View on market

The SEC’s request of amendments in fillings of spot Ethereum ETFs has boosted altcoins like MATIC. I anticipate Polygon’s bullish momentum could see it reach $0.95, making a Bull Call Spread strategy potentially profitable.

Bull Call Spread

The proposed strategy is a Bull Call Spread. A Bull Call Spread consists of one long call with a lower strike price and one short call with a higher strike price. Both calls have the same underlying stock and the same expiration date. It is established for a net debit (or net cost) and profits as the underlying stock rises in price.

You may consider taking this trade if your perspective on Polygon is bullish.

Trade Structure

(OTM Call) Buy 1x MATIC_USDC-31MAY24-$0.90-C @ $0.0025

(OTM Call) Sell 1x MATIC_USDC-31MAY24-$0.95-C @ $0.0010

Target: Spot level > $0.95

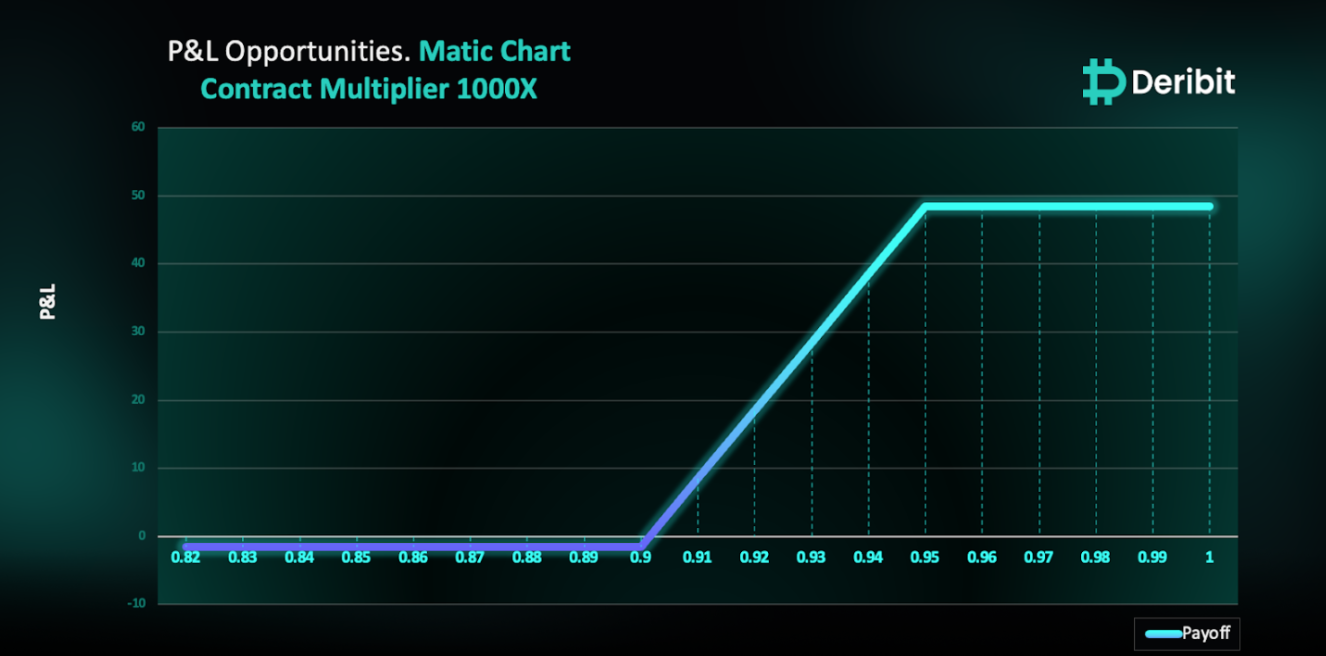

Payouts

Maximum Profit: $48.5/contract

Net Debit of Strategy: $1.5/contract

Why are we taking this trade?

We’ve witnessed a significant rally in altcoins, including MATIC, following the US SEC’s request for amendments to the 19b-4 filings on an accelerated basis for spot Ethereum ETFs. These filings, called Form 19b-4 are to inform the SEC of proposed rule changes, and are critical documents needing the SEC’s approval before spot Ethereum ETFs can become effective. This development has increased the likelihood of the SEC approving such products.

In my insights on May 17th, I anticipated bullish momentum for Polygon due to advancements like Miden, a zero-knowledge rollup designed to enhance Ethereum’s scalability, speed up transaction times, and reduce costs for users. Technically, Polygon has shown strength from a higher time frame demand zone, as highlighted in the attached chart. The next resistance level is at $0.95, and we can expect Polygon to reach this level if the SEC approves the spot Ethereum ETFs. Traders looking to capitalize on this opportunity might consider using a Call Spread strategy.

To implement this strategy, traders can buy a call option at a lower strike price (e.g., $0.90) and simultaneously sell a call option at a higher strike price (e.g., $0.95).

If Polygon reaches $0.95 when the options expire on May 31st, traders will achieve maximum profit from this strategy.

In case of a market downturn, the potential loss is limited to the initial debit of $1.5.

Note: MATIC Contract Multiplier is 1,000.

How to take this trade on Deribit?

Step 1: Go to Options books under MATIC_USDC & Select expiry.

Step 2: Choose Strike and execute your trade.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)