In March 2024, Deribit launched options on three altcoins: Solana (SOL), Ripple (XRP), and Polygon (MATIC).

All of these new altcoin option markets will use USDC as the settlement currency. This differentiates them from the current BTC and ETH inverse options on Deribit, which use the base currency (BTC and ETH respectively) as collateral.

Using USDC as the settlement currency has several potential benefits for traders:

- The same currency can be used for each of the different altcoin currency options, so there is no need to rebalance the collateral when positions are held in multiple currencies at once.

- For traders who prefer to remain flat in USD terms, there is less hedging required compared to holding BTC or ETH as collateral for example*.

- PNL calculations are more intuitive, because the USD profit does not then need to be converted into BTC or ETH, as it does with the inverse contracts.

- Some strategies, such as cash secured puts, are simpler to execute.

*For more information on hedging the USD value of non stablecoin balances, see this lesson.

Using the coins (SOL, XRP, MATIC) to offset upside risk

The new altcoin options are settled in a stablecoin, USDC. This means that the price of each option is set in USDC, and any profit/loss is also paid in USDC. Traders will usually hold USDC as collateral to trade these options then.

As well as holding USDC as collateral for positions in these options though, it is possible to hold the coins themselves to offset certain types of risk. Specifically, upside risk.

For example, if a trader would like to short a SOL call option, they can do so by holding only USDC. However, in doing so, they will have unlimited risk to the upside. If the trader is also holding some SOL though, this can be used to offset this risk to the upside. By holding some SOL as collateral, as the price of SOL increases (thereby generating losses for the short call position), the value of any SOL they are holding will also increase in value.

Assuming the user has cross collateral enabled, when calculating the margin requirements for positions held in the SOL options, the Deribit margin engine takes the trader’s SOL balance into account as well.

There are some limits to which risks altcoin balances can offset though.

1. The balance will only be used to offset risk in that currency. For example, a balance of SOL will only be used to offset risk in SOL options, and will not be used to offset risk in MATIC options.

2. Only upside risks will be offset. So a balance of SOL will be used to offset the risk of a short call position, but not a long call position.

3. Fees and settlements will still be in USDC. So even a trader who is only short calls, may need to keep some USDC in their account to support their positions.

To summarize, USDC may be used as margin for risks in both directions across all of the USDC settled options. The base currency (SOL, XRP, MATIC) can only be used for upside risk for that specific currency. Despite this limitation, traders who already hold one or more of the available altcoins will still find their holdings useful. This feature will be particularly useful for traders wishing to enter covered call positions.

Linear vs inverse options on Deribit

You may see the new stablecoin settled options referred to as linear options in various documents and communications. If you’re already familiar with the built in leverage and convexity in options, you may be wondering why the new altcoin options on Deribit would be referred to as linear options. And indeed in some sense ‘linear’ is a bit of a misnomer, because while the option has some time left until it expires, a linear option still has the convexity that you would expect from any other option.

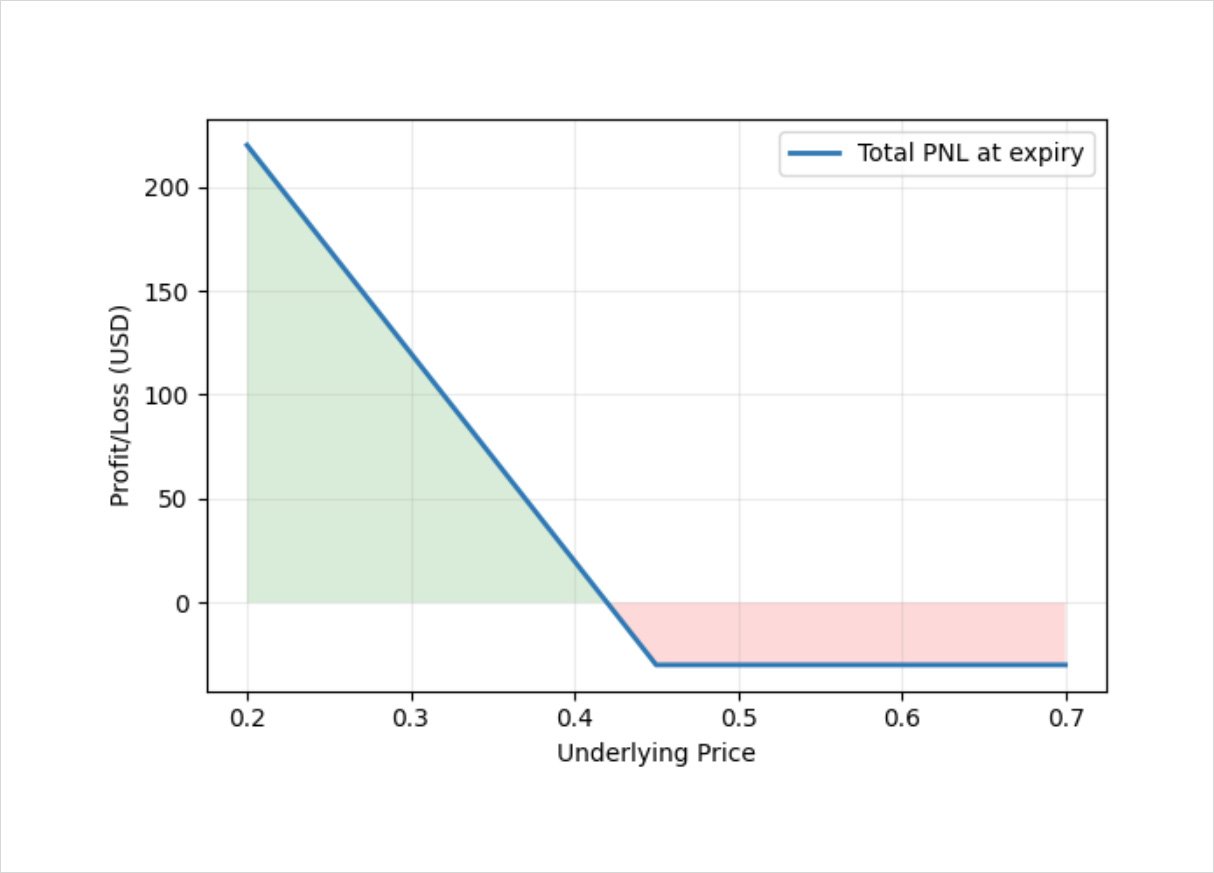

The reason they are named linear options on Deribit, is to highlight the difference between the new stablecoin settled options and the existing inverse options on Deribit. ‘Linear’ is a reference to the payoff at expiry, which for the stablecoin settled options is indeed a straight line. This is the payoff at expiry of a $100 call for example.

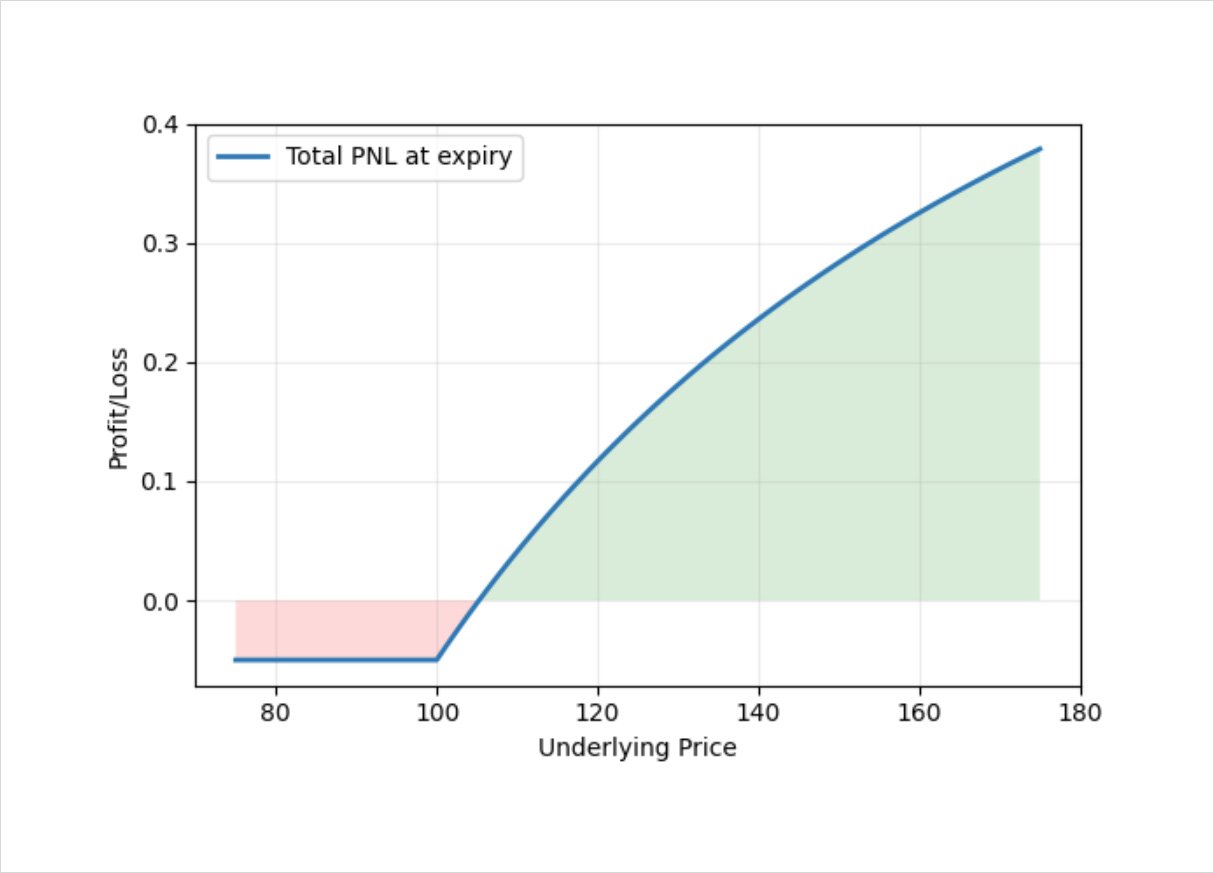

Compare this to the payoff of an inverse option, which is settled in the based currency (BTC or ETH), where we clearly see a curve in the payoff, even at expiry. This is the payoff at expiry of the exact same option, but measured in the base currency, like an inverse option.

So when you see options on Deribit referred to as linear options, it means they are settled in a stablecoin, and it is the lack of this curve in the payoff at expiry that the word linear is referring to.

Contract multipliers

The inverse options on Deribit have retained a 1:1 ratio between the position size and the notional size of the underlying. Meaning a position size of 2 BTC options represents a 2 BTC notional size, and a position size of 10 ETH options represents a 10 ETH notional size. In other words, the contract multipliers are 1.

With the new linear options, larger contract multipliers have been introduced to take account of the much lower price per coin for the newly added cryptocurrencies. Contract multipliers will already be familiar to traders of options in traditional markets, where a single option usually represents 100 shares of the underlying stock.

The contract multipliers of the newly launched coins are the following:

- SOL 10

- XRP 1,000

- MATIC 1,000

With these contract multipliers in mind, let’s work through a couple of profit/loss calculation examples.

Linear call option PNL example

Imagine we are bullish on the price of SOL, and we want to buy a call option to express that view. The current price of SOL is $110, and we buy a call option with a strike price of $130 that expires in 30 days. The price of the option we see in the option chain is $4, and this is the price per SOL.

It’s important to remember that the contract multiplier for SOL options on Deribit is 10, so one option represents 10 SOL, and therefore the total amount we pay is also multiplied by 10. This means we pay $40 in total for our SOL call option.

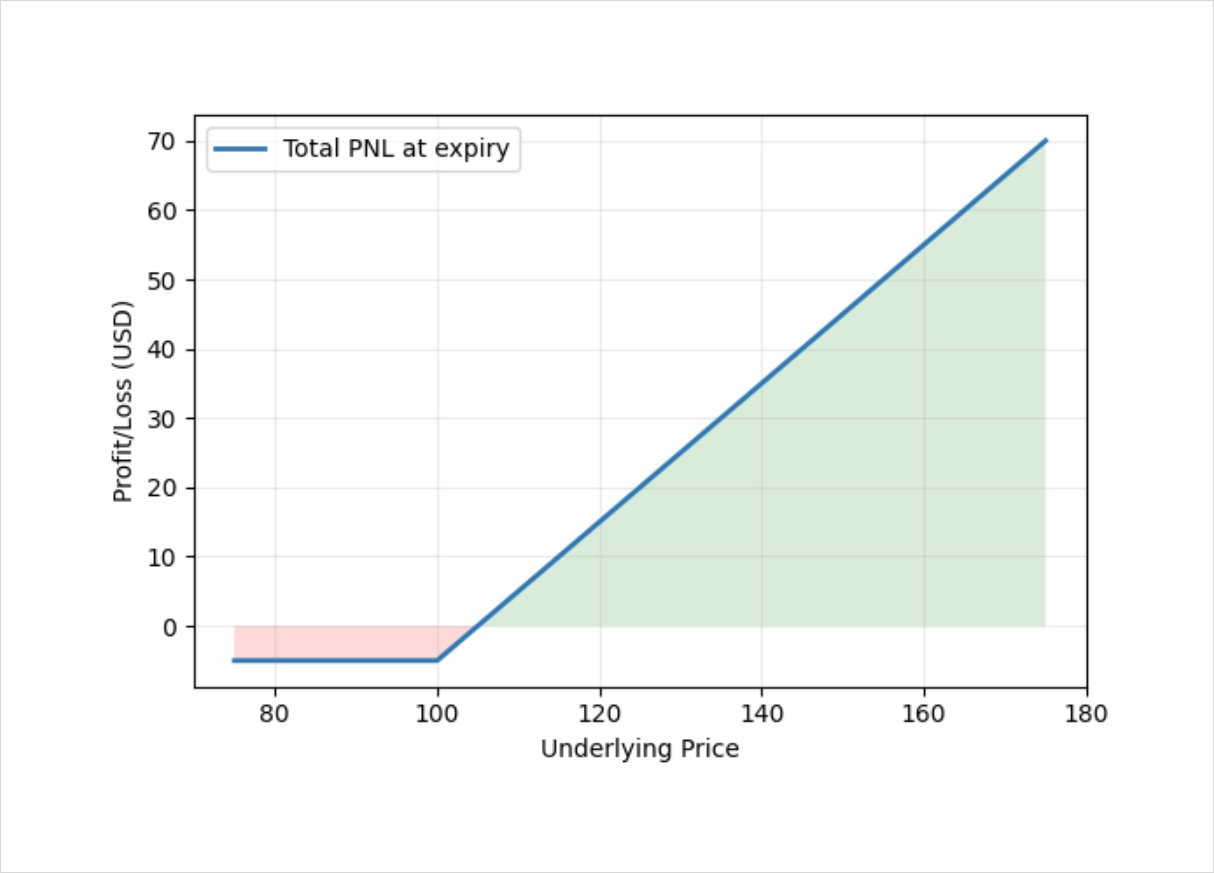

This is a chart of the potential profit of our position at expiry.

If the price of SOL is below our strike price of $130 at expiry, we will of course lose all of the premium we paid for the call, which is $4 per SOL, or $40 in total. If the price is above the strike price at expiry though, the call option will be worth $10 for every $1 above the strike price that the underlying price is.

To calculate the total profit, we can calculate the profit per SOL, and then multiply by the contract multiplier.

For example, if the underlying price is $150 at expiry, our call option will be worth $20 ($150 – $130) per SOL. We can then subtract the price we paid of $4 per SOL, and then multiply by the contract multiplier of 10. This gives a total profit of:

($150 – $130 – $4) * 10 = $160

Alternatively, we could use the total value of the option at expiry ($200), and subtract the total amount we paid for the option ($40). This gives us the same total profit of:

$200 – $40 = $160

Linear put option PNL example (MATIC)

Imagine we are bearish on the price of MATIC, and we want to buy a put option to express that view. The current price of MATIC is $0.50, and we buy a put option with a strike price of $0.45 that expires in 30 days. The price of the option we see in the option chain is $0.03.

The contract multiplier for MATIC options on Deribit is 1,000, so one option represents 1,000 MATIC, and therefore the total amount we pay is also multiplied by 1,000. This means we pay $30 in total for our MATIC put option.

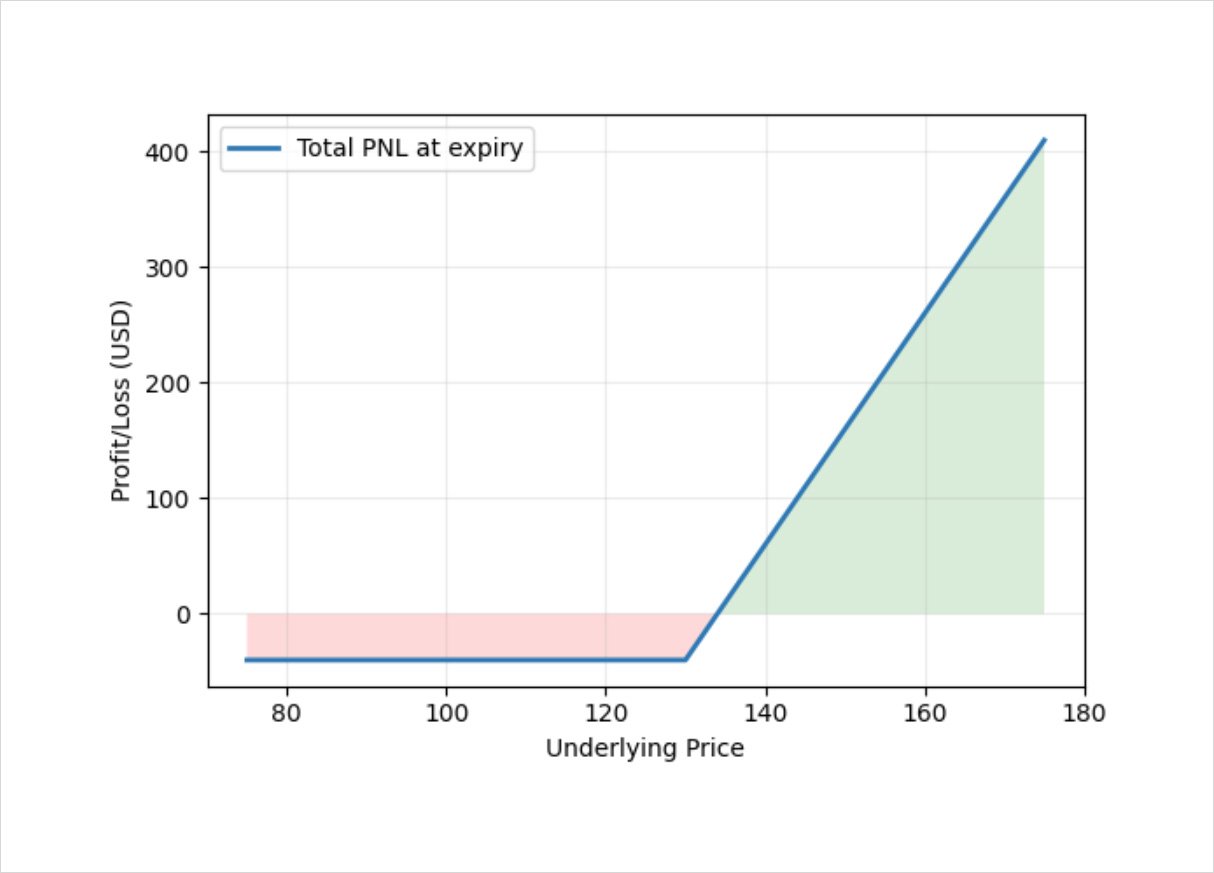

This is a chart of the potential profit of our position at expiry.

If the price of MATIC is above our strike price of $0.45 at expiry, we will of course lose all of the premium we paid for the put, which is $0.03 per MATIC, or $30 in total. If the price is below the strike price at expiry though, the put option will be worth $10 for every $0.01 below the strike price that the underlying price is. (because $0.01 * 1000 = $10)

To calculate the total profit, we can calculate the profit per MATIC, and then multiply by the contract multiplier.

For example, if the underlying price is $0.35 at expiry, our put option will be worth $0.1 ($0.45 – $0.35) per MATIC. We can then subtract the price we paid of $0.03 per MATIC, and then multiply by the contract multiplier of 1000. This gives a total profit of:

($0.45 – $0.35 – $0.03) * 1000 = $70

Alternatively, we could use the total value of the option at expiry ($100), and subtract the total amount we paid for the option ($30). This gives us the same total profit of:

$100 – $30 = $70

Depositing new currencies via the correct network on Deribit

As Deribit continues to add support for new currencies, it is important to be aware of which tokens and chains are accepted as deposits into each type of address. You should only deposit the tokens and currencies stated on the relevant deposit page, and only via the correct blockchain. The correct details are listed on the deposit page for each currency, but if you are in any doubt, please ask for help in the Deribit chat room, or email [email protected].

Where to find the new option markets

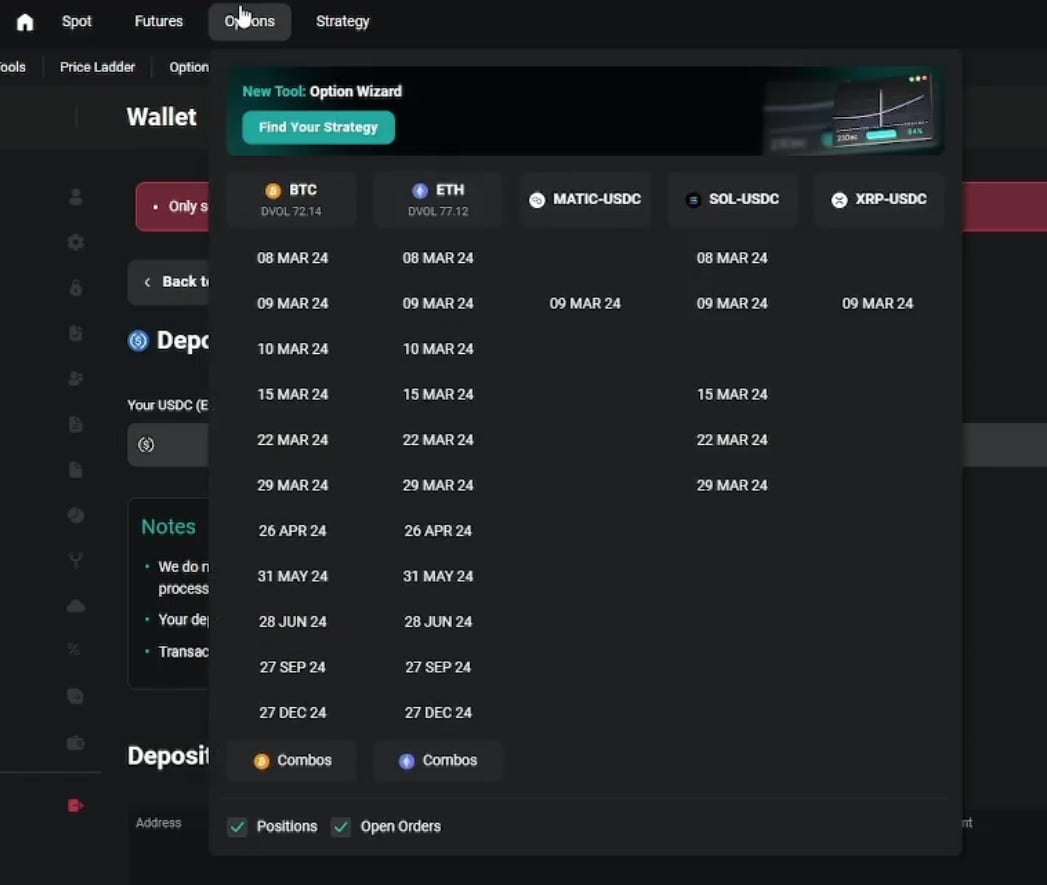

If you’re interested in trading these new altcoin options that use USDC as the settlement currency, give them a look today. You can find these new option markets in the top menu of the Deribit website.

AUTHOR(S)