In this week’s edition of Option Flows, Tony Stewart is commenting on latest surge in BTC price.

February 28

Astute buyer of BTC Mar25 45k Calls x1k+ yesterday vs 39k, IV 65-68%, at first looked premature as spot dipped to 37k.

But with IV firming 10%, his paper loss was limited and on the subsequent surge to 42k today was a 2x on Call premium, while others scrambled to cover shorts.

2) International community making strong stand vs Russian aggression, and BTC suddenly became in vogue causing a raft of liquidations in spot and short-covering of BTC Calls before month-end.

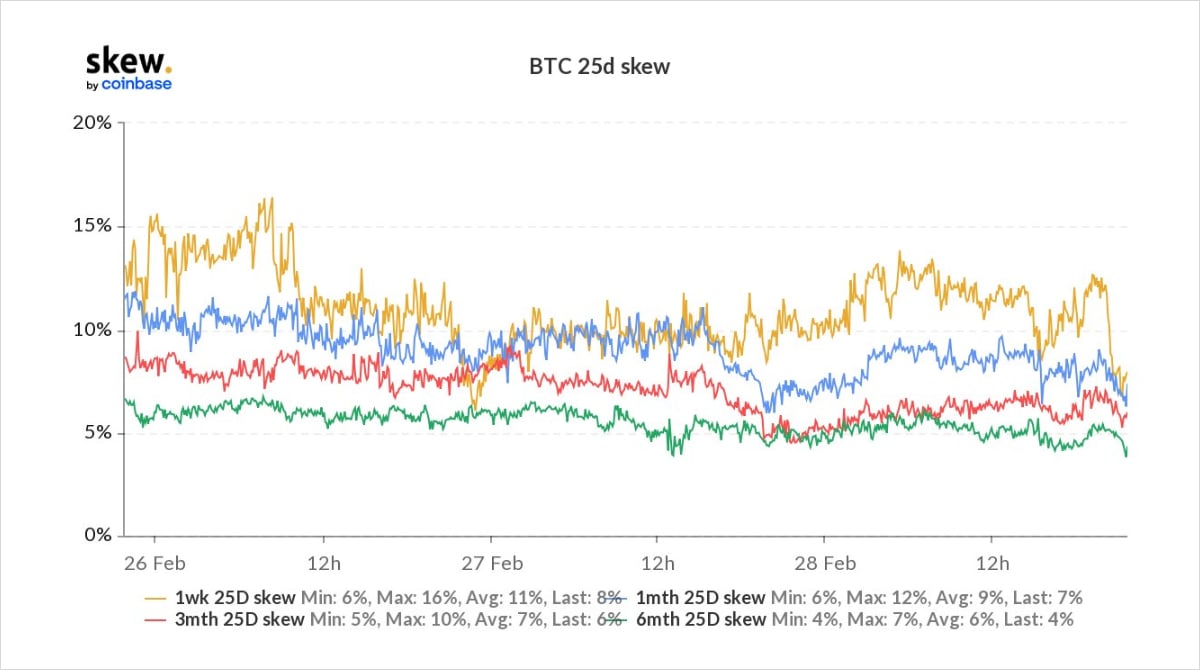

Skew fear softened, as Calls outstripped demand, particularly in 1-3week maturities.

3) This rampant spot move and Option dynamics kept Implied Vol firm.

As the Russian situation remains unsettled, IV sellers are dissuaded from counter-aggression and look for consolidation.

Other key metrics such as S&P and VIX also act in similar manner, strong rally, VIX 30%.

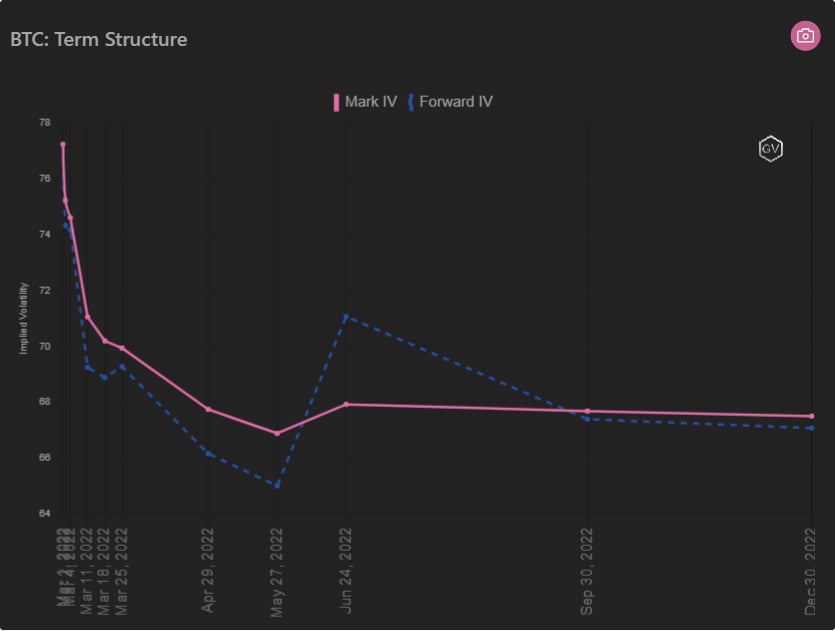

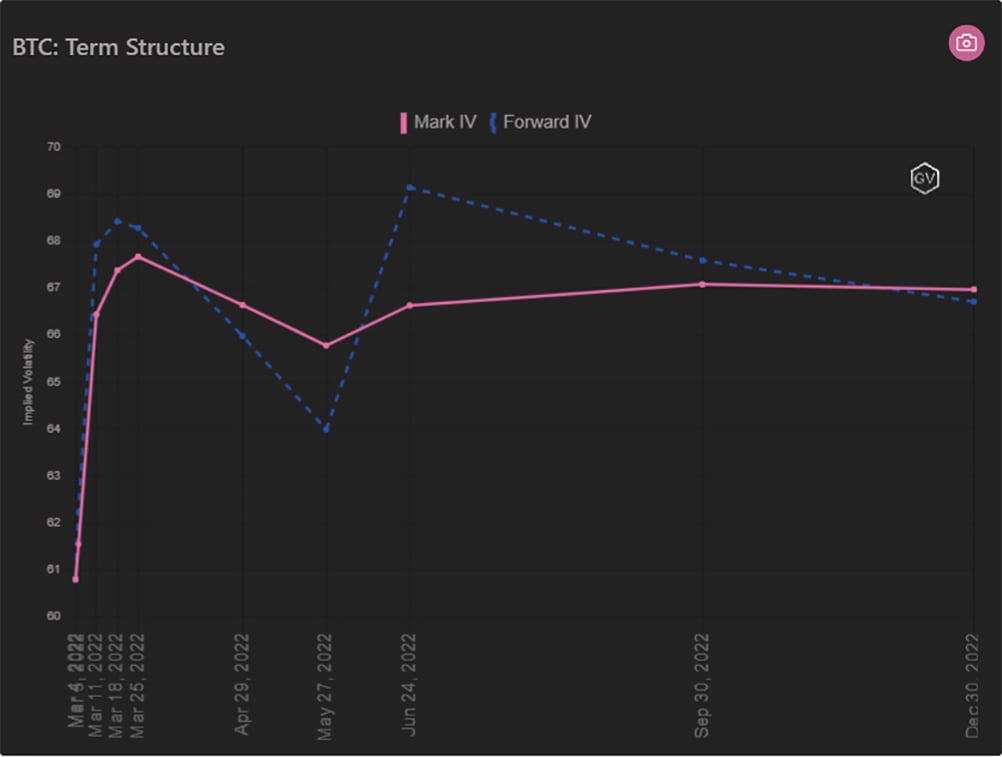

4) Term-structure remains in Backwardation as front-end gamma in play and market also cognizant of potential new-month Fund subscriptions.

Should the market take a breath, IV across the curve could relax, but also likely is that we see exposure moved out, and resulting Contango.

View Twitter thread.

March 3

BTC Options dominating ETH, as macro considerations, rumors of Russian reallocation lead momentum, forcing BTC >45k, note Call Strike discussed last thread. No indication of Option unwind.

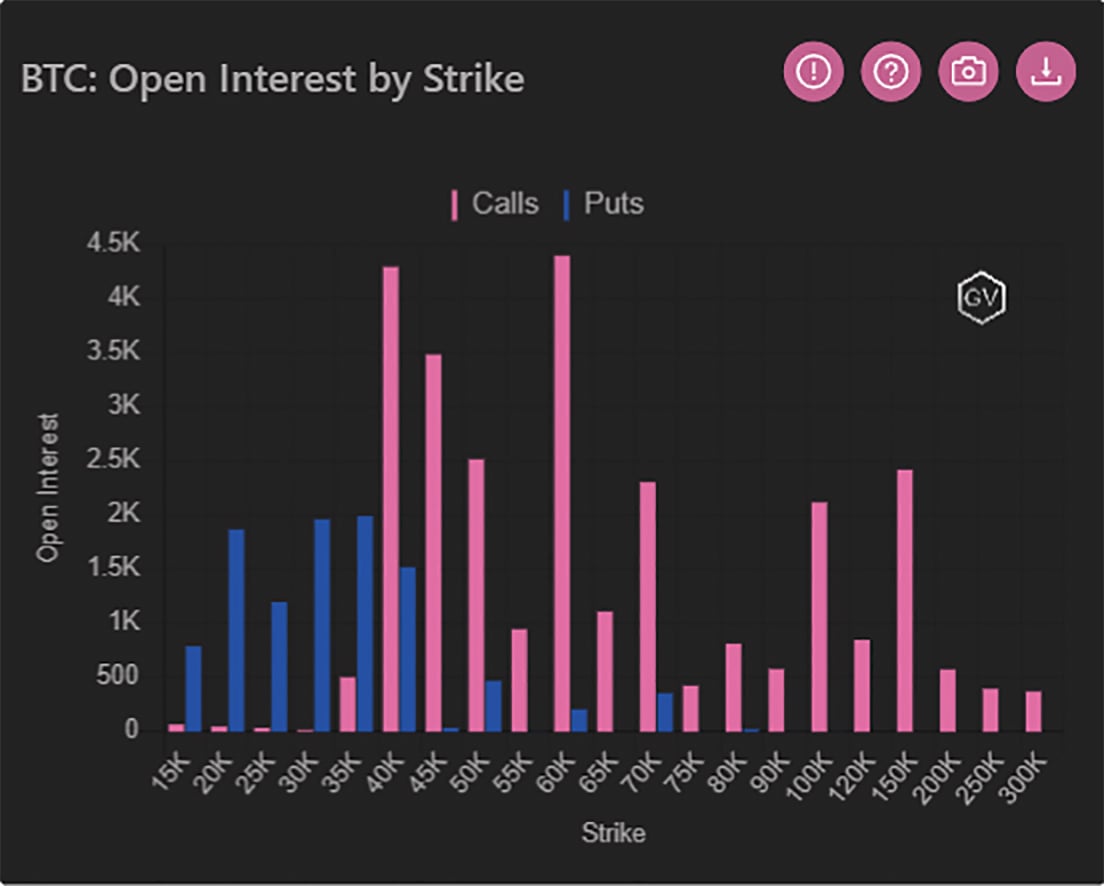

Despite the trace to 43k, Option flow bullish: Apr 60k Calls + Jun 45-60k Call spread.

2) April 60k Calls bought aggressively on-screen 1k+.

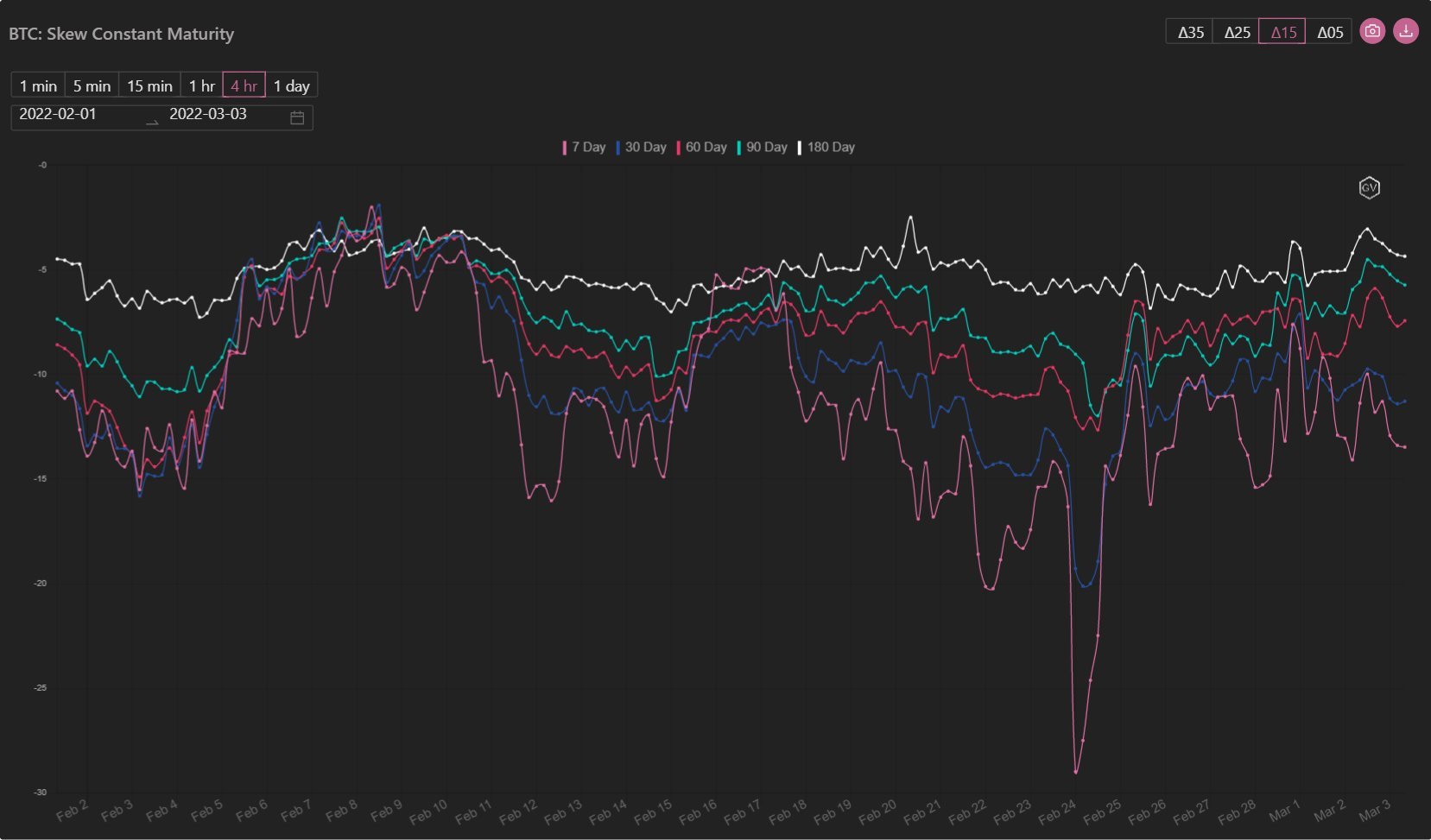

Because of Russian concerns, Put Skew is still firm, which has softened Calls relatively.

These Apr 60k Calls are ~flat vol to ATM, so the buyer is opportunistically looking for these to likely outperform in a strong rally.

3) The Jun 45-60k Call spread x1k is more complex, as again the Skew is flat, so technically not an optimum buy, but buying Jun deltas when funding is low is sound.

Using a Call spread naturally reduces the cost of buying the 45k Call outright.

Seen Jun Call spread buyer before.

4) Term-structure dictated by flow as DOV 43k Call + a seller of Mar4 44k Calls hits the 1day Option, but buyer of Mar11 42k Calls, Mar 45k-50ks previously +Apr 60k Calls keep the front end firm, consistent with VIX metric >30%.

Conspicuous is May, oblivious to buying in Apr+Jun.

View Twitter thread.

AUTHOR(S)