View on market

Bitcoin faces resistance and a downtrend, with U.S. spot Bitcoin ETFs seeing continuous net outflows and retail investors driving Blackrock’s ETF purchases. Traders might use a Put Butterfly strategy to capitalize on the bearish market structure and anticipated price movements.

Put Butterfly Strategy

The proposed strategy is a Put Butterfly strategy. A Butterfly Spread with Puts is a three-part strategy that is created by buying one Put at a higher strike price, selling two Puts with a lower strike price and buying one Put with an even lower strike price.

You can consider executing this strategy if you are eyeing downward movement in BTC prices.

Trade Structure

(OTM Put) Buy 1x BTC-28JUN24-$62,000-P @ $640

(OTM Put) Sell 2x BTC-28JUN24-$60,000-P @ $315

(OTM Put) Buy 1x BTC-28JUN24-$58,000-P @ $145

Target: Spot level > $60,000

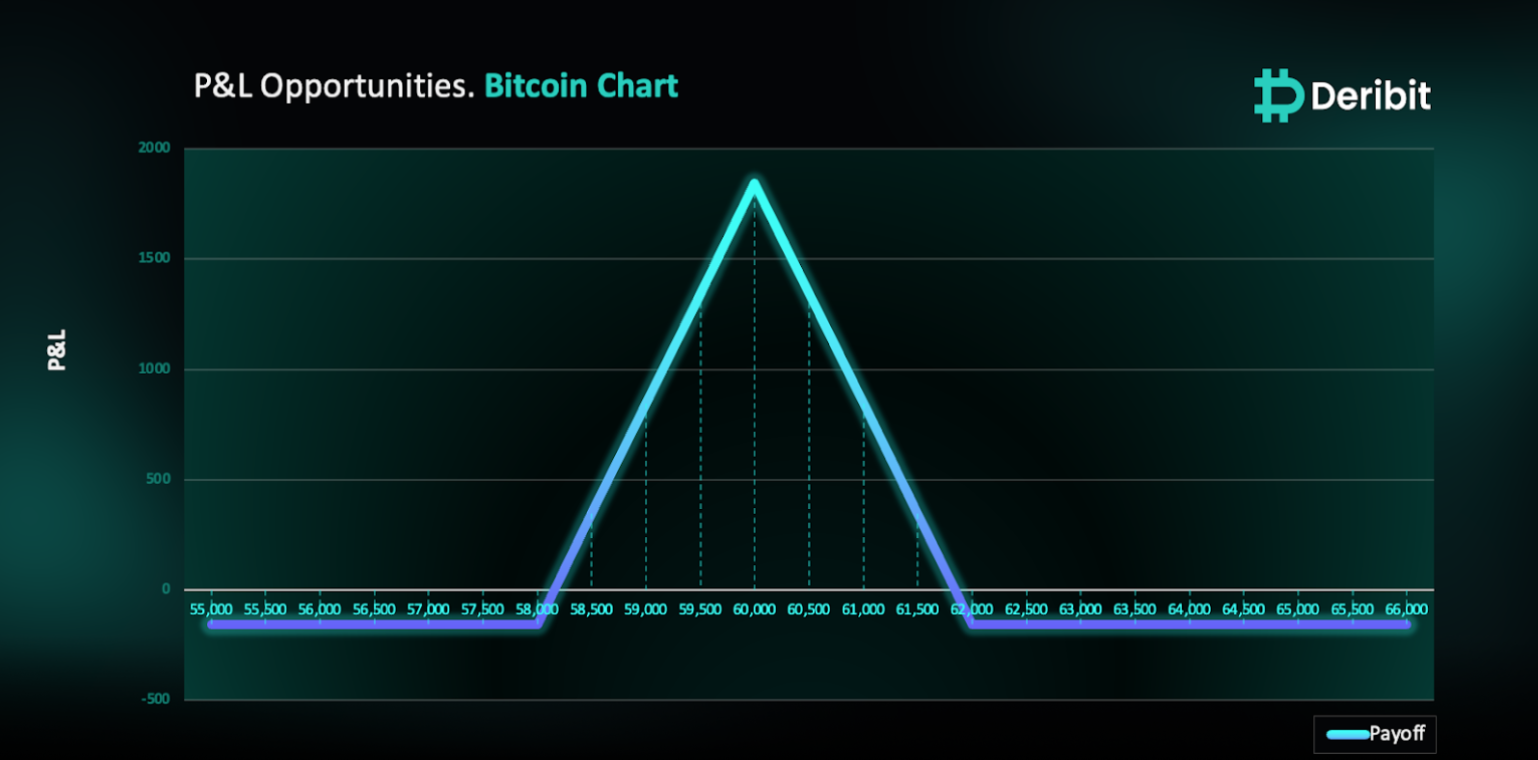

Payouts

Maximum Profit: $1,845/BTC

Debit of Strategy: $155/BTC

Why are we taking this trade?

As highlighted in yesterday’s analysis, Bitcoin is encountering resistance and remains in a clear downtrend. On Thursday, U.S. spot Bitcoin ETFs experienced $139.9 million in daily net outflows, marking the fifth consecutive day of such outflows (Source: Farside Investors). The market structure is currently bearish. Although the U.S. Federal Reserve has indicated potential interest rate cuts this year, only one rate reduction is expected in 2024.

Blackrock has observed that 80% of their Bitcoin IBIT ETF purchases come from retail investors rather than institutions, suggesting a ‘slow Institutional adoption journey.’ (Source: Coindesk)

Technically, Bitcoin’s price continues to form lower highs, indicating a persistent downtrend. Given this scenario, traders might consider using a Put Butterfly strategy to take advantage of the expected price movements.

To execute this approach, traders can purchase a Put option with a higher strike price (e.g., $62,000) while simultaneously selling double the quantity of Puts at a lower strike price (e.g., $60,000) and buying a Put at an even lower strike price (e.g., $58,000).

If the Bitcoin price is at $60,000 when the options expire on June 28th, traders will achieve maximum profit from this strategy.

In case of a market upturn, the potential loss is limited to the initial debit of $155.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)