View on market

The bullish outlook for ETH is supported by signs of potential SEC approval for a spot Ether ETF, including VanEck’s ETF listing on DTCC, amended filings from major exchanges, and technical strength in Ethereum’s price action. Traders can look to play this event by deploying Call Butterfly strategy.

Call Butterfly Spread

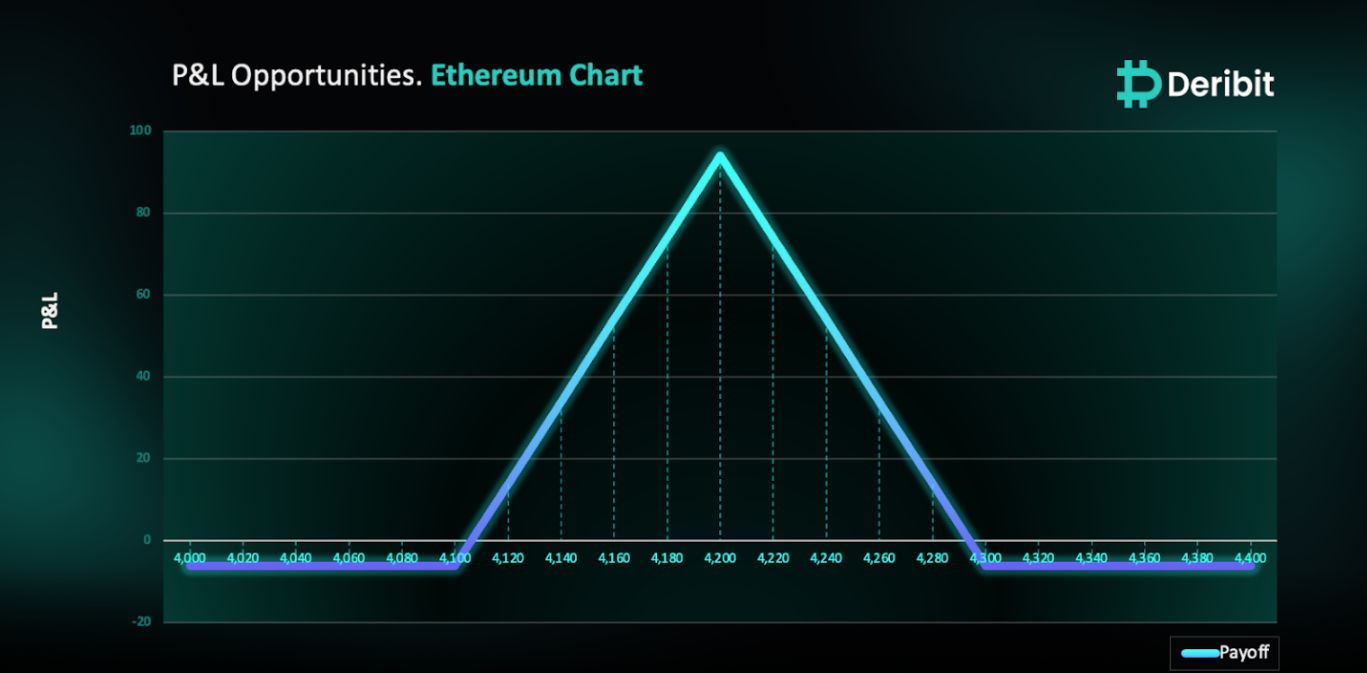

Call Butterfly SpreadThe proposed strategy is a Call Butterfly strategy. A Butterfly Spread with calls is a three-part strategy that is created by buying one call at a lower strike price, selling two calls with a higher strike price and buying one call with an even higher strike price.

You can consider executing this strategy if you are looking to play the event of ETH ETF approval via hedged strategy.

Trade Structure

(OTM Call) Buy 1x ETH-31MAY24-$4,100-C @ $89

(OTM Call) Sell 2x ETH-31MAY24-$4,200-C @ $67

(OTM Call) Buy 1x ETH-31MAY24-$4,300-C @ $51

Target: Spot level < $4,200

Payouts

Maximum Profit: $94/ETH

Debit of Strategy: $6/ETH

Why are we taking this trade?

In my insights from May 21st, I highlighted a bullish outlook for altcoins, with several indicators suggesting the SEC might approve a spot Ether ETF. Here are the key reasons:

- VanEck’s U.S. Spot Ethereum ETF Addition to DTCC: Global investment manager VanEck’s U.S. spot Ethereum exchange-traded fund has been added to the Depository Trust and Clearing Corporation (DTCC) list of ETFs on its website. The DTCC is a major provider of post-trade clearance, settlement, and custody services.

- SEC Requests Amendments from Exchanges: The SEC reportedly urged exchanges to urgently amend their 19b-4 filings. Late on Tuesday, Cboe BZX filed amended Form 19b-4s for multiple Ethereum funds, including the Franklin Ethereum Trust, Fidelity Ethereum Fund, VanEck Ethereum Trust, Invesco Galaxy Ethereum ETF, and ARK 21Shares Ethereum ETF.

- Grayscale’s Adjustments: Grayscale has removed the staking proposal from its spot Ethereum ETF filing, which is a notable change.

- Grayscale Ethereum Trust Discount Narrows: The discount on the Grayscale Ethereum Trust has narrowed to 10%, indicating increased optimism about the approval of a spot ETH ETF.

- Fidelity’s Removal of Staking Rewards: Fidelity has removed the possibility of staking rewards from its S-1 registration statement for its prospective Ethereum ETF, aligning with regulatory expectations.

Source: The Block (Point 1-5)

On the technical side, Ethereum has managed to break through significant supply zones at the $3,355 and $3,750 levels, demonstrating strength. Lower time frame demand zones are being respected even at levels of $3780, and the price appears to be picking up buy orders and moving towards higher levels, as shown in the attached chart. Traders looking to take advantage of this situation might consider using a Call Butterfly strategy to capitalize on the potential upward movement.

To execute this approach, traders can purchase a call option with a higher strike price (e.g., $4,100) while simultaneously selling double the quantity of calls at a higher strike price (e.g., $4,200) and buying a call at an even higher strike price (e.g., $4,300).

If the price of ETH is at $4,200 when the options expire on May 31st, traders will achieve maximum profit from this strategy.

In case of a market downturn, the potential loss is limited to the initial debit of $6.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (ETH), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)