BTC Weekly Close Confirms New Bullish Regime

$BTC has now entered a new bullish regime based on the recent weekly price action. It’s trading around $34-35k, surpassing the previously tough resistance at $32k, despite still facing lingering uncertainty around the timing of the BTC spot ETF approval.

The premature announcement of an ETF approval by CoinTelegraph and subsequent evidence hinting at a possible early approval have highlighted how under-allocated institutional investors are to BTC. Notably, BlackRock ETF’s ticker being listed as $IBTC on the DTCC website has intensified speculation about its upcoming approval.

However, it’s important to clarify that this doesn’t mean the SEC will decide soon. If the SEC follows its past strategy seen with the BTC/ETH futures ETFs, it might decide to approve several applications simultaneously. Should this be the strategy, and if the SEC waits for more applications like BlackRock’s to meet the standards, a decision might only come next year. Still, the central focus for $BTC’s performance should continue to be the spot ETF narrative, underscored by BTC’s decoupling from equities, with its correlation now below zero for the first time since July.

Separately, an intriguing shift worth highlighting in the BTC market is the difference between the 3- month futures basis for BTC and the 3-month US treasury yields. Once negative during the bear market, this spread has recently turned positive due to the BTC 3-month futures basis roughly doubling. This effectively places a higher value on Bitcoin’s ‘risk-free’ rate compared to USTs, paving the way for more strategic opportunities for quant/delta-neutral funds in BTC.

Realized Vol Stabilizes

After the surge of activity last week, crypto volatility has settled down. While 10-day realized metrics still reflect significant movements, shorter durations have normalized to prior averages of around 45%.

BTC’s implied volatility has decreased slightly but hasn’t drastically fallen. This is partly due to the setbacks faced by short vol traders and upcoming events like the FOMC and NFP, which could introduce more volatility. Positive volatility carry for a few more weeks might be necessary before gamma sellers become bolder and re-enter the market.

Overall, crypto markets have shown resilience against fluctuations in other risk assets. This makes a compelling argument for greater institutional investment, especially once ETFs launch, given the potential for diversification and historically high returns.

ETH Term Structure Holding Better

The BTC term structure has adjusted downwards following its significant move, with its spot now around $34k. The front end has seen the most decrease, pushing the curve back into contango. March 2024 remains relatively stable, likely because this period is anticipated for several ETF approvals. Despite these changes, the term structure remains considerably higher than it was a month ago.

The ETH term structure is proving more resilient than that of BTC. Front-end volatilities have dropped since GAMMA has not been performing after the major move. Volatility between December 2023 and March 2024 has increased due to a renewed interest in mid-term options and short covering. VEGA for the longer end remains consistent with BTC’s moves.

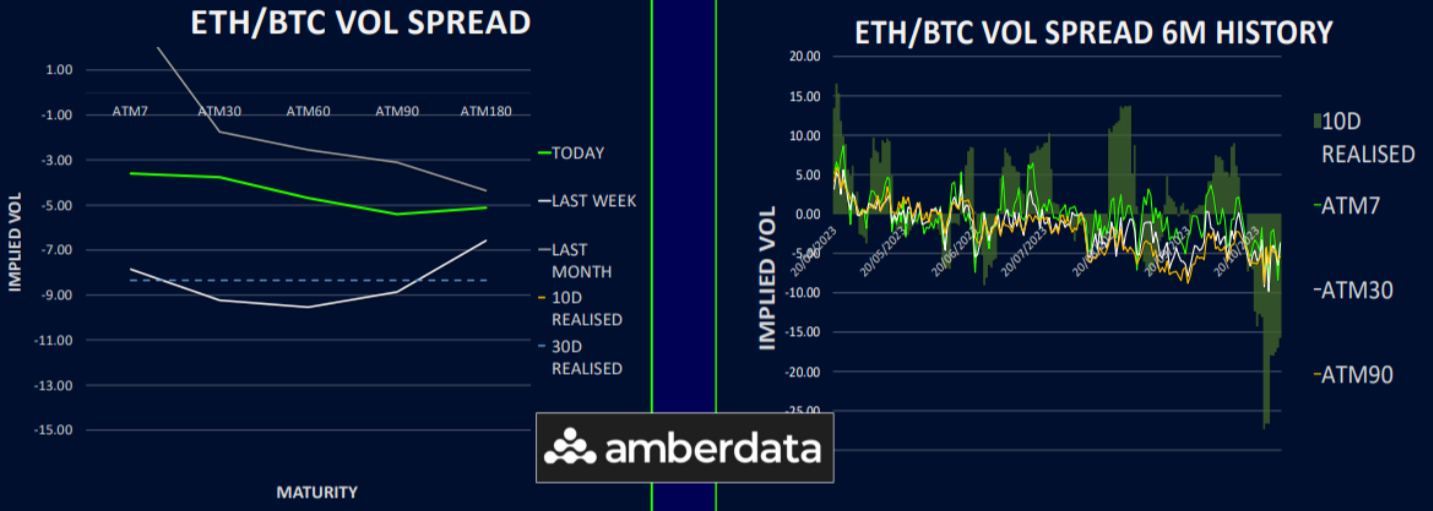

ETH/BTC Vol Spread Moves Sharply the Other Way

The volatility spread between ETH and BTC has experienced a notable shift since last week. While BTC’s volatility has decreased, ETH's has remained stable, particularly due to a significant player adjusting their short VEGA position for the 24th November expiration.

The realized volatility spread continues massively in favor of BTC. However, with the belief that most of the ETF news is already factored into prices, market attention might be pivoting towards potentially undervalued assets like ALTs.

We anticipate that BTC might still surge to the 38-40k range. The uncertainty lies in how ETH’s value might change in response. Currently, the ETH/BTC exchange rate remains low, but there are indicators of downside exhaustion.

Although dealer positioning seems to be limiting ETH’s movement in sync with BTC’s rise, there are short positions being closed for the 24th November in-the-money calls. This suggests that those writing calls might need to reconsider their approach, which would reduce ETH VEGA supply.

Skew: Call Premium Everywhere

Last week, BTC Skew experienced volatile shifts. An initial surge in the spot led to some profit-taking and a brief flattening of the call skew. However, buyers returned, capitalizing on this flattened call skew to initiate bullish risk reversals, pushing the call skew towards its peak levels again.

Given the consistent positive correlation between spot and volatility throughout the year, volatility traders may be inclined to buy a flat call skew, even when delta hedged, due to the positive vol dynamics. Currently, the front-end skew stands at around 5 vols and rises to 9 vols further out, with call premiums dominant throughout.

In contrast, ETH skew showed more stability, especially for calls. The upward spike prompted short- covering, suggesting ETH might have more room to run while BTC is nearing its peak with the ETF news priced in. After briefly surpassing BTC call skew, ETH has settled to a position below BTC but continues to maintain call premiums throughout its curve. It’s around 2 vols at the front and reaches up to 8 vols at the back end. The options market seems to favour owning longer-term ETH upside volatility over options expiring in 2023.

Given the inherent potential for upward movement in crypto markets, reflected by the deep call skew, traders who’ve profited from the recent surge may consider adopting hedging strategies as the year ends. The current market offers a favourable entry point for bearish risk reversals.

Option Flows And Dealer Gamma Positioning

BTC option volumes soared by 75%, nearing an all-time high of almost $12Bn. Calls expiring on 24th November were sold within the 30-34k strike range. Calls for 29th December 2023 were rolled up as via selling call spreads, establishing 40-45k as the new long strikes.

ETH trading volumes surged by 90%, largely influenced by significant short-cover trades. A prominent call writer closed out a substantial part of their short calls at the 24th November 1650 and 1700 strikes, overshadowing other flows.

Throughout the week, BTC dealer gamma positioning was predominantly short, with a focus on the 3rd November 35k strike. Should this level be surpassed, it might trigger further hedging from dealers and potentially propel BTC towards 38k.

On the other hand, ETH’s dealer gamma remains positive. Even with the covering of shorts on substantial downside ITM calls, it indicates that for ETH to diverge from its current trajectory and align more with BTC’s movement, its spot price must surpass the 1900 mark and get dealers into short gamma territory.

Strategy Compass: Where Does The Opportunity Lie?

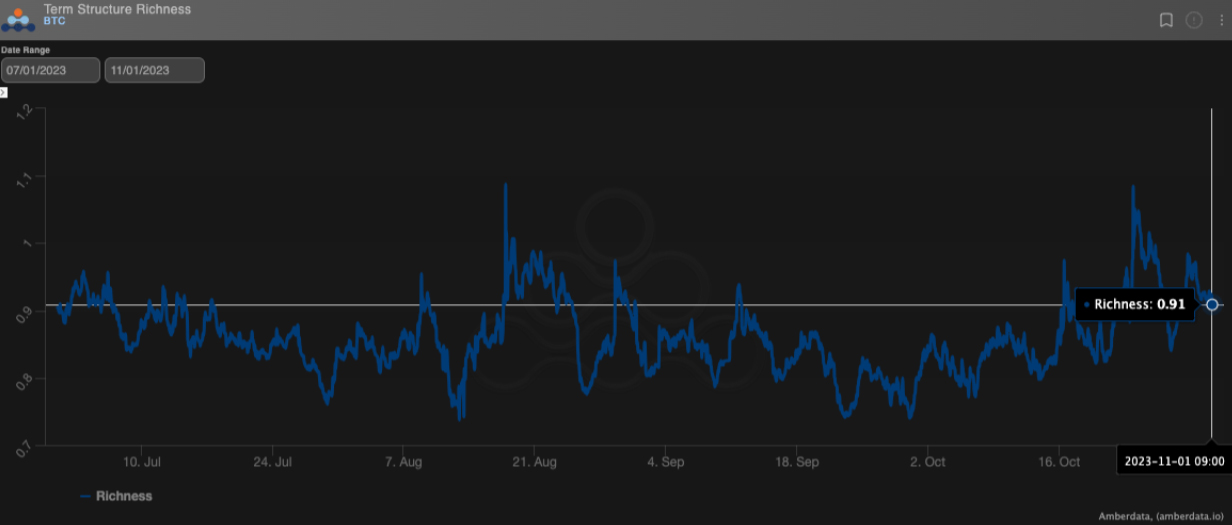

Now that spot prices have found some stability, and curves are slowly falling back into contango. Those who are bullish may consider using upside call calendars to express that view. These trades are flat to positive THETA and long DELTA, so will benefit from a grind higher into year-end as the ETF news becomes fully priced in. Term structure richness still has room to fall, when compared to summer lows.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)