After the delivery of derivatives on Friday, the crypto market rebounded rapidly. The market value returned to the level of $2 trillion, which was different from the performance of other major asset classes.

Derivatives markets did not support the rally, with perpetual contracts, futures, and options markets still dominated by bearish sentiment.

Thursday’s U.S. January CPI data and subsequent speeches by Fed officials may provide more information on the future direction of liquidity, but for the crypto market, since the general trend of liquidity changes has not yet reversed, the short-term rapid rise needs to be treated with caution by investors.

A Bull Market Return or a Short Squeeze?

After the low ebb in the second half of January, the crypto market did not follow other major asset classes to decline. Shortly after the new Non-Farm Payroll data release, BTC and ETH ushered in an unexpected wave of reverse pull-ups. As of February 8, the price of BTC once exceeded $45,000, and the 7-day price increase was close to 20%, while the 7-day price increase of ETH had exceeded 21%.

Affected by this, the crypto market has seen a rare continuous net short liquidation situation. According to Coinglass data, on February 4, the scale of short positions’ liquidation in major perpetual contract exchanges reached $226 million and reached $166 million on February 7. In comparison, the proportion of liquidated long positions was not even one-third of the total liquidated positions. The above seems to signal that market is walking out from the gloom of previous Fed policy, but maybe not.

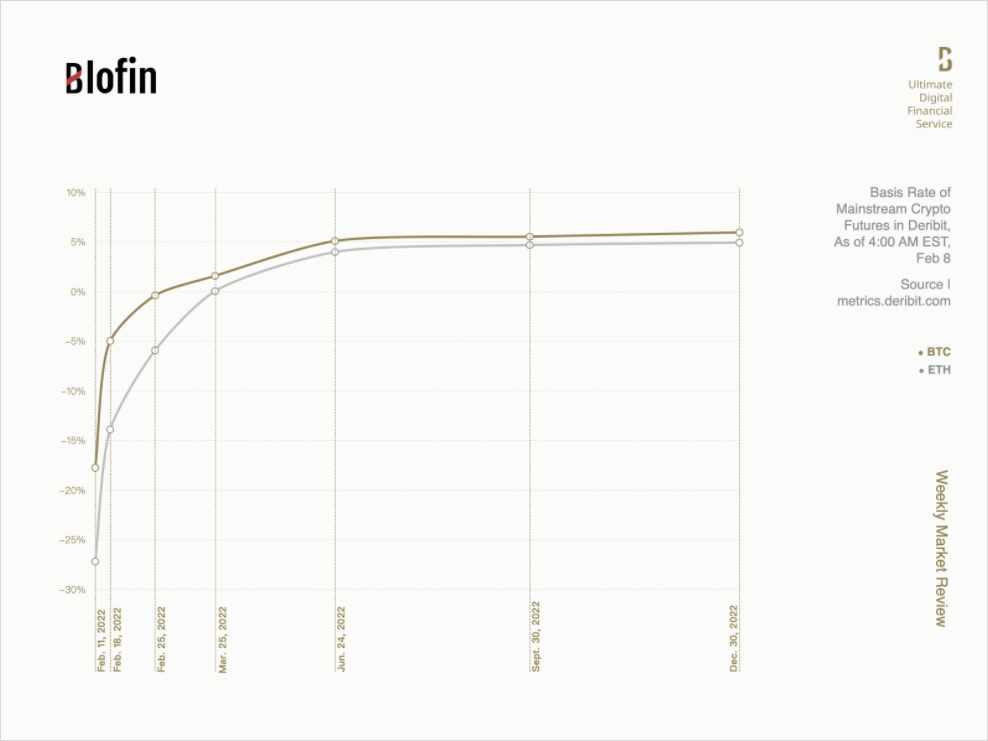

Futures Investors do not seem to support the current rise from the spot market either. Compared with perpetual contracts, the premium of futures contracts reflects investors’ expectations for the futures market to a certain extent. On the Deribit exchange, the front-month futures of BTC and ETH once hit a negative premium of lower than -20%.

In comparison, the annual futures premiums due on December 30 remained below 6% and 5%, respectively, basically the same as at the end of January. The above situation shows that investors are still not optimistic about the market’s future expectations. They are unwilling to pay more premiums when the liquidity crunch trend has not changed.

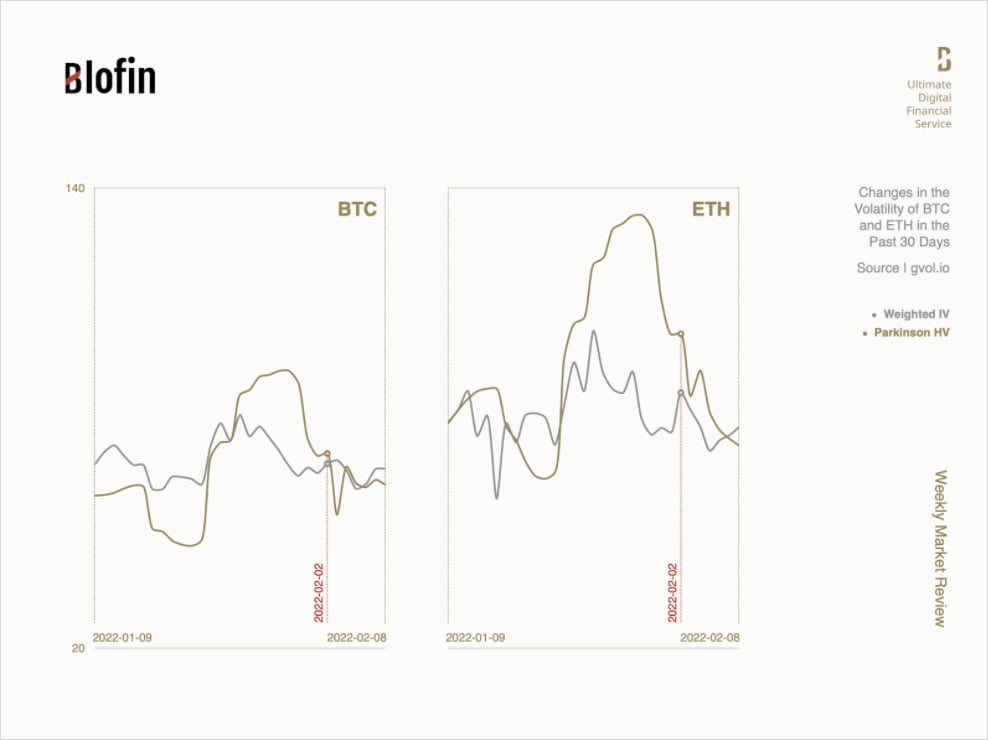

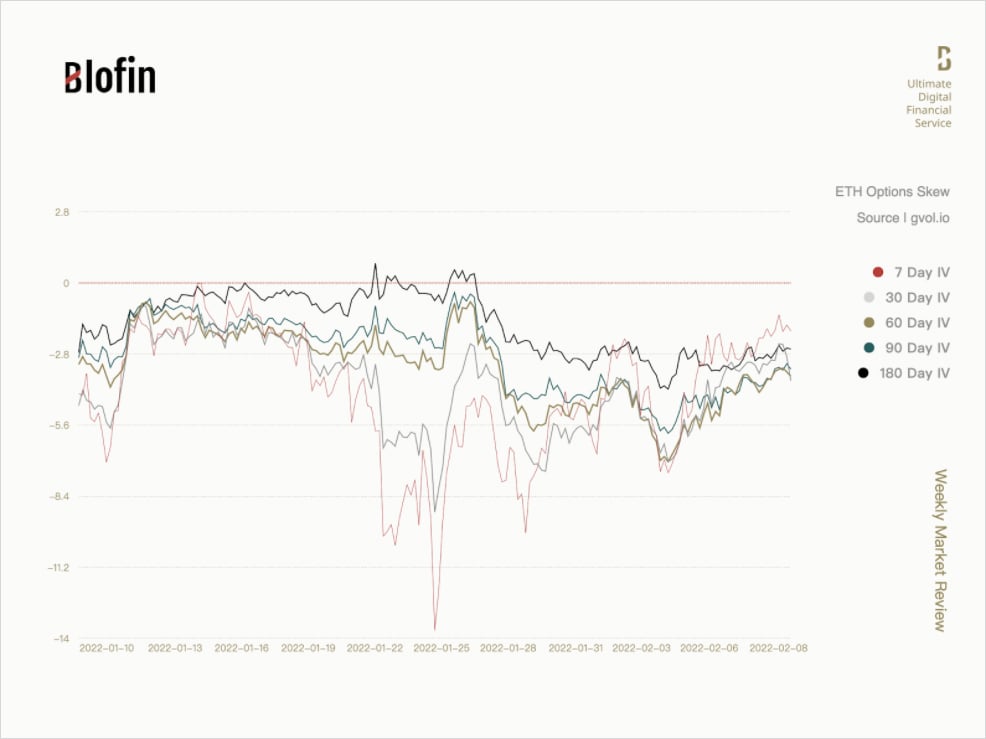

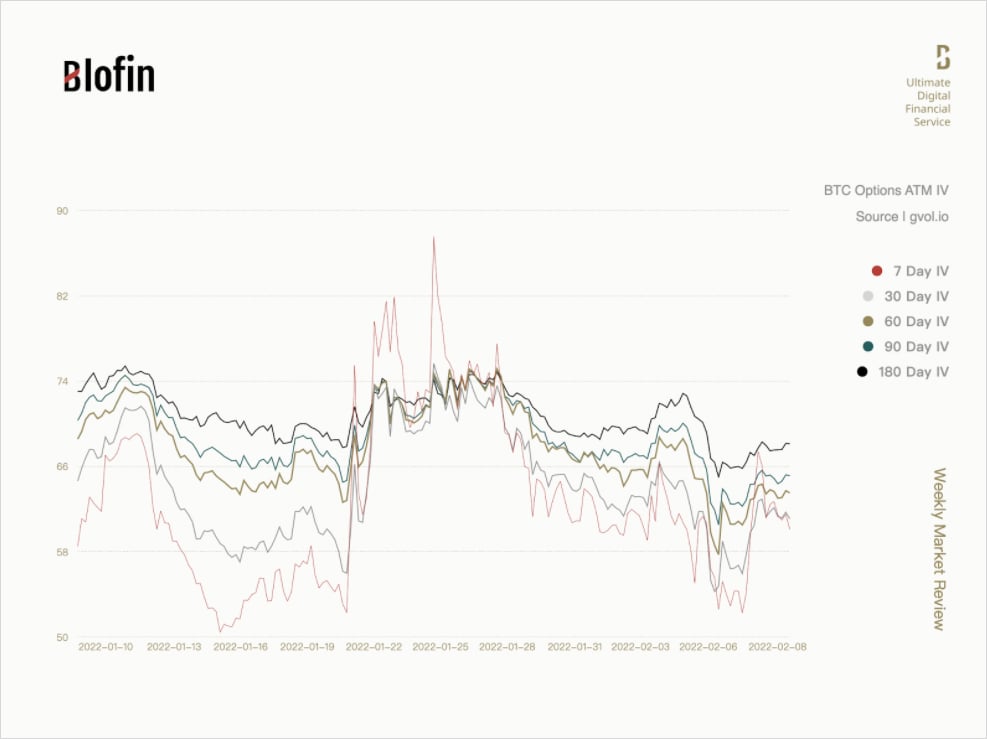

Although the realized volatility has dropped significantly from the options market, it still closely intersects with the implied volatility, and the changing trend is not clear. The options skewness data reveals more information: whether BTC or ETH, the skew curves of options expiring in 7 days and 30 days rose higher, while far-month options’ skew changes are not significant. This is more evident in the skew of ETH options.

Generally speaking, the increase in skew is pushed by the rising implied volatility of call options. This usually happens when market sentiment is more optimistic, but it can also occur when many investors buy call options. Observing the skewness data and the detailed changes in the implied volatility chart together, we can further find that from February 5 to 7, the implied volatility of options expiring in 7 days increased significantly, while other curves had no abnormal change.

At the same time, by comparing with the curve changes in mid-January, we can rule out the possibility of macroeconomic factors. The influence of macro factors on skew and volatility is continuous and can significantly affect all curves, not just a tiny subset of them.

If we also consider the abnormality of skew, it is not difficult to judge: the behavior of buying a large number of short-term call options pushes up the short-term skew and short-term volatility. Combined with the sluggish daily trading volume of less than $30 billion in the spot market in recent days, the possibility of a “short squeeze” is becoming more and more difficult to rule out.

“Autumn May Warm Up Briefly, but Leaves Will Still Fall”

Currently, the derivatives market does not support the short-term rise, and the macro data is also challenging to keep investor confidence as last year.

On the one hand, following in the footsteps of the Federal Reserve, central banks have further tightened investors’ expectations for future liquidity. For the first time, the European Central Bank revealed its intention to “do not rule out raising interest rates this year”. The Australian Central Bank also announced that it might stop bond purchases in February.

Traders in the interest rate and bond markets, on the other hand, have made more aggressive bets, reflecting expectations that policymakers will use a tightening front to curb inflation.

Strong U.S. jobs data on Friday boosted expectations for a 50-basis-point rate hike by the Federal Reserve in March to more than 30%. The Bank of England was one vote away from doing so last week, with traders pricing in a 50% chance of a 50 basis point rate hike in the coming months. ECB President Lagarde’s hawkish turn has recalibrated traders’ expectations, with the focus now turning to “whether the ECB will raise rates by 25 basis points this year”. Overnight index swap traders expect the RBA to raise interest rates to 1.25% this year.In addition,

the yields of multi-national bonds led by U.S. Treasuries have continued to climb, and the total global negative-yielding bonds have fallen to the lowest level since December 2015. In just two days, nearly $3 trillion in bonds returned to positive yield territory, in one of the most apparent signs yet that the era of easy money is coming to an end. For the crypto market, this means that the contraction and withdrawal of liquidity are inevitable, and the short-term rise is more likely to be a “short-term recovery when autumn comes”. Investors still need to prepare for the winter.

The U.S. CPI data for January will be released on Thursday, and several Fed officials will comment on the economic data later or reveal more details about the Fed’s measures against inflation and excess liquidity. On Friday, a large number of recently purchased short-term options will expire, which means that the market may experience significant fluctuations that should be concerned by investors.

AUTHOR(S)