In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

Unanticipated ETH ETF chatter flipped approval odds.

While Funds+CT were long Spot ETH (most staking) the Option positioning was offside with protective Puts, or short yielding Calls.

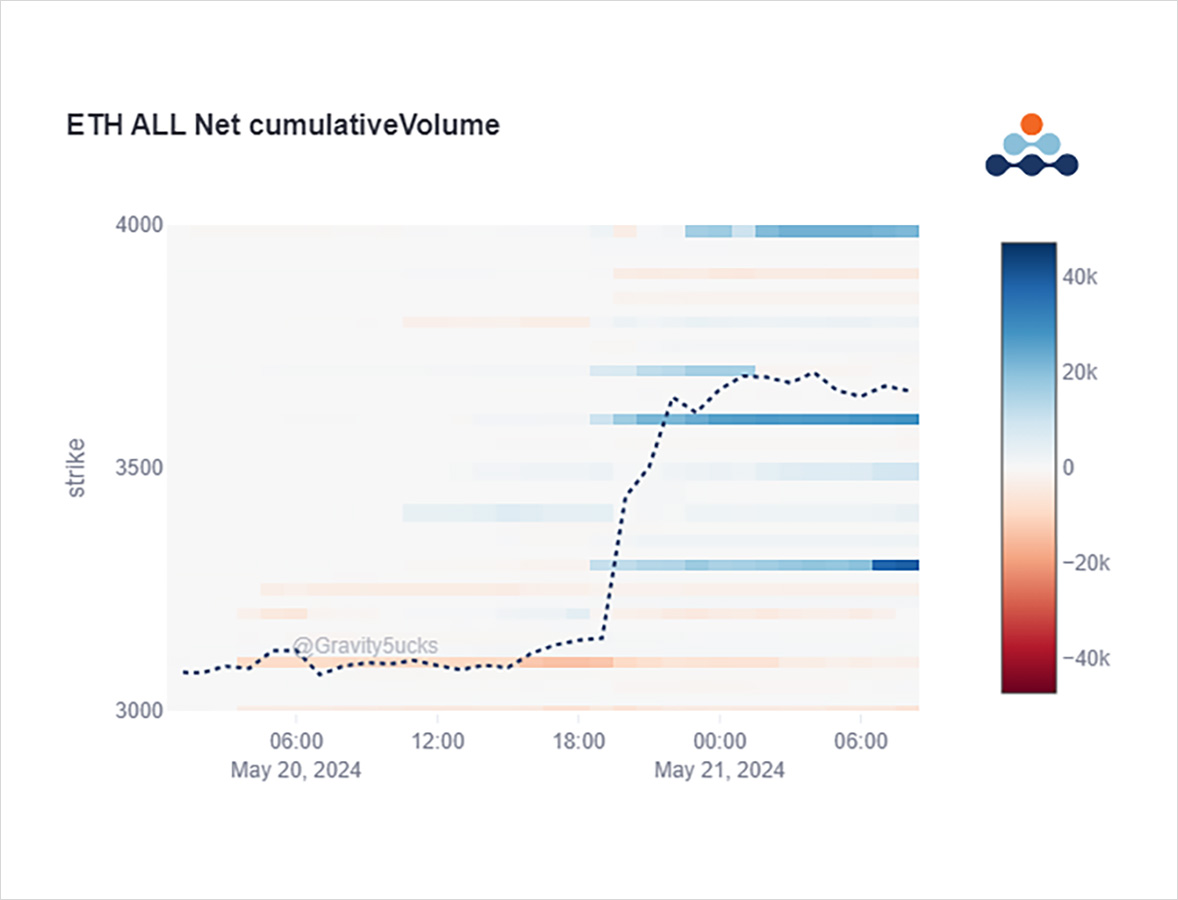

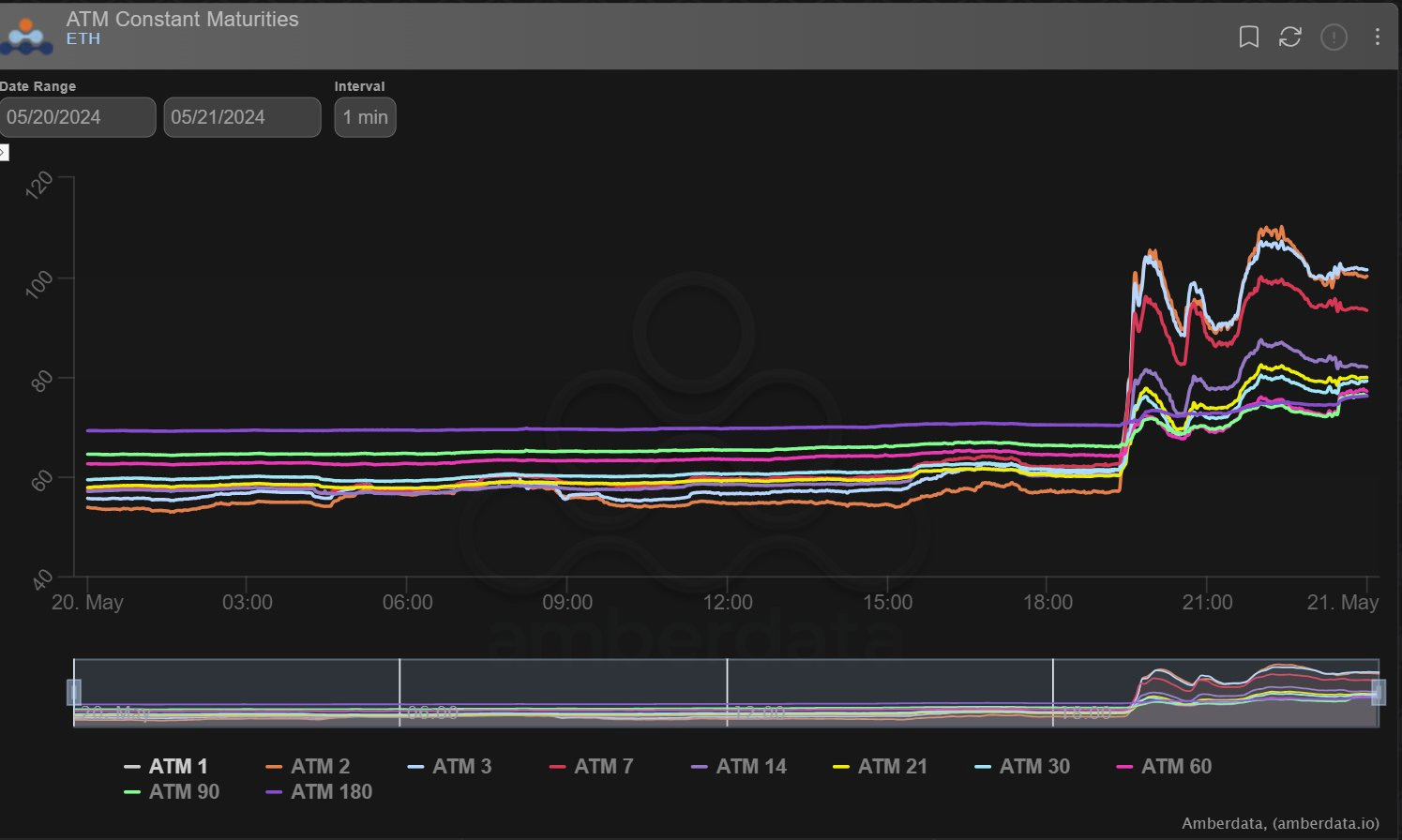

ETH Spot +20% forced aggressive short covering of May 3.3+Jun3.6k Calls. IV surged 35%+.

2) For a while, ETH has been the place to over-write Calls to add yield to staked ETH.

If done wisely with 1:1 ratio this can be well managed; if greedy with over-selling Calls it can become a problem.

Problems set in quickly on ETH ETF chatter, as short Calls had to market buy.

3) May 3.3k + Jun 3.6k Calls were the first to act quickly.

But on the ETH Spot surge, MMs pulled back offers, not wanting to sell Gamma cheap.

May 3.4k-3.7k buyers followed.

As a consequence, IV levels in May tenor Options pumped >100% from 60%.

4) Fresh adding of upside was limited to some buying of May+Jun 4k Calls (+spreads).

Call Skew has been increasing recently in 1m+ tenors sighting longer-term ETH bullishness.

But conspicuous absent rolling of near-date ITM Calls up(+out) indicates feeble short-term positioning.

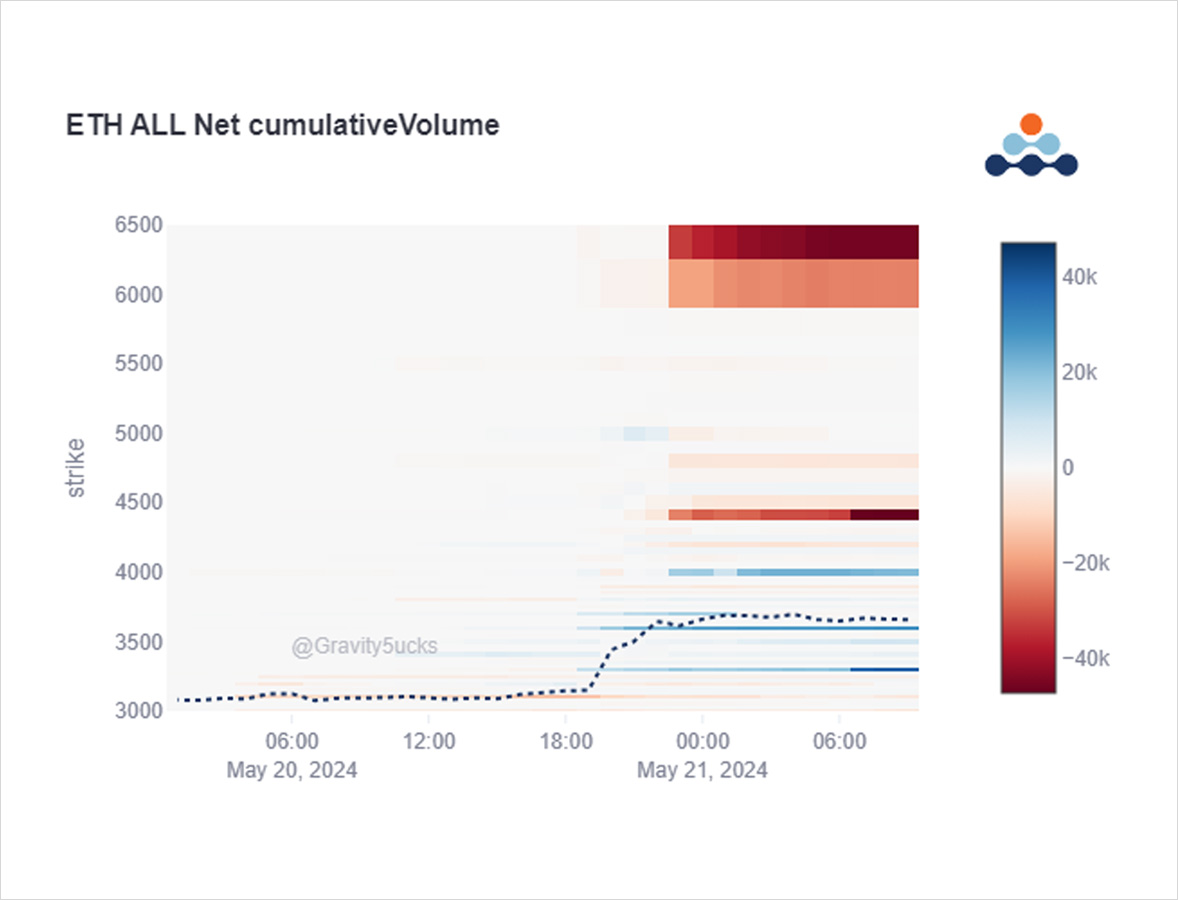

5) Presenting the full picture, we did see the unwinding of OTM convexity bets in May31 4.4k and Jun 6k-7k Calls.

The latter included an unwind of 50k Jun 6.5k Calls bought mid-April for just such an event as yesterday, but the wait had eroded the value, and a loss was cemented.

6) We also observed some likely profit-taking (but can’t rule out opening) of Vol positions with sales of Jun 3.7k straddles which gave some Gamma/Vega back to MMs, and allowed IV to subside as Spot moved in a tighter range during APAC hours.

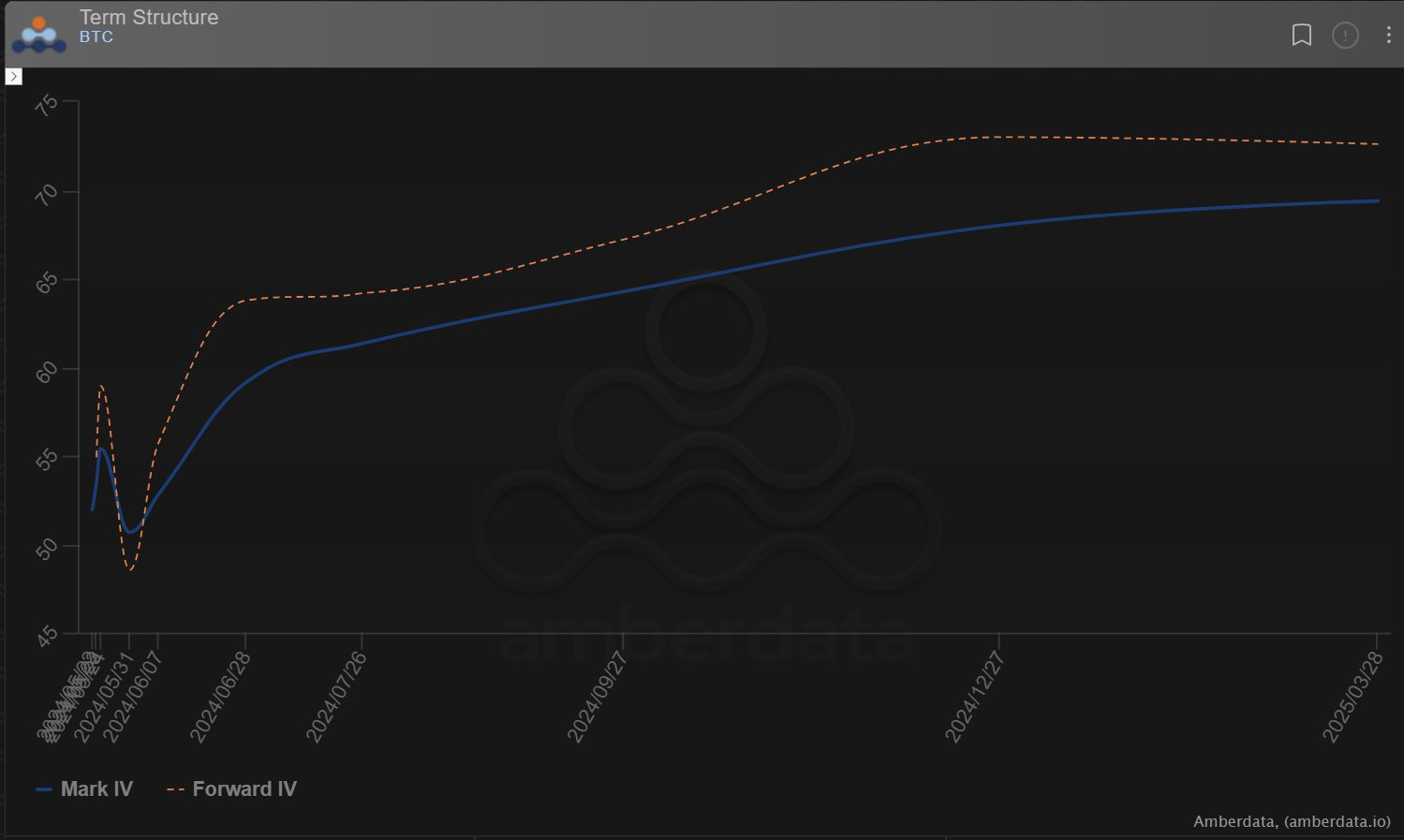

7) A bridesmaid for once, BTC also had a powerful rally given that the news focus was ETH-based.

Bullish biased flows with no oversized trades; we saw some profit-taking of May31 69+70k ITM Calls bought within the last week.

BTC Dvol discount perhaps neglects eclipsed BTC RV.

8) Still quite a few unresolved ETF actions to be concluded before approval, and aside from FED minutes tomorrow and potentially tradfi market-moving Nvidia results today, it would not be unsurprising to observe strong Gamma demand and non-aggressive supply.

Dvol BTC 58% ETH 76%

View Twitter thread.

AUTHOR(S)