In this week’s edition of Option Flows, Tony Stewart is commenting on Risk management, forced short closure and vast profits.

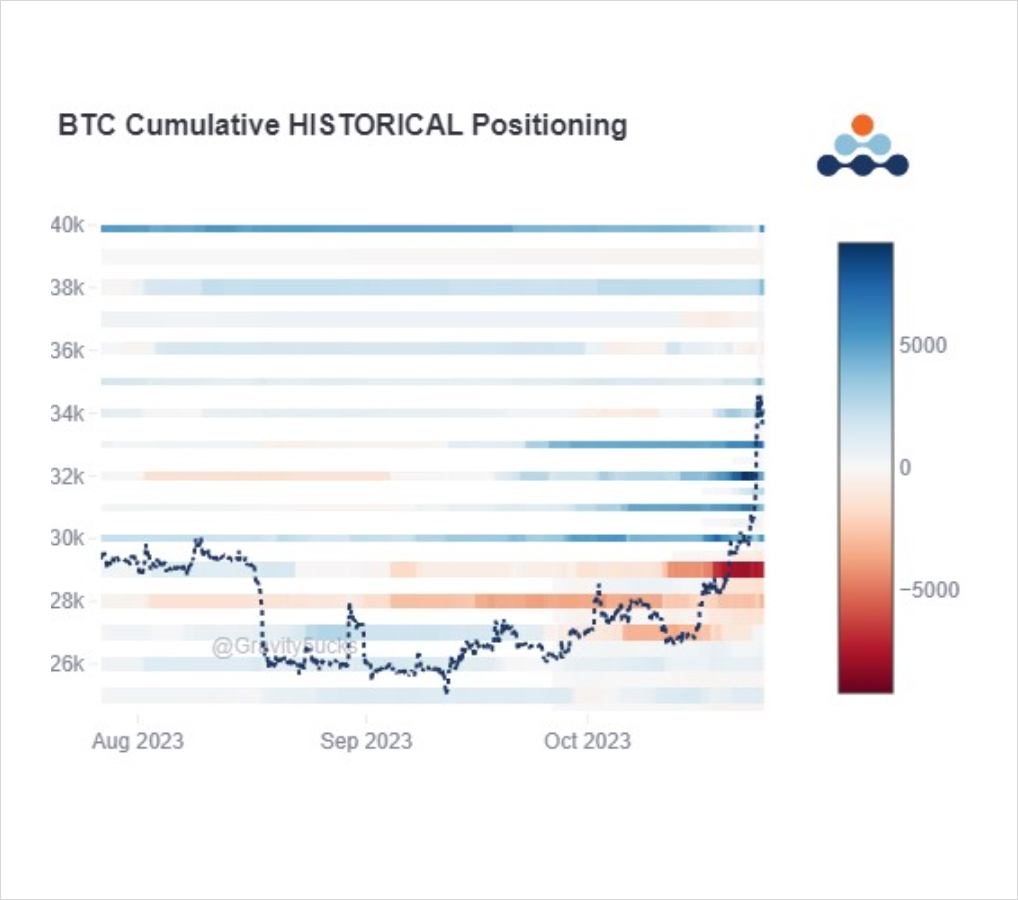

Confidence: clear signals for BTC Spot ETF, Fink flight to quality, Deribit Margin Model adjustments, and under-allocated Crypto Funds fused to ignite an explosive rally from 30k to 35k.

Risk management, forced short closure, vast profits.

The Definitive:

2) Sunday saw the first signs of what was coming.

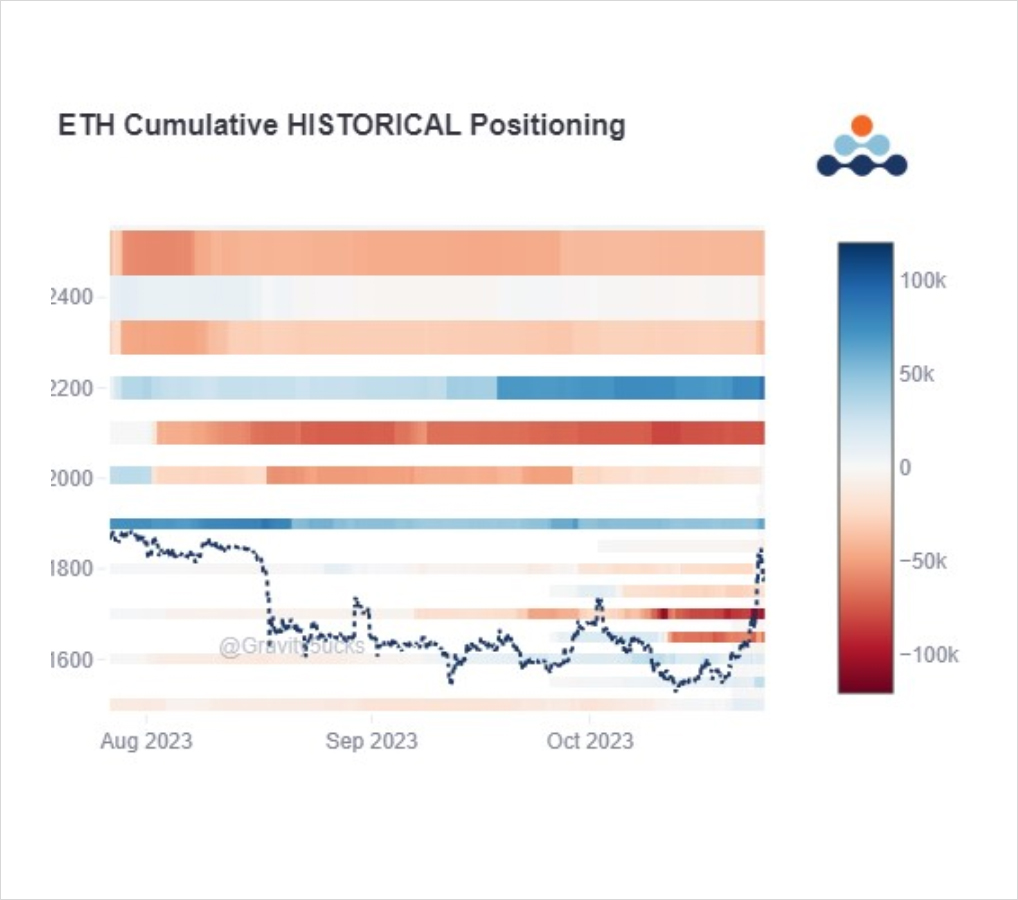

ETH nudged 1625. ETH Nov1.6k+1.65k Calls lifted 75k.

On CME open+APAC, BTC+ETH Spot found buyers.

BTC touched 31k, ETH 1.7k by the European Open.

ETH Nov1.65k+1.7k+Dec1.8k Calls short-covered by OWE x100k

DB posted margin reqs.

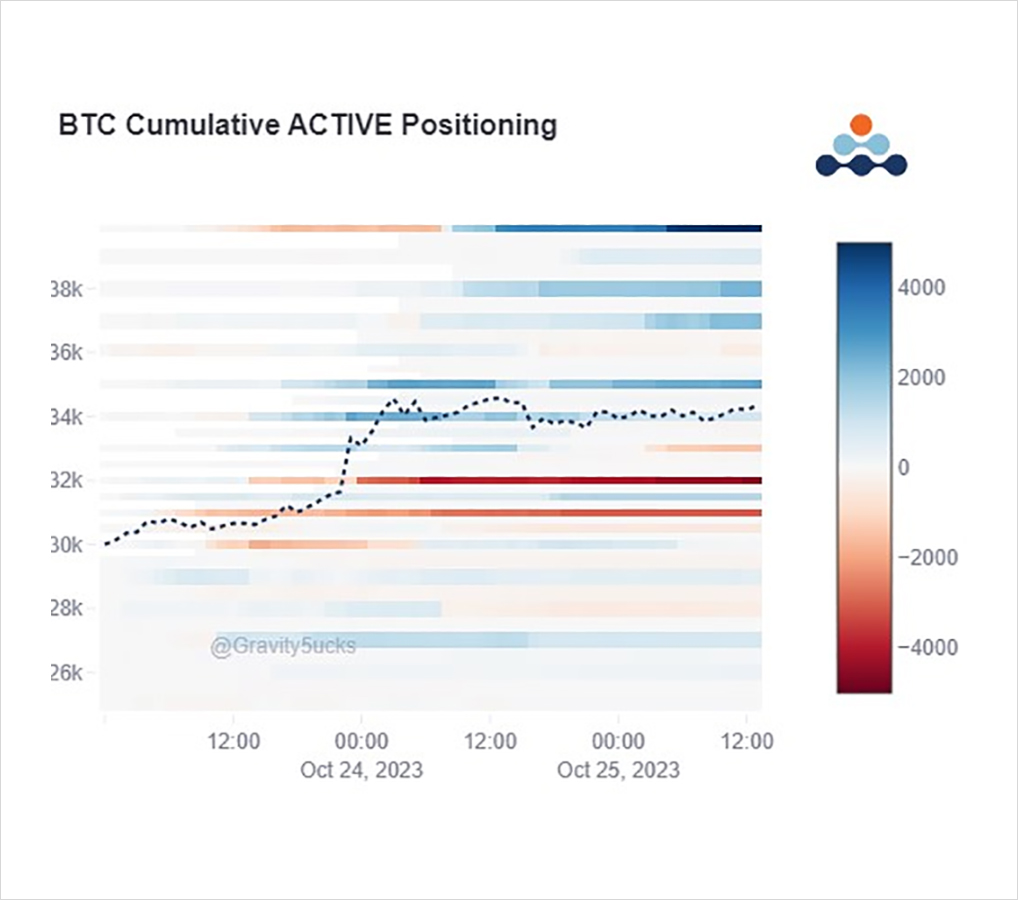

3) BTC Options saw opposing flows, as when the rally failed initially at 31k, there was a total of $10m of premium that flooded the market with Gamma via profits taken in Oct31k+Nov30+31k Calls.

These entities did not appear to roll profits.

Another rolled Oct32k to Dec34k x1.5k.

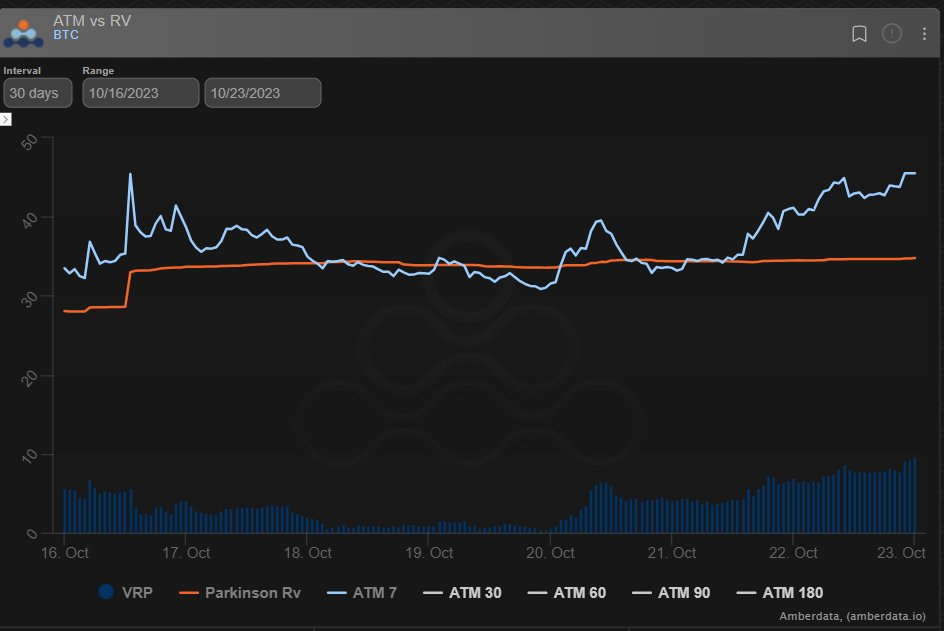

4) Despite the BTC onslaught of Gamma, IV firmed.

RV was increasing.

Prudent Deribit margin risk management procedures were announced and while not immediate, put shorts on notice.

Buyers entered.

Nov 33k+Nov34k Calls bought 3k, funded by Dec40+45k Calls.

Nov29k Calls covered 1k.

5) Upward momentum was building.

As US tradfi markets shut Monday, Crypto unleashed.

BTC spiked from 31.5 to 34k within minutes.

ETH from 1.7 to 1.8k.

Retrace back to 32.5k/1750 just fueled another move to 35k/1850.

MMs forced to widen markets. Zero got blocked.

Fast Market.

6) Stuff got messy; liquidity after a few minutes returned; thankfully, as there were some large short-covers to execute.

On ETH Nov1.7k+Dec1.9k Call covered 60k.

On BTC Oct32+34k, Nov29k, Dec 30k x5k.

How much these contributed to Spot is debatable; D1 active enough.

IV pumped.

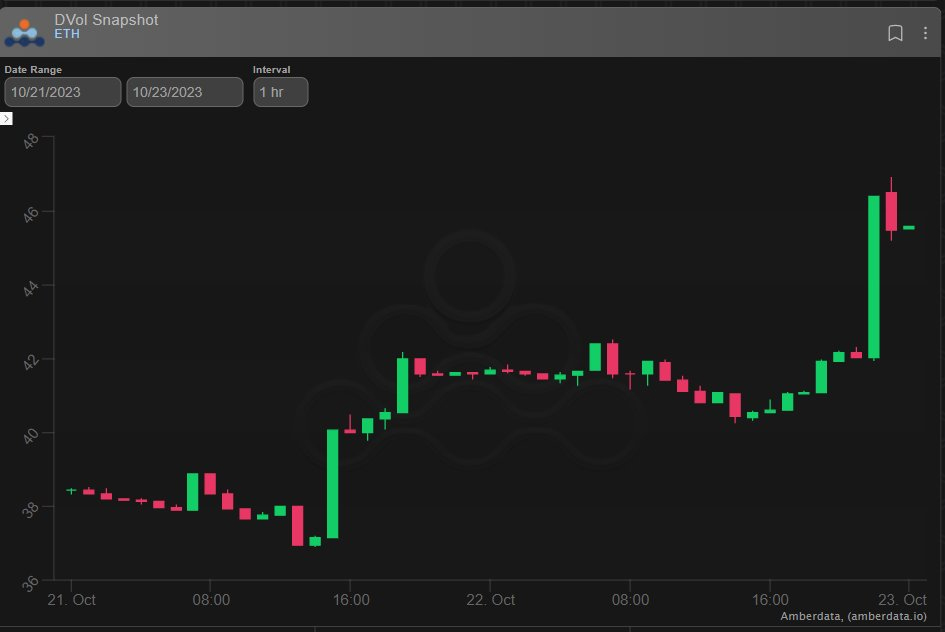

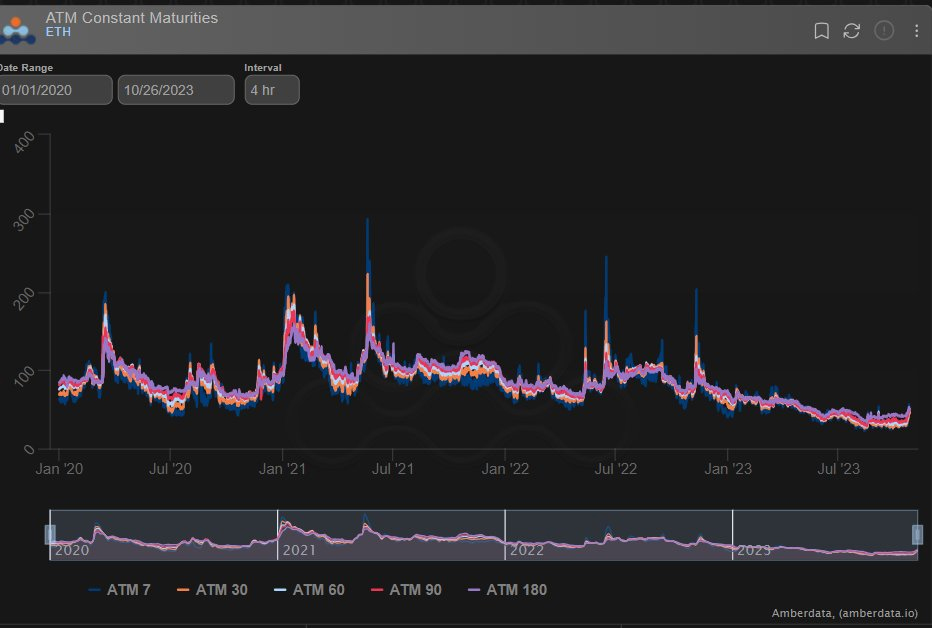

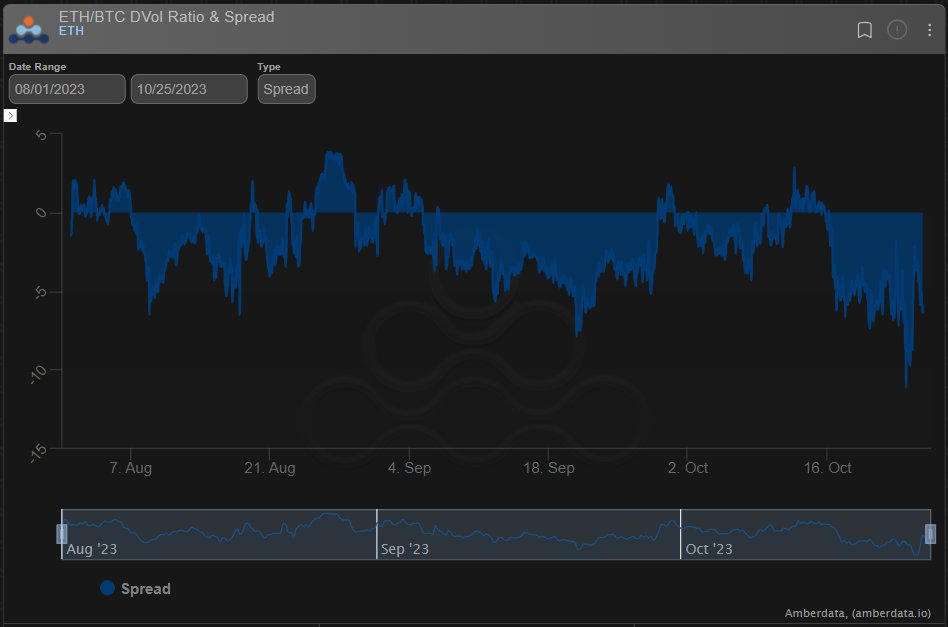

7) While some near-dated expiries briefly breached 100IV, Dvol topped out at about 64% BTC, 55% ETH.

Orderly when viewed against previous fast markets.

[Since Jan1 2020]

8) Short Options are always first to act in Fast mkts.

IV pumps.

Long options then hold on to their profits as long as they mentally can, before rolling or dumping.

Those that rolled:

Dec 34-40k, Dec35-40k, Nov33-35k x6.5k.

Those that dumped:

Jun27k + Dec36k Calls x4k (DSOB).

9) Jun27+Dec36k Calls were bought aggressively a month ago, and dumped aggressively, both times DSOB.

Like the Nov30+31k Calls on Monday have not rolled up profits (yet).

The Dec Call spread and similar in Nov rolling up and out to Mar show a willingness to believe more upside.

10) Note on the above chart the cumulative positions remaining, with many Funds funding more upside with selling Puts.

The Rolling had little impact on Vol despite the size.

The Dumping did, and was actioned at the point when IBTC was removed from DTCC (now reinstated).

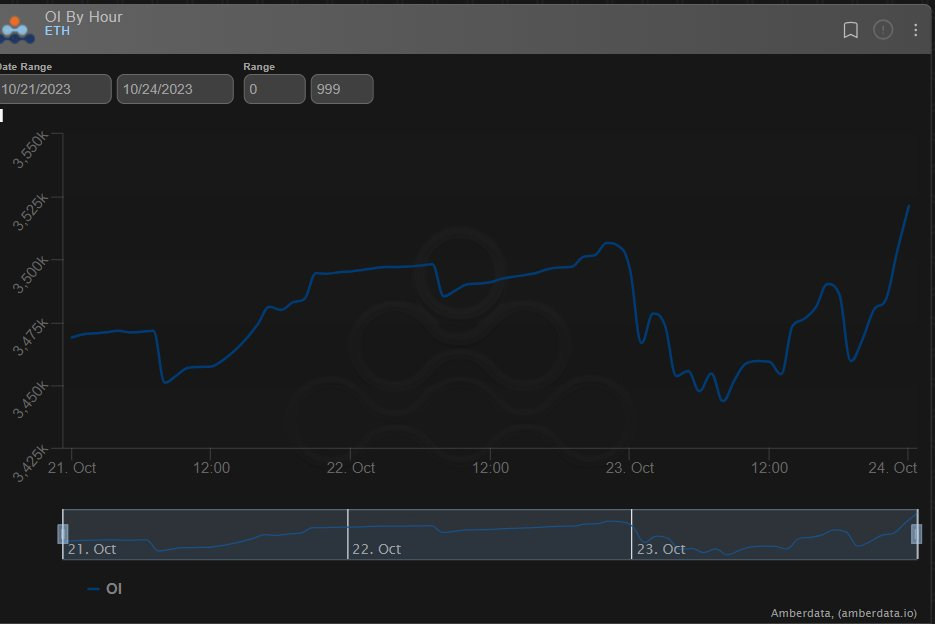

11) It is conspicuous that despite CT talking of a huge blow-out in ETH vol, the OWE rebuys did not have that ‘desired’ impact.

The trades are noticeable if you squint, but contained.

ETH IV remains at a discount to BTC.

And action since has been very muted on ETH.

12) Now a moment for many MMs to re-position after active trading – check risk slides – and for Funds+Retail to assess what next, and perhaps reposition and confirm.

BTC Dvol 55%, ETH Dvol 49%.

OWE significantly reduced Options positions, but assuming still long ETH; finished?

View Twitter thread.

AUTHOR(S)