View on market

The crypto market is bullish, supported by increasing Spot Bitcoin ETF inflows and political backing. Technically, BTC shows potential for another rally towards $74,000, hence traders can look to deploy a Call Ratio Spread strategy.

Call Ratio Spread

The proposed strategy is a Call Ratio Spread. A Call Ratio Spread involves buying a Call option that is OTM, and then selling two (or more) of the same option type (Call) of the same expiry, further OTM.

You may consider taking this trade if you have a bullish outlook on BTC.

Trade Structure

(OTM Call) Buy 1x BTC-31MAY24-$72,000-C @ $360

(OTM Call) Sell 2x BTC-31MAY24-$74,000-C @ $142

Target: Spot level < $74,000

Payouts

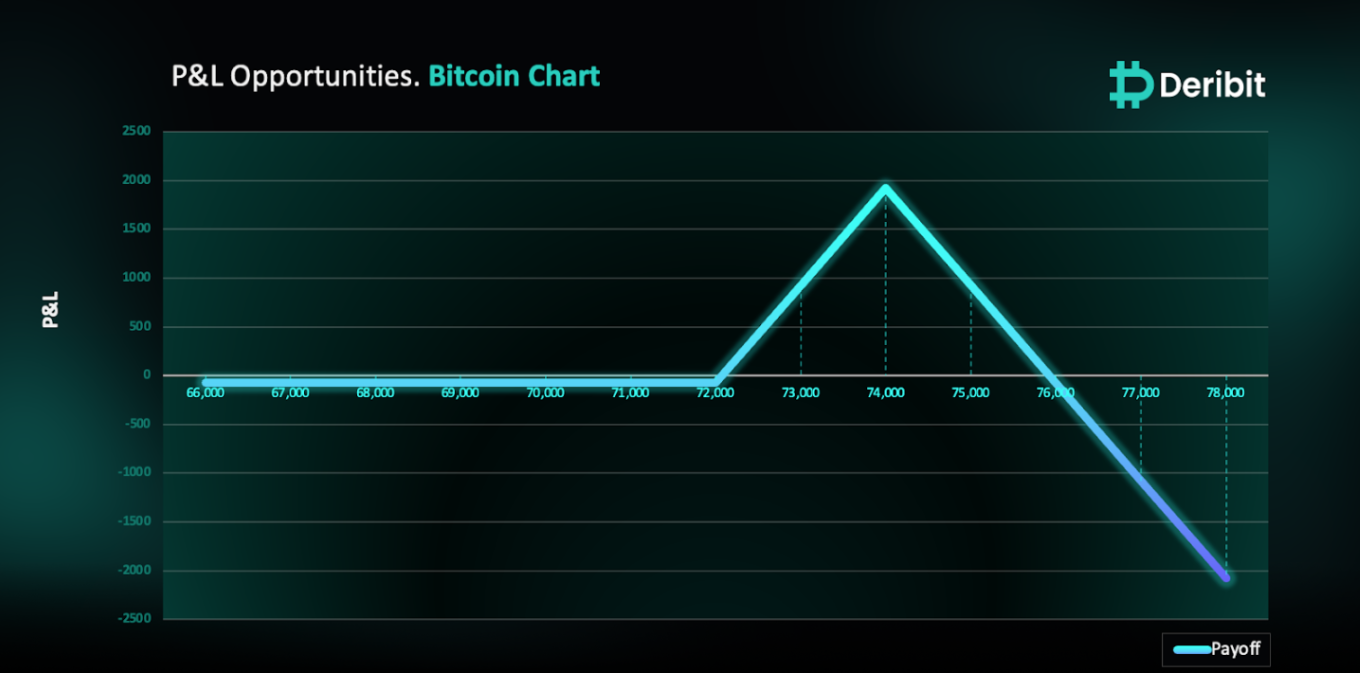

Maximum Profit: $1924/BTC

Net Debit of Strategy: $76/BTC

Why are we taking this trade?

The crypto market is experiencing a bullish trend, as highlighted in my previous Insights. This optimism is evident from the increasing inflows into Spot Bitcoin ETFs. Political support in the US is also boosting sentiment, with Donald Trump pledging to stop CBDCs and advocating for self-custody during his speech at the Libertarian Convention, positioning himself as a pro-crypto candidate (Source: The Block).

From a technical standpoint, as shown in the attached 4-hour BTC price chart, we’ve seen some retracements after the price touched approximately $71,970, entering the supply zone. However, these retracements are not significant, with no major violations observed. The price has reacted positively from the demand zone at $67,055, suggesting the possibility of another rally towards the highlighted supply zone, potentially moving higher this time. Additionally, there is another crucial pivot around $74,000, which is a significant one, as in mid-March we saw substantial Spot BTC outflows post prices hitting the pivot area. This area could be a target for the price, potentially pushing it below this pivotal point.

Traders looking to capitalize on this analysis might consider implementing a Call Ratio Spread strategy.

To implement this strategy, traders can buy a higher strike Call option (e.g., $72,000) and simultaneously sell Calls in double quantity (2x) of a higher strike price (e.g., $74,000).

If Bitcoin is at $74,000 when the options expire on May 31st, traders will be at maximum profit from the strategy.

It’s important to note that while the initial debit of this strategy is $76, losses beyond the initial debit are possible due to the position’s net short call exposure.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)