The rally enjoyed by both majors has seen a major pullback that has been exacerbated by a slew of liquidations in futures and perps markets. The event was signalled as early as last week by the skewing of short term volatility smiles towards puts, which we highlighted as signs of hedging paper gains ahead of the expected action in January. However, we also note that the ETF narrative has obscured other factors that have driven the rally, noting similar rallies in equities and correlation to the movements of gold that has continued into the selloff. While the pullback in spot may have allowed the build-up of leveraged long positions to normalise, downside protection remains in demand and volatility expectations have shown no signs of moderation.

Spot Price Pullback

Figure 1 Perpetual swap price for BTC (yellow) and ETH (purple) over the last 3 months. Source: Block Scholes

- Spot prices retraced to the $40K and $2.2K levels on Monday, following a months-long rally that has been popularly attributed to bullish ETF sentiment alone.

- This fact is also hallmarked by the unusual kink in the term structure of ATM volatility at the end of January.

- However, crypto has enjoyed much of this rally alongside gold and equities, with the dollar growing weaker throughout November.

- ETF tunnel-vision has likely obscured other factors that have contributed to crypto’s Q3 surge, and we should not ignore the correlation of crypto-assets to gold that this selloff has continued.

Short Term Shorts Validated

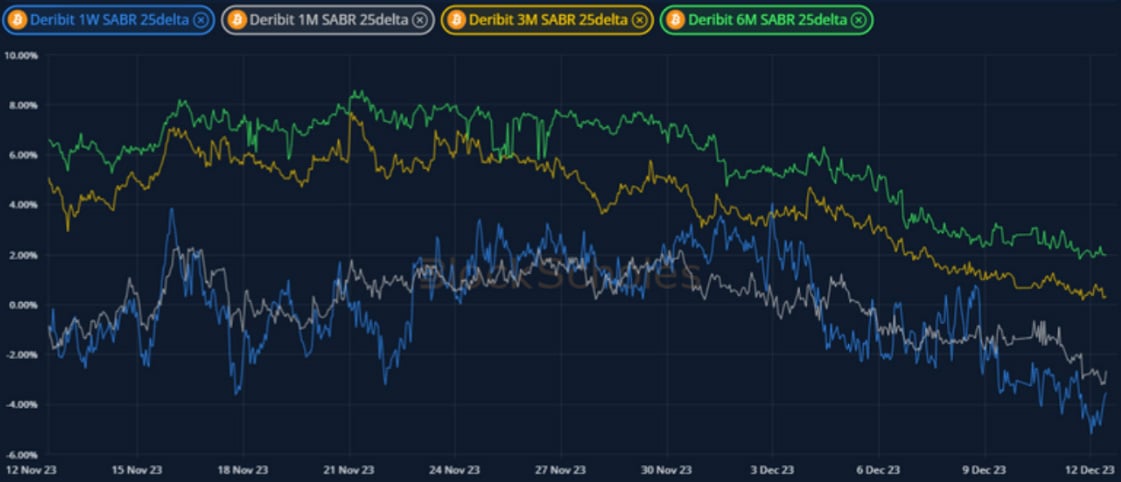

Figure 2 Hourly 25-delta, 1-month risk reversal for BTC at several key tenors over the last month. Source: Block Scholes

- We highlighted the shift towards bearish positioning in last week’s commentary that this selloff has validated, noting that short-term vol smiles had skewed strongly towards OTM puts.

- This was soon followed by a climb-down from a strong skew towards OTM calls at longer tenors.

- Despite the retrace in spot, positioning remains heavily tilted towards puts in the short term, indicating a lingering preference for protection against further downside.

Options Markets Remain Resolute

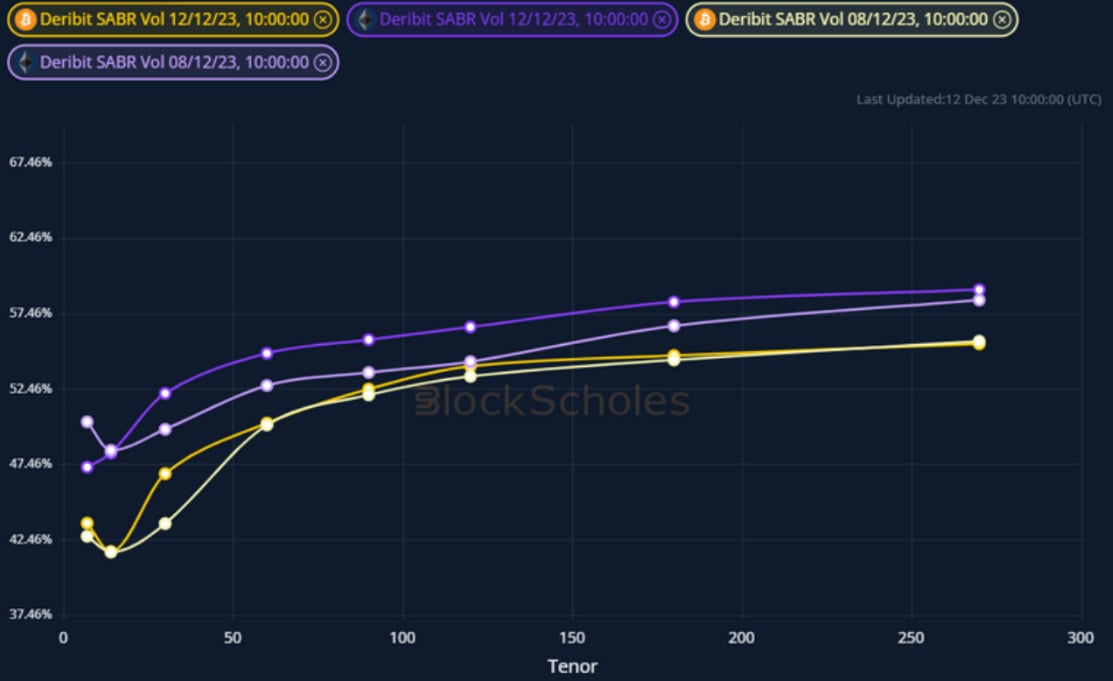

Figure 3 Term structures of ATM implied volatility for BTC (yellow) and ETH (purple) at 10:00 UTC 2023-12-12 (darker colours) and 10:00 UTC 2023-12-08 snapshots. Source: Block Scholes

- Perp traders appear to have trimmed bullish bets, likely as a result of the persistently high funding rate demanded of long perpetual swap positions while bullish momentum has stalled.

- However, positioning in vol markets has remained largely unchanged by the event.

- ETH markets still demand a higher premium over the level of delivered vol than BTC’s and both retain the kinks that are anchored to the end-of-Jan expiry.

AUTHOR(S)