View on market

BTC’s bearish trend evidenced by Lower Highs and respected supply zones, suggesting resistances in control, traders can consider shorting OTM calls, eg. $68,000, supported by high OI built-up.

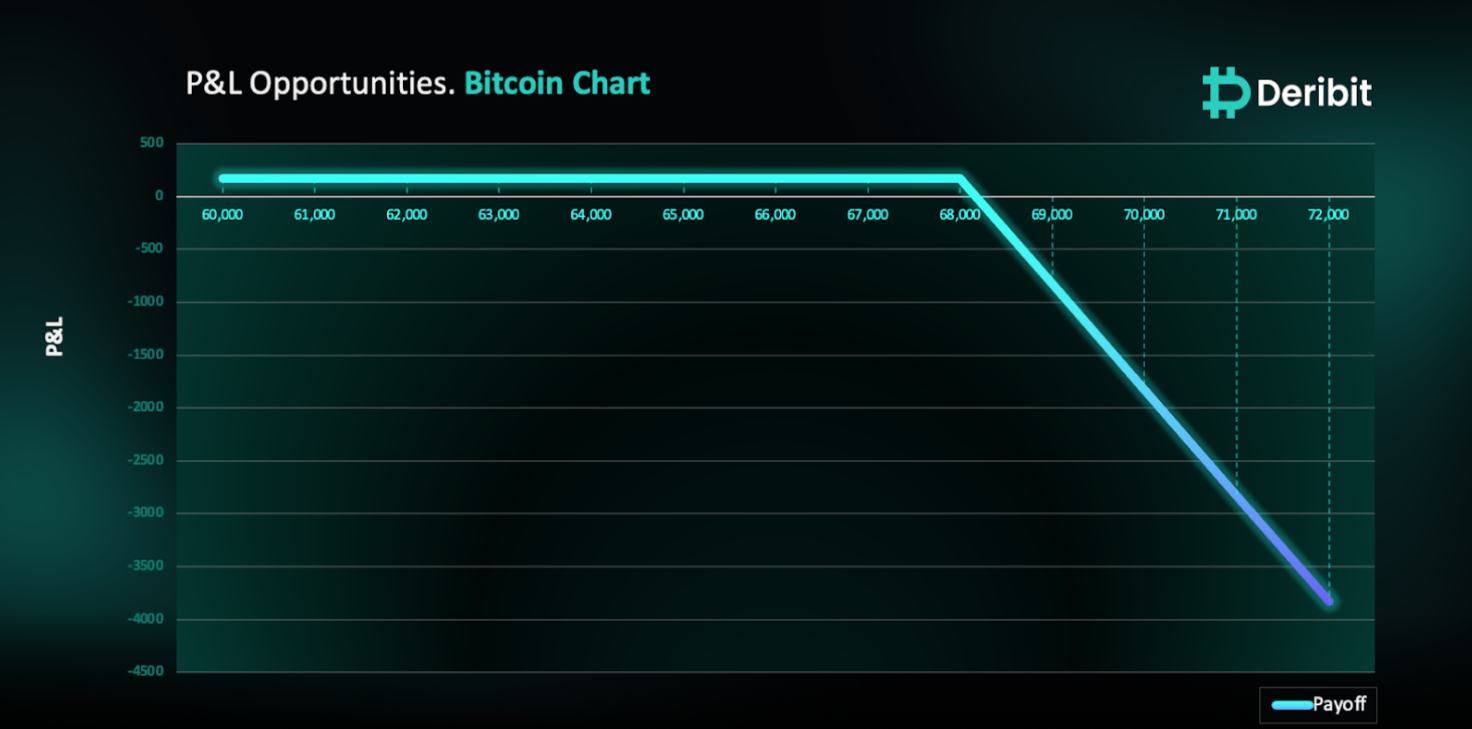

Short Call

The proposed strategy is a Short Call. A short call strategy is one of the simple ways options traders can take bearish positions. It involves selling call options, or calls.

You might consider initiating this trade if you believe that BTC can face hurdles in price to move higher from the supply zones.

Trade Structure

(OTM Call) Sell 1x BTC-3MAY24-$68,000-C @ $172

Target: Spot level < $68,000

Payouts

Maximum Profit: $172/BTC

Why are we taking this trade?

Aligned with our analysis, Bitcoin has once again demonstrated signs of a bearish trend with the confirmations of lower highs, evidenced by its selling off after hitting the trend line, as depicted in the attached 4-hour BTC price chart. The inflows into Bitcoin ETFs continue to indicate weakness and tepid investor’s interest.

We’ve identified several supply zones that could act as obstacles to BTC’s upward movement, and the market has consistently respected these zones, affirming the prevailing bearish trend.

Therefore, traders may capitalize on these resistance levels in BTC by shorting OTM calls, eg. $68,000. Adding to our odds, there is notable Open Interest(OI) observed in the $68,000 calls for the 3rd May expiry.

It’s important to note that a sudden surge in volatility leading to a substantial upward movement wouldn’t be advantageous due to the position’s short call exposure.

How to take this trade on Deribit?

Step 1: Go to Bitcoin Options

Step 2: Select Expiry, Strike and execute your Strategy.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)