View on market

The crypto market is bullish, with Spot Bitcoin ETFs seeing significant inflows, and technical setup suggest potential new highs. Meanwhile, the Bank of Canada has proactively reduced its overnight rate by 0.25 basis points to 4.75%, which could impact U.S. economic expectations, hence traders can look to deploy a Call Ratio Spread strategy in BTC.

Call Ratio Spread

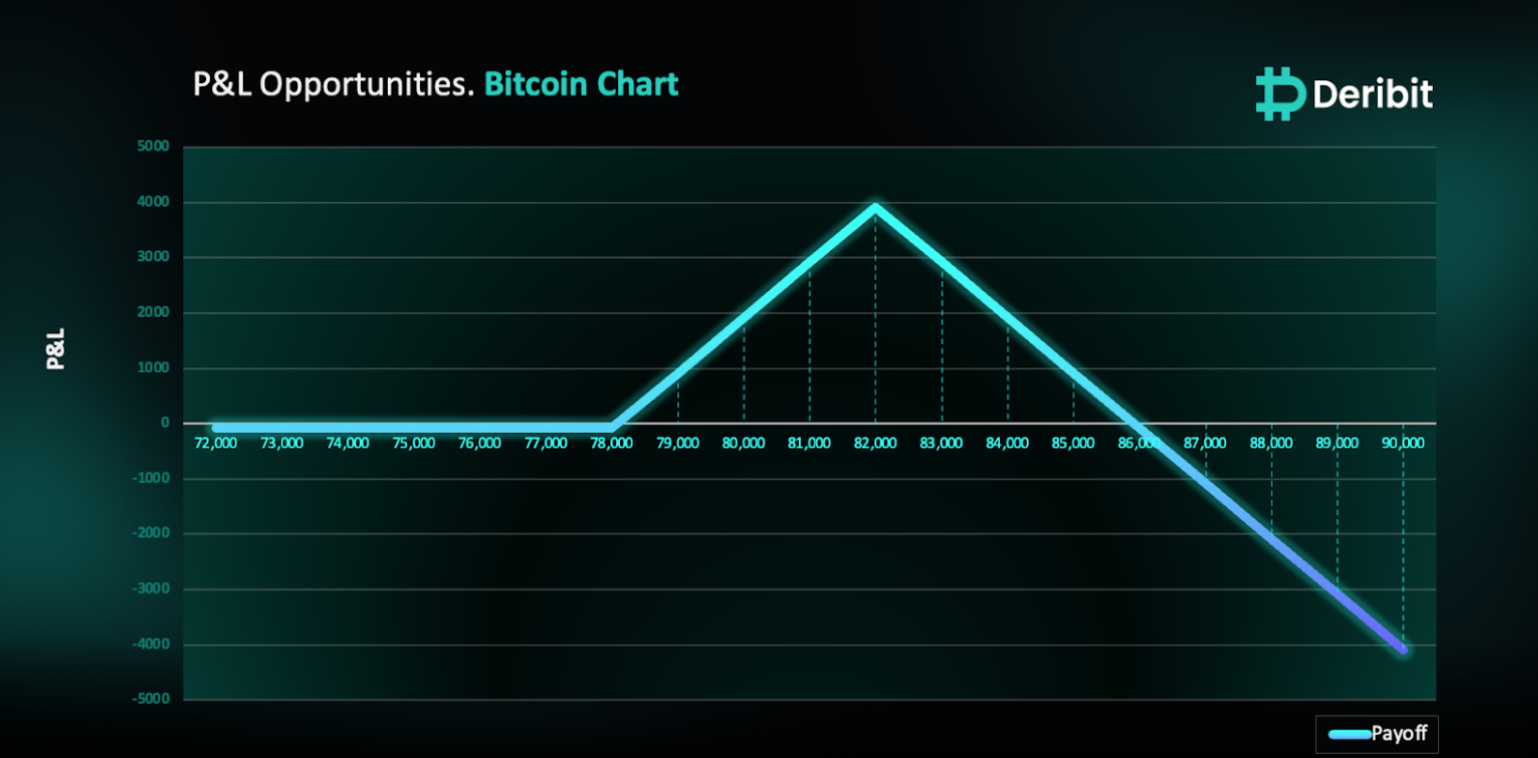

The proposed strategy is a Call Ratio Spread. A Call Ratio Spread involves buying a Call option that is OTM, and then selling two (or more) of the same option type (Call) of the same expiry, further OTM.

You may consider taking this trade if you have a bullish outlook on BTC.

Trade Structure

(OTM Call) Buy 1x BTC-14JUN24-$78,000-C @ $903

(OTM Call) Sell 2x BTC-14JUN24-$82,000-C @ $410

Target: Spot level < $82,000

Payouts

Maximum Profit: $3,917/BTC

Net Debit of Strategy: $83/BTC

Why are we taking this trade?

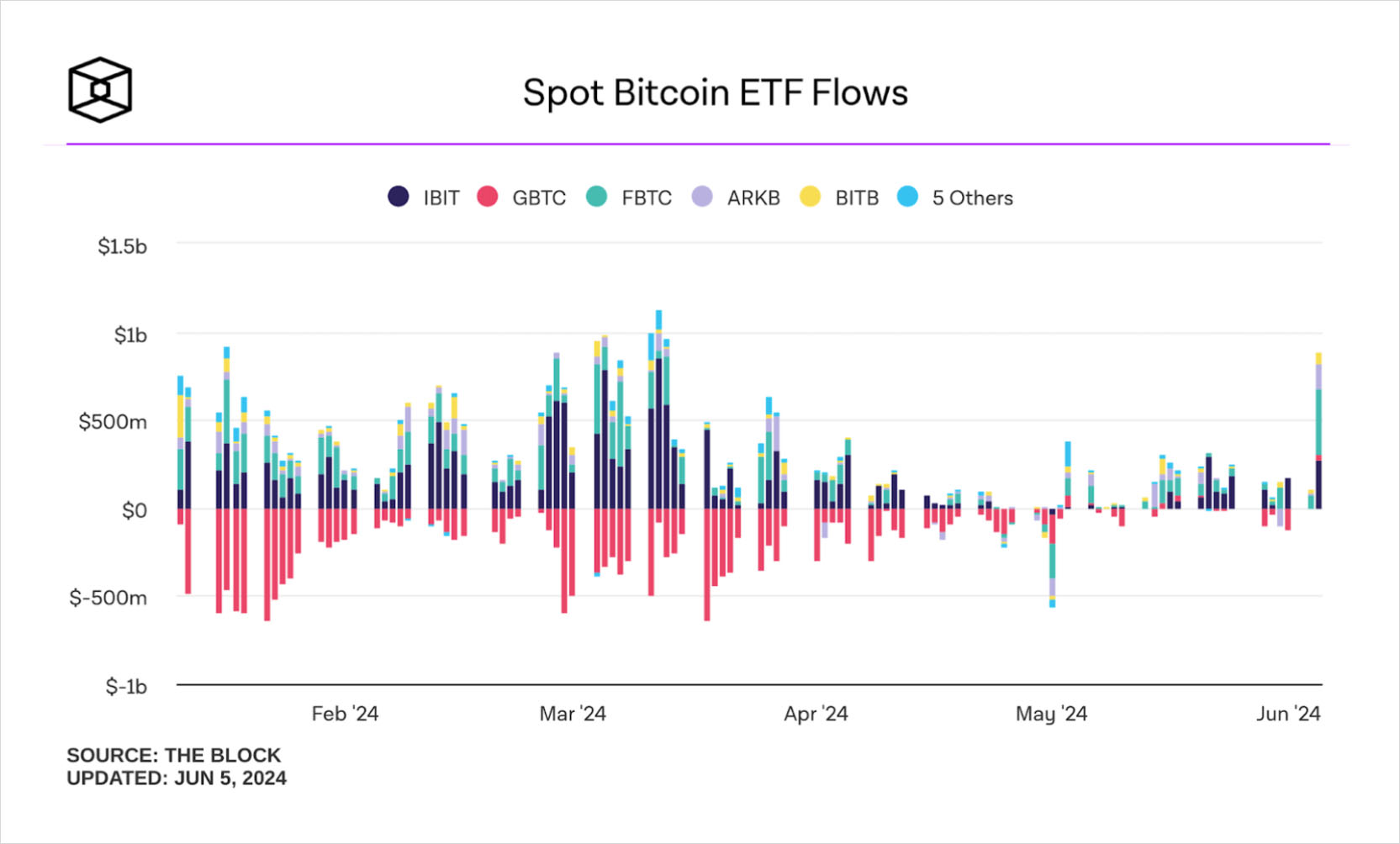

The crypto market is currently experiencing a bullish trend, as I highlighted in my previous Insights. This optimism is reflected in the growing inflows into Spot Bitcoin ETFs. On June 5, U.S. Spot Bitcoin ETFs saw a total daily net inflow of $488.1 million, marking the 17th consecutive day of net inflows. This streak matches the longest positive flow streak recorded earlier in January and February (Source: Farside Investors).

In addition to this, as noted in yesterday’s insights, we are anticipating new unemployment data this Friday. A weaker-than-expected report could reignite hopes for rate cuts. Next week, we’ll receive the CPI inflation report. If the CPI year-over-year figure is 3.3% or lower, it could push Bitcoin to new all-time highs. Historically, Bitcoin’s direction has correlated with CPI data—higher CPI tends to be bearish for Bitcoin, while lower CPI is bullish.

One economy closely tied to the U.S. has just taken the initiative to start reducing interest rates. On Wednesday, the Bank of Canada cut its overnight rate by 25 basis points to 4.75%.

From a technical standpoint, as shown in the attached 4-hour BTC price chart, Bitcoin has broken out of a triangle pattern (as indicated by the yellow line) with no major retracements observed. This suggests the possibility of a rally in Bitcoin to new highs, and traders can expect the bullish environment to persist. Additionally, high OI is observed in $78,000 and $82,000 strikes of 14th June expiry. Traders looking to capitalize on this analysis might consider implementing a Call Ratio Spread strategy.

To implement this strategy, traders can buy a higher strike Call option (e.g., $78,000) and simultaneously sell Calls in double quantity (2x) of a higher strike price (e.g., $82,000).

If Bitcoin is at $82,000 when the options expire on June 14th, traders will be at maximum profit from the strategy.

It’s important to note that while the initial debit of this strategy is $83, losses beyond the initial debit are possible due to the position’s net short call exposure.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)