View on market

In my June 3rd Insights, I anticipated a bullish trend for Bitcoin driven by Fed policy and Inflation data, with recent BTC ETF inflows and technical patterns supporting this outlook. Key upcoming data, including employment and CPI reports, could further push Bitcoin to new all-time highs, hence traders can look to deploy a Call Butterfly strategy.

Call Butterfly Spread

The proposed strategy is a Call Butterfly Spread strategy. A Butterfly Spread with Calls is a three-part strategy that is created by buying one Call at a lower strike price, selling two Calls with a higher strike price and buying one Call with an even higher strike price.

You can consider executing this strategy if you are eyeing upward movement in BTC prices.

Trade Structure

(OTM Call) Buy 1x BTC-14JUN24-$74,000-C @ $1,370

(OTM Call) Sell 2x BTC-14JUN24-$76,000-C @ $889

(OTM Call) Buy 1x BTC-14JUN24-$78,000-C @ $562

Target: Spot level < $76,000

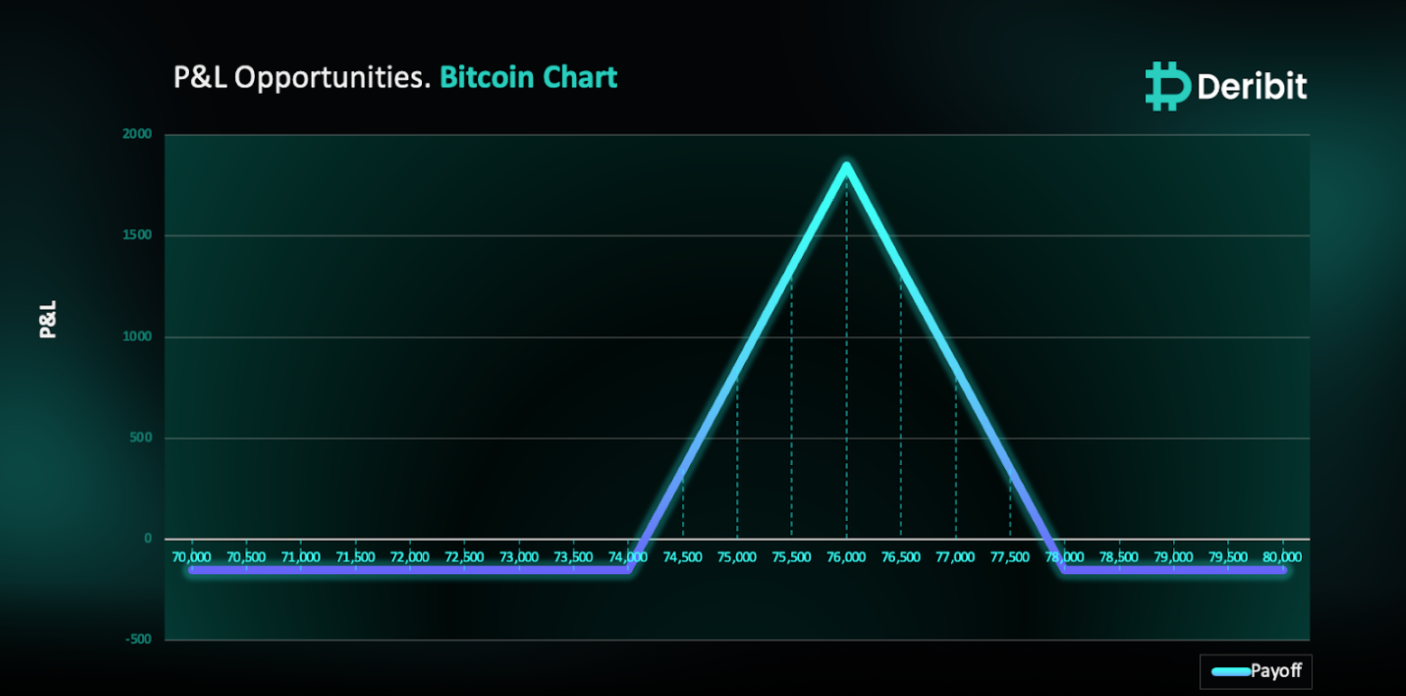

Payouts

Maximum Profit: $1,846/BTC

Debit of Strategy: $154/BTC

Why are we taking this trade?

June 3rd Insights Recap: Bullish Outlook for Bitcoin

In my June 3rd Insights, I anticipated a bullish trend for Bitcoin, highlighting that Federal Reserve policy and Inflation data are two critical factors that could drive Bitcoin to new all-time highs. Additionally, I highlighted a significant decline in Bitcoin exchange balances, suggesting that large holders (whales) are moving their coins off exchanges in anticipation of higher prices, which is a bullish sign.

Recent Developments Fueling Optimism

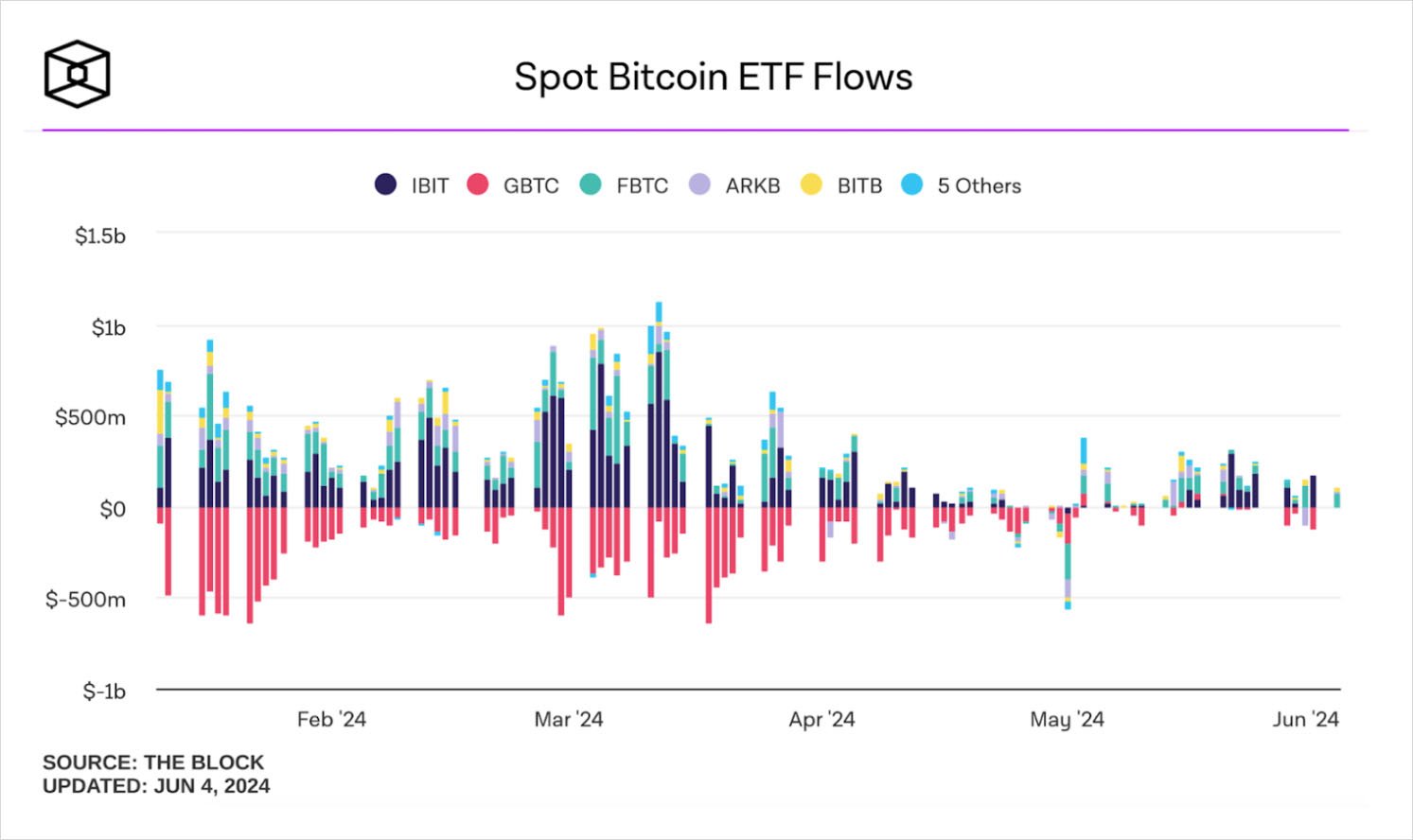

Recent events have further strengthened this bullish sentiment as U.S. spot Bitcoin ETFs have seen $886.6 Million in daily net inflows, marking the second-highest so far. (Source: Farside Investors).

This inflow streak has lasted sixteen consecutive days, just one day short of the longest positive flow streak recorded from January to mid-February.

Bitcoin’s value briefly touched above the $71,300 mark recently. In addition, the U.S. is on the verge of launching spot Ethereum ETFs, as major issuers have submitted amended registration statements to the SEC. Some of the largest cryptocurrency by market capitalization have surged in double digits in the past 24 hours, reaching a record lifetime high.

Key Data to Watch

This Friday, we all will be seeing the new unemployment data. A weaker-than-expected report could rekindle hopes for rate cuts. Next week, we’ll receive the CPI inflation report. If the CPI YOY is 3.3% or lower, it could push Bitcoin to new all-time highs. Historically, Bitcoin’s direction correlates with CPI data—higher CPI tends to be bearish for Bitcoin, while lower CPI is bullish.

Technical Analysis and Trading Strategies

Bitcoin has broken out of a triangle pattern (as indicated by the Yellow line), which was highlighted in the June 3rd Daily Trade Inspiration. I suggested a Bull Put Spread strategy, which has proven favorable for traders who adopted it.

From a technical perspective, Bitcoin is now in a higher time frame supply zone, initially formed in the first week of April. After its first touch on May 21, Bitcoin experienced some retracements but failed to breach the support level of $66,700. This resilience indicates a bullish trend. The inability of the higher time frame supply zone to breach the smaller time frame demand zone suggests the current supply zone may soon be overtaken.

As we approach the release of unemployment data, which could act as a catalyst for breaking the supply zone and pushing Bitcoin to new highs, traders can expect the bullish environment to persist. Therefore, deploying a Call Butterfly Spread strategy could be advantageous at this point.

To execute this approach, traders can purchase a Call option with a higher strike price (e.g., $74,000) while simultaneously selling double the quantity of Calls at a higher strike price (e.g., $76,000) and buying a Call at an even higher strike price (e.g., $78,000).

If the Bitcoin price is at $76,000 when the options expire on June 14th, traders will achieve maximum profit from this strategy.

In case of a market downturn, the potential loss is limited to the initial debit of $154.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)