View on market

Bitcoin’s Relative strength has come to 40% which is associated with pullbacks, also alignment of 50% Fibonacci retracement from swing levels, suggests potential for a rebound, prompting traders to consider a bull put spread strategy.

Bull Put Spread

The proposed strategy is a Bull Put Spread and it is invoked when the view on the market is ‘moderately bullish’ as it consists of one short put with a higher strike price and one long put with a lower strike price. Both puts have the same underlying and the same expiration date.

You may take this trade if you think BTC has made a short term bottom and may trade sideways to upside from here.

Trade Structure

(OTM Put) Sell 1x BTC-10MAY24-$57,000-P @ $805

(OTM Put) Buy 1x BTC-10MAY24-$56,000-P @ $595

Target: Spot level > $57,000

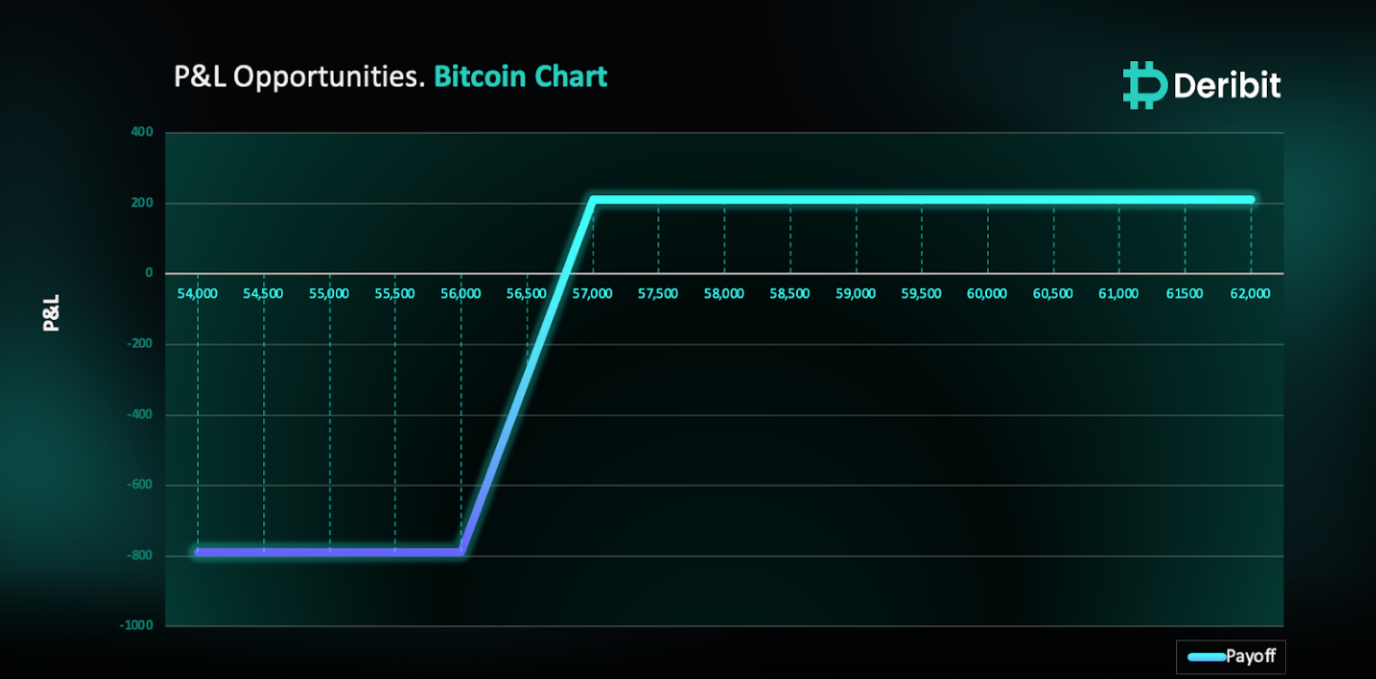

Payouts

Maximum Profit: $210/BTC

Why are we taking this trade?

In the previous Insights, I’ve expressed a cautious stance on BTC due to the macroeconomic environment and outflows from spot BTC ETFs, which led to BTC reaching around $56,500 levels. Following this decline, Bitcoin’s relative strength has now reached 40%, a level historically associated with rally attempts in recent times such as 22 Jan’24, 11 Sep’23, and 15 Jun’23, among others.

Moreover, BTC’s current price aligns with the 50% Fibonacci retracement level, calculated from the swing highs of Mar ’24 to Swings lows of Jan’24.

As highlighted in the attached 4-hour BTC price chart, there is a formation of Higher Lows, suggesting a potential rebound or sideways movement in BTC prices. Consequently, traders might consider implementing a bull put spread strategy to capitalize on this anticipated sideways to upward trend.

To implement this strategy, traders can sell a higher strike put option (e.g., $57,000) and simultaneously buy Put of a lower strike price (e.g., $56,00).

If Bitcoin is at or above $57,000 when the options expire on May 10, traders will be at maximum profit from the strategy.

In case of market downturn, the maximum loss is limited to $790 , Maximum loss of Bull Put spread = Difference between strike prices of puts ($57,000 – $56,000) – Net Credit ($210).

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)