View on market

Bitcoin’s price is following the trend line with many resistance zones in place. Market concerns arose after Mt. Gox’s $9 billion Bitcoin repayment plan, leading to a price drop amid rumors of major holders selling off their coins. Hence traders might consider deploying Bear Put Spread strategy in the current bearish market.

Bear Put Spread

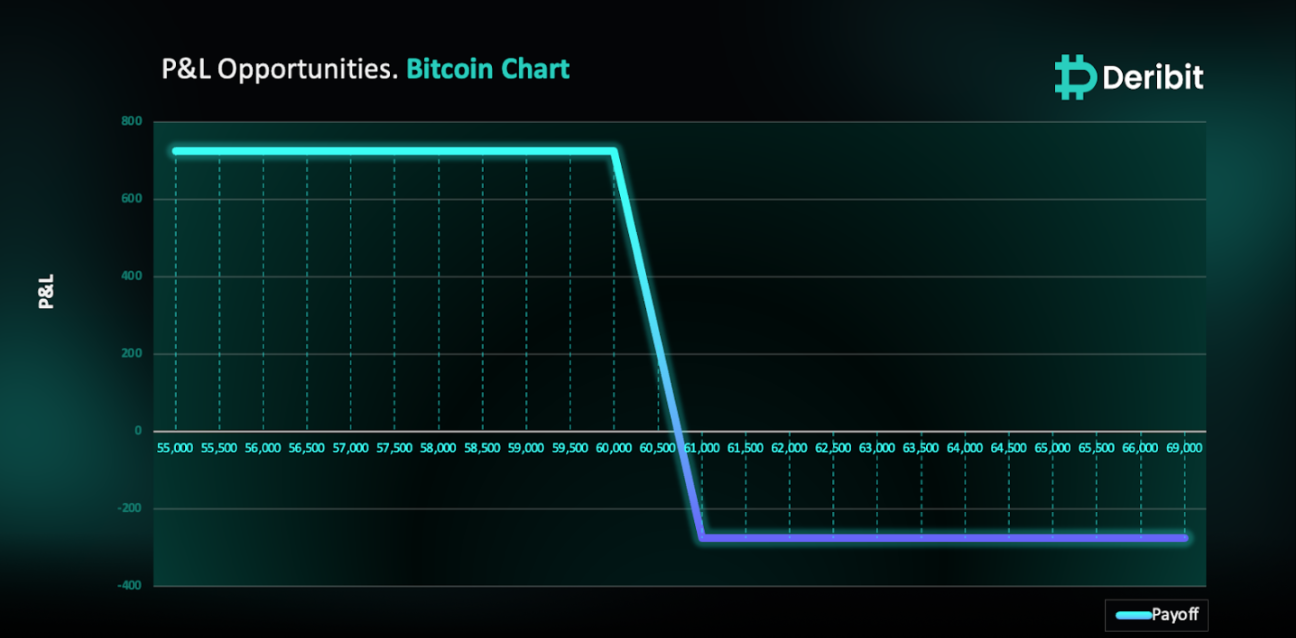

The proposed strategy is a Bear Put Spread. A Bear Put Spread is achieved by simultaneously buying a Put option and selling a Put option at a lower strike price but with the same expiration date.

You might consider initiating this trade if you feel BTC will face resistances and may trade lower.

Trade Structure

(OTM Put) Sell 1x BTC-28JUN24-$60,000-P @ $275

(OTM Put) Buy 1x BTC-28JUN24-$61,000-P @ $550

Target: Spot level < $60,000

Payouts

Maximum Profit: $725/BTC

Debit of Strategy : $275/BTC

Why are we taking this trade?

In my previous analysis of Bitcoin’s daily chart, I highlighted how the price has been following the trend line and respecting all pivots. Currently, we have a resistance zone around $64,000, followed by $66,400, and then pivots at $68,000 on the daily chart, which is considered a higher time frame.

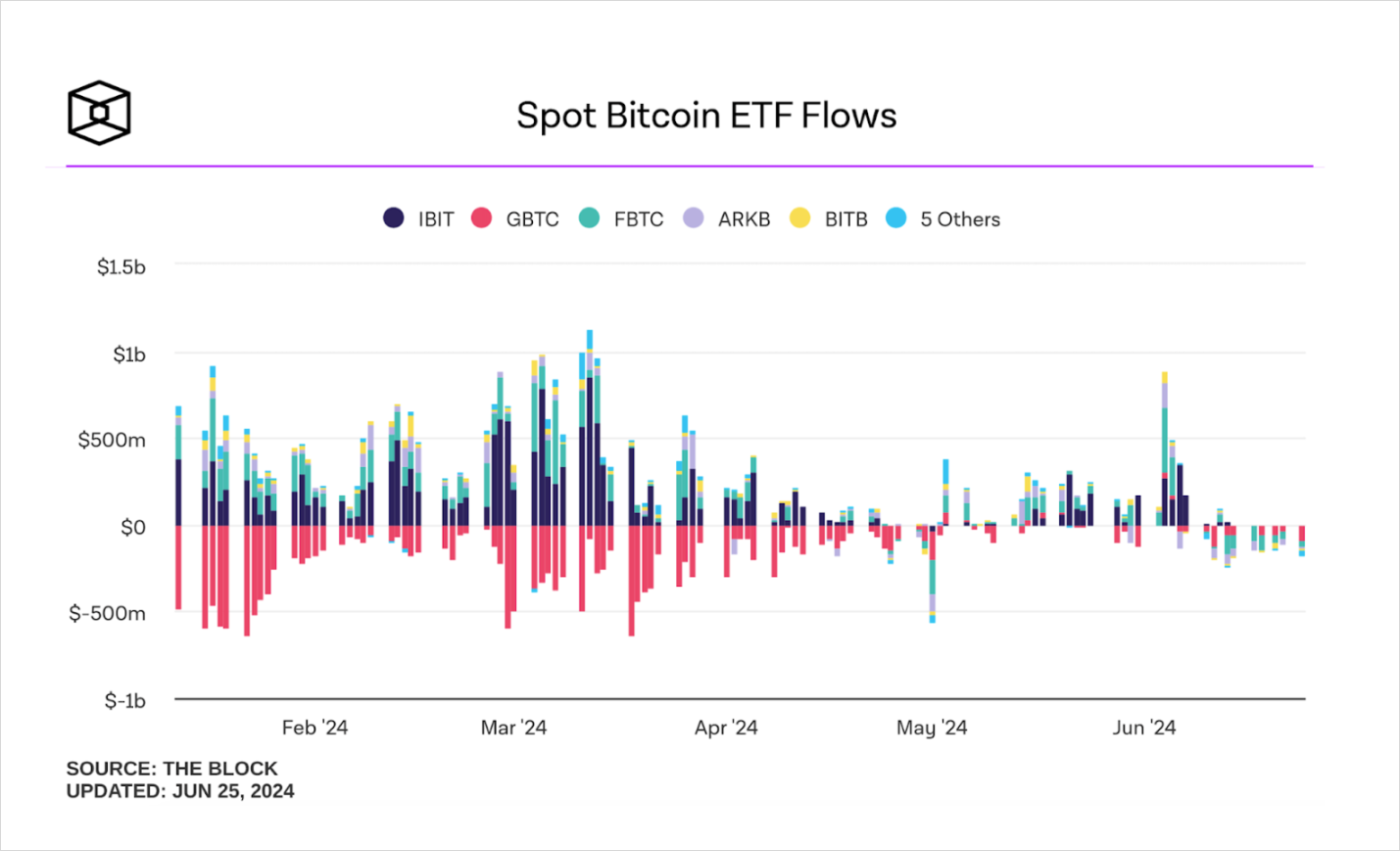

On Tuesday, U.S. spot Bitcoin ETFs recorded a mere $31 Million in daily net inflows after experiencing seven consecutive days of outflows. (Source: Farside Investors)

Bitcoin’s price fell over 5% on Monday after Mt. Gox announced it would distribute $9 billion in Bitcoin and Bitcoin Cash repayments starting in early July. This repayment is causing market concerns about the influx of supply, and it’s likely that beneficiaries will sell their coins to capitalize on significant gains made over the last decade.

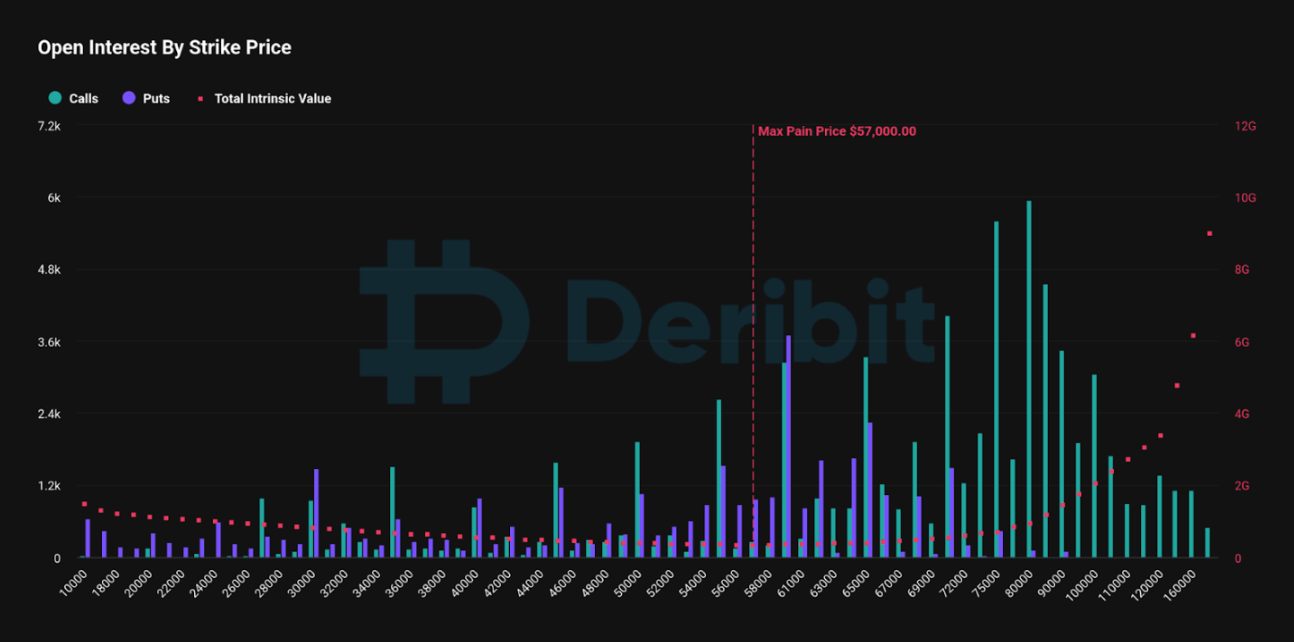

There is chatter that whales, including some of the largest miners and even the German government, are offloading their holdings. On looking at the 28th June options expiry data, Maximum Pain for BTC options stands at $57,000, hence the chances of prices trading closer to $57,000 mark are higher.

(Source: Deribit)

Hence, traders might consider deploying a Bear Put Spread strategy to capitalize on the anticipated price movement.

To execute this strategy, traders can buy a Put option of a lower strike price, eg. $61,000 while simultaneously selling a Put option of an even lower strike price, like $60,000.

If BTC prices are at or below $60,000, when the options expire on June 28th, traders will achieve maximum profit from this strategy.

In case of market upturn, the maximum loss is limited to the initial debit of $275.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)