In this week’s edition of Option Flows, Tony Stewart is commenting on the latest market movements where volatility is back at its highs.

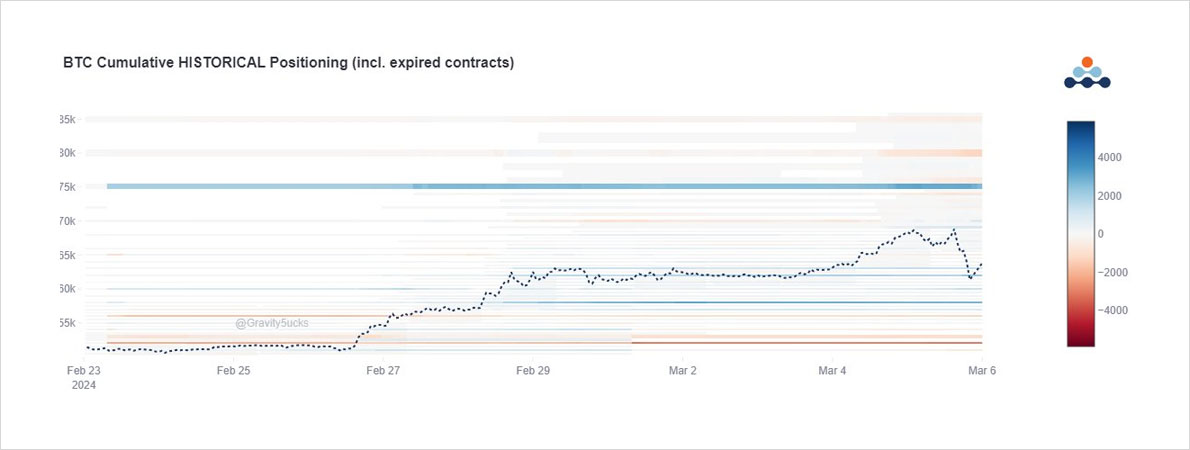

After nearly 2 months of ETF up-only momentum, Fund+Fast Money Call buying, and extreme levels of leverage, BTC hit an ATH and promptly flushed.

It is no coincidence that some Option players after such upside momentum, on this precise day, flipped.

24hrs later a full circle.

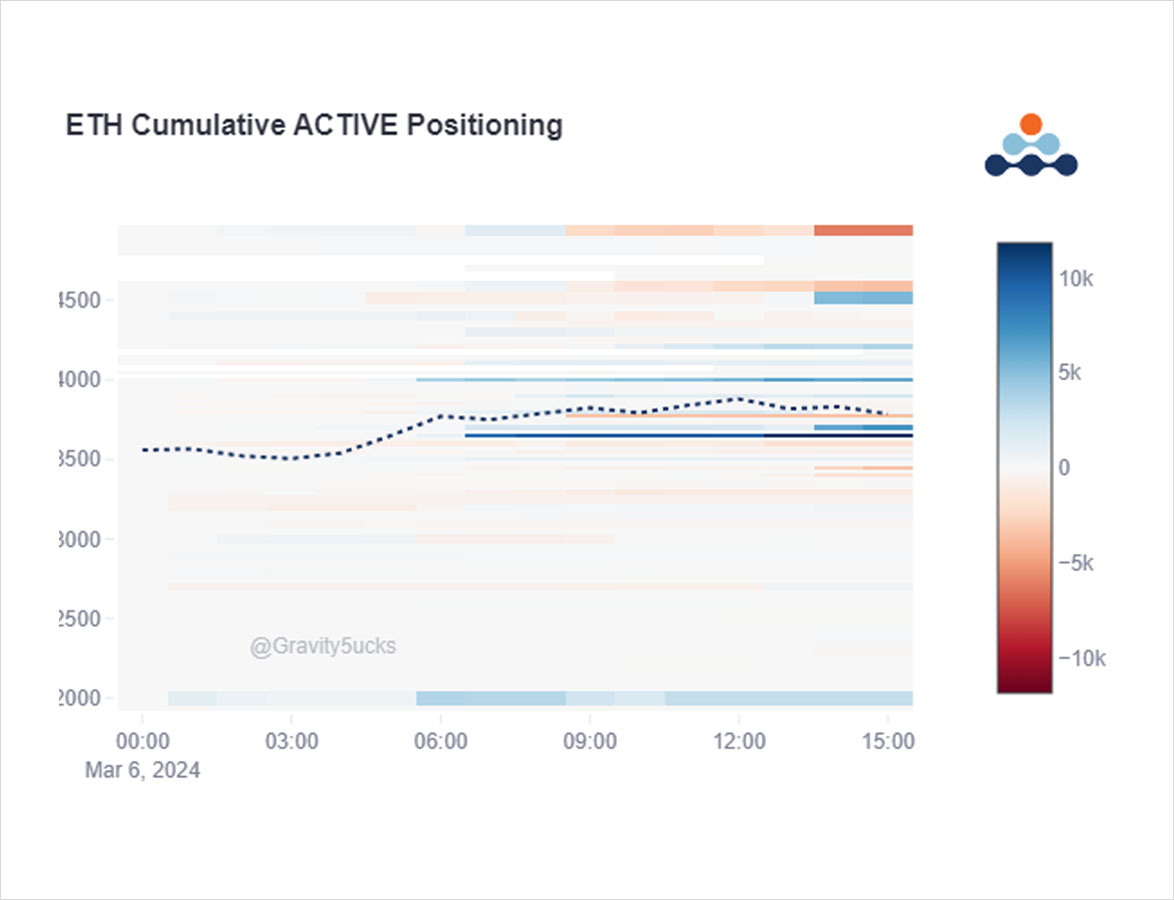

2) Before the flush: BTC Mar15 69k Puts bought ($1.4m premium), Mar29 70k+Jun75k Calls sold ($8.5m received). ETH 3.4k Puts bought ($1.5m premium), Mar29 4.5+5k Calls sold ($1.3m received).

As mkts descended, a mix of flows, but near the lows some panic- Apr 44k, May45+50k Puts.

3) A couple mid-sized trades caught the lows: a seller of probable protection in the Mar29 62k Puts, and a buyer of ETH Mar15 3.6k Calls.

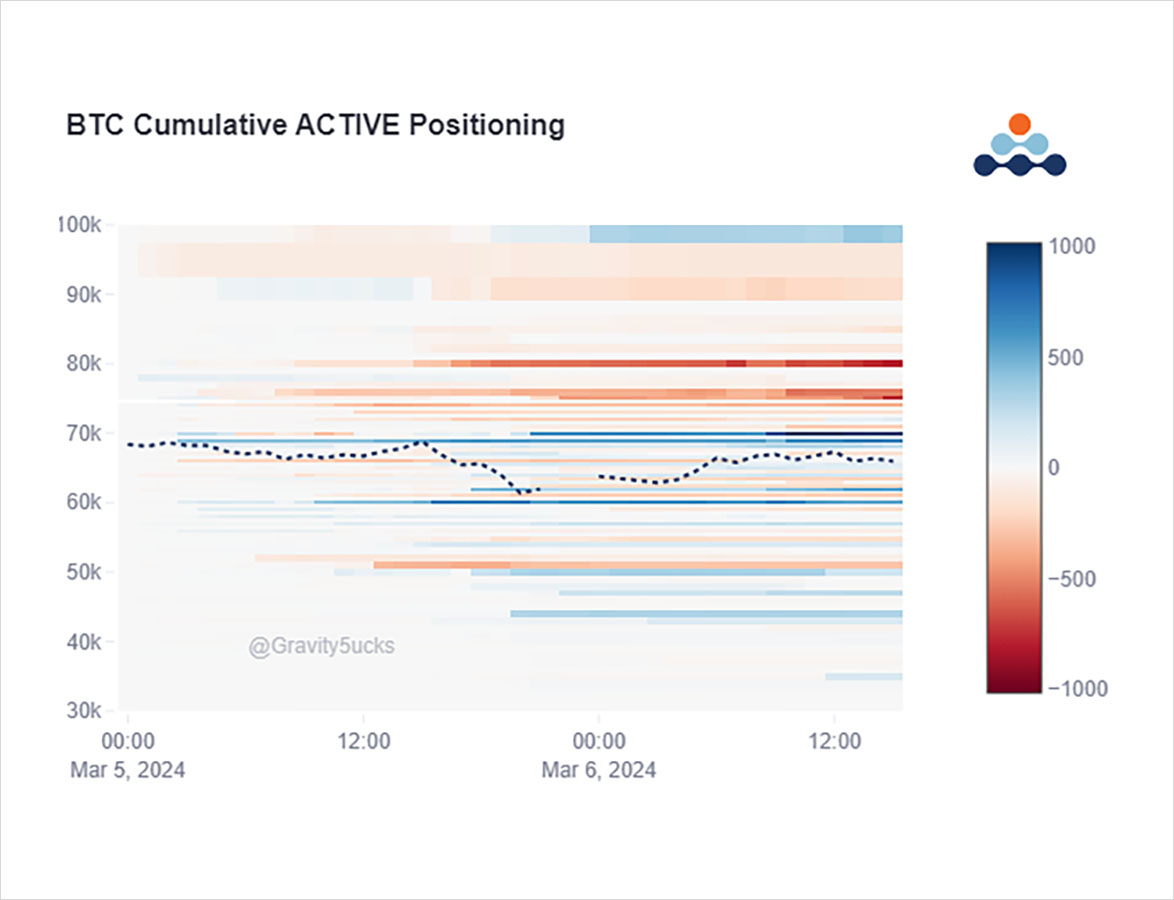

But given the size of the positions out there there was little moving around or change of commitment.

The large BTC Call longs remain engaged.

4) The bounce from the Spot lows after the US close yesterday was something to admire.

BTC ranged from 69.2 to 59.3, back up to 67.7, now trading 66.5k as I write. BTC Option Funds were at best calm, but perhaps too stunned to trade.

Two-way Call action on ETH ranging 20%.

5) ETH holders with a nervous disposition will have noted the blue streak at the Mar29 2k Put, purchased yesterday & today, total size 22k (not small), BUT for only $150k premium, this purchase can have many reasons often risk management.

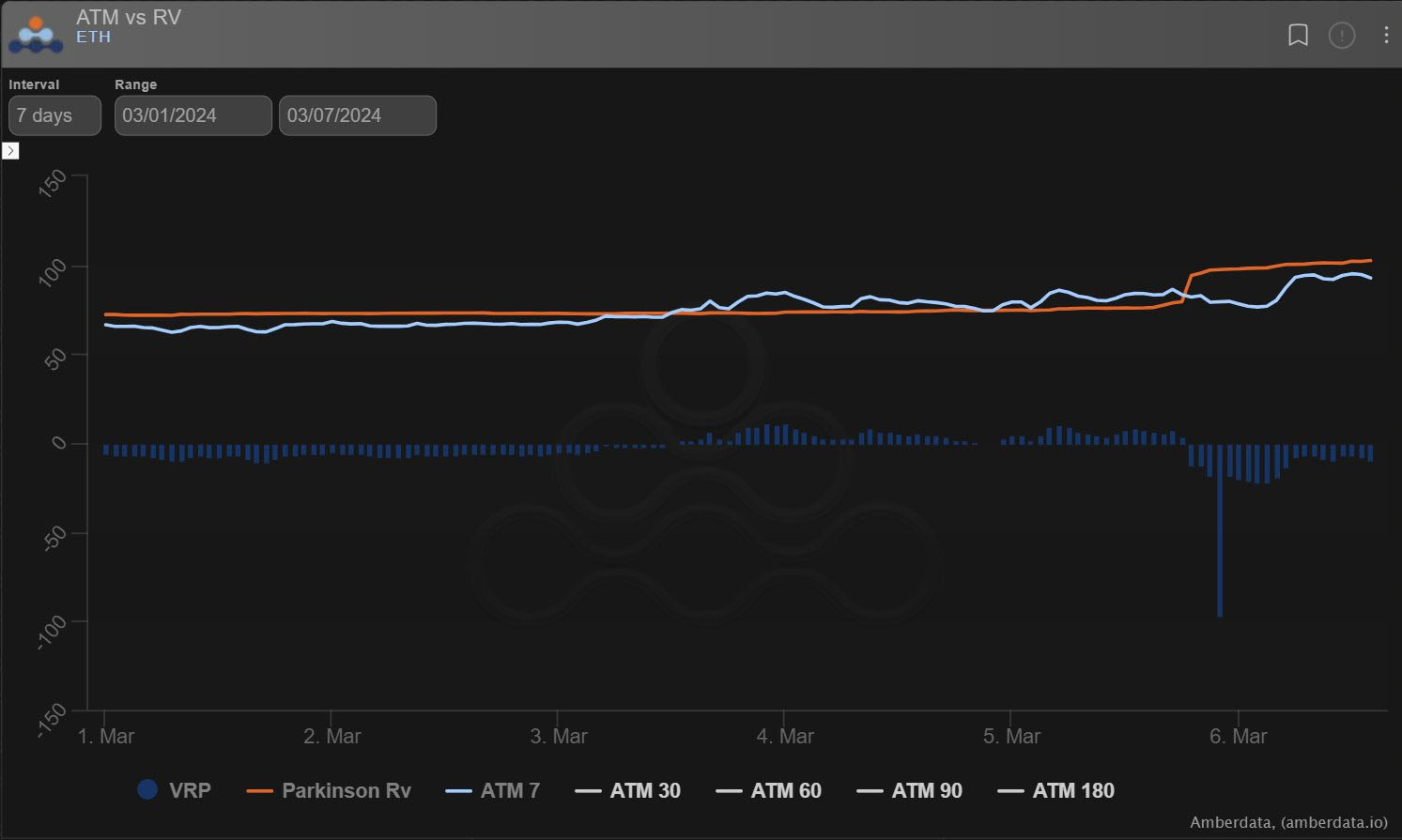

Risk management & FOMO has pumped wings.

6) On a day that wiped $1bn off books via derivative liquidations, IV is likely to remain on the firm side if these markets keep moving as they are, and market participants wise up to using Options over highly leveraged perps.

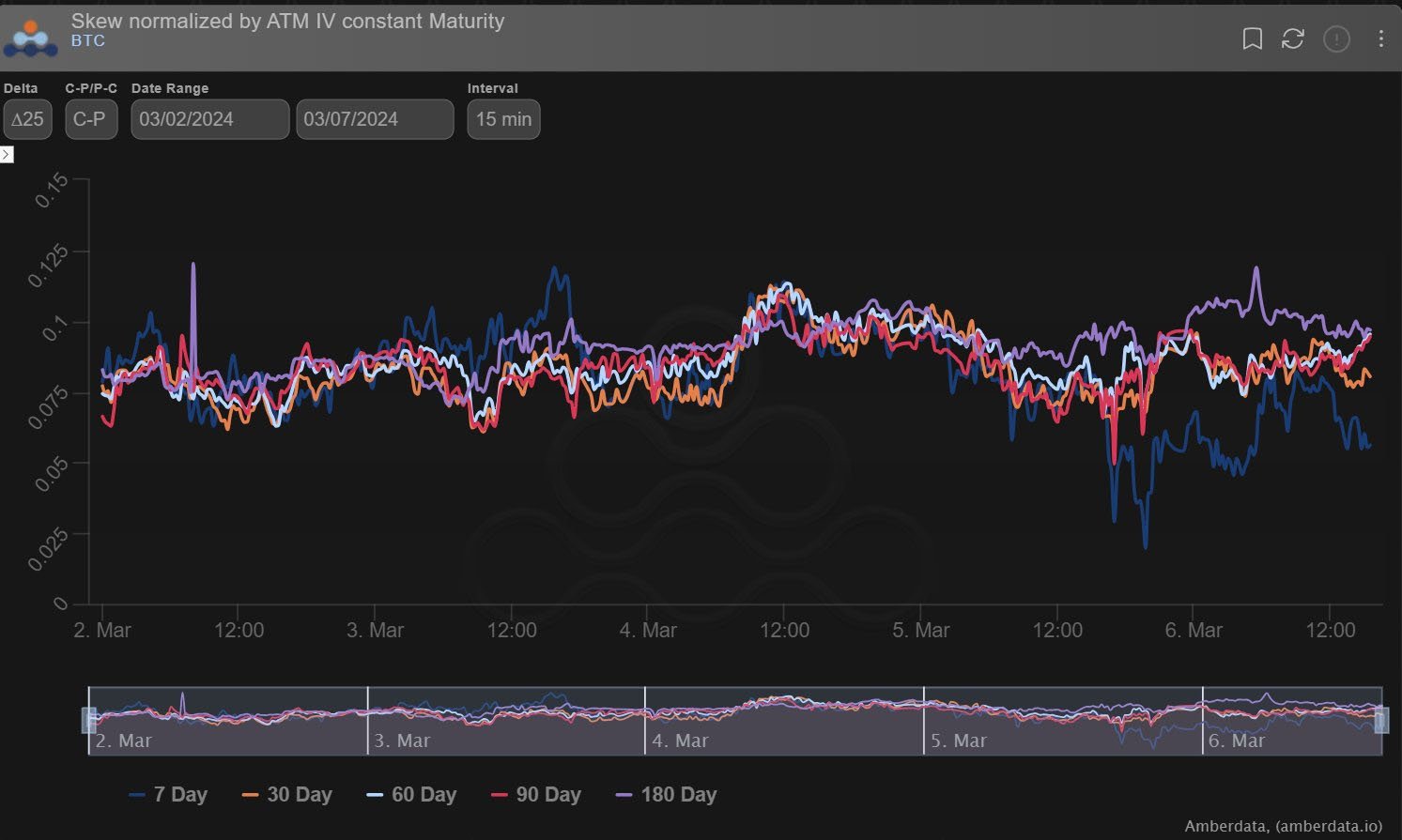

7) Skew looks a mess.

Still biased to the Calls, the Spot moves over the last couple of days did not impact the mid-long term structure, but looking at the shorter-dated (7day) Skew one can see the MMs less keen to sell Puts, and Option Fast-money relaxation for Call demand.

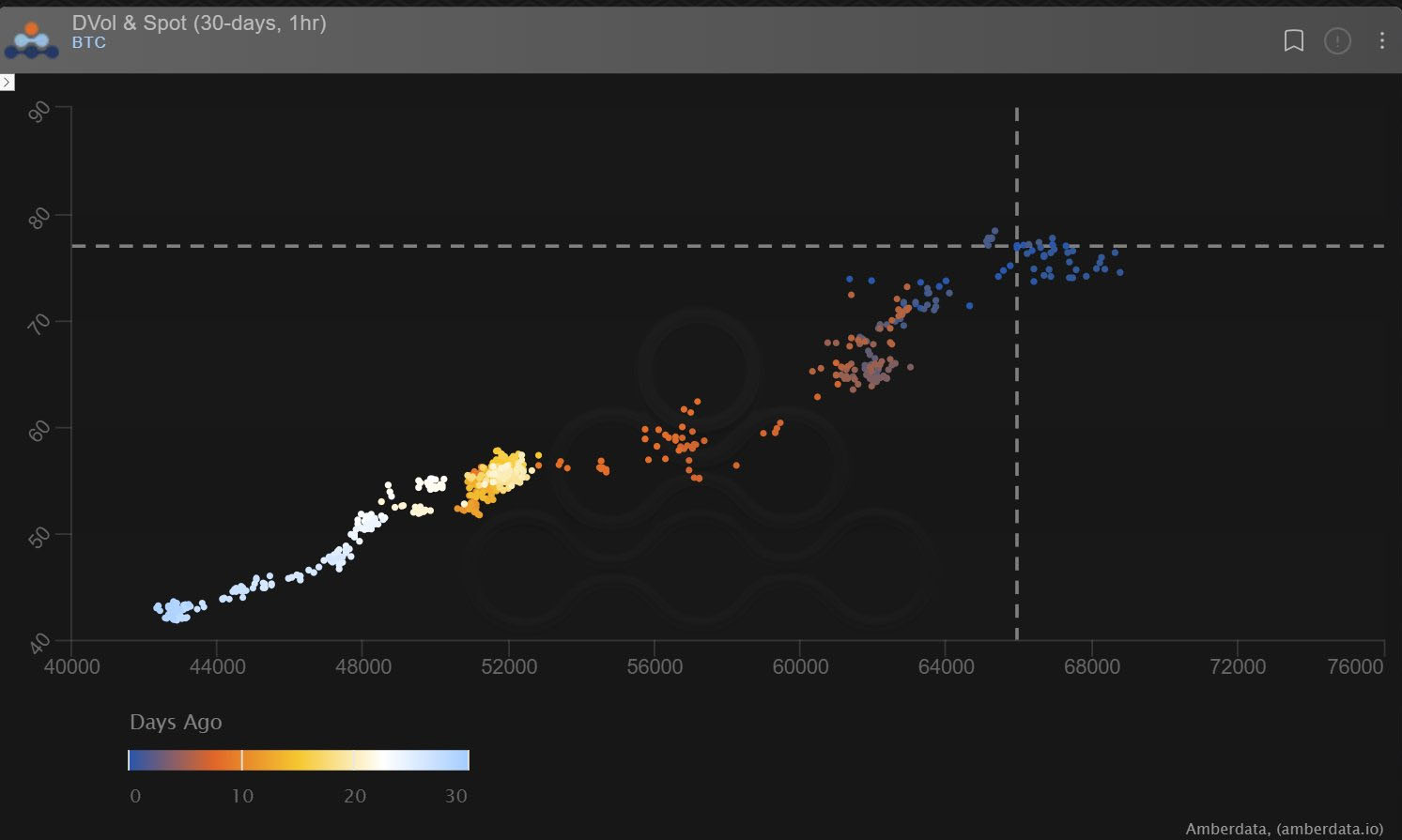

8) The +ve Call Skew is a factor (pro & reactive) to the Dvol-Spot correlation ie how 30day IV (Dvol) has responded to Spot price over the last 30days, on what appeared to be a one-way train.

Other than <7dte options, IV was resilient on yesterday’s move due to magnitude.

Gamma.

View Twitter thread.

AUTHOR(S)