerating since May 2023 as the US fiscal situation starts to look dire.

While every market situation is different, the cycles still rhyme, and the risk that higher bond yields are breaking something undoubtedly increases. While we cannot see how Bitcoin would have performed during the 1987 crash, we can see that Bitcoin had a +20% rally in March 2023 when those three banks failed. In March 2023, the idea of a blanked FDIC deposit insurance was floated, and this governmental liquidity support caused Bitcoin to rally overnight.

Therefore, Bitcoin might be the critical beneficiary if some part of the economy breaks due to an explosive rise in bond yields. We are already seeing the stress on banks’ balance sheets, commercial real estate, etc., and we could start to see the stress in the labor market if nonfarm payrolls begin to disappoint.

Bitcoin was the beneficiary during the March 2023 banking crash, and with at-the-money call options trading at only 30% implied volatility for the October 27, 2023 expiry, traders could buy those options as a ‘hedge’ if a 1987-style crash gets triggered due to higher bond yields.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)