View on market

Polygon’s new Miden zero-knowledge rollup enhances computational load, improving transaction speed, and increasing privacy. Technical analysis shows strong support and sharp rebounds, suggesting a Call Ratio Spread strategy for traders.

Call Ratio Spread

The proposed strategy is a Call Ratio Spread. A Call Ratio Spread involves buying a call option that is OTM, and then selling two (or more; in below case, it is 3 legs) of the same option type (Call) of the same expiry, further OTM.

You may consider taking this trade if your perspective on Polygon is bullish.

Trade Structure

(OTM Call) Buy 1x MATIC_USDC-31MAY24-$0.80-C @ $0.0079

(OTM Call) Sell 3x MATIC_USDC-31MAY24-$0.85-C @ $0.0039

Target: Spot level < $0.85

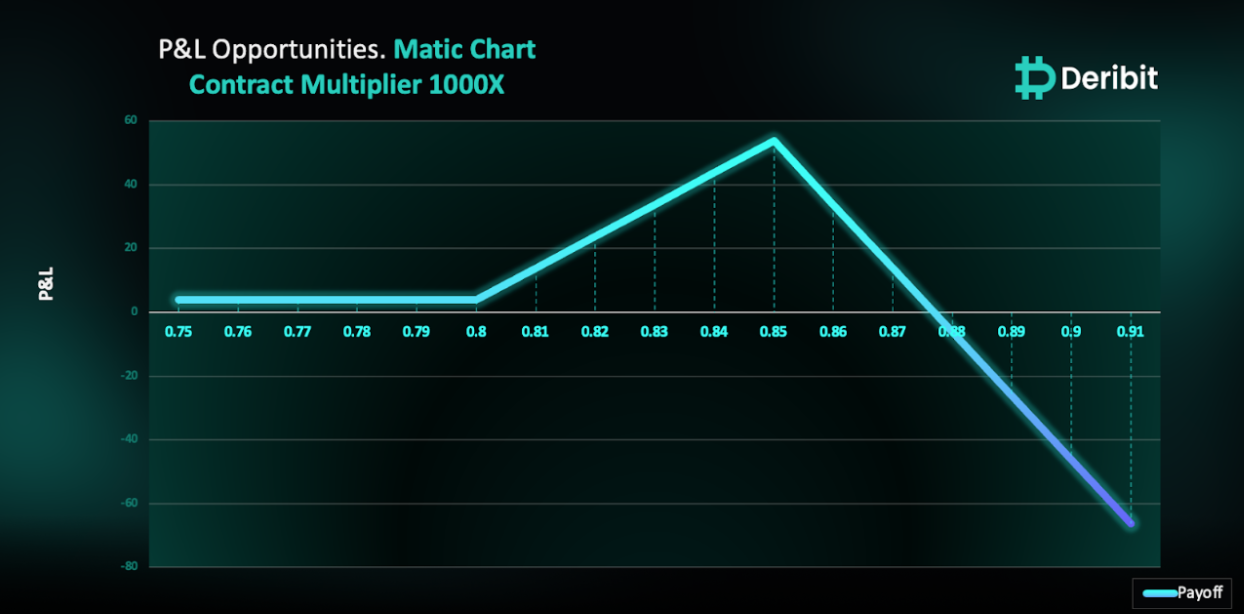

Payouts

Maximum Profit: $53.8/contract

Net Credit of Strategy: $3.8/contract

Why are we taking this trade?

Polygon has introduced Miden, a zero-knowledge rollup designed to enhance Ethereum’s scalability. Miden enables faster transaction times and reduces costs for users. This technology allows users to generate proofs for their transactions without exposing the details to the entire network, significantly boosting both privacy and scalability. On the technical front, Polygon has found support on a higher time frame demand zone, as illustrated in the attached daily chart of the underlying. This support level has led to sharp rebounds in the underlying asset as witnessed in the attached chart. Traders looking to capitalize on this development might consider using a Call Ratio Spread strategy.

To implement this strategy, traders can buy a higher strike call option (e.g., $0.8) and simultaneously sell calls in triple quantity (3x) of a higher strike price (e.g., $0.85).

If Polygon is at $0.85 when the options expire on May 31st, traders will be at maximum profit from the strategy.

It’s important to note that while the initial credit of this strategy is $3.8, losses beyond the initial credit are possible due to the position’s net short call exposure.

Note: MATIC Contract Multiplier is 1,000.

How to take this trade on Deribit?

Step 1: Go to Options books under MATIC_USDC & Select expiry.

Step 2: Choose Strike and execute your trade.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)