View on market

Bitcoin is facing resistance and downward pressure due to economic uncertainty and conflicting U.S. job data, recently dropping below key support levels. Investors are pulling out of Bitcoin ETFs amid hawkish FOMC signals, hence traders might consider a Bear Call Spread strategy given the bearish trend.

Bear Call Spread

The proposed strategy is a Bear Call Spread. A Bear Call Spread is achieved by simultaneously selling a Call option and buying a Call option at a higher strike price but with the same expiration date.

You might consider initiating this trade if you feel BTC will face resistances in moving up.

Trade Structure

(OTM Call) Sell 1x BTC-28JUN24-$70,000-C @ $623

(OTM Call) Buy 1x BTC-28JUN24-$72,000-C @ $350

Target: Spot level < $70,000

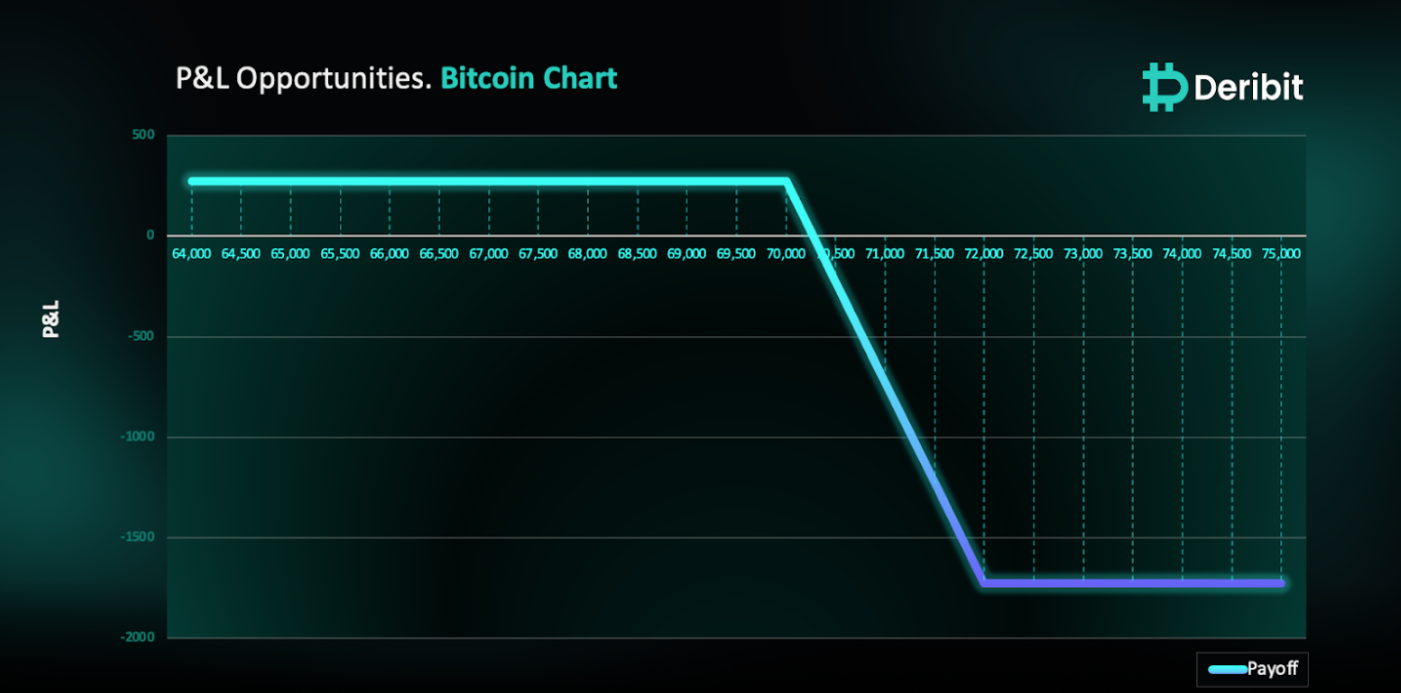

Payouts

Maximum Profit: $273/BTC

Why are we taking this trade?

In my previous analysis, I highlighted that Bitcoin is encountering resistance at higher levels due to economic uncertainty stemming from conflicting U.S. job data. Recently, Bitcoin fell below the critical support level of $66,000, triggering selling pressure and reaching a low of nearly $64,000 in yesterday’s session. And after this fall, there hasn’t been any significant retracements, this suggests there may be further downward pressure on BTC.

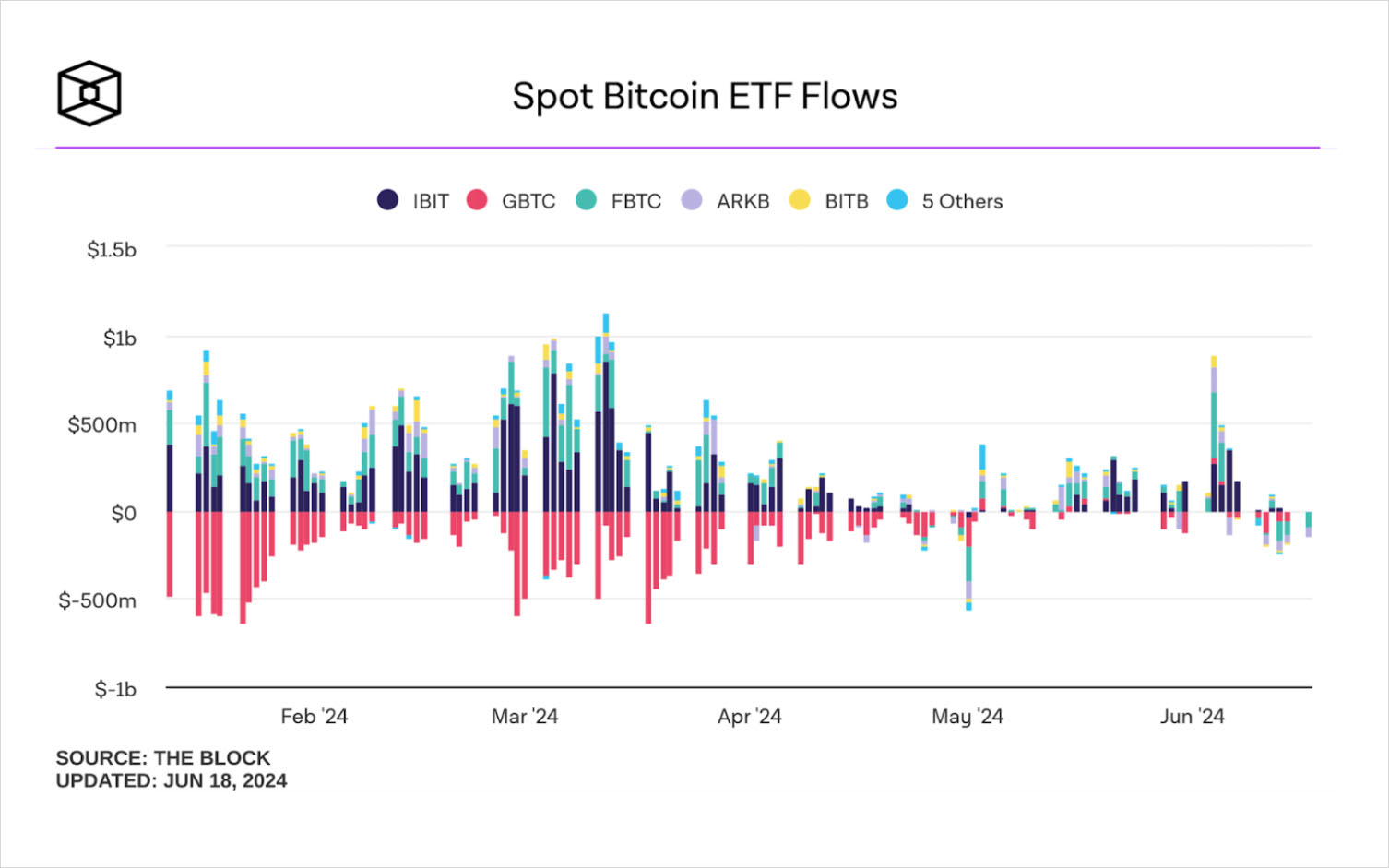

Exchange-Traded Funds (ETFs) are experiencing outflows amid the hawkish tone of the Federal Open Market Committee (FOMC) meeting. U.S. spot Bitcoin ETFs had been on a prolonged streak of net inflows until last week. However, conflicting U.S. non-farm payroll and unemployment data have led to investor uncertainty. Last week saw significant net outflows, particularly around the FOMC meeting on Wednesday, which maintained the current interest rate at 5.25% to 5.50%. Investors, who had hoped for multiple rate cuts this year, were informed that only one interest rate reduction is expected in 2024.

On the technical side, BTC has formed lower highs, as shown in the attached 4-hour price chart. With the breach of two key support levels, the trend is decidedly downward. Hence, traders might consider employing a Bear Call Spread strategy to capitalize on the anticipated price movement. Additionally, there is high open interest in the $70,000 strike for the June 28th expiry.

To execute this strategy, traders can sell a Call option of a higher strike price, eg. $70,000 while simultaneously purchasing a Call option at an even higher strike price, like $72,000.

If BTC prices are at or below $70,000, when the options expire on June 28th, traders will achieve maximum profit from this strategy.

In case of market upturn, the maximum loss is limited to $1,727. Maximum loss of Bear Call Spread = Difference between strike prices of calls ($72,000 – $70,000) – Net credit ($273).

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)