View on market

If you hold a positive outlook on BTC, here’s a trading concept tailored for the present market conditions.

Call Ratio Spread

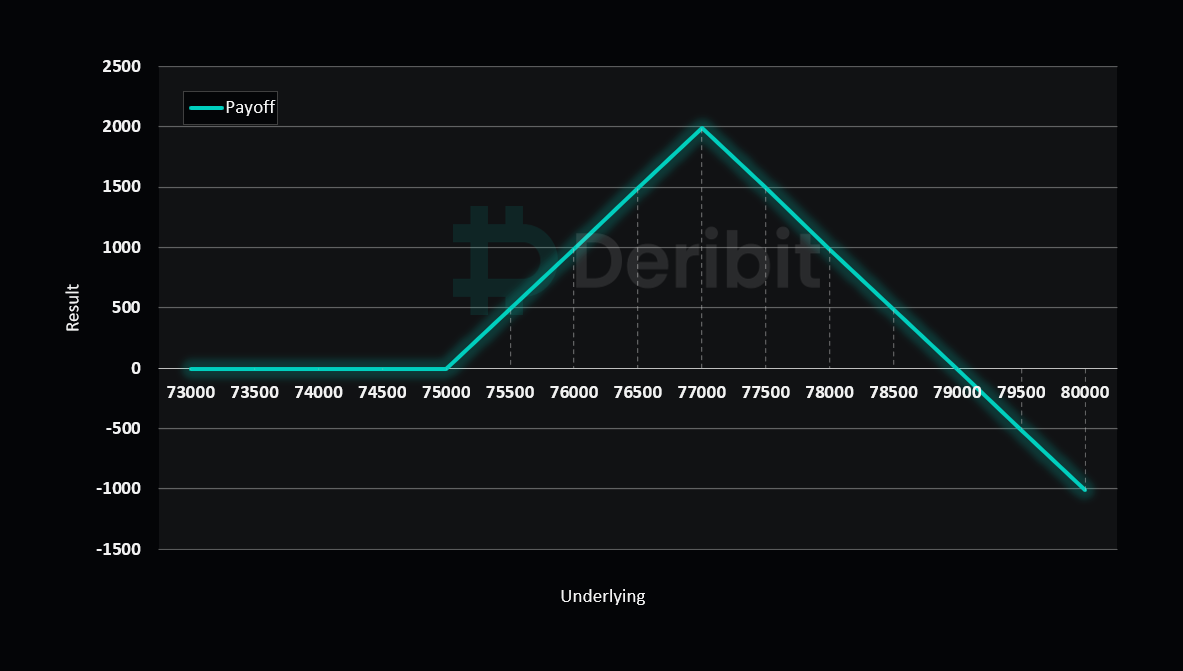

The proposed strategy is a Call Ratio Spread. A Call ratio spread involves buying a call option that is OTM, and then selling two (or more) of the same option type (Call) and of the same expiry, further OTM.

You may take this trade if you think BTC has upside potential on a short term basis.

Trade Structure

(OTM Call) Buy 1x BTC-29MAR24-$75,000-C @ $170

(OTM Call) Sell 2x BTC-29MAR24-$77,000-C @ $80

Target: Spot level < $77,000

Payouts

Maximum Profit: $1990/BTC

Net Debit of Strategy: $10/BTC

Why are we taking this trade?

We’ve noticed a diminishing rate of Bitcoin ETF outflows day by day, culminating in a net inflow of $418 million into BTC ETFs on March 26th.

Following a successful breakout from the triangle pattern barrier, Bitcoin has demonstrated robust follow-through in terms of price action. Furthermore, the previous resistance levels breached by Bitcoin are now proving to be strong support levels on the 4-hour timeframe, indicating a bullish outlook in the short term.

Traders looking to capitalize on this bullish momentum over the next few days might want to consider implementing a call ratio spread strategy for potential short-term profits.

To implement this strategy, traders can buy a higher strike call option (e.g., $75,000) and simultaneously sell calls in double quantity (2x) of a higher strike price (e.g., $77,00).

If Bitcoin is at $77,000 when the options expire on March 29, traders will be at maximum profit from the strategy.

Should there be a market downturn, the downside risk is confined to the initial debit of $10. It’s worth noting substantial open interest at the $75,000 followed by $77,000 mark, indicating a potential resistance level that could amplify profits around these levels.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)